Executive Summary

The AUM model for financial advisors has experienced tremendous growth over the past 20 years, from the rise of the independent RIA to the broker-dealer shift to fee-based accounts. And despite the rise of critics questioning whether the AUM model is the most effective way to align what the client pays with the value being provided, the accelerating momentum of major firms transitioning to the model suggests that not only is the AUM model here to stay… but there may soon be too many financial advisors using the same AUM model to pursue the same relatively-few households who have sufficient liquid assets available to invest and who are actually willing to delegate them to an advisor in the first place. In fact, if the entire advisory community makes the AUM shift all at once, there may be no more than about 23 clients per advisor available!

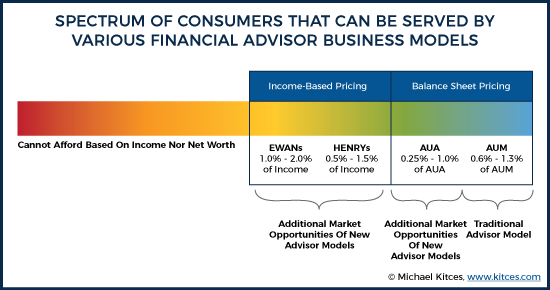

Yet the reality is that the opportunity in the marketplace for financial advice goes far beyond just those who have at least $100,000 of investable assets available to roll over to an advisor to manage. In part, this is because some advisors are now shifting to an “Assets Under Advisement” (AUA) model that aims to charge clients not just a percentage of their managed portfolio, but a percentage of their entire net worth (on which the financial advisor is providing holistic financial advice), opening up a larger segment of Mass Affluent (and Millionaire) households who have the financial ability to pay for advice, but not the liquidity to access it by rolling over an investment account (e.g., because their assets are tied up in a 401(k) plan where they’re still working!).

However, the even-bigger opportunity to expand financial advice is not just to shift from charging a percentage of assets to a percentage of net worth, but instead to charge a percentage of income instead. Which opens up yet another swath of consumers – commonly known as the “HENRYs” (short for High Earner, Not Rich Yet) – who may not have substantial assets or net worth, but have more than enough income to pay for advice directly out of their income, whether on an hourly, monthly subscription, or annual retainer basis.

And while for high earners, the most straightforward approach may be to simply shift from charging 1% of assets to 1% of income, the reality is that just as AUM fees are typically tiered on a graduated fee schedule – with higher-percentage fees for smaller portfolios and lower fees for sizable accounts – a percentage-of-income fee could be tiered as well. In fact, at a 2%-of-income fee, even median-income households (earning approximately $60,000/year) become economically feasible to service with advice… for which even a 2%-of-income fee can often be recovered by providing good advice on the other 98%, at a cost that is little more than what such individuals would pay in commissions on even a modest IRA rollover into A-share mutual funds or via an insurance purchase. In other words, charging fee-for-service advice isn't just about the HENRYs, but a far wider range of Earners Wanting Advice Now (EWANs) who have the financial wherewithal to pay for it (as a percentage of the income they have, not the assets they don't!).

The key point, though, is simply to understand that, while the AUM model continues to be popular, and has a lot of benefits that make it easy for consumers to pay and highly scalable, it is naturally limited in market size to those who have liquid portfolios available to manage. While the rising shift to alternative fee-for-service models, particularly a percentage-of-income fee, opens up entirely new “blue oceans” of HENRY and EWAN consumers who are not served today by holistic financial advisors!

The Upside And Limitations Of The 1% AUM Fee Model

The Assets Under Management (AUM) model has experienced a tremendous growth cycle over the past 20 years, as the entire advisory industry has increasingly shifted from its commission-based roots to an AUM-based model instead. From the explosive rise of the independent RIA channel to more than $4 trillion in assets, to the recent crossover in Financial Planning magazine’s tracking of the top-50 Independent Broker-Dealers that now generate more of their revenue from fees than commissions, it seems the entire industry is shifting to the AUM model. Which isn’t entirely surprising, given both the AUM’s reduced conflicts of interest (at least compared to a commission-based model), the superior scalability of building a recurring-revenue-based advisory firm, and the appealing combination of being both a transparent pricing model for consumers but also a low-saliency one that doesn’t amplify fee sensitivity.

