Executive Summary

Welcome to the July 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month's edition kicks off with the big news that Charles Schwab agreed to pay a whopping $187M to settle charges from the SEC that it misled investors by advertising that its Schwab Intelligent Portfolios robo-advisor was “free” when in reality Schwab not only was profiting on investor cash that was being swept to its affiliated Schwab Bank, but set its cash allocation targets in client portfolios at above-typical levels specifically to ensure it achieved its desired level of business revenue from its robo-offering (reducing long-term client returns by an amount equivalent to the advisory fee it said it wasn’t charging but indirectly generated anyway).

The significance of the Schwab settlement is not only its sheer magnitude– at $187M, it is likely enough to wipe out virtually all profits that Schwab ever earned on its robo-advisor in 7 years (equivalent to the profits on $375B of AUM assuming a 25bps fee and a 20% profit margin, while Schwab’s robo-advisor itself was reportedly ‘just’ $65B of AUM last month!) – but that it raises questions about whether Schwab’s other lines of business, including its RIA custodial offering, may also face regulatory scrutiny, given Schwab’s “Pledge” to not charge RIA custody fees while profiting from the cash sweep to Schwab Bank is remarkably similar to the marketing tactic it just settled with the SEC about for its “no-fee” robo-advisor.

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- Bento Engine raises $1.1M to implement a ‘Next Best Conversation’ for advisors by integrating with their CRM to prompt client outreach based on key age milestones

- RIA In A Box integrates with InvestorCOM to launch a new DoL PTE 2020-02 RolloverAnalyzer solution

- Pershing X signals the launch of an MVP of its new ‘All-In-One’ advisor technology platform… while questions remain about what its long-term business goals are for the new technology offering

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including:

- FutureProof and XYPN LIVE both announce new AdvisorTech Demo events where newer/startup technology companies can submit applications to be seen by a large advisor audience (without being required to pay a big sponsorship fee!)

- Fruitful raises $33M to launch a new financial-planning-app-plus-CFP-guide subscription offering for a $100/month fee, and raises the question of whether there’s a market for ongoing advice services in the ‘middle’ market between do-it-yourselfers and traditional full-scale advice relationships?

In the meantime, we’ve also made several updates to the beta version of our new Kitces AdvisorTech Directory, to make it even easier for financial advisors to look through the available advisor technology options to choose what’s right for them!

