Executive Summary

Welcome to the May 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month's edition kicks off with the news that self-directed retirement planning software provider NewRetirement has raised a $20M Series A round as the company demonstrates that its DIY tools really do turn a subset of consumers into bona fide prospects for financial advisors. Which positions the software as either a white-labeled solution for advisory firms that want a way to engage a high volume of prospects in their funnel, or simply a solution to convert its own 70,000+ active users into paying clients of NewRetirement's own financial advisors. Especially given that NewRetirement has already managed to get some sizable 401(k) providers and recordkeepers to offer the software on a paid basis to their own plan participants… which means NewRetirement is effectively getting paid to market its own advice services (a marketing funnel that pays for itself!?).

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- Betterment Premium raises fees for its human CFP service to 0.65%, putting it remarkably close to the 0.70% average revenue yield of the typical advisory firm, as the robo-advisor ends up emulating the human advisor service and pricing model it once sought to disrupt

- Trust & Will announces a strategic partnership with LPL and its 22,000 advisors, as more and more advisory firms look to include estate document preparation as part of their suite of value-added services to clients (while outsourcing the actual legal work)

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including:

- A pair of new research studies (one from Cerulli, another from Fidelity) highlight how "tech-savvy" firms with high technology adoption are outgrowing the rest… not by attracting more clients with a better digital experience for clients, but simply by finding more of their own operational back-office efficiencies to be able to scale faster

- The SEC serves up a series of very sizable fines to make examples of financial services firms that didn't do enough to supervise their employees' use of texting and other messaging apps (e.g., WhatsApp), in a reminder to all advisory firms that all business-related communication must be archived (and reviewed!)

- As the buzz and hype continue around AI, a warning (coupled with a pair of enforcement actions) from the SEC not to engage in "AI-washing"… advisory firms that promote how they're using artificial intelligence in their practices need to be certain that they are actually doing so

