Executive Summary

Welcome to the May 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month's edition kicks off with the news that robo-advisor Betterment entered into a $9M settlement with the SEC for misrepresenting its tax-loss harvesting practices in its client agreements and marketing materials compared with its actual practices (e.g., 'only' checking client portfolios for tax-loss harvesting every other day, after having advertised daily checks) – a first for the SEC in scrutinizing an RIA not for failing to execute its investment promises to clients, but for failing to execute tax-loss harvesting promises instead. Which may raise questions for other RIAs (including smaller firms) who promote their tax-loss harvesting practices as part of a 'tax-efficient' investing strategy about whether their own practices (and the technology they use to implement it) really align with what they claim to provide.

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- Altruist has announced a $112 million Series D fundraising round to expand its capabilities to meet the needs of larger advisory firms, the latest in a series of high-profile moves (including becoming a fully self-clearing broker-dealer and acquiring its rival custodian SSG) positioning Altruist to compete directly with the likes of Schwab and Fidelity for established RIAs.

- GeoWealth has acquired its fellow TAMP First Ascent Asset Management, marrying GeoWealth’s tech-forward, open-architecture investment management platform with First Ascent’s 'concierge'-style investment and service-oriented solution (and its flat-fee TAMP business model).

- T. Rowe Price has acquired Retiree Income, the parent company of popular retirement income planning software SSAnalyzer and Income Solver, to put its resources behind developing and distributing the company’s planning tools (albeit perhaps more to its retail and employee retirement plan clients than to advisors?).

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including:

- Business support software provider Benjamin shuts down its operations, which may say less about the demand for workflow support tools (which appears to remain strong) and more about Benjamin's positioning itself as an "AI-driven digital assistant" in an environment where advisors may not trust AI technology enough to pay for it as a solution.

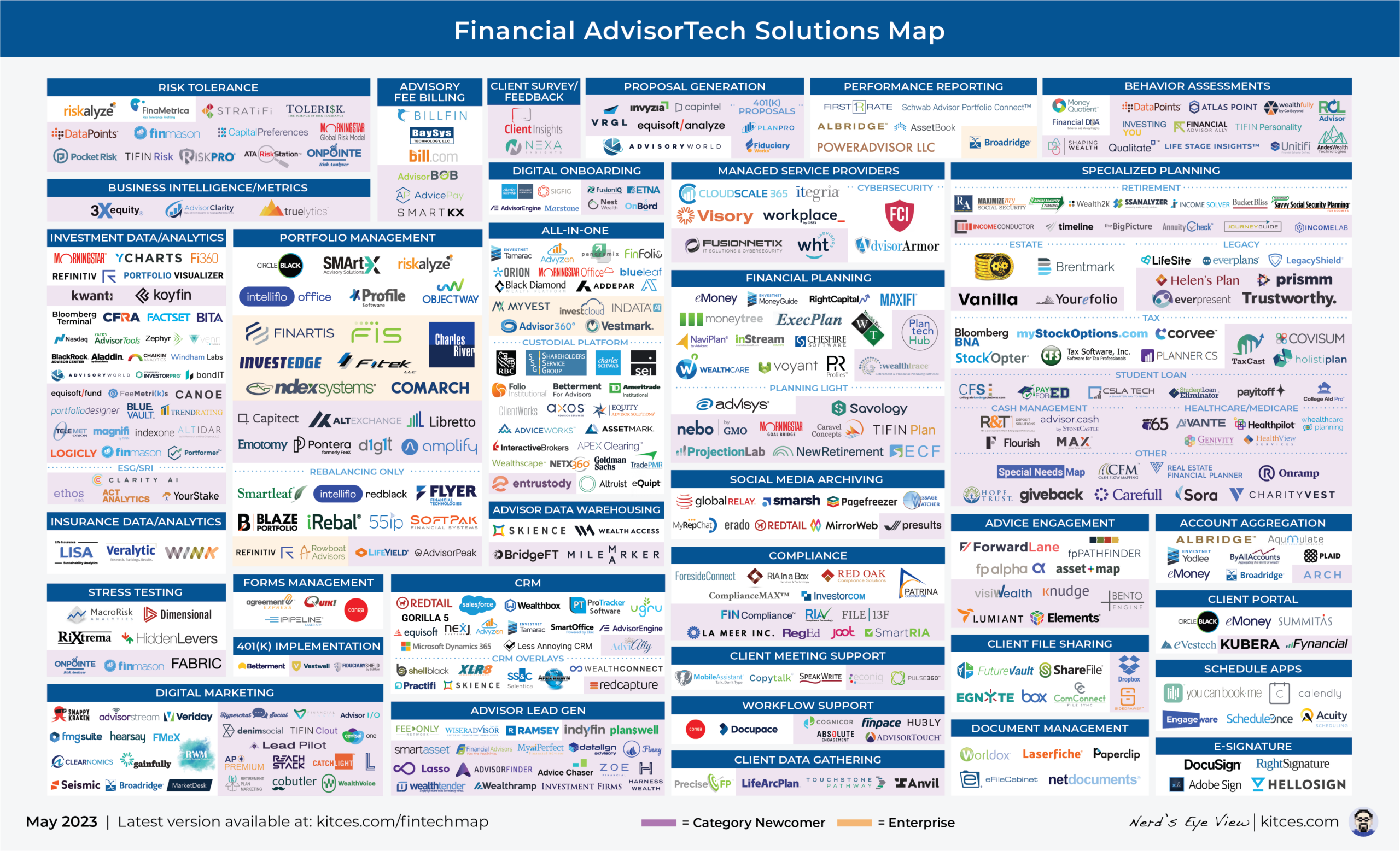

- A look back at the evolution of advisor technology as we come up on the 5-year anniversary of our Financial AdvisorTech Solutions Map, which reflects not only the increasingly crowded landscape with a proliferating number of solutions on the market, but also how shifting technology needs of advisors themselves are eliminating whole categories of advisor technology… and spawning new ones as well.

