Executive Summary

Welcome to the October 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month's edition kicks off with the news that digital estate planning platform Wealth.com has raised a whopping $30 million in Series A funding, following on the heels of Vanilla's follow-on $20M capital round just a few months ago – which on the one hand reflects the anticipated enthusiasm for solutions that can help advisors efficiently solve their clients' needs for estate document preparation (beyond 'just' estate planning software), but on the other hand raises questions about how big the market opportunity really is for advisor-driven estate document preparation, given that unlike tax planning tools (which have an annual cadence for filing tax returns with the IRS) most clients may only update their estate documents only 10–15 years (often amounting to no more than 2–4 clients per advisor per year).

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- VRGL has announced a new venture capital funding round to continue building out its capabilities to extract data from prospects' investment statements and automatically generate investment proposals – but while VRGL has proven popular among some advisors for its ability to save time spent poring over paper statements, it remains to be seen how many will want to use (and pay for) it as a standalone investment analytics and proposal tool versus 'just' as a tool for extracting investment data (to send to the advisor's preferred analytics platform)

- Cashmere, an AI-driven prospecting tool aiming to help advisors "identify, enrich and engage" with prospective clients, has announced a $3.6 million seed capital funding round – although, as multiple new solutions have cropped up in recent years that also seek to help advisors catch money-in-movement events, fill in gaps in data on prospects, and match advisors with their best-fitting prospects, the question remains how many different solutions the market for prospecting tools can support (especially given that most firms tend to move away from prospecting as soon as it's feasible to generate most of their new growth from referrals)

- Fidelity has announced that it plans to effectively cut off access to 401(k) plans on its platform by Pontera and other technology that uses client credentials to view and trade in held-away accounts – which while putatively being about protecting client data and privacy, also serves to highlight Fidelity's conflicts as both a 401(k) provider and custodian (since now in order to manage within Fidelity-held 401(k) accounts, advisors will need to have custody assets on Fidelity as well), and raises questions about how Pontera can resolve its disputes with both state regulators and now plan recordkeepers to continue allowing advisors to manage clients' 401(k) assets on its platform

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including:

- Charles Schwab has announced that it plans to shut down its Institutional Intelligent Portfolios "robo-advisor for advisors" in the coming year, further accentuating the decline of the B2B robo-advisor space in recent years as the costs of attracting next-generation clients to sign up have continued to outpace the growth of new assets, to the extent that only a small handful of the original crop of B2B robo-advisors from the mid-2010s still exist today

- Retirement planning platform Income Lab has announced the launch of a new Annuity Planning tool aiming to model the impact of a wide range of different types of annuities on a client's overall retirement picture – which is arguably the first tool capable of subjecting many annuities to a robust and objective analysis (rather than the optimistic projections included in annuity sales literature), and may help to settle some debates over how certain annuities might perform in a range of different scenarios