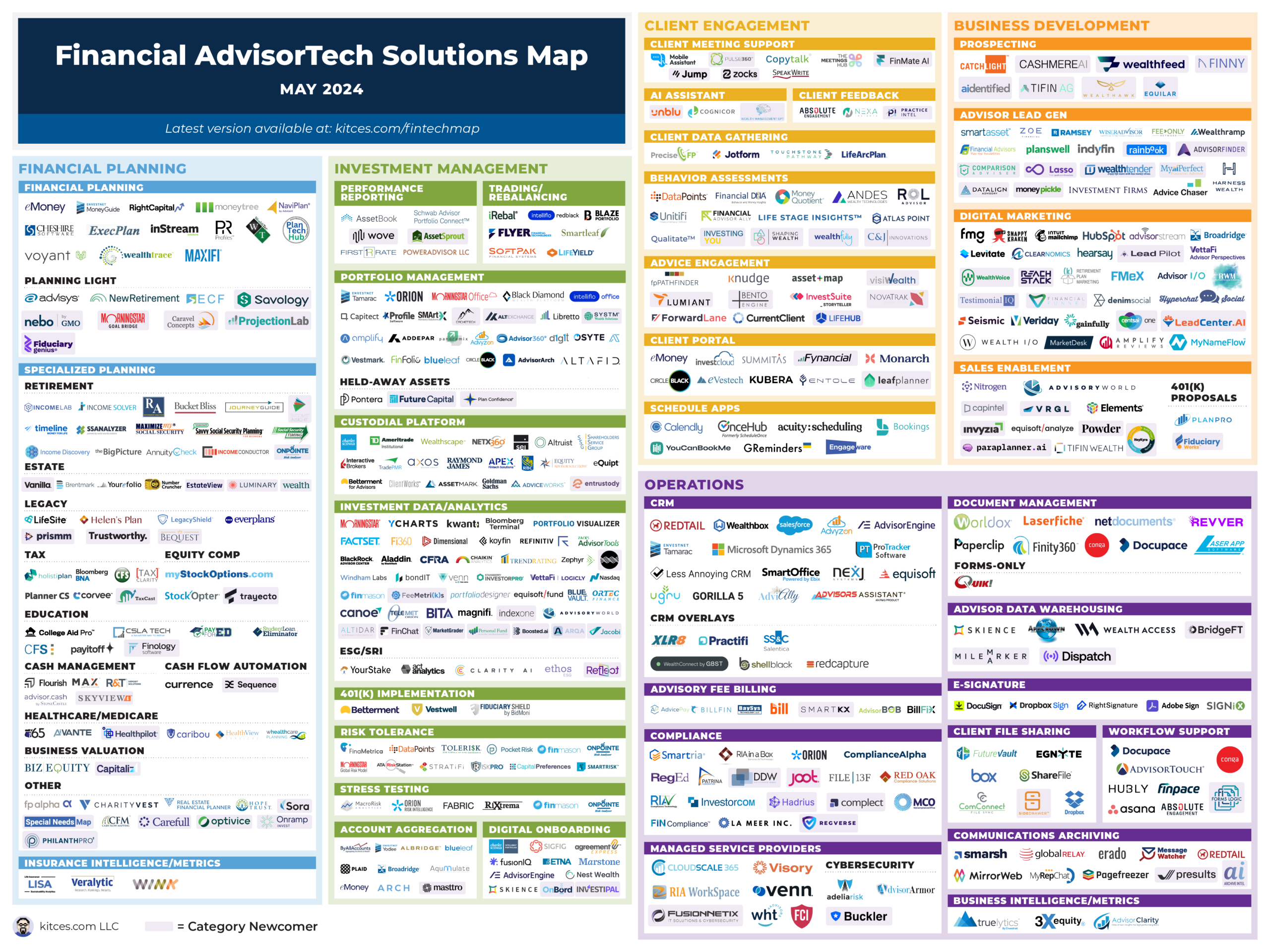

And be certain to read to the end, where we have provided an update to our popular "Financial AdvisorTech Solutions Map" (and also added the changes to our AdvisorTech Directory) as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

NewRetirement Raises $20M Series A Round With Self-Directed Planning Tools That Create A Pipeline Of Planning Prospects… For Itself?

For more than a decade since the first emergence of the so-called "robo-advisors", there has been a broad debate in the financial advisor world about whether or how much clients should have – or would even want – access to their own financial planning software tools.

On the one hand, self-directed financial planning software creates a low-cost, highly-scalable path to bring financial planning advice to consumers who can't otherwise afford the full services of a financial advisor, especially with the rise of increasingly sophisticated recommendation engines (or perhaps soon, the outright use of AI) to determine the consumer's best course of action. And even for those consumers who still ultimately want to engage a financial advisor for the advice itself, self-directed tools can expedite the planning process as new clients load their own data into the tool (saving the advisor's time and cost of doing it on the client's behalf) and perhaps even create more buy-in to the planning process with better engagement.

On the other hand, consumers often hire financial advisors because they don't have the time, knowledge, or inclination to figure it all out themselves, and would rather either delegate to the financial advisor (due to lack of time or inclination) or be able to rely on the advisor's expertise (in areas where they don't have enough knowledge to even know what to ask and analyze). Which implies that those who use self-directed planning software are, almost by definition, more "self-directed" and less likely to seek out and ever want to utilize a financial advisor at all!

Yet in practice, there is an in-between, where consumers may start out as more self-directed because their situation is simpler (relying less time and knowledge), but over time rises in complexity with life, wealth accumulation, and changing circumstances, that eventually results in a shift where they decide to seek out a financial advisor. Which ultimately helps to explain why platforms like Personal Capital were so successful – by giving away a self-directed personal financial management dashboard tool that was largely used by self-directed consumers, but was so popular that when 'just' 1%–2% of those users decided that it was time to get more help from a human financial advisor… Personal Capital was vaulted to become a nearly $1B enterprise.