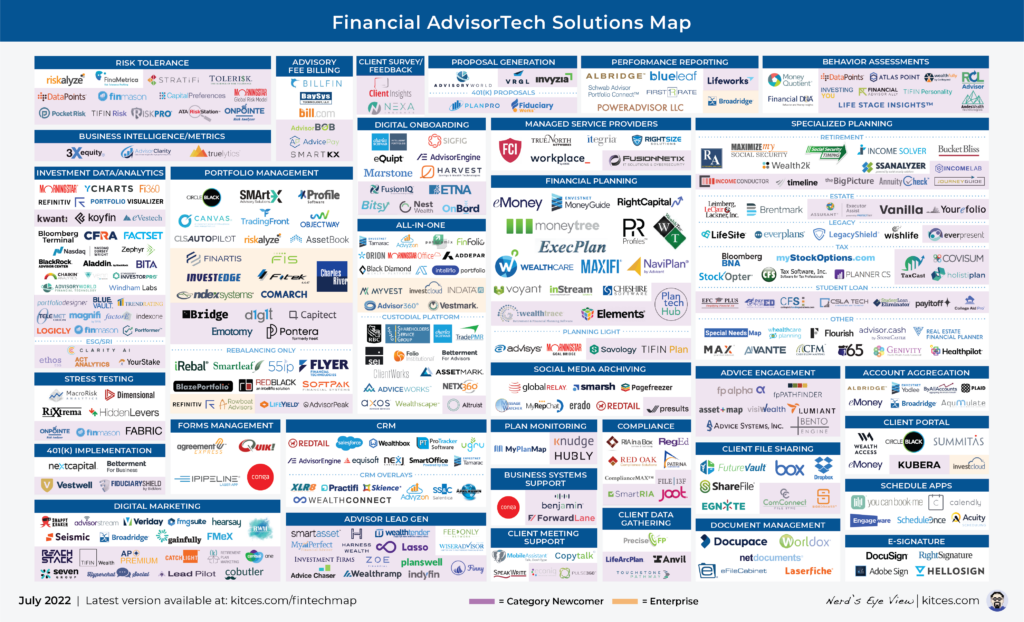

And be certain to read to the end, where we have provided an update to our popular “Financial AdvisorTech Solutions Map” as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Schwab Fined $187M For Misleading Clients About The ‘Free’ Cost For Its (Robo-Advisor) Platform

When robo-advisors first launched nearly 10 years ago, they made the case that consumers were paying too much to human financial advisors to allocate their investment portfolios, and that a robo-advisor could create a substantively similar allocation at a fraction of the cost – trying to set the ‘going rate’ for building an asset-allocated portfolio at an AUM fee of just 0.25% (relative to a ‘typical’ advisor cost of a 1% AUM fee), in the hopes that consumers would flock to their platforms for the cost savings alone.

Yet, what competing on price giveth, competing on price can also taketh away. And so it was just a few years later that Schwab decided to enter the fray, recognizing that robo-advisors were actually more of a DIY solution that threatened their self-directed brokerage platform than traditional advisors, and launching its own “Schwab Intelligent Portfolios” (SIP) solution, which decided to take price competition one step further by launching and promoting itself as a free solution, and highlighting how consumers would be able to save even more wealth in their own pockets by eschewing the fees of competing robo-advisors altogether.

Except the media noted at the time that Schwab’s “free” robo-advisor wasn’t entirely benevolent; while Schwab wasn’t going to charge a robo-fee like its brethren, it did include a cash allocation that would vary from 6% to almost 30%, which would be allocated to a cash sweep with Schwab’s own Bank, on which Schwab would earn profits that would allow it to make up for its foregone AUM fee. Such that in the end, not only was Schwab not necessarily ‘free’, but its higher-than-typical cash allocations would result in a “cash drag” on returns that could actually result in lower long-term returns (in addition to the fact that Schwab was making allocations to 'Smart Beta' ETFs that were "all... either proprietary Schwab ETF products or ETFs from issuers that pay Schwab to use them"), even as Schwab maintained that its ETF and cash allocations were simply a result of a ‘disciplined portfolio construction methodology’.

But this month, the SEC charged Charles Schwab and its robo-advisor subsidiary, for which Schwab agreed to pay a whopping $187M settlement (“without admitting or denying the SEC’s findings”), after making its determination that Schwab’s cash allocations were not “set based on a disciplined portfolio construction methodology designed to balance performance with risk management” as its brochures claimed, but instead “were pre-set for business reasons, and to compensate Respondents for not charging an advisory fee” and that “Schwab management set the percentages of cash that each of the model portfolios should contain, and the portfolio construction team then applied its methodologies to create the rest of the portfolio, using the cash allocations as a constraint”.

Which is important because, in the end, Schwab’s higher-than-usual cash allocations did adversely impact investors due to the cash drag. As the SEC noted, even Schwab’s own internal analysis had already found that “the cash allocations in SIP would reduce investors’ returns by approximately as much as advisory fees would have”. Even as Schwab was continuing to advertise how “fees can eat away at your bottom line” and imply that its robo-advisor solution would generate higher returns due to the lack of fees (without acknowledging that those benefits would be more-than-lost by the revenue and profits it was generating from Schwab Bank on the cash allocation).