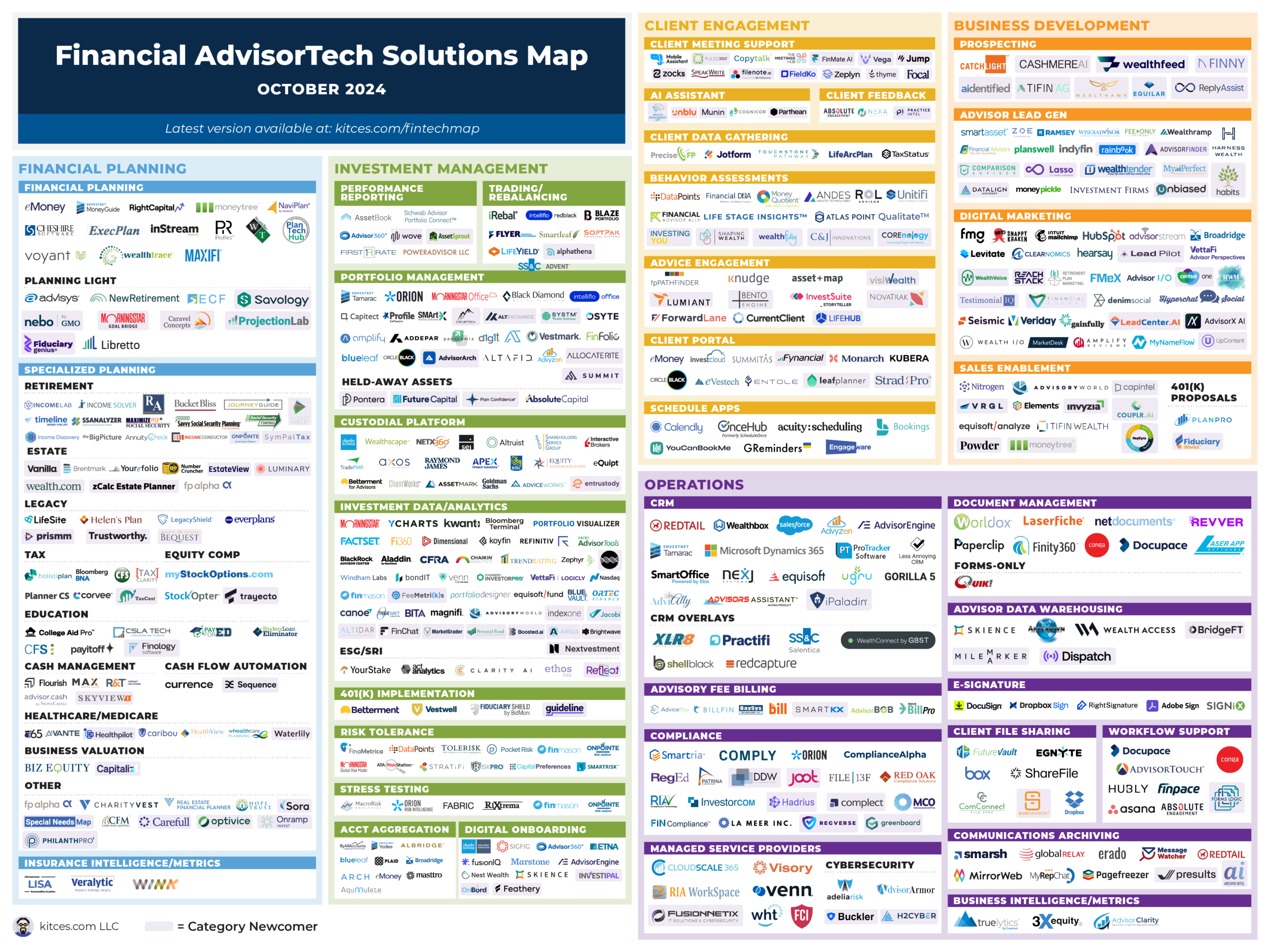

And be certain to read to the end, where we have provided an update to our popular "Financial AdvisorTech Solutions Map" (and also added the changes to our AdvisorTech Directory) as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Wealth.com Raises $30M In Series A Funding But How Many Clients Of Advisors Really Need New Estate Documents Every Year?

Estate planning has always been a core component of the financial planning process, but its nature has changed greatly over the last 25 years. Since 2001, the Federal estate tax exemption has increased by over 20X from $675,000 to $13.61 million. Furthermore, the introduction of portability allowed surviving spouses to make use of their deceased partners' unused exemption, which effective increases the current exemption for a married couple to $27.22 million.

As a result, the number of taxable estates subject to a Federal estate tax fell by a whopping 92%, from around 50,500 in 2001 to just 4,000 in 2023 – which didn't necessarily eliminate the need for estate planning altogether, but did fundamentally shift the focus of estate planning away from one centered around an 'alphabet soup' of complex trust strategies (A/B trusts, ILITs, SLATs, etc.) for all but a few ultra-high net worth clients who still remain exposed to estate tax, and clients in states with their own lower state estate tax exemptions. Instead, for many clients it's now simply about having proper estate documents in place – wills, powers of attorney, health care proxies, etc. – with the advisor's role being mainly to ensure the documents exist and remain up to date, and perhaps doing some planning to optimize not the estate tax but income tax (e.g., step-up in basis) consequences of death.

The caveat, however, is that most advisors don't actually create estate planning documents, which is the purview of a qualified attorney. So if the client doesn't already have an established relationship with an estate planning attorney, advisors can add value by connecting the client with a source that can provide the estate documents they need – which can either be a local attorney vetted by the advisor, or as a more cost-effective option, an outsourced service that can produce the estate planning documents without the multi-thousand-dollar cost of a "live" attorney.

To this end, a number of startups have emerged to build technology that aims to make it relatively fast and efficient for consumers to get their estate documents in place. Companies such as Wealth.com, Vanilla, EncorEstate Plans, and Trust & Will have all emerged to provide "digital" estate document preparation services – both direct-to-consumer and, increasingly, channeled through financial advisors as a value-add service – along with supporting software tools to help visualize clients' current estate plans and plan for future scenarios.

In this vein, it's notable that Wealth.com has recently announced a Series A capital raise of a whopping $30 million to ramp up its digital estate platform for financial advisors. Notably, this most recent round is led by Google Ventures, marking one of Google's first forays into the AdvisorTech channel.

Wealth.com's announcement comes 2 years after Wealth.com's own $16 million seed round, and barely 2 months after its competitor Vanilla completed another $20 million Series B round, signaling that investor enthusiasm for estate planning and document preparation services has not waned even as venture funding as a whole has slowed down in recent years (and also making it clear that advisors can be expected to be heavily marketed to by digital estate platforms for the foreseeable future, given the many millions invested). The momentum is understandable, given the need it fulfils for advisors: Clients really do need estate planning documents, estate planning attorneys are expensive and take a long time to find and vet, and advisors want to be able to play a part in the process in order to add value and ensure their clients' needs are being met throughout the process. Which makes it appealing to have B2B2C providers in the space that allow advisors to outsource the legal work (that they can't do themselves) while still guiding and adding value around the estate planning process.