And be certain to read to the end, where we have provided an update to our popular "Financial AdvisorTech Solutions Map" (and also added the changes to our AdvisorTech Directory) as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

SEC Scrutinizing Tax-Loss Harvesting Tech Implementations With $9M Betterment Settlement

Traditionally, the main value proposition for investment managers has been in managing investments themselves. Managers would seek to add alpha by picking the best stocks or bonds, or mutual fund managers, or manage along the investor’s efficient horizon to optimize their risk/return profile, or factor-tilt to take advantage of pricing inefficiencies over the long run – but whichever the method, the way the way the manager purported to earn their fee was in growing the market value of their client’s investments in some form.

But in a world where it’s harder to achieve alpha through investment decisions alone (or at least where it’s become much more widely known that most managers don’t outperform a broad-based index), investment managers have increasingly sought to demonstrate their value in other ways. One method that’s become popular in recent years has been trying to add not investment alpha, but 'tax alpha', in the form of both asset location, and more commonly via tax-loss harvesting (which rather than growing the nominal value of a portfolio seeks to avoid or defer capital gains taxes to grow the portfolio’s after-tax value).

In recent years, tax-loss harvesting has grown in prevalence amongst financial advisors as improvements in technology have made it easier to identify positions as a loss and trade into similar replacement securities (a trend that only accelerated as most broker-dealers eliminated trading fees, reducing the drag on performance that would otherwise result from frequent trading to harvest losses), which has allowed firms to implement tax-loss harvesting at scale. In practice, this means advisors at small- or medium-sized firms can use portfolio management software like iRebal to incorporate tax-loss harvesting into their rebalancing processes for dozens or hundreds of clients at a time, while giant robo-advisors like Betterment employ proprietary algorithms to regularly harvest losses for hundreds of thousands of clients. And as a result, RIAs both large and small often claim they’ll provide some 'tax alpha' for their clients – backed by at least some research – by harvesting losses and (at least in theory) reducing their tax bill.

While actual outcomes from investment managers are never assured – tax alpha, like investment alpha, will vary by whatever markets deliver, and the skill of the advisor’s execution – regulators like the SEC do focus heavily on how investment managers represent themselves, to ensure that they don’t overpromise their capabilities (via the results they advertise) and at least really do execute the strategies they purport to use to achieve those results. Accordingly, if an investment advisor advertises its investment performance, it needs to be transparent about the methods it uses to calculate that performance, and to make it clear that the prior performance doesn’t constitute a guarantee of future results. And if the advisor purports to use a certain strategy to choose investments or time its trades, it needs to prove that it actually does what it claims to do. All of which is fairly cut-and-dried when it comes to traditional ways of managing investments – but when the advisor’s investment strategy includes tax-loss harvesting, it hasn’t heretofore been clear whether regulators would also scrutinize the tax benefits that advisers claimed to provide (as they would any other investment strategy), and how effectively they implement those tax-loss harvesting strategies using their technology.

That question was least partially answered in April, when the SEC settled with Betterment for a $9 million penalty relating to its tax-loss harvesting practices; specifically, regarding differences between what the robo-advisor claimed it was doing when executing its loss-harvesting strategy for its clients, and what it was doing in practice. The SEC’s complaint identifies 3 main issues in Betterment’s tax-loss harvesting practices spanning from 2016 to 2019:

- Betterment claimed in its client agreements and marketing materials that it scanned taxable accounts every day for loss-harvesting opportunities, but actually scanned each account 'only' every other day

- 2 coding errors in Betterment’s algorithms prevented tax-loss harvesting trades from happening in the accounts of some clients who had opted into it – and when Betterment discovered the errors, they informed clients that the error had only affected their accounts in 2018, when in reality the issue went back to 2016

- Betterment’s tax-loss harvesting functioned differently when clients picked certain 3rd-party portfolio models versus Betterment’s own models, which resulted in fewer harvesting trades, when Betterment advertised that it would continue to work in the same way

In all, the SEC estimates that about 25,000 client accounts were impacted (a little less than 10% of the 275,000 total accounts that have thus far opted into tax-loss harvesting), and that Betterment’s violations cost clients around $4 million in total tax benefits (or about $160 per account in tax benefits that were lost).

On the surface this seems like an isolated event, with Betterment being a prominent target for regulators on account of its size and visibility. But in reality, the SEC’s actions have implications for anyone who does tax-loss harvesting, which is a practice that is hardly unique to robo-advisors. For one thing, the settlement stemmed from the fact that Betterment’s claims and disclosures about its tax-loss harvesting methods didn’t match what it did in practice – but Betterment is relatively rare among RIAs in that it actually does disclose its practices around tax-loss harvesting, which has tended to fall within a bit of a regulatory gray area between tax planning and investment management. Advisors are required to describe their investment strategies (and the risks involved in each) in their Form ADV, Part 2A, but how many include their tax-loss harvesting practices in that description? Will the SEC begin to require more detailed disclosures for all advisors about how, exactly, they implement tax-loss harvesting across each and every one of their client portfolios?