In a similar context, this month self-directed retirement software provider NewRetirement announced a whopping $20M Series A round of capital, to continue to expand its reach as it demonstrates that when self-directed software gets into the hands of enough consumers, a percentage of them really do 'upsell' into a human financial advice relationship. In practice, the company currently has 70,000 active users of its software, including 23,000 who are paying $10/month for premium financial planning features… and an unspecified number who are showing a willingness to move up to a $1,500 financial planning engagement with a human advisor, from a user base that's estimated to have $100B of potential assets to manage as well.

Notably, NewRetirement has generated its users both from direct-to-consumer marketing and outreach, and also by partnering with large retirement plan recordkeepers (e.g., 401(k) providers) who can themselves offer NewRetirement's premium planning tools as an 'upsell' for their financial wellness tools, allowing the firm to cost-efficiently reach a large base of consumers (akin to how Personal Capital itself was ultimately sold to 401(k) provider and recordkeeper Empower). At the same time, NewRetirement is also white-labeling its tools to advisory firms that themselves have a high volume of prospects (e.g., from the firm's existing content marketing or other marketing campaigns) and need a way to 'pre-engage' those prospects to determine which are ultimately 'just' self-directed and which might really want and need to work with a financial advisor now or in the future.

From the advisor perspective, the NewRetirement tools probably won't be helpful to most, simply because most advisory firms don't have the 'problem' of too many (hundreds or thousands of) leads coming in every year that they need to engage in a more initially-self-directed way to funnel down to the more qualified prospects. And even for those firms that do, if they're already using 'traditional' financial planning software (e.g., eMoney, RightCapital, or MoneyGuide) there may be some resistance to starting clients in one planning tool (NewRetirement) and then doing the bulk of the planning itself in another (the firm's traditional software). In other words, NewRetirement is likely only relevant for a very small subset of advisory firms that have so scaled their inbound marketing that they really do have a "too many leads to handle" problem.

From the broader industry perspective, though, the reality is that NewRetirement appears to be well on its way to monetizing itself not as a SaaS solution for advisory firms, but by becoming the advisory firm itself and monetizing its own lead flow into planning engagements. Which is especially notable because most advisory firms struggle to scale up to a large volume of prospects due to the client acquisition costs to get them…except in the case of NewRetirement, which has a series of planning tools valuable enough that 401(k) providers and recordkeepers are paying NewRetirement to put their tools in front of the 401(k) providers' own plan participants… effectively creating a scenario where NewRetirement could actually have a negative client acquisition cost because it's being paid to market its planning services by selling the precursor planning tool for an enterprise fee!

All of which helps to highlight that the biggest blocking point to expanding access to financial advice is not the cost to service and deliver the advice, but the client acquisition costs to get to those clients efficiently in the first place. For which NewRetirement appears to have built a solution by not solving an advisor efficiency problem, per se, but fulfilling a (direct-to-)consumer need that allows them to attract enough consumers to find the small percentage who are ready to pay to engage a (NewRetirement) human financial advisor. Because when the software reaches enough consumers directly, a small pecentage wanting an advisor can be more than enough!

Humans Beating Robots As Betterment Raises Fees On 'Premium' Tier With Human CFPs To Move Near Parity With Traditional Financial Advisors

It was more than 10 years ago that the so-called 'robo-advisors' like Betterment and Wealthfront first arrived, proclaiming that they could automate what traditional human financial advisors do at a fraction of the cost, and intimating that financial advisors are 'greedy pigs' who charge consumers 'an arm and a leg' with a 1% AUM fee for what robo-advisors offered at just 0.25%.

In response, financial advisors pointed out that the offered of (comprehensive) financial advice goes far beyond 'just' allocating into and systematically rebalancing a diversified portfolio as robo-advisors were implementing. It also increasingly includes a holistic financial plan from a Certified Financial Planner professional, ongoing advice from an advisor with whom you have a relationship and who really understands your situation (without needing to explain it all over again every time there's a question), and access to someone you can talk to when markets get scary. Such that it wasn't fair to compare an investments-only portfolio solution to a holistic advice relationship, because they fundamentally weren't the same service (portfolio management versus planning), and weren't built for the same consumer need (self-directed consumers who want to pick their own investment manager, versus delegators who want an advisor to figure it out for them).