The question, however, is whether the opportunity for estate document preparation is really big enough to justify the tens of millions of dollars raised by the key players in the last few years. Because even though document preparation can command a higher fee than estate planning software alone – digital solutions often charge somewhere between $400 and $700 for a set of estate documents for what could be each of an advisor's 75 active clients (amounting to $30,000 to more than $50,000 of revenue per advisor), as opposed to what is more commonly $1,000–$2,000 per advisor per year for most advanced planning software – each client may realistically only update their estate planning documents once every 10–15 years as their circumstances substantively change enough to merit doing entirely new documents. Which means that a 'typical' advisor with 75 active clients might only have 5–8 clients needing new documents each year, some of whom may not actually use the service: either because they already have established relationships with estate planning attorneys, or else have complex enough needs to necessitate having the documents drafted by a human estate attorney. And if advisors only actually have 2–4 clients per year engaging in estate document preparation on average each year, then those services really might not generate much more than the $1,000–$2,000 per advisor per year revenue that software itself costs.

Additionally, Wealth.com's subscription-style pricing model (reportedly starting around $5,000 per advisor per year for unlimited estate documents for clients), which differs from the a la carte pricing of competitors like EncorEstate, puts it in a difficult position as a producer of a commodified product like estate planning documents (or at least, the 'simpler' estate planning documents that are conducive to digital platforms producing en masse). For the relatively few advisors who need more than the average number of estate documents (say, 5-10+ per year), the subscription model loses money compared to a la carte. Which means that Wealth.com's pricing model relies on attracting and retaining advisors who need fewer documents than that – and also relies on those advisors not jumping ship to a more cost-effective a la carte solution that just prices per document, if not enough clients end up needing estate documents to provide enough of a value-add to justify the ongoing fee. And while Wealth.com's estate visualization and planning tools (such as its recently announced Family Office Suite) do provide some additional value beyond the core document preparation service, there are realistically far fewer clients with the complexity and potential estate tax exposure to make those tools especially useful, as there are only about 250,000 ultra-high-net-worth households in the U.S. with a $30M+ net worth that subjects them to Federal estate taxes, serviced by only a few thousand advisors who would have the need for such planning tools (and many of those clients are likely to prefer working with a dedicated estate planning attorney anyway).

So in the long run, while there's still an opportunity for digital estate planning platforms as long as there are clients who need estate documents and advisors who seek to take an active role in seeing them through, the question remains whether or not the mega-capital raises from the likes of Vanilla and Wealth.com can really fulfill their investors' expectations given the realistic size of the marketplace for outsourced document preparation among independent financial advisors. If the reality is that such platforms realistically can only generate $1,000 to $2,000 of revenue per advisor on average from the 2–4 clients who need documents each year, than even serving all 100,000 CFP certificants creates a total market of only $100M to $200M of total revenue… enough to have a very financially successful company, but far more problematic when leading providers have already raised more than $100M of cash just to capture what might only be a $100M/year revenue opportunity (as we'll never realistically see 100% adoption from all CFP certificants)?

Which means ultimately, estate document providers are going to have to figure out how to increase the frequency by which advisors engage in new estate planning documents for their clients (to cycle through faster than updates 'just' every 10–15 years), move 'upmarket' to do more complex estate documents at a higher fee (and put some advisors in the risky position of 'competing' against their COI referral sources), or instead the platforms will eventually need to pivot to stay alive – either towards enterprise firms that can drive significant new revenue compared to scaling at a rate of one independent RIA at a time (similar to Vanilla's partnership with Vanguard and Trust & Will's partnership with LPL, both announced earlier this year), or moving away from financial advisors and towards working directly with attorneys themselves who by definition have a much higher rate of clients looking for estate planning documents (but might not relish the thought of using technology that was once built to replace them)?

VRGL Raises New Capital For Its Automated Investment Proposal Solution – But Do Advisors Want The Proposal, Or Just The Automation?

The opportunity to turn a prospect into a client fundamentally drills down to the question of, "What can the advisor do to make the client's situation better than what it is today?". To answer that question, advisors often generate a proposal showing the prospect's current situation, what the advisor recommends, and some metric to quantify the difference between the 2; i.e., how much improvement the advisor's solution represents over the status quo.

Perhaps the classic example of this is Riskalyze's "Risk Number", boiling a prospect's risk tolerance down to a single metric and then comparing how that number aligns with the prospect's current portfolio versus the advisor's recommended portfolio. But there are also many other proposal generation tools centered around the portfolio itself, most of which seek to analyze the prospect's portfolio and generate a report to show how the prospect's actual portfolio scores against the advisor's recommendations by a range of different metrics. The challenge, however, is that the process of building an investment proposal can be a tedious one, requiring advisors to pore over a prospect's investment statements and manually input information like ticker symbols or CUSIPs, dollar values, and cost basis for each and every holding.