Additionally, the SEC’s action raises questions for advisors who use software to implement their tax-loss harvesting (which is practically everyone who does tax-loss harvesting, given the software’s importance in scaling the strategy on a firmwide basis). What kind of liability might advisors have if they don’t perfect implement the software properly, or even worse if the software they purchased doesn’t actually work exactly right 100% of the time for 100% of their clients? This is a more complicated question: Betterment’s issue here stemmed from two sources, (1) the initial coding error, and (2) the fact that it misrepresented the problem to clients after it found out. But if an advisor doesn’t catch a coding error while doing due diligence for their own software (or when outsourcing their investment management to a platform – like Betterment for Advisors – that uses its own software), it’s fair to wonder whether that could open the door to regulatory issues for the advisor, even if they can catch the issue and act quickly to resolve it. Yet at the same time, how many advisors are realistically able to perfectly vet every possible scenario of their 3rd-party trading and rebalancing software in advance (and for those that claim to have built their own proprietary algorithms to optimize tax loss harvesting, will they even be willing to share the details of their own software methodology)?

Ultimately, this tax-loss harvesting settlement seems to be a shot across the bow from the SEC to advisors who use (and market themselves with) tax-loss harvesting, emphasizing that the age-old adage of, "Whatever you say in your marketing materials, you’d better do" applies not just to investment management, but also to any tax-sensitive overlay that the advisor provides as well. And that it applies not just to how the advisory firm executes its tax-loss harvesting using software, but also the potential that the software itself has coding errors (at least or especially if the advisory firm has created its own spreadsheets or other tax loss harvesting/trading tools) that causes its execution of tax-loss harvesting to conflict with the advisor’s advertised methods. Advisors who market their tax-loss harvesting capabilities may now wonder whether they will be subject to more disclosure rule around tax-loss harvesting, and the extent to which their claims will be scrutinized against any benefits they actually provide – and whether those benefits to clients, and any marketing boost it gives to the advisor in differentiating their services, is worth the potential regulatory hassle?

Altruist Raises $112 Million To Expand Its Service And Tech Capabilities To Move 'Upmarket' To Mid-Sized RIAs

As independent RIAs proliferated in the last 20-odd years, a group of predominantly retail-focused broker-dealers (including Fidelity, Charles Schwab, and TDAmeritrade) sought to leverage their existing retail economies of scale by branching out to begin providing custody services to advisors, who also needed a 'qualified custodian' to hold their (clients') assets. These RIA custodial providers covered the core functions of custody itself (i.e., holding client assets and facilitating trades and money movement), but they didn’t provide everything that advisors needed to fully manage their clients' portfolios. Advisors also needed tools for additional functions like rebalancing (especially with the rise of model portfolios), portfolio accounting and performance reporting, and billing (across multiple accounts for a client, multiple clients in a household, and potentially multiple fee schedules). Which ultimately spawned a new industry of portfolio management technology aiming to fill in the gaps left between the advisors managing client investments and the custodians who held them – and resulted in RIA tech stacks that usually consisted of the custodian as the foundation, plus everything else the advisor needed to manage their clients' portfolios purchased separately and layered on top.

What made this setup practicable for advisors was that they typically didn't need to pay anything directly to the custodian for its core services: their underlying broker-dealer infrastructure made their RIA custodial profits off of trade commissions, spreads on sweep account cash, payment-for-order-flow, and fully-paid lending; all of which were paid either from client funds, or from institutional traders paying for access to those funds. But for RIAs, the 3rd-party portfolio management technology can often add up to a substantial expense – often $10,000+ per advisor just for portfolio management and performance reporting alone – in addition to the complexity of getting several independent software solutions to interface correctly with one another to complete the job of portfolio management. Still, this arrangement – and the expenses involved – was generally accepted as a cost of doing business, given how essential a functioning portfolio management process is to advisors who bill on assets under management. And for many years, portfolio management technology was actually so lucrative it became the most crowded category of the Kitces AdvisorTech Map with more than 50 providers all competing for advisor attention.

Into this environment entered Altruist, which launched in 2018 as a "modern custodian built exclusively for RIAs". Unlike other custodians, which had branched out from existing retail or institutional broker-dealers – who themselves often employed advisors to compete with the independent firms whom they served as custodians – Altruist was built specifically to serve independent RIAs, and aimed to provide an end-to-end custody-and-portfolio management software package… that included the rebalancing and model management, direct indexing, billing, and performance reporting, that advisors typically purchased from 3rd parties.

After several years of building out its product and gaining a foothold in the competitive RIA custodial market (particularly among newer and smaller RIAs, who face fewer hurdles in switching clients over from one custodian to another when they’re just getting started), Altruist has made several big moves so far in 2023 to position itself to compete more directly for established advisors with the likes of Fidelity and Schwab. Earlier this year, Altruist announced they would become their own self-clearing broker-dealer, and almost immediately thereafter acquired rival custodian Shareholder Services Group (SSG). And now in April, it has made news again by announcing a $112 million Series D fundraising round as it continues to ramp up its growth.