Sure enough, the subsequent years bore this out, as in 2017 even Betterment itself launched a new tier of "Betterment Premium" that, for 0.40% instead of 0.25% with a $100,000 minimum, would allow access to human CFPs for a once-per-year financial planning phone call plus unlimited email-based advice throughout the year. A tacit acknowledgment that the human CFP advice layer was in addition to and beyond what robo-advisors provided as a portfolio-management-only service. Which in turn was emulated by numerous other "robo" platforms that ultimately paired with human CFP professionals and charged more than 'just' the 0.25% robo-advisor fee, from Vanguard's Personal Advisor Services to Schwab's Intelligent Portfolios Premium.

And now this month, it was revealed that Betterment is substantively raising its fees on the Betterment Premium service, from 0.40% to 0.65%, effectively pricing the human CFP offering at 40bps above (and more than 1.5 times) the underlying 0.25% fee to 'just' have a Betterment-managed portfolio.

From the industry perspective, Betterment's change is a remarkable affirmation for the pricing of a "traditional" human financial advisor. As while the industry often talks about the proverbial benchmark of 1% AUM fees, in practice with breakpoints, householding families together (to reach those breakpoints), and discounts/concessions for individual client circumstances, the average revenue yield of an advisory firm is actually 0.70% according to the latest Investment News benchmarking study. Which means with its latest repricing, Betterment's flat 0.65% fee schedule is almost perfectly synced up to and emulated what "non-robo-advisors" charge for their own human CFP advisors!

In turn, Betterment's repricing and alignment to traditional advisor pricing also helps to highlight how in practice, most human advisory firms have largely adopted technology (from rebalancing/model management software to the use of model marketplaces) to be able to execute their own portfolio management processes in a remarkably 'robo-like' fashion (and thus able to implement at a similar cost for the base portfolio management service, on top of which the firm adds its 'human advisor' fee for financial planning services).

To be fair, it is worth recognizing that traditional advisory firms do tend to work with a somewhat more affluent clientele (where $250k to $500k+ asset minimums are more common, compared to Betterment's $100k minimum), which means in theory human advisory firms should have somewhat lower fees simply because of the superior economies of scale that come from generating more revenue per client from fewer clients. Though at the same time, more affluent clients also tend to have higher expectations – from more experienced (and thus more expensive) advisors, to a higher level of service with more meetings and touchpoints – which implies that traditional advisory firms may simply remain slightly more expensive than Betterment Premium because they're providing a slghtly deeper service to a slightly more affluent clientele who can and are willing to pay for it.

All of which collectively affirms that robo-advisors were never really a threat to real advisors, and instead were simply offering a different service to a different clientele… and ultimately found that there is still so much demand for the holistic relationship-based advice services that financial advisors offer, that robo-advisors became emulators of the traditional advisors they once sought to disrupt!

Research Shows Tech-Savvy Advisory Firms Have Better Growth… Due To Operational Efficiency, Not (Digital) Client Experience?

Over the past decade, the rise of direct-to-consumer platforms, from robo-advisors to Robinhood (or outside of financial services, the ubiquitous Amazon), has created a growing clamor amongst financial advisors that we, too, need a better 'Amazon-like' digital experience for clients. Some have suggested that advisors 'must' improve their digital experience to stay relevant (especially to more-digitally-native next-generation clients), while others have stated that at the least advisory firms need to have mobile apps and (better) websites to support clients alongside their human advice services.

Yet in practice, advisory firms seem to have struggled with generating a positive ROI on many "digital experience" initiatives. Most notable was the rise of the "robo-advisor-for-advisors" platforms, from RobustWealth to Vanare to SigFig to Jemstep, that proclaimed advisors could accelerate their growth with Millennials by adding digital robo tools to their websites… only to find that in the end, Millennials weren't even going to their websites to engage with those tools anyway. Similarly, there have been numerous "financial planning lite" software tools that were designed for advisors to create a more digital (and more self-directed) experience for clients, which have also withered on the vine (with poor adoption or outright shutdowns).