And so when VRGL came onto the scene in 2021, it generated a lot of buzz as the "Holistiplan for investment proposals" – that is, a tool that could eliminate a meaningful amount of advisors' time spent poring over paper statements by scanning the statements and extracting key information, just as Holistiplan used similar technology to greatly reduce the time needed to manually review a client's tax return. In a nutshell, VRGL's key value proposition was in cutting down on the manual work of creating investment proposals by automatically extracting account positions, holdings, market value, cost basis, and other key information from prospects' uploaded account statements. From there, the software analyzes the portfolio and packages the results into a proposal that evaluates the prospect's holdings on the basis of what VRGL calls the "5 Pillars" – performance, risk, diversification, fees, and tax – and compares that against how the advisor's recommended portfolio stacks up.

It's notable, then, that in the news this month is the announcement that VRGL has raised an additional round of venture capital – reported at $6 million – almost exactly 2 years after its initial Series A round of $16 million in 2022, which VRGL will use to keep building out its statement extraction and proposal generation capabilities.

Even in an era when advisors increasingly focus their value proposition around financial planning, investment management is still a core component (and the primary revenue generator) for the majority of financial advisors – which means there's still a step in almost any advisor's sales process reserved for reviewing the prospect's investment holdings, comparing them to the advisors' recommendations, and showing the prospect how the advisor can deliver value through managing the investments themselves. For which VRGL's statement extraction and automated proposal capabilities can greatly expedite the process of creating a recommendation (and ultimately getting the prospect signed on as a client), cutting out what can amount to hours of work trying to pull out all the details of a prospect's holdings and running them through an analytics engine.

The caveat, however, is that while almost all advisors share the need to review and analyze prospects' existing investment portfolios, they don't all share the same philosophy or methods for actually doing the analysis. Advisors who are more strategic and passive in their approach might focus on the total fees in the portfolio; those who lean more towards risk management might emphasize metrics like diversification, Sharpe ratios, and downside risk exposure; while more active managers may lean towards performance metrics against a specified benchmark. But despite all the differing opinions on how to analyze a portfolio, VRGL's internal investment analytics capabilities are limited to 'just' the single 5-pillar analysis – which is fine for those who agree with VRGL's scoring and weighting of the different factors in its analysis, but not so much for advisors who have their own opinions on which portfolio factors should be emphasized more than others.

Notably, VRGL does make it possible for advisors to export client investment data into other investment analytics platforms, either directly via API through their integration with YCharts or via a spreadsheet export preformatted for other platforms like Bloomberg or Morningstar. Which is helpful for those would rather let VRGL handle 'just' the extraction of data from the client's statements, while substituting their own analysis from their preferred analytics software. But it does raise the question of how many advisors will want to use VRGL only for data extraction, while still paying for other features - i.e., the 5-pillar analysis and its featured role in the proposals generated by the software - that ultimately go unused? Or put differently, are there enough potential users out there who either plan to use VRGL's full capabilities of data extraction, portfolio extraction, and proposal generation, or for whom the data extraction alone is worth paying the full cost of the software, to meet the growth goals that VRGL (and its venture capital investors) seek?

Still, for those who can accommodate VRGL's portfolio analytics within their own investment narrative, the pure time savings represented by VRGL's ability to automatically turn a pile of investment statements into a completed proposal is compelling. What remains to be seen is how VRGL can further build out its internal proposal capabilities to meet advisors where they drive their value for clients, and create a solution with more universal appeal for advisors with differing investment philosophies. Which could mean either allowing for different analyses alongside VRGL's own baked-in 5-pillar model; or potentially unbundling the cost of the proposal generation, data extraction, and investment analytics capabilities. Or at the extreme, even being acquired and tucked into an existing investment management solution that wants to deepen its own proposal capabilities.

In the long run, however, portfolio management remains a staple of most advisors' business, and thus there's a need for some way to demonstrate to prospects how the advisor's proposed strategy will improve the prospect's financial situation. The question in the meantime, as other solutions like Powder have arisen that can also extract data from client statements for analysis, is how VRGL can continue to differentiate itself beyond 'just' time savings (which more and more tools can now also provide) to prove itself uniquely valuable as a standalone proposal generation tool that effectively demonstrates advisors' value – or how it can best enable advisors to perform their own analysis if they'd rather do so?

Cashmere Raises $3.6M For Its AI-Powered "Enriched" Prospecting Solution

Traditionally, emerging financial advisors came up amid the "eat what you kill" model of business development, where the advisor's ability to make a living was almost wholly reliant on their ability to bring on new clients and generate revenue for the firm. Which meant that, to the extent that early-career advisors were trained at all, it was with an emphasis on prospecting, sales, and business development techniques – reflecting the roots of the financial advice industry where the vast majority of advisors worked for broker-dealers, mutual fund providers, or insurance companies, for which advisors were their primary distribution channel.