In a nutshell, the theme of this fundraising round seems to be about going upmarket from Altruist’s original core user base of smaller and newer RIAs, and expanding its capabilities to serve bigger, more established advisors (and thereby accelerate the growth in its on-platform assets). Bigger RIAs have more complex needs – they require more account types, more asset classes, more portfolio models, etc. – and so in order to serve more firms in the mid- to large-size range of $100 million - $1 billion AUM, Altruist needs the capital to further build out its technology beyond what was 'good enough' for smaller startup RIAs.

The challenge for Altruist is that, for established RIAs, switching custodial providers (which Altruist's existing small/startup RIAs didn’t have to do because they may have just started with Altruist in the first place) represents an enormous investment in time and resources to repaper accounts, port over and clean up historical data, and retrain staff and then adjust processes and workflows around the new technology. 2023 represents a unique opportunity in that regard given that many advisors are already switching custodians in the transition from TDAmeritrade to Schwab, which likely explains the timing of Altruist’s moves as it seeks to peel away some of those advisors during the transition period – yet after this year, it will remain an uphill battle for Altruist to entice advisors to depart from their current custodians.

However, the fact that Altruist isn’t 'just' a custodial platform, but rather an all-in-one solution with performance reporting and billing on top of its core custodial services, means that it can’t really be thought to be in competition solely with existing custodial providers – in reality, it’s competing with advisors' entire custodial-plus-portfolio-management tech stack. If Altruist can demonstrate that advisors don’t really need to pay for 3rd-party technology like Black Diamond or Tamarac on top of their custodial platform – and that its $1-per-account-per-month platform fee represents significant hard-dollar savings compared to the cost of advisors’ existing tools – it creates a strong selling point and an opportunity to make advisors reconsider whether it isn’t really worth switching after all. Or stated more simply, it’s not just about Altruist versus Schwab/Fidelity/Pershing, it’s about Altruist versus one of those custodians plus Orion/Tamarac/Black Diamond, and if Altruist can save a mid-sized firm as much as $50,000 - $100,000 in portfolio management software fees with its all-in-one solution, it’s a powerful financial incentive for RIAs to go through the ‘hassle’ of switching custodians.

Of course, Altruist may have less appeal for advisors who would prefer to build their custodial and portfolio management tech stack from individual third-party solutions themselves, rather than commit to an all-in-one platform. Some simply would rather have the ability to pick and choose the 'best' solution for them, while others would rather go with a single provider with seamless integration between all its components – similar to why some people prefer to buy iPhones and live in Apple’s ‘walled garden’ while others would rather have the customization potential of Google’s Android. So while Altruist’s approach might not be for everyone in the long run, the platform that it’s building shows that it is clearly aiming to be the go-to custodian for advisors who do prefer their gardens to have walls and just want a platform where everything just works well enough right out of the box.

Tech-Forward TAMP GeoWealth Acquires First Ascent To Offer (Flat-Fee) Investment Management At Scale

When an advisory firm manages investments for its clients, it needs a way to systematize the investment management process as it accrues more clients, accounts, and assets. And as the AUM model has grown over the last 20 years, there has also been increasing demand for tools that can streamline or automate the process surrounding investment management: trading and rebalancing, performance reporting, billing, etc.

The need for solutions to manage client portfolios at scale has led to a plethora of portfolio management tools on the market, making it one of the most crowded categories on the AdvisorTech map. And advisors have been willing to pay for the technology: After multiplying the platform’s per-account fee by the total number of client accounts for each advisor, it isn’t uncommon for RIAs to pay $10,000-$15,000 per advisor every year on portfolio management solutions (e.g., $40/account × 3 accounts/client × 100 clients = $12,000). Which, despite being one of the largest single technology expenses for an advisory firm, has generally been considered worthwhile as a cost of doing business since the greater efficiency allowed by systematizing the investment management process means that advisors can generate more than enough extra AUM revenue to make up for the platforms’ substantial cost.

However, despite the high amount of revenue per advisor that portfolio management technology can generate, it isn’t necessarily easy being a software provider in that market today. First, the lucrative opportunity presented by portfolio management technology has invited a large number of competitors in the space – peaking at more than 50 simultaneous competitors in the portfolio management category – which puts pricing pressure on all providers as they seek to gain market share. Second, custodial platforms like Altruist, Schwab, and Fidelity are increasingly building out their own technology offerings that integrate seamlessly with their own custodial services that advisors are already using at little or no extra cost, increasing the pressure on standalone investment management platforms to offer more tools (and further reduce prices) to differentiate themselves and justify their value. And third, once RIAs reach a certain level of size and scale, they often have the resources (and the incentive) to build their own in-house technology that eliminates the need for a 3rd-party option.

Two platforms that have found ways to differentiate themselves in this competitive environment are GeoWealth and First Ascent Asset Management. Both platforms are essentially Turnkey Asset Management Platforms (TAMPs) aiming to streamline asset management for financial advisors, but they each approach the task in slightly different ways. GeoWealth, which was created as a homegrown tech solution originally built to serve one large advisory firm, largely used its technology as its own selling point, offering an open-architecture TAMP platform through which advisors could implement either 3rd-party ‘Model Marketplace’ portfolios or the advisor’s own model portfolios. But by building its own in-house technology, GeoWealth has positioned itself as being a lower-cost provider than 'traditional' TAMPs that have to layer their own costs on top of (relatively expensive) 3rd-party portfolio management software.

