Executive Summary

Welcome to the October 2020 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month's edition continues with new co-author (and AdvisorTech guru) Craig Iskowitz, along with guest contributor Kyle Van Pelt, and kicks off with the launch of eMoney Advisor’s next-generation planning tool “Project Avocado”… which as it turns out, has been pivoted into an app now dubbed “Incentive” to provide financial wellness in the 401(k) channel instead, a boon to advisors looking to compete with the growth of 401(k) providers increasingly offering financial advice to 401(k) participants (before independent advisors ever have a chance at capturing the future IRA rollover), but also a potential competitor as Fidelity signals it may begin to use eMoney’s Incentive itself as a ‘direct-to-consumer’ solution with its own 401(k) plan participants to provide them in-house Fidelity advice before they ever retire out of a Fidelity 401(k) plan to an independent advisor.

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- Facet Wealth follows the path of LearnVest as it raises a $25M Series B to pivot into the employee financial wellness channel

- NextCapital raises a $30M Series D as it expands its white-labeled digital advice solution for 401(k) providers

- Mega-RIA Wealth Enhancement Group grows impatient with financial planning software and builds its own “Next Best Action” solution

- Pershing expands its biometric multi-factor authentication to desktop NetX360 as a passwordless future looms large

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including Envestnet’s Tamarac launching an integration with Flourish as off-platform cash becomes a hot asset class, Edward Jones builds a new matchmaking tool for consumers to differentiate amongst a sea of (its own) similar advisors, Fidelity expands its Integration XChange API capabilities as even single-custodial advisors are increasingly seeking multi-technology-vendors, YCharts expands into SMA analytics, and Executor Assist launches as a somewhat ‘low-tech’ way to compete with other high-tech estate planning tools for financial advisors.

And be certain to read to the end, where we have provided an update to our popular new “Financial AdvisorTech Solutions Map” as well!

I hope you're continuing to find this column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Project Avocado Morphs Into Fidelity’s “Incentive” Answer to Empower Buying Personal Capital? The 401k space is shaping up to be the next great battleground for Advisor Tech to make a difference. On the one hand, the ongoing commoditization of the 401(k) channel has already turned it into a heavily commoditized price-competitive environment, with a business model in turmoil as fiduciary lawsuits force the separation of previously bundled proprietary products and revenue-sharing pricing models. Which in turn is leading to a shift of 401(k) providers seeking new ways to add value (and generate revenue) by expanding into the broader realm of “financial wellness”, the emerging buzzword for all things related to the financial health of employees (and the technology tools to help them improve their health and wellness)… and then further “upselling” to providing holistic human-based financial advice. The proof is in the pudding with the Edelman-Financial Engines combination (a direct marriage of scaled human advice provider and a mega 401(k) provider), and more recently Empower’s announced acquisition of Personal Capital. Yet the caveat is that these combinations aren’t just a function of pairing 401(k) solutions with human advisors; they’re also playing on technology, from pairing Financial Engines’ financial wellness tools with Edelman advisors, to pairing Personal Capital’s technology with Empower’s retirement plan advisors. And in this vein, eMoney announced that its nascent new ‘financial planning for next-generation clients’ app – dubbed “Project Avocado” – is being pivoted into a 401(k) financial wellness app called “Incentive”. The shift appears to be at least in part an acknowledgment that Project Avocado’s “simplified” planning approach in “Project Avocado” was not going to be as successful for eMoney as an upsell as it is for Chipotle, as AUM-based advisors struggle to attract younger clients in volume and non-AUM advisors (e.g., using monthly subscription and other fee-for-service models) look for more complex (not simplified) planning tools to show planning value. And to the extent that next-generation clients do have assets, they tend to be in an employer retirement plan… so that’s where Project Avocado has gone. At its core, the new Incentive offering – currently still in beta – offers advisors working with 401(k) plans an opportunity to provide a Personal Financial Management (PFM) dashboard directly to their 401(k) plan participants, white-labeled to the advisor’s firm, and the mobile-first app aims to “teach lessons about finance [e.g., on topics like emergency saving, retirement plan participation, debt management, budgeting, and more] and is meant to promote responsible financial behavior”… and contact the advisory firm for a deeper relationship if they need more help. But arguably, the broader story here is to recognize that Fidelity just so happens to be the largest 401k service provider in the world already. Being able to combine their recordkeeping with eMoney’s new Incentive solution is very enticing, as it promises to deepen the relationship between 401(k) plan providers and their participants (with the advisor’s support). And while eMoney Incentive is currently for advisors, Fidelity notes it may soon be available “directly to individual investors” as well… suggesting that, similar to Empower and Financial Engines, it may see the Incentive technology as an opportunity to build connections from its 401(k) plan participants directly to Fidelity’s own internal advisors, as a strategy to retain the 401(k) business in the first place when participants retire (rather than having them rollover out to an independent advisor in the first place). In the end, though, the real wild card to it all is the account aggregation. eMoney owns and maintains their own aggregation capabilities, and specifically notes that Incentive uses the next generation of API token-based aggregation (not client login passwords); if they can unleash that aggregation tech on not only Fidelity’s recordkeeping data, but entice next-generation 401(k) plan participants to bring additional account data into the app, it creates a potentially powerful flywheel for Fidelity in the challenging 401(k) plan business to be a pathway to attracting and consolidating assets from next-generation clients and helping to offset the outflows of an ongoing wave of baby boomer retirements rolling their 401(k) plan assets out.