Today, fewer advisors are as reliant on sales for their income; in the fiduciary model where advisors are paid for their advice rather than product sales, there's value in being able to serve a client well and develop a deep relationship over time. And so the training for financial advisors now more often revolves around strengthening financial planning knowledge (e.g., by attaining the CFP and advanced designations), and learning the "soft skills" of relationship building and meeting management.

But the fundamental challenge remains that it doesn't matter how good an advisor is at giving advice if they can't find any clients who are willing to pay for it. And advisors whose training focuses solely on technical planning skills, once they gain enough seniority at their firm that they're expected to bring in new business of their own, can find themselves in for a harsh awakening when they realize how hard it actually is to find and retain new clients.

One of the biggest challenges faced by planning-centric advisors is the dearth of information on new prospects – after all, the financial planning process facilitates very extensive knowledge of each client's life and financial circumstances, increasing the trust and comfort level as more information is shared between the client and advisor – but that doesn't generally happen until well after they become a client. Which makes it hard to know, out of all the advisor's LinkedIn contacts, which people need advice (and are willing to pay for it), what kind of advice they need, and what type of advisor might be the best fit for them.

All of which has led to the rise of technology-driven prospecting platforms such as Cashmere, which is in the news this month after raising $3.6 million in seed capital (following a $4.6 million seed round in May of this year), that aim to help advisors "identify, enrich, and engage" prospects for a more efficient client acquisition process.

Cashmere is now one of several recent startups that are trying to help expedite the prospecting process and ensure that advisors are investing their time pursuing the "right" types of prospects, which also includes Catchlight, WealthFeed, AIdentified, Wealthawk, and Finny. All of which aim to make use of publicly-available data (e.g., IPO filings, capital raises, real estate listings, etc.), often with the help of AI, to identify "money in motion" events that might bring new prospects to the surface or to "enrich" the available data on prospects already in the advisor's sales funnel. Additionally, by drawing from the advisor's existing client and prospect data to infer details about the advisor's preferred client attributes, Cashmere also seeks to automatically rank and prioritize prospects that it determines would be the best fit for a particular advisor.

For advisors who engage in a lot of outbound prospecting – where the sooner the advisor can determine whether a new contact is worth investing more time into as a prospect, the faster they can decide whether to "fish or cut bait" and move on – a solution like Cashmere might be appealing as a way to give advisors the information they need without the need to search for it all themselves. And notably, some firms that already have deep marketing funnels might also be interested in a platform like Cashmere in order to use its data enrichment capabilities to match incoming prospects to one of the firm's advisors – which might at least save the time it takes to schedule and hold a screening call to accomplish the same goal.

What's ironic, however, is that while many advisory firms do struggle with organic growth (that for many firms hovers around 5%-7% each year), those same firms also tend not to be prospecting- or marketing-oriented enough to feel compelled to invest in technology for it. Firms might start out by prospecting proactively for new business, but once they reach a certain critical mass of clients they tend to move away from prospecting and towards getting referrals from existing clients. There's only a small subset of firms that are both big enough and growth-oriented enough to keep building in the direction of prospecting, and so it isn't clear that there's enough of a market for the (at least) half-dozen technology providers that currently cater towards those firms – especially given the fact that the most growth-oriented firms likely already have their own process of prospect identification and engagement, with email marketing platforms like Mailchimp being able to provide at least enough "enrichment" data to keep the process moving forward.

So while the traditional prospecting process can certainly be inefficient – largely because there was historically little incentive for firms to invest in more efficient processes because their commission-based advisors bore all the risk and reward of bringing in new business themselves – which would seem to make it ripe for improvement by way of technology, the question remains how much demand there really is for prospecting technology, when most advisors tend to move away from prospecting as quickly as possible. And for firms that do stick to the old "eat what you kill" model of cold-calling prospects, the question is whether they'll want to invest in a solution to bring "warmer" leads to those newer advisors, when it already costs them little to replace the ones who can't bring in new business on their own?

Fidelity To Cut Off Pontera's Access To Its 401(k) Plans: Just Data Security, Or Fidelity's Own Business Conflicts Of Interest?

401(k) plans have been a key component of retirement planning for over 40 years now since they were first established, but it hasn't been until relatively recently that financial advisors have been able to directly manage their clients' individual 401(k) accounts. In the 1990s and 2000s, if an advisor wanted to advise their clients on what to do with their 401(k) assets (and the client couldn't simply roll the funds out as an in-service distribution), they would have had 2 options: Either direct clients on which actions to take, which the client would then do on their own (either on their own or by logging into their account on the advisor's computer during a meeting); or collect the client's login information so the advisor could access the account and make the moves themselves.