First Ascent, on the other hand, leaned into portfolio management by offering its own suite of model portfolios – and perhaps more notably, became one of the only TAMPs to offer flat per-account pricing rather than a basis point-based fee, which made it particularly appealing to advisors charging flat fees (e.g., subscription fees) themselves, whose bps-based TAMP costs for investment management alone could eventually eclipse their own (flat) advisory fee altogether if their clients' affluence and accounts grew high enough.

In this context, it's notable that this month the news broke that Geowealth has acquired First Ascent, representing a marriage between GeoWealth’s homegrown TAMP technology and open-architecture investment model with First Ascent’s investment- and service-oriented model.

From GeoWealth’s perspective, the deal expands the offerings it can provide beyond 'just' its TAMP technology and access to model portfolios by integrating First Ascent’s investment expertise and ‘concierge’ investment consulting services (and GeoWealth also adds experienced TAMP leadership to its ranks with First Ascent CEO Scott MacKillop, who has worked in leadership roles for various investment management technology platforms going back to the late 1990s). For First Ascent, the main benefit of the combination is to bring in GeoWealth’s in-house technology to allow it to better scale its own high-touch offering and keep its own costs down by eliminating 3rd-party portfolio management tools – which is especially important given its flat fee model that stays capped even as assets on the platform grow (such that “big” clients can’t cross-subsidize smaller clients, so First Ascent has to stay tech- and cost-efficient and profitable on every client it serves).

The press release announcing the deal states that First Ascent will continue to operate as an independent subsidiary of GeoWealth. First Ascent’s services and flat-fee pricing will still be available for its advisor clients, who will also now have access to GeoWealth’s technology platform. Firms on GeoWealth’s platform will presumably have access to First Ascent's in-house investment models, and if they decide the flat-fee approach of First Ascent makes more sense for them, they could make the switch with minimal disruption given that both platforms are now based on the same technology.

Even before the deal, GeoWealth was a strong up-and-comer in the investment management technology category, with about $7.5 billion in assets under management and $20 billion in total assets on their platform (presumably representing a mix of assets managed directly by GeoWealth's TAMP and those managed by advisors using GeoWealth’s technology), and the deal adds another 80 advisors and $1.4 billion in AUM from First Ascent (though First Ascent’s flat-fee model makes it unclear how much revenue that additional $1.4 billion of AUM supports).

Ultimately, though, the real significance of the deal may be more both the ongoing trend of TAMPs (and RIA custodians) to in-house their own portfolio management technology (presenting an ongoing threat to 3rd-party portfolio management tools), and also about the future opportunity it represents in offering a combination of basis-point and flat-fee models built to scale on the same technology, which leaves GeoWealth/First Ascent uniquely positioned among TAMPs to serve a wider range of advisors who may see advantages in either model (particularly as increasing numbers of advisors are themselves adopting subscription, retainer, and other flat-fee models).

T. Rowe Price Buys SSAnalyzer And Income Solver AdvisorTech Parent Company To Invest In And Amplify… Its Direct-To-Consumer Tools?

The earliest financial planning software was built as a retirement projection tool for people still accumulating savings during their working lives. The software could calculate an estimate of a client’s retirement savings picture based on their current trajectory versus where they needed to be to reach their goals and demonstrate any gaps… into which the advisor could then sell them a product (e.g., a mutual fund or life insurance policy) to help make up the shortfall. And while further iterations of financial planning software grew more sophisticated over time – for example, by incorporating cash flow-based planning and Monte Carlo analyses to provide more realistic retirement planning scenarios – the software still tended to focus primarily on projecting the growth of retirement portfolio values over time. Other aspects of the client’s retirement picture were painted with a fairly broad brush, using rough assumptions for elements like Social Security income and tax rates on retirement withdrawals with few (if any) tools to actually improve them.

As financial planning grew more advice-centric and less product-centric, there was increased demand for planning tools that could accomplish what traditional financial planning software couldn’t, particularly in the domains of Social Security optimization and tax-sensitive portfolio drawdowns – two ways in which advisors found they could add value by demonstrating to clients how they could boost their retirement income by choosing the right Social Security claiming strategy and by reducing the taxes paid on their retirement assets by managing their tax brackets (e.g., by making strategic Roth conversions to 'fill up' lower tax brackets).

One of the early leaders in providing these specialized planning tools was Retiree Income, founded in 2008 by Bill Meyer and Dr. William Reichenstein. Based on Reichenstein’s academic research and Meyer’s experience in software product design, they built tools to easily model relatively complex Social Security claiming strategies for both single retirees and couples, and to demonstrate withdrawal strategies incorporating Social Security as well as optimized asset allocation and sequence of withdrawal methods. Notably, the company developed both an 'advisor' and a 'consumer' version of its tools, releasing SSAnalyzer and Income Solver for financial advisors (which is mainly geared towards analysis of different strategies, with the advisor left to recommend and implement the strategies themselves), and Social Security Solutions and Income Strategy as direct-to-consumer tools (with an option for advice on top of the analytical tools for DIY-preferring clients).