Will Facet Wealth Go The Way Of LearnVest After Raising $25M Series B And Pivoting To Employer-Channel Financial Advice? Nearly a decade ago, LearnVest emerged amongst a first generation of “robo-advisors” that aimed to expand the reach of financial planning to next-generation clients not well served by traditional financial advisors. What was unique about LearnVest, though, was that it actually employed human CFP professionals to provide the financial planning advice – rather than a ‘technology-only’ robo experience – and instead built its own proprietary technology in the hopes that it would make their financial advisors efficient enough to be able to serve the requisite volume of clients it would take to be profitable at a pricing model as low as $19/month. As it turned out, though, the real challenge was not finding and building the technology necessary to service a high volume of clients as a human advisor, but simply being able to cost-effectively attract a high enough volume of clients to reach a critical mass of scale in the first place; in other words, it wasn’t the cost of service that proved the challenge, but the cost of client acquisition. As a result, after a few years, LearnVest had to pivot from a direct-to-consumer model to Workplace Solutions offering, in the hopes of accelerating their growth by earning big blocks of clients by signing up employers to offer LearnVest’s solution to their entire base of employees. Unfortunately, though, the employee benefits channel still proved not to provide enough growth fast enough, and LearnVest ended out being sold less than 2 years later to Northwestern Mutual (which largely bought LearnVest for its technology and not its business model, as the LearnVest financial planning offering was wound down and its technology tools were integrated into Northwestern’s own base of insurance agents). Yet just as – and perhaps because – LearnVest was sold for an eye-popping $250M to Northwestern Mutual in 2015, a year later Facet Wealth was founded, with a similar mission of bringing financial planning to mass affluent consumers using virtual but human-based advisors, priced on the then-emerging monthly subscription model, with a vision of building their own technology tools to be able to scale their advisors to serve enough clients per advisor to make the economics of “small” clients work. With initial traction, Facet raised a hefty $33M Series A round from Warburg Pincus in 2018, with an eye towards scaling the business, not with direct-to-consumer marketing (that LearnVest had struggled with), but with a model of acquiring “small” clients from other advisory firms that didn’t want to service those clients themselves (and could instead focus on serving their more affluent ‘A’ clients). Yet ironically, just as Facet ramped up its strategy of taking ‘small’ clients from other advisors, competitor FirstPoint Financial – a subsidiary of Marty Bicknell’s mega-RIA Mariner Wealth – was shutting down, finding that it just wasn’t cost-efficient to try to acquire small clients from advisors one advisor at a time (as a purchase transaction of clients from another advisor, no matter how ‘small’, is a time-consuming process for both sides). Accordingly, it is perhaps not surprising that barely two years later, Facet too is shifting away from the acquire-from-other-advisors model, and instead is taking a page from the LearnVest book by pivoting into the employer channel and aims to offer an employee financial wellness program that gives employees an opportunity to ‘upsell’ into an ongoing financial planning relationship… and has landed another $25M Series B round (with Warburg Pincus re-upping) to scale it. The question, though, is whether Facet will be able to figure out how to actually scale its reach into the employer channel quickly enough – as LearnVest struggled to do with a similar model – as Facet reports a substantial uptick in growth since it began piloting the program and that 100 new clients per week are now rolling in. However, the growth appears to be just the ‘top-line’ number of employees at firms being signed up for Facet’s free employee wellness offering, with “just” 20% of employees actually transitioning into Facet’s paid services (which, on top of its existing clients and recent Grove acquisition, brings the firm to 1,500 clients reported on its Form ADV at the time of this publication). By industry standards, a 20% conversion rate from employee financial wellness into human financial planning is itself an astounding success – and bodes well for other advisors and financial services firms pivoting into client growth via the employer channel, from Edelman/Financial Engines to Empower/Personal Capital and those independent advisors using eMoney’s new Incentive app. Yet with 1,500 clients reportedly paying an average of $2,000 of revenue/client, it remains to be seen whether Facet’s ~$3M of revenue can gain enough traction quickly enough in an increasingly competitive employer financial wellness channel to justify what is now a total of $58M of venture capital funding… or whether, similar to LearnVest, it may have stumbled on the ‘right’ marketing channel and solution, but have too much in burn rate and VC expectations to be able to achieve the astronomical growth it needs to justify its current valuation?

NextCapital Raises Another $30M Series D to Expand White-Labeled Digital Advice Tools For 401(k) Providers. Forty years ago, the retirement savings of many Americans were managed by their employers, with Fortune 500 companies like Exxon, IBM, and General Electric offering their staff defined benefit pension plans with the promise that employees would receive a check from their dedicated fund every month for life in retirement. Eventually, private pensions were replaced by defined contribution accounts, or 401(k) plans and profit-sharing plans, such that last year, only 14% of Fortune 500 companies offered pension plans to new hires (compared to 59% in 1998). From the industry context, the significance of this shift is that defined contribution plans are a form of self-directed investing that allows employees to manage their own retirement savings… or for the financial services industry to ‘help’ them invest those savings, putting trillions of retirement dollars in play. And with competition for defined contribution plans continuing to heat up – not just for IRA rollovers, but to apply layers of financial advice to the 401(k) plans themselves – NextCapital just announced they have closed a Series D funding round of $30 million to continue their digital assault on traditional IRA rollovers and 401(k) plan management. NextCapital was built on the core intellectual property and with much of the team from a company called Business Logic that started back in 1996 selling one of the first software applications that provided 401(k)-match management. In 2014, three of the four founders of Business Logic launched NextCapital to take advantage of the nationwide shift from pensions to 401(k)’s which shows no signs of letting up, pairing up with digital advice pioneer Rob Foregger (who had previously co-founded both Personal Capital and EverBank). The Chicago-based technology firm offers a digital advice platform that automates IRA rollovers into 40(k) plans, with configurable workflows and connectivity to recordkeepers and retail custodians via their APIs, and can operate as an advisor-led or direct-to-investor experience. Participant data from the recordkeeper is used to create on-demand, personalized retirement plans or risk-based general investing proposals. NextCapital's IRA rollover solution is also paperless, and auto-populates rollover forms and new account opening documents and executes the rollover and back-end processing, funding, and trading process. The company now counts 15 large asset management firms and retirement plan providers as clients, including Franklin Templeton which is deploying their new Goals Optimization Engine (GOE) in partnership with NextCapital as part of a discretionary managed advice solution for the defined contribution industry. Other key retirement plan provider clients, including MassMutual and John Hancock’s 2.7 million retirement plan participants, rely on NextCapital to encourage employees to consolidate all retirement assets (including held-away IRAs) into their defined contribution plan providers, while also advising individuals on how to maximize their retirement savings and tailoring the software to offer unique savings expertise. What’s unique about NextCapital in this space, unlike competitors Morningstar and Edelman Financial Engines, is that NextCapital allows their investment customers to personalize the platform to offer their institution’s financial advice, effectively operating as a technology-only layer to facilitate an asset manager or retirement plan provider’s own growth in assets in the space (rather than trying to capture the assets themselves) as an unbundled white-labeled solution. Accordingly, they are planning to invest the Series D round funding on expanding on their capabilities to make it faster and simpler for institutions to configure the platform to meet each individual’s user experience, alongside the firm’s own investment methodology as well as each recordkeeping system’s needs. Ultimately, NextCapital is still a micro-cap player in the space with just over $2 billion in assets on its industry IRA rollover platform. But with firms like Edelman providing human financial advice in the 401(k) channel, such that retirees will increasingly no longer need to find an advisor at retirement (as they’ll just continue with the advisor they have had all along with their existing 401(k) plan), there is a newfound hunger in the marketplace to capture customized and personalized advice relationships, scaled with technology, in the 401(k) channel before independent financial advisors ever have a chance to grab 401(k) rollovers for unaffiliated consumers that don’t have an advisor on the way out. Which means NextCapital is well-positioned in deploying $30 million in fresh capital to enhance their platform to fight their way into more enterprise wealth management firms that need the technology to scale the opportunities they too see alongside Edelman/Financial Engines and Empower/Personal Capital.