Both options had a number of pitfalls. On the one hand, asking the client to make the trades on their own is inefficient, involving potentially several back-and-forth exchanges with the client, and risks miscommunication resulting in a wrong trade that might not be caught until the next quarterly or annual review cycle. Not to mention that clients who hire advisors are often delegators who don't want to do it themselves, and prefer to have someone do such investment trading for them instead. But on the other hand, an advisor collecting their clients' login information themselves to complete the trades on the client's is potentially even more problematic, and risks the advisor being deemed as having custody over the client's assets (while also opening up exposure to liability in the event that a cybersecurity breach allows another party access to the client's login information).

In more recent years, however, several developments have made it possible for advisors to more directly manage clients' 401(k) assets, without the need to personally collect and store their clients' login information. For one thing, plans began offering brokerage window options, allowing clients to make self-directed investments in their 401(k) plans rather than sticking to the standard fixed lineup of mutual funds, and many of those brokerage windows allowed clients to sign an LPOA giving their advisor discretionary trading authority over the brokerage window assets (although as of 2021 only about 31% of plans offered a brokerage window). Furthermore, in 2018, Pontera (then known as FeeX) launched a new offering that allowed advisors to access and trade in clients' 401(k) accounts – with the client not giving their login information to the advisor but instead entering it on a one-time basis into Pontera's own systems and giving the advisor access to the account thereafter – which purportedly gave advisors a more compliant way to proactively manage their clients' 401(k) assets without collecting and storing the clients' login information themselves.

In the years since, Pontera has gained traction among advisors who appreciate it either as a pure value-add for clients (with its ability to manage 401(k) assets in a consistent and scalable way by integrating with investment management software to manage those assets in the context of the client's entire investment picture), or as a way to drive additional revenue by now providing a "managed" 401(k) assets service that allows them to more readily bill on the held-away accounts not just as assets under 'advisement' but outright under management. In the last year, however, Pontera began to encounter some friction with state regulators around the way they allow advisors to access clients' accounts with the permission of the client but not necessarily the permission of the 401(k) plan provider, which led some advisors who had built their processes and/or business models around Pontera to wonder if they would even be allowed to use it going forward.

And now in the news this month, Fidelity – the biggest 401(k) plan provider by far with over $3.4 trillion in defined contribution assets across 30 million participants – announced that going forward it would take steps to "prevent platforms reliant on credential sharing from access and taking action" in its accounts. Which while not naming Pontera directly, the announcement clearly meant that Fidelity would be blocking advisors' access to clients' Fidelity-held 401(k) accounts using Pontera or any similar technology.

For advisors who use Pontera to manage client accounts, Fidelity's announcement forces some difficult decisions about how to move forward. Advisors could potentially continue using Pontera for non-Fidelity clients, while managing Fidelity-held assets either through plans' brokerage windows (though Fidelity may problematically require that the advisor have custody assets at Fidelity in the first place to have access to their 401(k) brokerage window as well) or by using the old-fashioned method of walking the client through rebalancing trades (that the client still has to implement themselves) during their review meeting. But either option creates questions around whether it's feasible to scale an investment management process of managing held-away 401(k) plans when potentially half of all clients would need to be managed in a different way, and using different technology, than the others. And for advisors who bill on clients' 401(k) assets, there's also the question of whether it's reasonable to continue billing on assets that aren't managed directly on Pontera, and whether a manual rebalancing process across many clients can even be profitable with an "Assets Under Advisement" (AUA) fee that's potentially lower than the advisor's standard AUM fee.

At an industry level, despite Fidelity's putative reasoning for the decision to cut off Pontera access being that it's about protecting its clients' data and privacy, there are many who view the real reason behind the announcement as being about Fidelity using its size and influence to stifle external advisor access to its 401(k) assets. And it's true that Fidelity has conflicted interests in the matter, since clients who want management of their Fidelity-held 401(k) accounts are now limited to advisors who custody assets at Fidelity (or are willing to move assets there in order to have access to Fidelity's brokerage window option), or Fidelity's own in-house advisors. Although ironically, the move to block Pontera could ultimately lead Fidelity to lose 401(k) assets in the long run, since with Pontera (before Fidelity cut off their access) advisors could manage clients' 401(k) assets wherever they happened to be, including at Fidelity; whereas now, in order to keep managing the funds, advisors would have to move the assets away from Fidelity. In other words, Fidelity's efforts to limit advisor access to its 401(k) participants actually gives advisors much greater incentive to roll assets away from Fidelity as soon as possible, whether that's when the client retires or changes jobs, or even (in cases where in-plan rollovers are allowed) as soon as the client's payroll contributions hit the account every month.