All of which helps to explain the remarkably large $187M sum that Schwab ultimately agreed to pay in settlement with the SEC (without even addressing Schwab's use of its own proprietary funds in its robo-models as well!), which includes $45.9M of profit disgorgement, $5.6M in interest, and a $135M civil money penalty, to be deposited into a ‘Fair Fund’ that will be paid back to investors in the coming months. To put that in context, if Schwab’s robo yields an average of 0.25% on managed assets (a price similar to competing robo-advisors), the settlement is equivalent to all the annual revenue from nearly $75B of AUM… and Schwab’s total AUM in its Intelligent Portfolios solution was reported last month at ‘only’ $65B of AUM! And if Schwab generates a 20% profit margin on its robo business, the settlement is the equivalent to the profits on $375B of robo-advisor assets… which means its $187M payment may be close to wiping out all cumulative profits Schwab ever made on its robo-advisor since it was established 7 years ago!?

Notably, though, even as Schwab’s settlement with the SEC may wipe out years of profitability on its robo-advisor, it still can’t undo the competitive damage that Schwab caused in the marketplace itself. As Schwab’s growth, ostensibly driven in no small part by its years of aggressive advertising about its “free” robo-advisor, hobbled virtually every competing robo-advisor in the mid-2010s out of business, as FutureAdvisor, Vanare, SigFig, Jemstep, Hedgeable, WiseBanyan, and more, were all either shut down or sold to ‘traditional’ financial services firms after failing to compete successfully in the retail marketplace, and Schwab Intelligent Portfolios alone is now larger than Betterment, Wealthfront, and all the other ‘standalone’ robo-advisors combined. In other words, while the SEC may have penalized the profits that Schwab generated from its “misleading” no-fee marketing against competing robo-advisors, it can’t bring back the competition that Schwab also decimated along the way.

Which in turn raises questions of whether Schwab will eventually face similar scrutiny for its other offerings, given that Schwab has similarly made a very public “Pledge” that it does not and will not charge custody fees to RIAs… and instead generates RIA custody revenue in a substantively similar manner to its robo-advisor (sweeping advisors’ client cash into its Schwab Bank offering, while also earning a piece of the underlying expenses of third-party products that advisors use and must pay to be available on the Schwab platform). Though while Schwab’s robo-advisor was itself an RIA – and the SEC’s charges focused on Schwab’s violations of the Investment Adviser Act requirement that investors not be misled – Schwab’s RIA custodial offering is technically a brokerage platform… which means Schwab doesn’t have the same obligation to its own RIAs, and it is up to the RIAs that use Schwab’s platform to make their own determination of whether Schwab’s revenue model is the right fit for their clients.

Bento Engine Raises $1.1M To Build ‘Next Best Conversation’ Integrations For Advisor CRM

One of the biggest challenges that advisory firms face as they scale up the number of clients they serve is simply keeping track of the sheer number of advice opportunities that may exist at any time amongst their clientele. From reaching key ages where life transitions occur, to simply having life events happen, the ongoing flow of potential advice needs is what keeps the value of advice relevant to clients over time… but also requires an ongoing series of client meetings just to find out if there’s anything the advisor and client should be talking about now. Which is remarkably inefficient, as it simultaneously means that often advisors are simply having a meeting for the sake of figuring out whether they even needed that meeting in the first place (“let’s have a check-in meeting and see if there’s anything to talk about?”), and risks failing to be proactive enough to engage with clients at the exact moment they really need to meet (e.g., because they’re turning 65 soon and should be enrolling in Medicare).

Several years ago, Morgan Stanley made AdvisorTech waves when they attempted to solve for this internally with a solution known as “Next Best Action”, which used AI to scan across the firm’s entire client base, watch for investment opportunities that might arise in their portfolios, and then prompt the firm’s brokers with investment ideas that they could reach out to those clients about. Ideally, Next Best Action could turn what historically was a very sales-based approach (here’s a product our company has for sale, let’s see which clients want to buy it) into a more client-centric approach (the software has identified something a client might want and need, let’s reach out to show them how it solves their problem).

The caveat to Next Best Action, though, is that, functionally, it was arguably still more focused on product distribution than the advice itself. After all, a lot of the most meaningful opportunities to engage with clients have nothing to do with a change in their investment portfolio (or their investments at all), and instead could tie to retirement planning, tax strategies, insurance or estate needs, or any of the numerous other domains of financial planning where advisors can add value.