Franklin Templeton Launches Optimization Engine To Unbundle The 401(k) Target Date Fund? There’s a technology arms race going on among asset managers to see who can build out the best investment and planning tools for RIAs. The winners will see their distribution networks expand, as advisors use their ‘free’ software to build portfolios and financial plans, and reap new inflows of cash into their products that are often embedded as defaults or at least prominent ‘options’ to choose from. This broader strategy is being driven by the ongoing shift in the advice business from broker-dealers to RIAs, from traditional commission-based distribution networks to fee-based advisors, and the rise of robos and other technology platforms as distribution channels… forcing every asset manager to try to figure out how to stay relevant, find new ways to cross-sell products, and get their foot in the door of more RIAs. Unfortunately, though, while technology may be a pathway to RIAs, advisor-facing technology isn’t the core business model for most asset managers, which means it’s an uphill battle for most. BlackRock is the undisputed leader in this fight, with a wide range of applications, platforms, and systems, including being the first-mover in the pivot to robo-advisors as a B2B2C distribution channel by acquiring FutureAdvisor in 2015, expanding the reach of their risk and portfolio management software Aladdin Wealth, launching their retirement income planning tool iRetire, and also spending $123M to buy a 5% stake in leading wealth management technology provider and TAMP, Envestnet. A number of other managers are working hard to catch up including State Street, which spent $2.6 billion to buy Charles River Development (one of the leading providers of trading software to other asset managers) and is rumored to be looking to move into the RIA space. Invesco has also made significant investments in acquiring technology to build out a robust RIA ecosystem, including digital onboarding vendor Jemstep, portfolio management system Portfolio Pathway, and portfolio rebalancing software RedBlack. Not to be outdone, Franklin Templeton bought digital advice vendor AdvisorEngine in May (albeit from WisdomTree, another asset manager that never fully figured out how to leverage and monetize the FinTech offering it acquired in 2016), and is now launching an internally developed portfolio construction tool they are calling Goals Optimization Engine (GOE), which takes an investor’s goals as input and generates an optimized asset allocation (ostensibly using at least a few Franklin Templeton funds!?) that maximizes the probability of the investor successfully achieving those goals. This optimization process occurs regularly through the investment’s time horizon, as GOE re-allocates assets to increase or decrease portfolio risk as needed. Franklin Templeton appears to be positioning GOE as the “strategist", that designs bespoke allocations that can then be populated with their proprietary funds, although they are promoting it as open architecture and delivering the models through their AdvisorEngine platform. On the one hand, distributing models as a strategist through model management software isn’t exactly new, as numerous technology vendors and custodians have launched Model Marketplaces in recent years (a centralized platform where financial advisors can select from a series of third-party-created investment models but retain control and discretion to implement the trades themselves). Yet in practice, the leading model marketplace technology platforms have included Morningstar, TD Ameritrade, Riskalyze, Orion Advisor, and Oranj, none of which are directly owned by an asset manager (and with the exception of TD Ameritrade, the other four vendors compete directly with AdvisorEngine in the RIA market and have strong product offerings). In this context, a differentiated Model Marketplace that is more of an automated (and continuously adjusting) customization of models could set Franklin Templeton’s platform apart from the pack, functioning as a vertically integrated FinTech-as-a-distribution-channel approach (similar to Blackrock’s FutureAdvisor acquisition). On the other hand, Franklin Templeton’s GOE announcement also noted a partnership with robo-401(k)-advisor NextCapital, which will bring GOE to market as part of a discretionary managed advice solution for the defined contribution industry. In this context, Franklin Templeton’s GOE may effectively function as a form of unbundled target date fund, customized and continuously updated with Franklin’s GOE constantly tweaking the models (that also contain their funds) to maintain the optimal probability of retirement success for each plan participant, where NextCapital provides the portfolio rebalancing and last mile of trading execution into 401(k) plans. In other words, while GOE could be an option that is attractive to RIAs that are already using Franklin’s funds and want to automate allocations, or are open to switching in order to access their combined GOE-AdvisorEngine-NextCapital solution, the real endgame for Franklin’s GOE may be a first-stage disruptor of technology-as-an-unbundled-target-date-fund.