In the long run, it's an open question as to whether Fidelity and Pontera will come to some sort of data-sharing agreement that gives advisors access to Fidelity-held 401(k) assets – which is slightly ironic given that Fidelity invested greatly in its own data-sharing API hub Akoya (that's since been spun off as its own company) with the goal of creating more open access for data sharing purposes. And ultimately, accessing 401(k) trading via API (rather than password sharing) really is a more secure way for clients' 401(k) accounts to be managed. But with the issues that advisors using Pontera have encountered over the last year – first with the scrutiny of state regulators, and now with Fidelity cutting off access to its 401(k) accounts – the bigger question going forward is whether and how Pontera will work with the stakeholders involved and reshape its technology (and the availability of APIs for not only 401(k) account balances but 401(k) account trading) to satisfy everyone before the uncertainty around the platform's future causes advisors to leave en masse. Because ultimately, when these disputes occur, it's easy for the parties to direct blame in each other's direction – but the longer the conflict drags out, the more disruptive it is for the advisors and their clients who get caught in the middle.

Schwab Plans To Shut Down Its Institutional Intelligent Portfolios "Robo-Advisor For Advisors"

It's been almost exactly 20 years since iRebal launched what was the first widely available rebalancing and model management software for independent advisory firms. Born in the era when most advisors still built bespoke portfolios of mutual funds for each client, iRebal's emergence coincided with RIAs beginning to scale up their assets under management in the 2000s, which led to a broader shift towards using centralized models rather than one-off custom portfolios. Which meant there was a need for processes to ensure that advisors could consistently manage to those models across a large volume of clients – a need that iRebal was well equipped to fulfill.

Within a few years, rebalancing software had caught on among advisors, spawning competitors for iRebal including TRX, Redblack, Tradewarrior, and Blaze Portfolio. However, it was only a matter of time before scaled model management made the leap from being exclusive to financial advisors to becoming available directly to consumers – which soon took shape in the form of the robo-advisor movement, including Betterment, Wealthfront, Personal Capital (now Empower), FutureAdvisor, and others.

Initially, robo-advisors gained momentum while being heavily marketed towards Millennials, who were perceived as both more digital-savvy as their Boomer and Gen X predecessors and cheaper to serve with their (at the time) comparatively simple financial situations and smaller levels of investable assets. But soon, technology developers, recognizing that advisors had long struggled to market to and serve younger clients in a cost-effective way, also perceived an opportunity to for robo-advisor technology to bridge the gap to the next generation for human advisors. Which in the 2010s led to a new crop of "B2B robos", including both purpose-built solutions like RobustWealth and Jemstep, as well as B2B offshoots of existing direct-to-consumer robo-advisors like Betterment for Advisors, FutureAdvisor, and Charles Schwab's Institutional Intelligent Portfolios. All of which marketed themselves to advisors as being solutions that would make it easy for clients to quickly open and fund an account directly through the advisor's website, allowing the advisor to passively grow and nurture a steady base of next-generation clients at a fraction of the cost of onboarding and serving their parents' and grandparents' generations.

But despite the initial hype, many of the B2B robo-advisors struggled almost immediately, as it rapidly became clear that adding an "Invest Here" button to an advisory firm's website wouldn't automatically translate into a steady flow of new assets. Because as it turned out, the real blocking point for RIAs in serving more next-gen clients was never the inefficiency of onboarding or managing their portfolios, which tools like iRebal had already made possible to do at scale for over a decade. Rather, it was the challenge of marketing to and acquiring those clients in the first place, as advisors found themselves competing with both direct-to-consumer robo advisors and large brokerage firms like Schwab and Vanguard, as well as with successive generations of consumer investment platforms like Robinhood and Stash. All of which led to much higher client acquisition costs than the B2B robos had originally predicted, and caused one after another to either shut down (like FutureAdvisor) or to be acquired and stripped for its parts (like FutureAdvisor and Jemstep).

And now, Schwab has announced that its Institutional Intelligent Portfolios, one of the few remaining B2B robo-advisors, will be closed to new accounts as of November 15, 2024, and will be shut down entirely sometime in 2025.

From an advisor perspective, the shutdown of Institutional Intelligent Portfolios really only affects the relatively few advisors who used the service. But they'll need to decide going forward whether to remain at Schwab while making use of iRebal – acquired by Schwab as part of the TDAmeritrade acquisition – to scale portfolio management going forward, which provides arguably a more robust model management solution that Institutional Intelligent Portfolios did (allowing advisors to create their own models, set cash allocations, choose fund options, etc., which wasn't an option with the robo solution), with no additional cost for advisors on the Schwab custody platform. The caveat is that while iRebal can monitor and propose trades, it doesn't execute the trades itself, so to that extent it isn't a "set it and forget it" solution as many of the robo-advisors boast. Otherwise, advisors could move to one of the few remaining B2B robos, like Betterment for Advisors, or else make use of an investment management platform like AdvisorEngine that incorporates robo-like technology into its investing solution.

In the end, the demise of Institutional Intelligent Portfolios serves as one more proverbial nail in the coffin of the B2B robo-advisor movement (which disappeared as a category from the Kitces AdvisorTech Map long ago and was folded into the "Digital Onboarding" category), and provides the clearest indicator yet that appealing to next-generation clients requires more than a button on a website in between the stock images of the lighthouse and the sailboat; rather, it requires firms to build a brand and value proposition that actually appeals to next-generation clients and shows what the firm can do that any other retail investment platform can't. Or put differently: It's too much to expect of robo-advisors to boost a firm's appeal to young investors when the firm isn't built to serve those clients to begin with.