In this context, it’s notable that this month, Bento Engine raised a $1.1M round (from a notable list of “RIA influencers”) to power up its ‘Next Best Action’-style offering that is focused on evolving beyond ‘just’ highlighting investment product ideas and towards supporting actual financial planning advice conversations.

At its core, Bento Engine integrates with the advisor’s CRM system (currently supporting integrations to Redtail, Wealthbox, Salesforce, and Microsoft Dynamics), and uses a ‘Life in Numbers’ framework (that identifies common age-based milestones that may trigger planning conversations, from teenagers who could start their first Roth IRA with summer job money to benefit from multi-decade compounding, to eligibility for IRA and 401(k) catch-up contributions at age 50, or HSA catch-up contributions at age 55) mines CRM data to spot when clients are approaching those age milestones, and then prompts the advisor to reach out to the client regarding the planning opportunity. In turn, to support the outreach, Bento then provides pre-packaged educational content, from articles to PowerPoint presentations and other visuals, that can be white-labeled to the firm for branding purposes, and used to help facilitate the conversation with the client.

Notably, because often financial planning advice doesn’t end in a product sale – the advice value-add is the conversation itself, and helping to introduce a new idea or concept to the client – Bento Engine’s approach is arguably less about a “Next Best Action”, per se, and more about facilitating the “Next Best Conversation” that an advisor can have with the client to add value. Which may or may not result in a subsequent action. As, in the end, the reality is that even when clients decide not to act, it’s still a meaningful moment in the advice relationship to have the conversation in the first place. Which Bento Engine is built to both prompt (with its CRM integrations) and help facilitate (with its supporting educational materials).

In the long run, the real question for Bento Engine is whether they’ll be able to draw in enough data from advisor CRM systems to find the planning opportunities beyond ‘just’ age-based milestones (which arguably advisors can build triggers to prompt themselves about already in existing CRM systems?), which truly introduces new conversations, at the exact moment they’re most beneficial, that advisors would otherwise have only uncovered through the time-consuming traditional ‘meetings-to-find-out-if-we-needed-a-meeting’ approach that tends to be less timely. Which is also important, because, in the end, it means that Bento Engine won’t necessarily succeed by ‘saving advisors time’ by cutting down on time-consuming conversations with clients, but instead by re-allocating the advisor’s time to ensure the conversations they’re having are the most timely and relevant ones to be having at that moment?

Pershing X Signals Near-Term Launch Of MVP But The Long-Term Strategy Remains Hazy…

The past decade has witnessed a veritable explosion of Advisor Technology solutions, transforming the space from a cottage industry of ‘homegrown’ solutions (where an advisor has a problem, can’t find a solution, builds their own solution, starts selling their solution to other advisors, and ends out with a software company ‘on the side’) into a domain where advisors have half a dozen or more choices in every major category that can be woven together through the proliferation of APIs.

The good news in this proliferation of solutions is that advisors have more choice than ever about what solution they want to use – which means both a better chance to find software that’s the ‘right’ fit for their firm, and ongoing competition that forces all players to make improvements to keep up with one another. The bad news is that the number of potential integrations that need to occur amongst an ever-widening breadth of players means that most tools don’t integrate as well as they could or ‘should’ (as each company suggests that the ‘other’ one should build the integration to their API, often resulting in a finger-pointing stalemate), and advisor data ends out splintered across multiple systems in a way that is both hard to maintain, often necessitates double data entry, and prevents having one clear ‘source of truth’.

As a result of these integration challenges, in recent years the pendulum has begun to swing away from an ever-widening range of standalone best-in-breed solutions, and towards the rise of ‘all-in-one’ platforms that aim to cover the full range of an advisor’s technology needs within a single platform – which means all the solutions are natively integrated with one another, and all the data is housed in one central location.