Independent RIA Wealth Enhancement Group To Build Its Own ‘Next Best Action’ Solution As Financial Planning Software Lags. For most of its history, financial planning software has operated as a ‘point-of-sale’ tool, taking in client information to produce a ‘needs analysis’ to identify 'gaps' for which financial advisors could sell a product as a solution and earn a commission (from a capital needs analysis to prompt a life insurance sale, to a retirement or college funding analysis to prompt more savings to investment accounts). As the financial advisor business model has evolved from commissions to ongoing AUM or retainer fees, though, advisors must not only demonstrate the value of their advice upfront but also on an ongoing basis by continuously monitoring and trying to identify new opportunities to add planning value (and validate the advisor’s ongoing fee!). Yet in practice, financial planning software has thus far lagged this transition, and instead still typically requires the advisor to input updated/new data to run an updated/new analysis in the hopes of spotting new planning opportunities (an approach more befitting of the broker-dealer model of the past than the advice model of the future). Which in turn is leading some large enterprises to begin to adapt their own solutions, starting with Morgan Stanley’s launch in 2018 of their “Next Best Action” solution, and emulated in 2019 by Merrill Lynch’s new Advisor Insights tool, both of which monitor a client’s portfolio and planning needs and prompts the advisor when there’s an opportunity to engage with the client (rather than regularly engaging with clients and collecting data in the hopes of finding a planning opportunity!). Of course, wirehouses are themselves multi-trillion-AUM enterprises that can afford to reinvest into such tools for their own business ROI. But this month, 'mega'-RIA Wealth Enhancement Group (WEG), which boasts 'just' about $20B of assets under management (making it 'huge' amongst independent RIAs, but still 1/100th the size of Merrill Lynch or Morgan Stanley!), announced that it had hired the former head of data science and growth analytics for Microsoft’s Cloud + AI unit to begin developing a version of ‘Next Best Action’ as an internal solution for WEG’s financial planners as an extension of its Salesforce CRM and supplementing its existing third-party financial planning software. From the perspective of an advisory firm, “Next Best Action” capabilities that identify planning opportunities for advisors to proactively reach out to their clients can reduce attrition and improve retention rates by helping its advisors better show ongoing value (in a world where a mere 1% improvement in attrition rates can increase lifetime client value of a $1M AUM client by $10s of thousands). And in practice, many advisory firms have a regular cadence of in-person meetings with clients just to figure out if there are any planning opportunities to discuss… whereas financial planning software that identifies those opportunities and triggers the advisor to reach out can also reduce the number of ‘unnecessary’ client meetings (providing a substantial potential time savings that materially increases advisor productivity). Of course, arguably it should be financial planning software itself that builds in ‘Opportunity Triggers’ to prompt advisors about proactive planning opportunities with clients, rather than large advisor enterprises building their own ‘homegrown’ solutions in its absence. But with financial planning software providers increasingly focused on broker-dealer enterprises still playing ‘catch-up’ with their brokers who refuse to use ‘time-consuming’ software, advisor enterprises with resources and focused on ongoing planning advice are taking matters into their own hands… and in the process, signaling that financial planning software itself may be the category most lagging and ripe for disruption?

Envestnet | Yodlee Launches Consumer Spending “Insights” APIs As Financial Planning Goes Holistically Beyond The Balance Sheet. One of the most overused buzzwords in our industry has been “holistic”. Almost every vendor has used this term at one time or another to describe how their application or platform can provide data in such a special way that advisors will have a more complete view of their clients’ financial lives. But in practice, they almost never live up to their marketing, and advisors are left with mostly incomplete views that have huge gaps, especially around liabilities and household expenses/cash flow. Of course, the reality is that most advisors still focus primarily or even solely on managing the accumulation and decumulation of assets, such that their technology choices tend to reinforce this narrow view, while robo-advisors and other fintech-based services that have been less AUM-centric have been at least a little ahead of the curve (though not by much). However, the COVID crisis has accelerated calls for fintechs to start selling financial health, not ‘just’ asset-based financial services, and a majority of advisors seem to be feeling this pressure. In a recent survey, 51% of advisors said they plan to increase their focus on holistic financial planning within their practices, with younger advisors (under 40) being four times more likely to say that the main value they provide to clients is holistic financial planning. Foreseeing this shift, back 2018 Envestnet’s former CEO, Jud Bergman (who tragically died in an automobile accident last year), announced a new company-wide initiative called “financial wellness”. He believed that a fundamental shift was required to expand the definition of advice from picking stocks (or more generally, managing portfolios) to helping clients achieve their goals. Almost every step Envestnet has taken both before and after Bergman’s passing has been moving towards the goal of providing advisors with an end-to-end platform that focuses on financial wellness. From the acquisition of financial planning software leader MoneyGuidePro in 2018, to launching integrated insurance and credit exchanges, to their much-maligned (at the time) 2015 purchase of data aggregator Yodlee, they have been steadily marching in this direction. In turn, their Yodlee division has moved beyond simply providing data aggregation services to become a larger part of their financial wellness solution with their launch of Insight Solutions, a set of application programming interfaces (APIs) that will enable enterprise clients and technology partners to take advantage of the massive amount of consumer spending data collected by Yodlee. Bergman’s 2018 presentation at Envestnet’s annual Summit noted that a critical factor to succeed in the future of wealth management would be “transforming data into client-actionable intelligence to create better outcomes”, and Yodlee’s new data tools could be the foundation for this goal by enabling clients to combine actionable insights, peer benchmarking, and personalized views to build digital financial experiences that will better engage customers. Since this data infrastructure can only be accessed via back-end programming (rather than through a pre-built user interface), advisors will have to wait for their broker-dealer or AdvisorTech vendor to build connectivity to the Yodlee data and then build the UI to present the information. But when they do this, according to Yodlee, users will be able to take advantage of features like predictive cash flow, spending, credit limit, refund monitoring, and even visibility into subscription-based and other recurring consumer expenses… effectively filling the gap of a more household-cash-flow-based Personal Financial Management (PFM) solution to complement the industry’s existing asset-based account aggregation solutions today. If Yodlee’s “hyper-personalization” data and analytics work as promised, advisors could have enough data that they would have a deeper understanding of their clients’ financial lives, allowing them to expand to a truly-more-holistic advice offering beyond the common balance-sheet-centric approach of today. However, Envestnet is clearly targeting enterprise clients with Insight Solutions, looking to become their outsourced data science team and in the process, make their enterprise wealth and Tamarac platform much stickier. For instance, Broker-Dealers could leverage these APIs to build something similar to Envestnet’s “Opportunities To Engage” recommendation engine which provides the next best actions for independent advisors that would be customized to their target client segments and/or tightly integrated into other applications in their technology stack. As Bergman stated, “those who have the ability to integrate technology will determine who succeeds.” Envestnet appears well on their way to delivering on Bergman’s vision, as well as continuing the industry’s shift towards truly holistic wealth management.