Which isn't to say that technology for financial advisory firms doesn't matter. It's simply that the most repetitive tasks (that are most conducive to technology automation) aren't necessarily more advice- or relationship-oriented interactions with clients… they're the back-office tasks that are otherwise done by the advisor manually or delegated to a team member. In fact, the latest Kitces Research on Advisor Productivity finds that advisors themselves still spend more than 1/4th of their time on "back-office" activities like administrative tasks and client-servicing requests. Providing a significant amount of room for technology to impact behind-the-scenes tasks in advisory firms!

Accordingly, it's not surprising that 2 recent industry research studies highlighting the benefits of technology for financial advisors both find that the benefits of "tech-savvy" and "digitally empowered" advisors are showing up in back-office support technology, not necessarily client-facing tools. For instance, a Cerulli study shows that tech-savvy advisors are outgrowing their peers, garnering the greatest efficiencies from e-signature, CRM, and video conferencing tools. And a Fidelity study shows that more digitally-empowered advisors report the most significant improvements in process efficiency around money movement, trading and rebalancing, and other account maintenance tasks.

From the advisor perspective, this is a big deal, as it signals that advisory firms may want to focus less on how they improve their "digital client experience", and instead focus more on how they digitize more of their own internal processes and workflows to free up the time to improve the client experience more directly (e.g., more meetings, more touchpoints, more [non-digital] services, etc.). Which might cover anything from replacing (or improving the utilization of existing) CRM systems with better workflows, to better leveraging their platform's digital onboarding (e-signature, account application) capablities and integrations, to perhaps testing out some of the emerging AI-driven Client Meeting Support tools that can automatically capture meeting notes and action step takeaways. Rather than trying to find (yet another) tech-savvy client portal.

From the broader industry perspective, the research also implies that technology platforms themselves may be better served by focusing on how to make it easier to train into and actually utilize their software to implement common advisor workflows, rather than 'just' trying to drive advisors (and their clients) to the latest portal enhancement as a form of digital experience. As the Cerulli study outright notes that beyond compliance constraints of certain platforms, the biggest inhibitors of technology adoption amongst financial advisors were not regarding its digital appeal to clients, but the lack of cross-tool integrations (to facilitate workflows), and challenges with training and actual implementation.

Ultimately, though, the key point is simply that when consumers choose to engage a financial advisor (rather than using a self-directed technology platform), there is an implicit expression that the client is not just looking for a superior digital experience… they're looking for what a human advisor can uniquely do beyond what technology provides. In turn, that implies the best investments that advisory firms can make are not necessarily towards their digital experience for clients, but their own internal systems for greater efficiency and freeing up time in order to provide their relationship advice service to clients!

Advisory Firms Continue To Value-Expand Into Estate Document Preparation As LPL Inks Partnership With Trust & Will

For as long as there has been financial planning – since the early 1970s – "estate planning" has been a staple of the comprehensive financial plan. For the first several decades, this was driven by the fact that the Federal estate tax exemption was so low (just $60,000 in the early 1970s, and rising 'only' from $120,000 to $600,000 from 1977–1997). Which meant that even a young married couple with young children that had a "reasonable" amount of life insurance (e.g., $500k each) had an estate tax problem. As a result, financial planners – who commonly sold life insurance at the time – had to be knowledgeable about estate planning as a part of the financial plan, in order to be able to get the insurance sale (which typically involved setting up an Irrevocable Life Insurance Trust, or ILIT, to get the insurance out of the estate).