In this context, it was notable when last year, Pershing announced the launch of a new business unit, dubbed “Pershing X”, with the vision of building – from scratch – its own ‘end-to-end’ advisory platform to become the next generation all-in-one solution to compete with the likes of Orion, Morningstar Office, Black Diamond, and Envestnet, citing the challenges that even incumbent platforms (like those) have in weaving together data and workflows across disparate systems and sources. And now, after hiring up nearly 350(!) team members to build, Pershing X has indicated that it expects to launch an initial MVP (Minimum Viable Product) by the end of 2022 (while acknowledging that it will probably be 2-3 years before all the core features are fully built out).

From a pure technology perspective, Pershing’s ambitions to build a competitive full-scale advisor platform in ‘just’ a few years is daunting in and of itself, especially given that Pershing is not exactly known for the pace of its technology innovation (as the subsidiary of one of the oldest banks in the country). For which the company’s more ‘modern’ Lean-Startup-style “MVP” approach is at least a promising step in the right direction.

But the bigger question from the advisor perspective is simply what Pershing’s end-game goal is for Pershing X in the first place. After all, the reality is that most advisory firms spend only a few percent of their revenue on all technology combined, which means even a robust All-In-One technology platform may command no more than 2 – 3bps in software fees (or as per-account, per-client, or per-account user fees, when converted into a bps equivalent)… paling in comparison to the nearly 10X revenue that broker-dealers like Pershing can generate from the actual RIA custodial business. Even as Pershing has emphasized that Pershing X is a separate division from Pershing’s custodial offering, and that Pershing X is expected to be a multi-custodial platform not specific to ‘just’ Pershing as an RIA custodian.

It's possible that the vision for Pershing X is to be less like a custody/clearing platform (which Pershing itself is) and more akin to Envestnet, where its technology facilitates the distribution of investment products, for which Pershing X can generate revenue-sharing payments for distribution, or even queue up its own Pershing-owned asset management solutions. Already, Pershing has tucked its own TAMP – Lockwood – under the Pershing X umbrella, and has signaled more broadly that model marketplaces and product provider lists (which often involve revenue-sharing from asset managers to the technology platform that facilitates them) could be part of its future.

Pershing X itself is simply emphasizing the potential time savings that it may be able to generate for advisors with a more efficient technology platform, highlighting Cerulli research that the typical advisor spends only about 25% of their time meeting with clients (which is similar to Kitces Research also showing that the typical advisor only spends about 1/4th of their time actually meeting with clients). However, the reality is that the rest of an advisor’s time is more often spent on meeting preparation and follow-up, planning analysis for clients, business development activities, and internal team management time… none of which are particularly impacted by the technology that Pershing X is building. As, in the end, the typical advisor spends barely 10% of their time on investment-related tasks in the first place, given the efficiencies that technology has already brought to the investment process that Pershing X is now trying to improve upon.

All of which means the real challenge for Pershing X, in the long run, may not even ‘just’ be its monumental task of trying to build an entire all-in-one advisor platform from scratch, but the end goal it's actually trying to achieve, given that there may not actually be much time-savings on the table for Pershing X to generate for the typical advisor (that hasn’t already been saved with technology, or delegated to staff). Will Pershing X actually be able to save advisors meaningful time? Will it pivot to make the case that it can improve advisor margins by cutting down back-office staff time instead? Will Pershing X turn out to be more of an asset-management-distributed-via-technology play than an actual technology solution unto itself?

Because in the end, it will be hard for Pershing X to gain traction with advisors, until it gets clear on the advisor problem it’s actually being built to solve?

RIA In A Box Partners With InvestorCOM For DoL PTE 2020-02 Rollover Compliance

Over the past 20 years, what were once two completely separate channels in the financial services industry – broker-dealers selling investment products to their customers, and registered investment advisers providing advice and managing portfolios for clients – have converged into one channel of “financial advisors” who typically receive ongoing (typically ~1%) fees to provide their clients an ongoing advice service. Which has, in turn, led to a decade of regulatory debates – from potential Dodd-Frank legislation to Regulation Best Interest – about how best to converge the differing suitability-vs-fiduciary regulatory standards of care that historically applied to brokers versus investment advisers, as the line between them becomes increasingly blurred.