Income Lab Launches First-Of-Its-Kind Annuity Planning And Comparison Tools

When an annuity company offers a new product, it usually produces sales materials to promote its benefits: Explanations of the annuity's key features, examples of how it may have performed in historical scenarios, and projections of how it could hypothetically behave in the future. All of which are designed to give an impression of how the annuity might perform in a wide range of scenarios, and ideally to facilitate a comparison between multiple products. But among the many shortfalls of such projections – alongside their tendency to often be too optimistic about how the annuities' performance would play out in the real world – is that they usually fall short in terms of projecting the impact of the annuity on the entirety of the client's financial plan. Because by definition, product illustrations only illustrate the dollars that go into the product itself, not the other aspects of the client's financial situation that are affected by real-world events.

Ideally, advisors would be able to use their core comprehensive planning software to understand how a given annuity will impact the outcome of client's financial plan, but in practice this too is quite difficult. In part because annuities have gotten so complex over time (from the mechanics of variable annuities' benefit base and withdrawal guarantees to the caps and participation rates of fixed index annuities) that even fairly robust financial planning software isn't built to fully model every potential variable – including not just the annuity's performance, but also the tax consequences of specific annuity types, and the different ways that withdrawals might be sequenced in different circumstances.

The end result of this dynamic is that advisors who do use annuities can find themselves struggling to illustrate how to objectively illustrate what's gained by the annuity without simply taking the projections in the annuity sales materials at face value, as well as to optimize how they're integrated into the client's plan. And more portfolio-centric advisors tend to simply shun annuities altogether, with the lack of modeling capabilities making it easier to ignore cases where an annuity really could be the best solution for a client. At the same time, annuity providers haven't pushed to have their products included in major financial planning software, perhaps out of reluctance to fully share the proprietary details of their products' inner workings – or perhaps simply because they fear that their products won't look very good when subjected to a more rigorous analysis.

Which makes it notable that Income Lab, which has quickly become one of the most sophisticated analytical tools on the market for retirement planning, has announced the launch of a new Annuity Planning tool that will allow advisors to more robustly model how particular types of annuities with specific features (e.g., certain benefit basis, annuitization factors, participation rates, caps, etc.) would perform as part of a client's overall retirement picture.

From an advisor perspective, the new Annuity Planning features will likely appeal to many advisors who use annuities but who have heretofore struggled to illustrate their impact within a holistic retirement plan – for which Income Lab's focus on not just wealth accumulation but stability of income and drawdown risk might show annuities in a more favorable light than would be the case in traditional Monte Carlo-based retirement simulators. At the same time, for advisors who want to show how a particular annuity might not be in a client's best interests, Income Lab's upgraded features can allow for a more definitive analysis.

The caveat, however, is that there are still certain aspects of some annuities that can make it difficult for even Income Lab's new tool to provide a comprehensive analysis – for example, fixed index annuities could use proprietary indices rather than standard ones like the S&P 500, while many annuity features – like participation rates and caps – tend to not be guaranteed over the life of the annuity but can change year-to-year depending on interest rates and market conditions. All of which introduce some uncertainty when trying to model the annuity's impact, which the advisor will need to account for when using software like Income Lab to run the projection.

Nevertheless, Income Lab's new Annuity Planning tool is notable in that comes from a platform that is neither linked to the annuity industry, nor is inherently anti-annuity – but simply seeks to cast the most accurate light on how annuities can be expected to perform in the context of a retirement projection. Which might ultimately create some waves on both ends of the spectrum, as some annuity types might come across as better than expected (putting pressure on portfolio-only advisors to become more open towards incorporating annuities in their clients' plans); while others may struggle to look good in almost any retirement picture (and risking pushback from annuity providers).

Ultimately, the fundamental idea that some retirees might be willing to trade some portfolio upside potential in order to mitigate their downside and longevity risk is worth considering for almost any advisor. The question, in the end, is which particular products can hold up under a robust analysis and prove to be beneficial for a client's goals and retirement picture under a range of circumstances – and which can only succeed under the overly optimistic projections in the sales materials – for which we now have an objective tool to provide that analysis.

In the meantime, we've rolled out a beta version of our new AdvisorTech Directory, along with making updates to the latest version of our Financial AdvisorTech Solutions Map (produced in collaboration with Craig Iskowitz of Ezra Group)!

So what do you think? Do enough clients need estate planning documents to make it worth an annual subscription to provide them? Does VRGL's "5-Pillar" system provide enough analysis to generate an investment proposal, or would it be better for advisors to be able to create their own analysis? Does Fidelity's decision to block access to Pontera make it more uncertain that advisors will want to use the platform? Let us know your thoughts by sharing in the comments below!

Leave a Reply