Will Envestnet’s Tamarac Integration With Flourish Cash Begin To Eat RIA Custodian Profit Margins? In the internet era, where technology at a massive scale can reduce marginal costs to be astonishingly close to $0, the “freemium” model has become one of the great disruptors of established businesses. As what started with simply giving away ‘a taste’ in order to get recurring business in the future (e.g., King Gillette giving away from the razors to sell a lifetime of razor blade refills), has evolved into far more complex (and more disruptive) models of cross-subsidies where profits from one area allow another to be given away for free (e.g., Google giving away Maps for free to earn advertising opportunities for local businesses, and nearly putting Garmin in-car GPS systems out of business along the way)! In the context of the financial services business, financial advisors have long operated on a ‘freemium’ model as well (e.g., giving away the financial plan in order to win the implementation commissions!), as has the RIA custodial model (giving away RIA custodial services and technology to win the brokerage trading commissions). Notably, though, those freemium and cross-subsidy models can shift over time as well, from financial advisors who are now increasingly charging standalone planning fees (and in some cases ‘throwing in’ the asset management for free!), to the shift of the RIA custodian business model to a world of charging zero for trading commissions and instead driving profits from the net interest margin the custodian earns on its cash sweep solutions for advisors’ clients (now the majority of revenue for Schwab Advisor Services!). Yet even as RIA custodians increasingly focus on the revenue opportunities of client cash by paying lower yields, so too are competitors eyeing the opportunity to win cash management business by offering higher yields, especially in an era where moving cash between financial services institutions is increasingly digital, making transfers faster and easier, cash more mobile and yield-chasing, and providing advisors the opportunity to add value to clients by showing their clients how to get better yields by moving away from their RIA custodial platform. Accordingly, in recent years there have been a plethora of new platforms launching specifically to support advisors offering compelling off-custodian cash alternatives for clients, from MaxMyInterest to Stonecastle’s FICA for Advisors (now Advisor.cash) and Flourish Cash. The caveat to such programs is that advisors have to move client cash off their custodial platform to earn better rates… and given that the cash business is the RIA custodian’s cash cow, there’s little incentive for the platforms to reduce the friction of transfers and cash management (and instead increasingly default advisors to the custodian’s proprietary or affiliated-bank cash sweep solution, and require advisors to trade out of them even just to use the on-platform cash alternatives!). Which means it falls to the cash management platforms themselves, and the third-party AdvisorTech tools that firms use to manage their clients' assets, to fill the void. Which means it’s not surprising to see that this month, Envestnet’s Tamarac portfolio performance reporting solution announced an integration to Flourish cash, allowing data on Flourish cash positions to feed directly into Tamarac. From the advisor’s perspective, the appeal of the integration is that even if clients’ cash assets are held away from their RIA custodian (via Flourish), advisors can still to do holistic performance reporting (and conceivably even household fee calculations) incorporating clients’ Flourish cash accounts and its competitive (at least in today’s environment) 0.7% FDIC-insured yield. From Envestnet’s perspective, they are arguably late to the game (as Flourish already integrated with Orion and also eMoney nearly 9 months ago), and the Flourish integration simply puts them on-par with most competitors. But as Envestnet itself is increasingly pivoting its own business model to a broad-based “platform of platforms” – facilitating distribution of not only third-party asset managers as it has from the start, but also its new Insurance/Annuity Exchange, and also its Credit Exchange, and taking a small slice of all business that crosses its platform – arguably the real question is whether Envestnet is setting the groundwork to also formulate a “Cash Management Exchange” to facilitate (and take a scrape of) the distribution of cash management solutions that are becoming increasingly popular in the wake of RIA custodians’ own pivot to a cash-centric business model… and providing Envestnet yet another means to compete against (or at least eat the margins of) the RIA custodial business model without ever actually needing to become one?

YCharts Expanding To Larger RIAs And Broker-Dealers By Adding SMA Data To Their Expanding Portfolio Analytics Toolkit. Separately managed accounts (SMAs) were once exclusively the domain of wirehouses, but independent broker-dealers and RIAs have been slowly gaining ground as accessibility increases and account minimums decrease (from what were previously as high as $1 million per client). The shift has been driven by both the growth of intermediaries that facilitate SMA distribution (from the growth of Envestnet to the expansion of RIA custodial platforms), along with the evolution of providers like Lockwood Advisors that entered the space and developed their own cost-efficient technology that combined many smaller accounts to make SMAs delivery scalable (and minimums fell to as low as $25,000). And demand is rising, as more RIAs look to both outsource investment management implementation to gain better cost efficiencies, while also differentiating themselves from robo-advisors, fintechs, and ETF strategists… for which SMAs can help them personalize clients’ portfolios and manage their tax efficiency, as well as offer increased transparency through direct ownership of securities. As a result, Cerulli projects assets in unified managed accounts (UMAs) to nearly double by 2022 to an estimated $1.85 trillion, up from a base of $994 billion in 2018 (and SMAs already accounted for nearly half (47%) of assets in UMAs). YCharts, which provides portfolio research tools for advisors, noticed this trend and is adding support for SMA analytics into their growing suite of portfolio analytics tools. Starting from a base of technical analysis through charting, YCharts has built what looks like a powerful, yet easy-to-use software platform that is taking on established players such as Morningstar Direct, Factset, and Refinitiv. Interestingly, Morningstar is an investor in YCharts, even as YCharts is looking to chip away at the dominance of the Morningstar Direct product in the portfolio analytics space (which in turn means that even if Morningstar is losing to YCharts, it’s still winning?). The new YCharts SMA screening and filtering will include performance, risk, allocation, exposure metrics, manager tenures, fees, and benchmarks. Advisors can also drill-down into the underlying SMA holdings, which is helpful for due diligence. Since YCharts is getting their SMA data from Morningstar (big surprise), advisors will be able to screen and filter across their entire universe of 10,000 strategies, rather than just a restricted set that would be available from an external provider. Notably, most RIAs that want access to SMAs have to go through a TAMP or RIA Custodian, since they often do not have enough assets to allocate to any third-party manager to make it economically feasible to negotiate a contract directly with them. But Platform TAMPs such as Envestnet, SEI, AssetMark, Orion-Brinker, and Vestmark-Adhesion, all offer a supermarket of third party strategies that are available with a single contract. A smaller selection of SMAs are also available through Schwab, Fidelity, and Pershing. However, their ability to screen for different data points varies by platform and provider. YCharts is looking to become part of more advisors’ research processes when seeking out an SMA upfront, by providing the ability to build custom models that will be able to include SMAs (by the end of the year, according to YCharts). These models can be used as the core of a proposal that can contain hypothetical performance, key metrics, and a comparison of current versus target portfolios. YCharts has made inroads into the independent space with over 5,000 RIAs using their tools, and LPL Financial recently added them to their Vendor Affinity program, giving their almost 17,000 advisors access to the software. And now, YCharts charting, news, and screening capabilities, paired with strong client communication tools and now SMAs, will give the firm more firepower to move upmarket from RIAs and further into the enterprise broker-dealer market, where they will be going head-to-head with Morningstar Direct (which is embedded at most every enterprise firm). We will see if their expanding data set and robust analytics are enough to unseat the incumbents… though ironically, it appears that Morningstar may still win either way?