At the same time, though, there is a third channel to how financial advice is delivered – to employer retirement plans, which is regulated by ERISA, which has its own (fiduciary) standard of care. And as the broker-dealer and RIA channels have converged, so too has their delivery of advice to consumers via retail brokerage accounts and via their employer retirement plans, leading to a series of Department of Labor fiduciary rule proposals over the past decade about how to modernize advice standards for both employer retirement plans, and rollovers from them to IRAs (and even rollovers from one IRA to another).

In December of 2020, the Department of Labor finalized its latest rule – known as PTE 2020-02 – which prohibits both investment advisers and broker-dealers from receiving a wide range of (conflicted) compensation when engaging in retirement account rollovers… unless they are eligible for a “Prohibited Transaction Exemption” (PTE). Which includes a number of key documentation and disclosure requirements, including not only the scope of the relationship and any potential conflicts of interest, but also specifically regarding the existing costs the client faces, how those costs would change if they begin to work with the new advisor, and a (written) justification of why engaging is such a rollover is in the best interest of the client (even and especially in light of any additional costs that will be incurred). All of which are now required as of June 30th of 2022 (after the original rule’s 18-month delay to allow time for the industry to prepare to implement).

Accordingly, this month RIA In A Box – which provides a software platform that helps RIAs manage their ongoing compliance obligations – announced a new partnership with InvestorCOM and its “RolloverAnalyzer” solution, just as the new PTE 2020-02 requirements take effect.

At its core, InvestorCOM’s RolloverAnalyzer is built to help fulfill the documentation and disclosure requirements when conducting rollovers, which it aids by extracting cost data on a prospective client’s existing employer retirement plan from available Form 5500 public filings, benchmarking those plan costs against similar plans, comparing those costs (and the associated services) to the advisor’s own costs (and associated services), providing an explanation to the client of the recommendation, and then capturing the information shared and the subsequent recommendation that was made. Which RIA In A Box users will simply be able to access directly through their partnership.

Ultimately, the irony is that while financial advisor technology innovation has increasingly focused on financial planning and investment platforms, arguably compliance is one of the domains that has the most consistently repeatable processes that are most conducive to technology that automates or at least greatly expedites the process. For which RIA In A Box has long been effective at rolling out tools that directly address the compliance challenges that advisors face, and the integration with InvestorCOM’s RolloverAnalyzer – while not directly an ‘RIA’ requirement, but a DoL requirement that RIAs must also now comply with – fits perfectly within RIA In A Box’s domain of making advisor compliance more efficient through technology.

FutureProof And XYPN Announce New AdvisorTech Demo Events For Up-And-Coming Vendors Looking To Reach Advisors.

Financial advisors don’t change their technology solutions very often; in fact, a recent Kitces Research study on AdvisorTech found that only 4% to 8% of advisors were looking to change software in any particular category last year… which means on average, advisors only change any specific technology tool every 12 – 25 years!

This dynamic is further complicated by the fact that the advisor landscape is extremely fractured, where the overwhelming majority of advisors are either entirely independent (e.g., as an RIA), or at least are independent contractors affiliated to a centralized platform (e.g., most independent broker-dealers), and even the largest advisor enterprises – wirehouses – that have as many as 15,000 advisors still only amount to barely 5% of the total advisor market of ~300,000 advisors.

The end result of this environment is that advisor technology companies looking to grow have to spend a lot of money on marketing just to reach prospective advisors, one individual or small firm at a time. A pathway that is often cost-prohibitive for most startups (at least, unless they’re already raising outside capital to spend on marketing), or at least means that growth will be very slow, attracting one advisory firm at a time until the software company grows large enough over a span of years to crack into the enterprise marketplace.

Which has made it all the more important that in recent years, a number of advisor events have arisen that give new AdvisorTech companies a chance to showcase their wares and “be seen” by a wide range of individual advisors… without necessarily being required to pay the steep price of ‘pay-for-play’ presentation slots or exhibitor booths. (Of course, conferences need to support their own economic model, which is typically supported by vendor sponsors, but startups that are required to pay top dollar to compete never get the opportunity to grow to the point that they can afford to pay for sponsorships in the long run!)