It's notable, then, that news came out in March that parent-company Retiree Income was being purchased by asset management giant T. Rowe Price. The deal is somewhat surprising given that Retiree Income’s tools are well-known and popular among advisors (with Kitces Research on AdvisorTech showing SSAnalyzer and Income Solver having the highest adoption rate in their respective software categories), while T. Rowe Price is primarily known for its roots selling direct-to-consumer mutual funds and managing employer retirement plans – meaning that in all likelihood, it’s the consumer versions of Retiree Income’s tools that T. Rowe price is targeting through this deal, rather than its highly-regarded advisor tools. As T. Rowe Price’s own press release of the deal highlights, “the software will be an important part of our [T. Rowe Price] strategy to build personalized retirement income solutions and services for our [T. Rowe Price] clients”.

To that end, it seems likely that T. Rowe Price will use the heft of its resources to invest in Retiree Income’s consumer tools and distribute them via its direct-to-consumer channels (and very possibly its employer retirement plan services as well). From the advisor standpoint, while SSAnalyzer and Income Solver reportedly will still be available, it’s hard to imagine that T. Rowe Price will direct the same level of attention and investment their way as the consumer tools – after all, as a $1.3 trillion asset manager, a B2B tech solution for advisors won’t grow T. Rowe Price’s revenue in any substantial way, at least compared to the ability to reach literally millions of consumers who already use T. Rowe Price directly through their newly acquired retirement income software tools for consumers.

So while it’s good to see the successful exit of an AdvisorTech provider – particularly one that built not one, but two sophisticated and well-regarded solutions in the advanced planning domain – the acquisition ultimately raises the question of how much adoption specialized planning tools can expect among advisors before they need to find other channels for growth. As while SSAnalyzer and Income Solver may have led their categories in adoption rate in our Kitces AdvisorTech Research, the reality is that only so many advisors will choose to employ specialized tools beyond their existing financial planning software, which leaves specialized tools only so much room to grow. Retiree Income was fortunate (and perhaps savvy) in also developing direct-to-consumer versions of its tools which caught the eye of a giant asset manager interested in investing to distribute those tools further – but most specialized planning tools don’t have a feasible direct-to-consumer path.

Strategically, then, the T. Rowe Price acquisition of SSAnalyzer and Income Solver highlights how specialized planning tools either need to find a way to be more directly integrated to financial planning software (so advisors don’t have to make an either-or choice), sell themselves to a financial planning software provider… or face the risk that an acquirer comes in and repurposes their software to its own goals. Because in the end, it’s very challenging to develop such a great specialized tool that advisors are willing to adopt it on top of the other financial planning software they already use?

AI-Driven Sales Pitches Falling Flat To Advisors As Workflow Support Platform Benjamin Shuts Down

Advisory firms have a natural tendency to grow. Client retention rates for a typical firm average well over 90%, meaning that once a firm gets over the initial hurdles of growing to a point where it can sustain itself, even a relatively modest growth rate thereafter can lead to needing multiple advisors and support staff to attend to all the needs of the firm’s clients over time.

But as a firm grows, its operations can get messy. With more clients, accounts, and employees, there are more processes that must get handed back and forth between multiple staff members, bringing the potential for hangups and miscommunication when everyone isn’t on the same page. And with the independent RIA model having taken hold in the last 20 years or so, many firms which have seen steady growth over that time – who may have originally ran lean solo practices – are now increasingly in that ‘messy middle’ stage of learning how to coordinate workflows and handoffs across multiple employees serving clients as a team.

In that context, there has been increasing demand for tools that can help advisory firms manage their multi-staff multi-system workflows as they increase in scope and complexity. To some extent, CRM software has stepped in to fill that need, with providers such as Redtail and Wealthbox launching workflow capabilities within their platforms (leveraging the client information already housed within their software), and larger advisory firms are increasingly migrating towards Salesforce (which has long had deeper workflow and automation capabilities… at least for the advisory firms that can budget enough for Salesforce consultants or overlays to program the platform to their firm’s specific workflow needs). But most providers of CRM software, which traditionally served as a digital rolodex built primarily for handling sales opportunities, haven’t yet treated workflow management as a core function of their products (or in the case of Salesforce, haven’t done so in a manner that is cost-effective for small-to-mid-sized advisory firms), and so have largely failed to provide tools that can handle the increasingly complex workflows and task management functions needed for a modern, multi-employee (but not ‘huge’ enterprise) advisory firm.

As a result, 'workflow support' has been an emerging and growing category of the Kitces AdvisorTech Map in recent years, with tools such as Docupace, Hubly, and Cognicor providing various forms of solutions that overlay and integrate with advisors’ existing CRM platforms to streamline back-office functions like opening accounts, moving money, and scheduling meetings (as well as increasingly supporting middle- and front-office functions like drafting meeting agendas, reviewing planning items, and flagging topics for review, and managing all the documents that go with the process along the way).

In this context, it's notable that Benjamin, one of the early entrants into the emerging workflow management category, announced in March that it was shutting down operations. Launched in 2019 after being developed in-house at the RIA firm of its founder, Matt Reiner, Benjamin was re-launched in 2020 as “the world’s first AI assistant created for advisors by advisors”. But despite garnering industry media buzz for its pioneering AI tools – winning a Wealth Management Industry Award for Business Support Systems and receiving an initial round of seed funding plus additional investments from the Scratchworks fintech accelerator competition – Benjamin apparently found itself unable to achieve substantive traction with advisors themselves, ostensibly resulting in a struggle to achieve break-even cash flow after nearly 4 years (and shutting down after not being able to find additional capital to otherwise keep itself going).