Edward Jones Creates Matchmaker Tool To Help Clients Differentiate Amongst Advisors By Their Personality Type? Organic growth is increasingly difficult for financial advisors in the hyper-competitive market for fewer and fewer new and not-already-advisor-attached clients, especially as more and more financial services firms offer increasingly holistic financial planning advice to differentiate themselves from the product-centric financial salespeople of the past. Yet the irony is that as comprehensive financial planning advice becomes ubiquitous, it becomes harder for clients to differentiate amongst advisors as well. As a result, most advisor search portals for consumers drive clients to search by zip code – effectively turning driving convenience into the primary advisor ‘niche’ to differentiate from all other not-quite-as-conveniently-local advisors. In fact, the irony is that even as some advisor search tools try to give consumers more ways to distinguish amongst advisors – e.g., by choosing various topical specialties like retirement planning, estate planning, or charitable planning – “comprehensive” advisors tend to check all the boxes (in the hopes of getting a chance at any/every client)… such that consumers likely end out overwhelmed with an indistinguishable number of choices and still can’t figure out how to winnow down the list of whom to work with. Or stated more simply, it’s difficult for consumers to differentiate amongst advisors who aren’t even willing to differentiate amongst themselves! Accordingly, some advisor search tools like XY Planning Network specifically limit the number of specializations the advisor can claim to have, to ensure they only select the areas they can truly distinguish themselves, in the hopes of providing consumers with ‘fewer’ results that make it easier to actually select amongst a manageable number of choices. In this context, it’s notable that this month, Edward Jones launched their new “Edward Jones Match” portal, which aims to provide a new even-more-refined way of helping consumers actually figure out which (Edward Jones) financial advisor to work with. The distinction is that while Edward Jones Match does still include a geographic component (based on zip code) and does have a layer of matching based on client complexity and specialized needs (e.g., business owners), it is also aiming to match advisors based on hobbies (e.g., those who like to travel around the world) and other personality traits… matchmaking more akin (by design) to popular dating apps like Tinder or Bumble. And to reduce the risk of client overwhelm, Edward Jones Match aims to recommend up to 3 advisors (who then have 24 hours to respond), in anticipation that the prospective client will probably choose 2 of the 3 to interview, and then select 1 to work with. Of course, any advisor matching system could theoretically try to test other/different matching criteria and iterate to see which drives clients to actually move through and select an advisor, and ironically Edward Jones is already a leader in local-based advisor matching (given its strong focus on putting advisors into small-town local communities). But the significance of the new Edward Jones Match initiative is that because it ‘only’ recommends amongst its own 19,000 advisors, it will actually be able to track results from start to finish – rather than handing off to external third-party advisors – which potentially creates a stronger feedback loop to better allow Edward Jones Match to test and determine what really drives clients to select an advisor, which advisor matches actually result in the client doing business with the advisor, and which matches tend to be longer-term fits that retain (beyond just local geographic convenience). In turn, whatever Edward Jones finds actually drives consumers to do business with and retain their advisors, whether it’s a particular personality type or a certain kind of advisor expertise, can become what they train more of their advisors to do to create better matches in the future, expanding their ‘marketplace’ of advisor matches for consumers. Ultimately, the real question will still simply be: can Edward Jones turn advisor searches through its Match platform into real prospects that convert in the first place, in what is again an increasingly competitive landscape? Still, though, arguably Edward Jones Match, thanks to being vertically integrated with its advisors, is better positioned than most to figure out what really works when it comes to consumer-advisor matchmaking.