Over the past 25 years, though, the situation has changed dramatically. The estate tax exemption rose from $600,000 to $13.6M, and the introduction of portability between spouses effectively doubles the exemption to $27.2M for a married couple. Which not only removes "routine" family insurance coverage from being an estate tax problem, it has overall cut the number of annual estates subject to a Federal estate tax by approximately 95%! As a result, even amongst financial planners (who generally work with above-average-affluence households), most clients simply don't have an estate tax problem.

Of course, this doesn't mean that "estate planning" is irrelevant. It simply means that estate planning – to ensure the timely and orderly handling and/or distribution of assets in the event of disability or death – isn't a matter of planning around estate taxes, it's simply a matter of having documentation by actually having the proper estate documents drafted in the first place (i.e., Wills, Powers of Attorney, Medical Directives, and perhaps Revocable Living Trusts).

Which itself is leading to a bifurcation of what it means to "do estate planning" for clients – where for ultra-HNW clients, there remains a heavy focus on estate tax avoidance, but for the rest (literally, the other 99%), it's mostly about estate document preparation. Resulting in 2 separate categories of "estate planning" solutions for financial advisors – estate (tax) planning tools like Vanilla, Yourefolio, Luminary, Estateview, and FP Alpha, and estate document preparation services like Trust & Will, EncorEstate, and Wealth.com. Where the latter actually have a far far wider reach and market opportunity than the former (simply because of the relative number of clients impacted).

In this context, it's notable that this month, LPL announced a strategic partnership with Trust & Will, bringing their estate document preparation service to LPL's 22,000 financial advisors across all 50 states.

From the advisor perspective, the appeal of estate document preparation services like Trust & Will is that they provide a means to ensure that clients actually implement their documents as a part of the financial plan, with a solution that is substantively more affordable than working with a local attorney for a typical "we just need reasonable documents in place" scenario. In some cases, firms may even highlight that they "offer" the service themselves and cover the document fee out of their own advisory fees… while still allowing the external provider to actually draft the documents (and avoid advisors getting into hot water for the Unauthorized Practice of Law). At the same time, the opportunity remains to work more collaboratively with local attorneys (for a higher level of service, and/or to establish cross-referral relationships) for the most affluent clients who may still have estate tax exposure and a need for a more sophisticated and complex estate plan.

From the industry perspective, the rising interest in providing clients with estate document preparation mirrors a similar growing interest in offering tax preparation services for clients… both because it helps to bolster the advisor's "holistic" positioning (and defend their traditional advisory fee with more value-adds), because it's hard to find reasonable-cost professionals to service the average advisor's mass-affluent clientele, and ultimately providing more services with more touch points tends to make clients "stickier" in the advisor's core model (because there are more service-providers they would have to replace if they leave). Which means this is a trend that's likely to continue for the foreseeable future.

The irony, though, is that while such services often position as "tech" solutions, ultimately they are still service providers – in the case of estate document preparation, literally fulfilling a legal service that would otherwise require hiring a local attorney instead. Which actually boosts their market opportunity further, as an advisor buying estate planning software (for their high-net-worth clients) might pay a few thousand dollars per year, but an advisor whose client needs estate documents may spend several hundred dollars per client for those documents, which across dozens of clients in an advisory firm means estate document preparation services (tech-enabled to be efficient and low cost) is actually the bigger market opportunity in serving advisors and their clients!

Personal+Work Device Challenges As SEC Cracks Down On Use Of Unarchived SMS Text And Other Messaging Platforms With Fines Up To $50M!

Making investment recommendations on someone else's life savings is a high-stakes proposition, and even more so in situations where the advisor has outright discretion (or full-on custody) of the client's investment assets. Beyond simply the responsibility to make and implement prudent recommendations, in the context of publicly traded markets, there are also risks that firms use their knowledge (or actual control) of clients' investment trades to profit on their own behalf (e.g., front-running client trades or trading against them). Not to mention the risks of outright fraud.