This month, both FutureProof (a new advisor conference by a very experienced conference advisor team that’s looking to make a big splash as a new kind of “advisor festival”) and XYPN LIVE (the annual conference for XY Planning Network, an organization predominantly compromised of ‘next-generation’ advisors serving next-generation clients) announced new Demo Events where emerging AdvisorTech companies will have the opportunity to showcase their software to a wide audience… without the requirement to pay a big sponsorship fee. (Companies are only required to pay for their own travel and accommodations to participate in the event itself.)

In the case of FutureProof, judges will select 10 AdvisorTech companies to participate in a “FinTechX Demo Drop”. Submissions will be judged based on their “creativity, outside-the-box thinking, and the ability to create a real impact for the Future Proof audience”. In the case of XYPN, their “AdvisorTech Expo” will highlight 6 finalists, and submissions will be judged by how well they support “Advice Engagement” (delivering financial planning advice to clients in a more engaging way), though it is specifically limited to ‘startups’ (companies launched in the past 12 months, or that have less than $1M of revenue, or an existing company with a substantively new offering that itself meets one of those criteria).

In both cases, the finalists that are selected will have an opportunity to showcase their software to the audiences of the respective conferences, which run from September 11th to 14th (FutureProof) and October 8th to 11th (XYPN LIVE). Submissions are due in the coming weeks (by July 8th for FutureProof, and August 1st for XYPN LIVE), with applications for FutureProof here and applications for XYPN’s AdvisorTech Expo here.

Fruitful Raises $33M Series A For $100/Month Subscription Financial Planning But Will Consumers Pay For A ‘Mid-Point’ Solution?

As the first wave of Baby Boomers began to reach retirement (and Social Security) age in the mid-2000s, the financial advice industry increasingly began to focus on retirement planning and the assets under management model. The shift made sense; just as bank robber Willie Sutton famously robbed banks because “that’s where the money is”, advisors increasingly focused on baby boomer retirees and helping them with their retirement portfolios because that’s where the money is (with 85%+ of investable assets at the time in the hands of retiring baby boomers and their already-retired parents in the Silent Generation).

Yet at the same time, there was a growing concern that eventually, the older generations will pass away, and the advisor community had no established relationship with the next generation of clients (Gen X and Millennials), inhibited primarily by the fact that the younger generations were unprofitable to serve because they didn’t (yet) have substantive portfolios and the complexity that comes with more significant wealth, such that they didn’t have the complex needs to pay what it takes to have and get value from a financial advisor relationship.

The reality, though, is that while Gen X and Gen Y clients may not yet have substantial portfolios, their financial lives are not simpler, they just have different (non-investment-related) complexities. As a result, the younger generations were interested in, and willing to pay for, a relationship with a financial advisor for help with the complexity in their lives. They simply needed a different way to pay for advice than the traditional AUM model, leading to the rise of the monthly subscription fee for financial planning, from advisor networks for subscription fee planning like XYPN, to scaled RIAs like Facet Wealth also championing the model, and technology platforms like AdvicePay to facilitate the payments and associated compliance obligations.

Of course, not everyone even wants a financial advisor to deal with the financial complexity in their lives. Some are fine to use the available do-it-yourself technology tools, or simply doing their own research on the internet, to handle their own situations. While others would prefer to pay someone else to help them figure it out and want a full financial planning relationship. In turn, there is a mid-point of people who may want to engage in more ‘piecemeal’ advice as needed – dubbed the Validators by Forrester Research – who right now tend to buy hourly as needed (when they have a complex issue and a tentative plan and need an expert to validate their course of action).

In this context, it was notable that this month, Fruitful emerged from ‘stealth’ mode with a big $33M Series A round to fuel a combination of a financial planning app (to be launched on smartphones this fall) paired with access to a CFP professional who will serve as a “guide” to provide ongoing financial advice, all for a cost of about $100/month. Which effectively appears to aim at a midpoint between pure DIY tech (with apps that are free or have a very low nominal cost), and full-on subscription financial planning, from firms like Facet or advisors at XYPN, which increasingly is pricing at $200/month and up.