Fidelity Attempts To Relieve Integration Fatigue By Further Opening Up Integration Xchange For Better API Integrations? It is no secret that the larger the advisory firm, the more likely they are to operate their business with more than one custodian. In turn, custodians, like asset managers, have been fighting to be in the seat where they have at least a majority of a firm’s “wallet share”, in the hopes of consolidating the firm’s business entirely to their platform… or making newer advisors so accustomed (or even deeply embedded and dependent) on their platforms that the advisor never expands to become multi-custodial as they grow. Fidelity has traditionally tried to accomplish this through an Apple-like “walled garden” approach, investing truckloads of money into building their own proprietary all-in-one advisor technology platform – Wealthscape – and in 2015 they even scooped up popular third-party financial planning software eMoney to bring financial planning into their walled garden. However, in practice the strategy does not appear to have played out as hoped; the independent-mindedness of independent advisors means that the opposite “open architecture” approach embraced by competitor TD Ameritrade allowed them to grow even more rapidly, increasingly forcing Fidelity and Schwab to join in. In fact, according to Fidelity’s own recent Technology Study found that over 90% of the advisors that use Fidelity in some capacity are using at least one third-party integration, more than half utilize at least 6 third-party AdvisorTech vendors, and 94% of advisors, in general, believe that the number of third-party AdvisorTech integrations they use will remain the same or increase in the coming years. Accordingly, Fidelity announced this month that it has decided to further open up their third-party opportunities on Integration Xchange, adding more filtering tools to navigate Fidelity’s API inventory, and a “Try It Out” feature that allows firms to test-drive integration prototypes before moving forward with a full build. More broadly, though, conceding the idea that advisors are going to be multi-custodial for the foreseeable future and further opening up APIs is notable. On the one hand, advisors are increasingly struggling with “integration fatigue” from the number of integrations that firms must patch together (the majority using 6+ of them!). But in practice, integration fatigue is often a result not of the breadth of integrations, but the struggles of third-party applications not being able to get, or send, data they need via API, leading to a patchwork integration that can’t fully execute what is needed. What may be emerging instead, though, is an approach where custodians operate more like card network providers: Visa, Mastercard, American Express, and Discover. These networks have robust API solutions, with the single intention of making it easier for third-party applications to transact through their networks, recognizing that if they become the platform hub their business is secure (even if they’re not trying to build all the solutions themselves as Fidelity has historically done). By contrast, instead of the credit card network approach, custodians are wealth management networks… where instead of being able to swipe a credit card on any processor in the world to transact, custodians do the equivalent of making the customer go to visa.com, selecting the grocery store they are at, and then processing the transaction there. Needless to say, it could be more efficient. Still, though, while it is great news for independent advisors that Fidelity is further opening up their Integration Xchange, the real question is when and whether they’ll repurpose more of their R&D resources to stop trying to build proprietary tools on Wealthscape and instead build more APIs like Visa, Mastercard or Stripe, for the ever-growing network of third-party vendors to build on top of?

Pershing Signals The Beginning Of The End Of Passwords By Adding Biometric Sign On To NetX360. Last August, Google announced that they were starting to replace passwords as a method of verifying identity for 1.7 billion Android users. Microsoft did the same for their 800 million users of the Windows 10 desktop operating system. Apple was the leader in ditching login passwords when they launched the iPhone 5S with a fingerprint reader way back in 2013 and later replaced it with facial recognition on the iPhone X in 2017. And now, finally, the shift away from passwords and towards biometrics is starting to arrive in the domain of financial advisors, as Pershing announced this month that its NetX360 advisor desktop application can now leverage biometric verification to enable users to log in without having to type their password, authenticated instead via a mobile phone app (currently only available on Apple devices, but with support for Android planned for 2021). While entering a password isn’t too much of a hassle, eliminating it is one less thing advisors have to worry about as their tech stack becomes more complex and applications proliferate that all require their own password to access (and particularly as the SEC recently issued a Risk Alert for ‘credential stuffing’ where hackers use a compromised password from one site to try to gain access to an advisor’s other key software solutions). The Pershing feature will work in a similar fashion to how Google uses their iPhone app or YouTube app to verify a user’s identity when accessing sensitive services like changing their password. When a user attempts to log in to NetX360, the system will send a message to their NetX360 iPhone app, asking them to click a verification link. Once that is done, the NetX360 desktop will auto-login the user, bypassing the password requirement. This is a form of multi-factor authentication (MFA), using 1) Something you know: your iPhone PIN, 2) Something you have: your iPhone, 3) Something you are: your fingerprints or face, and 4) Someplace you are: location-based authentication using GPS to know if you are at your home or office. Biometrics help secure the chain of devices attached to a user's identity, and enable totally digital authorizations to be made for other services, all in a manner more secure than a single factor authentication like a password alone (as biometrics can’t simply be stolen online and entered like a password can, and thus are also more protected from phishing attacks). And notably, MFA via an app to the advisor’s phone is much more secure than sending an SMS message, like many websites do for user verification because app-based authentication eliminates the possibility of a hack called SIM card swapping (where a nefarious individual calls your mobile provider pretending to be you and tricks them into giving them a SIM card with your mobile number on it and disabling your own SIM card, such that by the time it takes you to realize this has happened, they have reset the passwords on one or more of your online accounts and now you’re locked out). With more sites are offering the option of using an authorization app like Google Authorizations or Authy, and Pershing advisors now providing access to MFA on the NetX360 desktop (having already provided it on their mobile app and also their client portal for a while) anything that can reduce friction, such as making the logon process faster, is a worthy target for technology improvement to help expand market share (though other custodians like Fidelity Institutional and Charles Schwab are also increasingly supporting biometric authorization for clients to access their portals and mobile apps). In turn, after the logon is rolled out, Pershing’s next step is to direct MFA towards asset movements authorization (currently in beta for an end-of-year release), including Fed Fund Wires, journals, and ACH, where the end client could simply enter a request for funds, and the advisor or assistant would be notified and when the transfer is ready NetX360 would send a push message to the investor's mobile app requesting approval of the transfer. This would not only reduce paperwork and manual steps, but also significantly cut down on fraudulent transfers that increasingly target advisors’ clients. Once every RIA application has migrated to biometrics, a huge weight will be lifted, as many operational and administrative tasks will disappear, and the opportunities for hackers and criminals to compromise the firm’s security will have decreased significantly; Pershing’s biometrics rollout on their desktop application is an important step forward (especially given how advisors still overwhelmingly rely on desktops over mobile apps to manage their practices).