To mitigate these risks, advisory firms have substantive record-keeping requirements that all written business (including client) communication be saved and archived, which allows compliance departments to periodically review that communication in an attempt to spot the wrongdoing as it is happening (and allows for regulators to have more information available in an investigation if an allegation of wrongdoing comes in). In fact, advisory firms have an outright obligation to supervise their employees (i.e., to periodically review the archived written communication) to ensure there is at least a reasonable likelihood that they can catch (and by the risk of being caught, further deter) problem behavior.

For much of the past 20 years, such communication archiving has been accomplished relatively efficiently through the centralized capture of email. Because the advisory firm itself typically controls the email domain, it's relatively straightforward to ensure that all messages are saved and archived. And it's only natural to use a work email address to communicate with both colleagues at work and clients being served (especially as technology has enabled smartphones and laptops to access that work email centrally).

However, over the past decade, the rise of smartphones has introduced a new wrinkle into the equation. As while smartphones have made it relatively easy to access email from anywhere, the popularity of SMS text messaging, and more recently messaging apps like WhatsApp, means that a lot of clients don't want to communicate via email. Yet at the same time, while advisors may have texting and other messaging apps on their phones, those are typically personal (not work) devices, which means many people don't want their employers to have access to their personal communication. Even as clients and advisors use those communication channels.

The end result: over the past 2 months, the SEC has levied a series of major fines, including $81M of penalties against a series of 16 broker-dealer and RIA platforms in February, and a $50M settlement with LPL alone in March, for failures to sufficiently archive "off-channel" communications of their employees (and an associated failure to supervise those communications, because they weren't being archived in the first place). Which the SEC noted wasn't 'just' about a pedantic requirement to archive communication, but may have outright impacted SEC investigations of wrongdoing (e.g., where nefarious activity was intentionally being communicated via outside channels to avoid being caught by compliance).

From the advisor perspective, the message from the SEC is clear: all communication with or regarding work and clients needs to be handled via a work-approved communication channel that is being properly archived. Full stop. Employees need to be trained that all work communication must occur via work channels (i.e., if the firm doesn't have a way to properly archive text messages, don't text clients or co-workers from your phone, use email). Which may include explaining to clients why, unfortunately, your firm requires interactions to occur via email and not text messaging. Or alternatively, for those who do want to adopt text messaging (particularly with clients), consider solutions like MyRepChat or Redtail Speak.

From the industry perspective, though, the challenges of the SEC's recent actions highlight a current incongruency between emerging consumer preferences on how to communicate via our personal devices (where messaging of various forms is on the rise, and email is on the decline), versus how businesses typically manage communication (via work email and/or intranet or internal messaging platforms like Slack or Teams that are more readily archived). Where advisors get caught in the middle with their own personal devices where they may use such messaging platforms themselves personally… but find themselves unable to use the same platforms for work-related functions, even when the client asks them to.

Ultimately, many of the penalties that the SEC assessed was for supervisory gaps that occurred back in 2020 and 2021… a relative "eon" ago, since which most advisory firms have at least tried to clarify their policies and procedures when it comes to alternative communication channels (if not adopting new technology to help). But as capabilities like dual-SIM become more standard in smartphones, the question also arises as to whether a personal device could also increasingly be a "work device" as well (e.g., where compliance archives all texts and messaging apps tied to the work number, but not the personal number?). Or if alternative workarounds (to facilitate compliance archiving of "work" messages on a "personal" device) might be available. All of which means that there may be an opportunity emerging for a new generation of compliance archiving tools, built to solve the current era of work+personal communication on our smartphones?

SEC Fines 2 Firms For "AI-Washing" In Their Marketing But Is Promoting Artificial Intelligence Even A Benefit In AdvisorTech Solutions For Advisors?

About once a generation, there's a technology breakthrough that seems poised to change the world as we know it. From the first microchip in 1958 that kicked off the modern world of computers, to the Apple II in 1978 that ushered in the era of personal computers in the home and office, to the first arrival of the internet in the late 1990s, and the emergence of the smartphone when Apple launched the first iPhone in 2007. When technology takes a leap forward, there is an initial burst of enthusiasm and hype (that typically proves overblown), followed by a "trough of disillusionment" (according to the Gartner Hype Cycle)… and then the world actually changes.