As the overall growth of the workflow management category shows, Benjamin’s demise isn’t likely due to a lack of desire from advisors for workflow support – and the growth of both workflow capabilities in CRM systems like Redtail and Wealthbox, and more substantively the rising traction of platforms like Hubly, shows that advisors are increasingly even willing to pay to improve their workflow capabilities as their needs grow above and beyond what their CRM can provide (ironically, often at a cost that is higher than the underlying expense of the CRM software itself, suggesting that CRM providers may still be under-investing in workflow support if competitors can charge more than they do for ‘just’ one key feature!).

At its core, however, it appears that Benjamin’s demise may be less about advisor desire and willingness to pay for a workflow support engine, and more about advisor resistance to how Benjamin leaned heavily into marketing the 'AI' that drove its technology. Which on one hand makes it ironic that Benjamin had to shut down just as the recent buzz around AI reached a high point, but on the other hand illustrates how the newness of AI still creates some hesitancy in advisors who don’t yet trust the technology enough to hand over the keys to their operations to it. And so as other providers like Cognicor and FP Alpha emphasize their AI-driven tools, it remains to be seen whether doing so is really helping their sales pitch to advisors, or whether advisors really just want a tool that solves their problems (while being less interested in how the technology actually works). In other words, while advisors may jump at a solution that automates workflows and assigns tasks automatically, they might be less eager if they find out the solution uses AI to perform those functions. Not to mention that while AI-based chatbots may be a hot topic of conversation, it’s not actually clear whether a chatbot interface actually improves the user experience for advisors over one that focuses on how advisors already prefer to use their technology and manage their workflows (as Hubly has done).

Benjamin notwithstanding, however, there are clearly opportunities today for technology that can augment the workflow capabilities of advisors’ CRM platforms, and in the long run it seems inevitable that elements of AI will weave their way into the technology as well. Still, the core question when it comes to workflow support in particular is whether the rising demand for tools will spur CRM providers themselves to step up their capabilities (either by building the tech themselves, or by acquiring one of the increasing number of workflow support providers out there) to save advisors the (often-substantial) cost of a 3rd-party overlay – or whether workflow support will become a standard and necessary standalone tool for advisors as they grow in size and scale?

The Kitces AdvisorTech Map Highlights The Evolving Landscape As It Turns 5 Years Old

5 years ago, a boom was emerging in advisor technology. Robo-advisors had emerged a few years prior and, while they didn't disrupt the human advice industry as many feared, they did leave a legacy by demonstrating how clunky and old a lot of advisor interfaces had become, spurring a major cycle of investment from advisor platforms that suddenly felt a renewed sense of urgency to catch up. Additionally, in those years the rise of FinTech – and PE firms that invest into it – began a wave of AdvisorTech acquisitions, including, among many others, Principal Financial acquiring RobustWealth, Franklin Templeton acquiring JemStep, Northwestern Mutual acquiring LearnVest, and perhaps most notably Fidelity buying eMoney for nearly $250M – that demonstrated an opportunity for founders to build in the AdvisorTech space with the possibility of a successful financial exit as industry incumbents increasingly sought to acquire and bring new technology in-house. And adding more fuel to the fire, persistent low interest rates just further amplified the amount of venture capital money looking to invest in the next big FinTech acquisition.

As a result, by the mid- to late-2010s there was a plethora of new startups emerging, while mergers and acquisitions activity combined other providers together (or absorbed newer solutions back into established incumbents). Which led to a challenge for advisors who wanted to take advantage of all this new technology: How to keep track of all of the new technology coming out, navigate which tools solve different pain points in various ways, and figure out how to fit all of the tools together, so that managing the proliferating advisor technology choices didn’t become a separate job unto itself?

In an attempt to create a high-level overview of the tech landscape and make sense of who all the players were, we launched the Financial AdvisorTech Solutions Map (originally called the Financial Advisor FinTech Solutions Map) in April 2018 and have updated the map every month since. The purpose of the map was twofold:

- To provide a clickable navigational map to keep track of the proliferating number of companies providing different solutions; and

- To categorize providers by their 'primary' function.

This second point was becoming increasingly necessary in an environment where more and more software providers were providing additional features and capabilities to their tools and trying to do everything for everyone, which made it hard to get a sense of what they really did as their core capability. For instance, although many software solutions included a client portal or document-sharing vault, few advisors would buy them just for the portal function. Similarly, eMoney offered advisor-branded marketing tools, but few would use eMoney for marketing unless they first used it for financial planning. And Orion acquired Advizr to offer financial planning software, but few would use Orion Financial Planning unless they first used Orion for portfolio management to begin with.