New Product Watch: Can Executor Assist Boomerang Heirs Back To The Advisor After The Death Of A Client? The good news of the growing focus of financial advisors on retirees is that it’s literally where the money is, with the overwhelming majority of all investable assets in the hands of baby boomers nearing or in retirement (or their parents’ generation that are still alive). The bad news, however, is that demographics are destiny, and advisory firms that concentrate their client base on retirees are highly likely to see a significant number of their clients pass away… in a world where, according to one survey, as many as 86% of heirs intend to terminate the financial advisor their parents used. The end result is that advisory firms are increasingly focused on trying to identify ways to establish and maintain relationships with the next generation heirs of their current clients. In turn, this has led to the rise of a number of technology providers offering ‘estate planning’ solutions that advisors can use to augment that relationship, not by doing the prospective estate planning (e.g., helping clients determine what assets will be inherited by who and subject to what terms), but by actually getting involved in the process of how assets are transferred to heirs at death. For instance, services like EverPlans, Lifesite, and LegacyShield all provide solutions where advisors can help clients create a portal that houses all of their financial information (and even essential documents), share access with prospective heirs, and provide heirs the information (and even login details) they’ll need to facilitate their parents’ assets (or settle their parents’ estates) in the event of incapacitation or death. The caveat, though, is that for advisors to use their solutions with their clients, they must actually use the solutions. Which means helping clients to set up and configure the portals, actually load in essential documents and financial details, and properly configure the tools to provide the appropriate access to heirs at the appropriate time… arguably a very valuable value-add solution for clients, but one that imposes non-trivial additional costs not only in terms of the software licensing fees but the time of the advisor and their staff to help clients to adopt in the first place. In an attempt to offer a simpler solution, this month Executor Assist announced a new offering for financial advisors to help future executors facilitate their parents’ estates – and stay connected with the advisor – with a solution that requires little work by the advisory firm until the client actually passes away and the time has come. At its core, Executor Assist is simply a series of checklists and pre-filled forms that executors can fill out to notify financial, government, and other organizations that the decedent has passed, which is important both for the estate settlement process and also because the failure to notify organizations of a death increases the risk of “ghosting” (identity theft of a deceased person, which occurs an estimated 2.5 million times per year!). Information about Executor Assist, and how to access it via the financial advisor, is stored with the rest of the client’s estate documents, such that when a client passes away and heirs must begin to settle the estate, they find the contact information and contact the advisor (who can then connect them with Executor Assist’s tools for support). Notably, this means that in practice Executor Assist is not so much a ‘tech’ solution as simply a clever way to engage heirs back to the financial advisor in the event the client passes away for a series of relatively ‘low-tech’ checklists and pre-filled forms, but it does ‘compete’ in a similar category to more holistic estate support alternatives like EverPlans, Lifesite, and LegacyShield. And Executor Assist is priced accordingly – at just $45/month for up to 100 clients or $249/month up to 1,000 clients (i.e., pricing is effectively ‘per firm’ based on the number of clients in the firm), or the equivalent of just $0.45 to $0.25 per month per client to be able to provide them Executor Assist’s templates if/when the time comes. Which doesn’t necessarily replace the more robust AdvisorTech solutions in the estate planning category. But it does at least force advisory firms to really consider – is the purpose of providing such tools really as an ongoing value-add to the practice (where solutions like EverPlans are more likely to shine), or simply just to make fresh contact with heirs after a client passes away (where Executor Assist may be enough to accomplish the goal)?

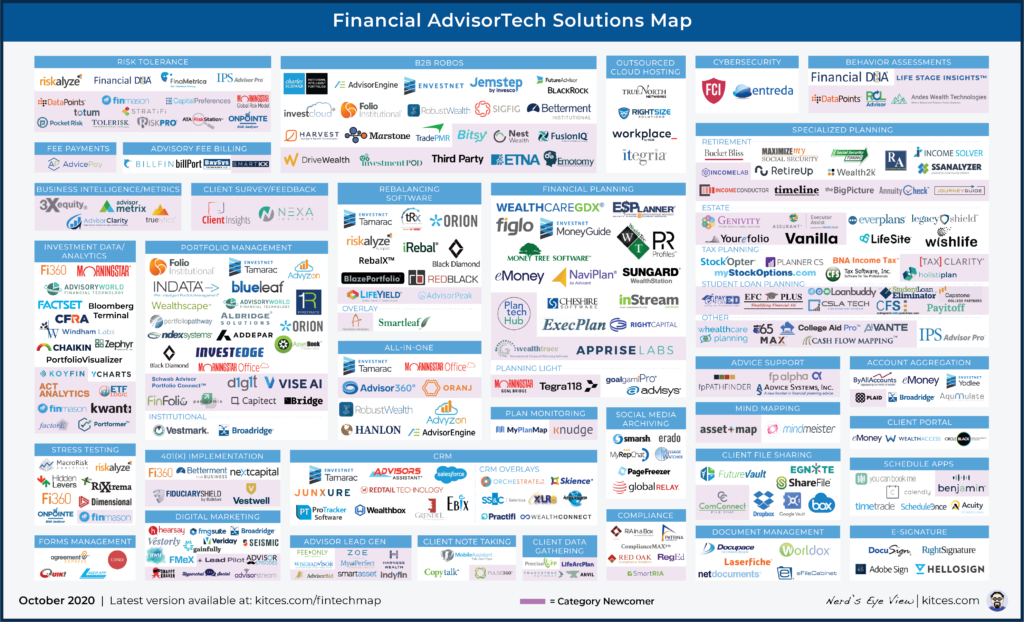

In the meantime, we’ve updated the latest version of our Financial Advisor FinTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Will employee “financial wellness” become the next big channel for the distribution of (human) financial advice? Has financial planning software missed the opportunity by failing to turn account aggregation into actionable planning opportunities (such that enterprise wealth management firms must build their own solutions)? Will Edward Jones’ new matchmaking tool really facilitate better connections between advisors and prospects? And how deep does advisor technology really need to be to support when it comes to estate planning, or will Executor Assist gain traction by helping advisors connect to next generation heirs without the additional technology complexity? Please share your thoughts in the comments below!

Special thanks to Kyle Van Pelt, who wrote the sections "Project Avocado Morphs Into Fidelity’s 'Incentive' Answer to Empower Buying Personal Capital?" and “Fidelity Attempts To Relieve Integration Fatigue By Further Opening Up Integration Xchange For Better API Integrations?". You can connect with Kyle via LinkedIn or follow him on Twitter at @KyleVanPelt).

Disclosure: Michael Kitces is a co-founder of XY Planning Network and is on the advisory board of Timeline, both of which were mentioned in this article.

One of the great lines from the mind of Kitces:

“…acknowledgment that Project Avocado’s “simplified” planning approach in “Project Avocado” was not going to be as successful for eMoney as an upsell as it is for Chipotle…”

https://uploads.disquscdn.com/images/79751a77ce9003f58ed21843f9b6e5f56cc83c3206ff3bd0534f2a8f386c520e.png