As with most other “low-cost, highly-scaled” advice solutions that have entered the marketplace in recent years, the immediate question from the advisor community has been “how many clients will a Fruitful CFP guide actually be able to support?” After all, at an annual fee of $1,200, each CFP guide would ostensibly need 300 – 400+ clients to be able to meet typical advisor-industry revenue/advisor productivity metrics (and Fruitful would ostensibly be expected to have even ‘better’ numbers as a venture-funded technology company?). Which at 2,000 working hours per year, of which even a very efficient advisor would likely struggle to maintain more than 50% - 60% of time in client meetings (given the need for training, professional development, management, some level of operations/administrative and compliance work, etc.), suggests that at best a typical Fruitful client may only get 3-4 hours per year of engagement with their CFP guide.

To the extent that Fruitful’s app can also add meaningful value, arguably consumers may still be happy with the service even with fewer hours from their CFP guide in any particular year. Though to the extent that competitors like Personal Capital gave their app away for free – because ironically, it was so popular the app was more effective to use as a free lead generation tool than it was to monetize by charging for it – arguably there’s only so much room for Fruitful to maintain its $100/month fee via an app when most such tools charge less than $100 per year (if anything at all).

The added complication for Fruitful is that to the extent it is serving Validators who tend to engage for ‘just’ a few hours of advice here and there as needed, Validators can already engage in piecemeal hourly advice from a wide range of advisors for a going hourly rate of $200 - $300/hour… which means that Fruitful’s pricing structure for Validators would actually be more expensive for them than simply hiring an advisor as needed on an ad hoc basis (especially in the years where there are fewer advice questions that crop up in the first place)?

In other words, the irony is that while on the one hand there’s clearly a market for some low-priced technology to support the do-it-yourselfer, and a market for higher-priced advice for those who have more complexity and want an ongoing advice relationship (e.g., even Facet’s “highly scaled” model runs at $1,800 - $6,000/year), it’s not so clear whether the middle will be viable. Not only because client acquisition costs may be prohibitive (when the typical advisory firm spends $3,000+ to acquire a client), and because Fruitful’s cost may not even be competitive for Validators who could just pay an hourly rate as needed, but also simply by virtue of a service that is priced for an ‘ongoing relationship’ but would only have room for 3-4 hours/year of client engagement. By comparison in the world of physical fitness, DIY consumers can look up exercises for free on YouTube or pay a few dollars per month for an exercise app, or hire an ongoing personal trainer to work with them several times per week to keep them on track for their goals; but not many people pay a coach an ongoing fee for an ongoing relationship, but just meeting an hour here or there.

Of course, it’s still very early for Fruitful, and the company has substantial funding to give it room to iterate and decide whether it wants to move further upmarket (with higher fees for a deeper relationship) or further downmarket (with an even-more-scaled offering that relies primarily on its app instead of CFP guides). Nonetheless, Fruitful may well prove to be a good test case for the feasibility of an ongoing recurring-revenue model to serve not the do-it-yourselfer or the deep-relationship delegator, but the broad base of Validators who still struggle to engage with traditional financial advisors?

In the meantime, we’ve rolled out a beta version of our new AdvisorTech Directory, along with making updates to the latest version of our Financial AdvisorTech Solutions Map with several new companies (including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation)!

So what do you think? Will Fruitful be able to find a market and scale with Validators paying ‘just’ $100/month, or will they have to go further up- (or down-)market instead? Will Schwab’s “free” RIA custodial offering attract the kind of regulatory scrutiny its “free” robo-advisor faced? Will Bento Engine find traction with a “Next Best Conversation” solution for advisors? Let us know your thoughts by sharing in the comments below!

Disclosure: Michael Kitces is the co-founder of XYPN and AdvicePay, both of which were mentioned in this article.

I’d never heard about Bento Engines, but it looks interesting and I am contacting them.