The original AdvisorTech Map from April 2018 had 188 different software solutions, reflecting how overwhelming the range of options in AdvisorTech was already becoming at that time – but fast forward to April 2023, and there now 409 different software solutions crammed into the one-page map! To be fair, some additions to the Map are likely a result of companies we missed in the initial launch and added in the months thereafter… though the overwhelming bulk of the additions simply reflect the continuing boom in AdvisorTech itself, with the total number of solutions more than doubling (and the more-than-doubling of different solutions itself understates the amount of new software that has come along during that time, since many tools have either disappeared or been folded into other companies during that time as well!). In fact, the Map itself became so dense with company logos of increasingly small size that were harder and harder to click, that we last year launched our Kitces AdvisorTech Directory to provide an even more navigable interface to find new solutions and help advisors build their own AdvisorTech stack.

But even as use of our AdvisorTech Directory has grown, the Kitces AdvisorTech Map has become a thing unto itself – both a navigational aid for advisors to find technology, the punchline to a joke about the dense proliferation and sometimes overwhelming number of choices that advisors now have… and a visual statement of the evolution of the AdvisorTech itself as the monthly updates of the Map document changes to the landscape. Some highlights of these AdvisorTech evolution trends over the past 5 years include:

- The near-disappearance of the 'B2B robo' tools as advisors demanded better onboarding capabilities but showed an unwillingness to pay for them on top of their broker-dealer or custodial providers… such that companies either died out, or became assimilated into larger asset management or portfolio management platforms (so much so that the category itself, which once took up a sizable part of the map, has converted into a small "Digital Onboarding" category of more specialized solutions today).

- The rapid diminishment of the portfolio performance reporting category as distinct from trading and rebalancing, as portfolio management tools have increasingly bought or built performance reporting and performance reporters acquired most of the available trading and rebalancing tools in a massive consolidation into what is now the "All-In-One" category

- The growth of the Behavioral Assessments category, reflecting the growing hunger for advisors to demonstrate their value through behavioral finance and financial psychology beyond 'just' investment management alone

- The proliferation of specialized financial planning software as advisors increasingly find their core financial planning platforms don't provide the depth of planning capabilities that they need to demonstrate more value to defend against fee pressures

- The explosion in advisor marketing technology – both in the form of digital marketing tools to help advisors market themselves on their own, and lead generation tools for advisors who prefer to have their leads handed off to them ready-made

- The emergence of additional categories as advisors scale up their capacity to provide ongoing advice year-round to justify the ongoing advice relationship after the initial financial planning process, including workflow support and advice engagement categories

The shifts in the AdvisorTech landscape also reflect the themes of how advisory firms themselves are evolving: The increase in depth and breadth of advice to deepen the advisor’s value proposition beyond just portfolio management; the challenges of marketing and growth in a competitive environment where it’s no longer sufficient to differentiate solely on being a fiduciary or offering comprehensive financial planning; the workflow and management challenges that arise as firms grow and accrue clients, assets, revenue, and staff and need to become more efficient to scale further; and the relative diminishment of investment-related tools – which, while still present in most advisors’ tech stacks, have undergone a wave of consolidation and are continuing to experience the greatest pricing pressure as the cost of providing asset-allocated portfolios (and willingness to pay for tech to support it) has plummeted in the robo-advisor era.

Looking forward, we expect to see a few of these trends continue: advice engagement and workflow support tools will likely continue their growth as relatively new categories with plenty of room for new adoption, along with other emerging categories that could see further growth include data warehousing (as larger advisor enterprises seek to not only integrate their cross-system workflows but centralize all of their business and client data), and client meeting support (particularly as AI tools such as ChatGPT pick up steam and present the opportunity to automate many of the time-consuming tasks surrounding client meetings like writing follow-up emails and assigning tasks for next steps). On the other side, investment management technology seems likely to consolidate further (as custodial platforms like Altruist gain share with their own in-house technology, with other custodians potentially following suit), and other waves of consolidation may follow – such as in the "Risk Tolerance" category (where no one has yet managed to dislodge the now-dominant Riskalyze) and "Behavioral Assessments" (where, despite research showing evidence of the benefits of behavior-based advice, few advisors have been willing to wade very far beneath the surface of client behavior and psychology – or to pay for solutions for doing so).

But whatever the path that the evolution of AdvisorTech takes from here, we’re committed to continuing to help advisors navigate the choices… and in the process, document its ongoing progress and evolution. It’s been exciting to see the Kitces AdvisorTech Map pop up in other contexts, such as corporate strategy presentations and even in venture capital pitch decks – and to appreciate that what started out as a navigational aid, and branched out into a directory as the map itself got crowded enough to test the eyesight of its readers, has become a kind of visual commentary on the AdvisorTech landscape itself. Which becomes all the more apparent when watching the (literal) evolution of the map in its 60 monthly iterations over the last 5 years, as illustrated below!

Kitces - AdvisorTech - Anniversary Video by Ashley Lawson

In the meantime, we’ve rolled out a beta version of our new AdvisorTech Directory, along with making updates to the latest version of our Financial AdvisorTech Solutions Map with several new companies (including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation)!

So what do you think? Should the SEC scrutinize RIAs’ advertisements of their tax-loss harvesting practices in the same way as any other investment strategy? Would you rather be able to choose the individual portfolio management solutions that you like the most, or live in a 'walled garden' where the choices are fewer but everything is built to just connect and work all by itself? Would you trust an AI-driven solution to handle your core business processes (and pay to do so)? How far do you need to zoom in on the AdvisorTech Solutions Map to be able to read it all? Let us know your thoughts by sharing in the comments below!

Leave a Reply