From the regulatory perspective in the investment world, the difficulty when such breakthroughs occur is that in the hype phase, there is a high risk that consumers are taken advantage of. At best because they get caught up in the hype and buy/invest with companies whose price is disconnected from reality (e.g., in the late 1990s, when any company with ".com" in its name participated in the boom, as epitomized by Pets.com that generated $619k of revenue after spending $11.8M on advertising in its first year, yet still managed to raise $82.5M in an IPO… before being shut down and liquidated 268 days later!). And at worst, companies that don't even fit the hype just appropriate the label-du-jour for marketing purposes.

The phenomenon is generally known as "whitewashing" (where cheap white paint is used to cover up and make something appear clean and smooth to hide the flaws or problems underneath). Over the years, the label has been re-used in alternative formats to connote particular whitewashing contexts such as "greenwashing" (making a product or company appear to be "green" and environmentally friendly to distract from potentially problematic environmental practices), which the SEC has recently been cracking down on as rising investor interest in ESG has been leading some funds to imply they're more ESG-oriented than they actually are.

And now with the latest transformative technology of Artificial Intelligence (AI) emerging, the SEC has issued its latest warning, against so-called "AI-washing" – where companies claim they're offering or utilizing AI because it's the hot thing, but are not actually doing so. Which the Commission coupled with a series of 2 firms that were fined a total of $400,000 for engaging in "false and misleading statements about their use of artificial intelligence" such as claiming to be the "first regulated AI financial advisor".

From the financial advisor perspective, very few are likely to outright market themselves as "AI financial advisors". But as more advisors adopt AI tools, some might get excited to share their use of cutting-edge technology with clients and prospects (e.g., "we leverage the latest AI technology to enhance your experience with our firm")… which can potentially raise regulatory scrutiny. Not that there's anything wrong with advertising AI and its use – but as the SEC's enforcement action highlights, if a firm is going to promote that they're using AI, it better be an accurate reflection of reality in how the firm really is serving their clients! (And if the advisory firm is using third-party tools, the advisor better make sure it's done vendor due diligence to affirm that the vendor really is using AI as they claim!)

From the industry perspective, the SEC's scrutiny also means vendors developing AI solutions should be mindful to ensure that their tools are actually doing (or in this case, using) what they actually say they are. As if the advisor promotes that they use the (AI-enhanced) technology solution in their practice with clients, there's a risk that a vendor's feature exaggeration could become the advisor's AI-washing enforcement action. And more generally, scrutiny from the SEC about whether those promoting AI are really actually using it will likely create an atmosphere of greater scrutiny and due diligence amongst all advisors. Particularly while we remain in the 'hype' phase of AI.

Perhaps the greatest caveat to it all, though, is simply that with questions also arising about the privacy concerns of AI, and still-plentiful examples of "AI hallucinations" (providing answers/insights that are not factual) or outright inaccuracies, there is still a level of AI distrust coupled with AI enthusiasm. Such that in one recent informal poll of financial advisors on their AI views, promoting AI in an AdvisorTech solution was equally likely to make advisors more interested (yay efficiency!) as it was to make advisors less interested (privacy! accuracy!)… and a plurality of advisors didn't actually care about whether the AI was present or not at all, they just want to know what the software actually does!

In the meantime, we've rolled out a beta version of our new AdvisorTech Directory, along with making updates to the latest version of our Financial AdvisorTech Solutions Map (produced in collaboration with Craig Iskowitz of Ezra Group)!

So what do you think? Where does technology impact your firm the most… with client-facing tools, or back-office efficiencies? Are you thinking about using services like Trust & Will, EncorEstate, or Wealth.com to offer estate document preparation as a supporting service for your clients? Does a technology solution promoting AI make you more or less interested in the software (and would you want to promote AI to your prospective clients, too)? Let us know your thoughts by sharing in the comments below!

Leave a Reply