The caveat, however, is that the AUM model doesn’t work for everyone. As by definition, in order to charge a percentage of assets under management, the prospective client needs to have assets available to manage in the first place. And if an advisor can only manage about 100 households in an ongoing financial planning relationship, the advisors needs to generate at least about $1,000 - $2,000 per year in fees, to have a reasonable advisor compensation after business expenses (and given the risk of running an independent advisory business in the first place).

Which helps to explain why most financial advisors only work with households at least wealthy enough to be part of the “mass affluent” – those with at least $100,000 of net worth (outside of their primary residence), who at a 1%+ advisory fee will generate at least $1,000/year in fees to the advisor to support the relationship.

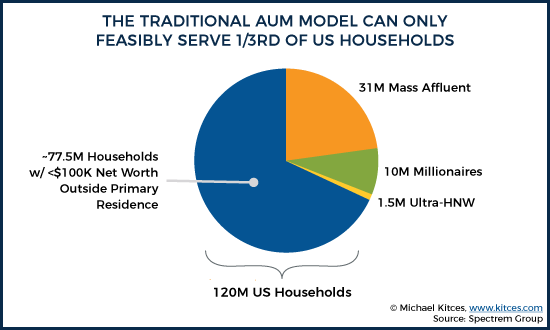

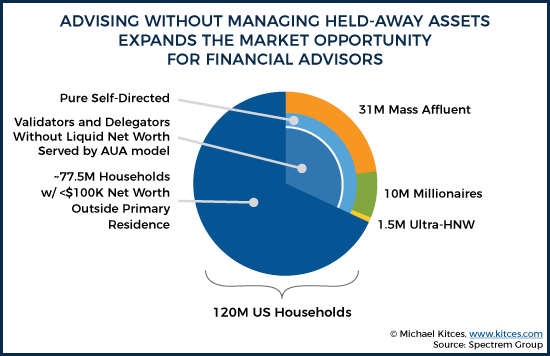

And according to market sizing estimates from industry researcher Spectrem Group, that means advisors can only effectively work with the top 1/3rd of households or so – an estimated 31 million households who are Mass Affluent, plus another 10 million that have at least $1M in net worth, and 1.5 million more households who are ultra-high-net-worth ($5M+ in net worth), out of a total of nearly 120M households in the US.

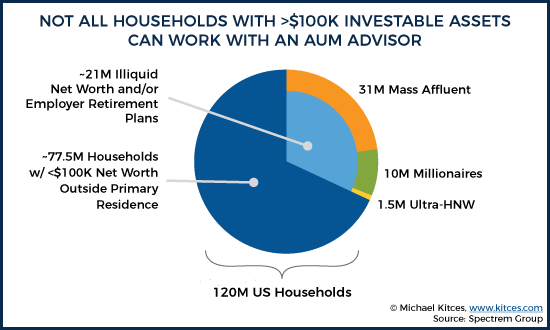

Of course, the caveat is that not all of that net worth is necessarily held in the form of a liquid investment account that an advisor can actually manage. In some cases, it may be illiquid (e.g., the value of a small business). More often, though, it’s simply not available to be managed because it’s tied up in an employer retirement plan, and the individual is still working! If we assume these constraints represent half of all the households that meet the definition of mass affluent (or higher), it does still leave about 21 million households that financial advisors can serve with the AUM model.

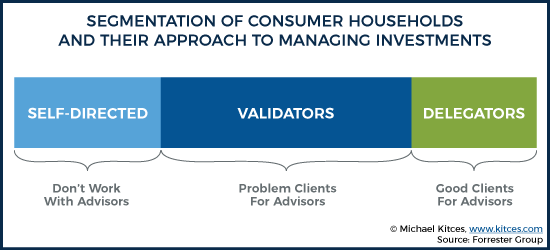

However, not all of those households necessarily want to work with an advisor! Nearly 20 years ago, Forrester research segmented consumers into three distinct categories: self-directed investors (“soloists”) who tend to do it themselves; “validators” who do a lot of their own research but may also seek out a professional advisor for some support (to “validate” their current plan); and “delegators” who prefer to just pass the buck entirely to a financial advisor. Or in advisor terms, there are good clients (delegators), clients who will never work with an advisor (do-it-yourselfers), and problem clients (validators who have a tense relationship with their advisors because they didn’t really want to turn over their portfolios but it was the “only” way to get access to the advisor). And with delegators estimated to be no more than 1/3rd of consumers, only about 7 million of the 21 million remaining households who might have the liquid investable assets to work with a financial advisor will actually want to turn them over (i.e., delegate them) to an advisor!

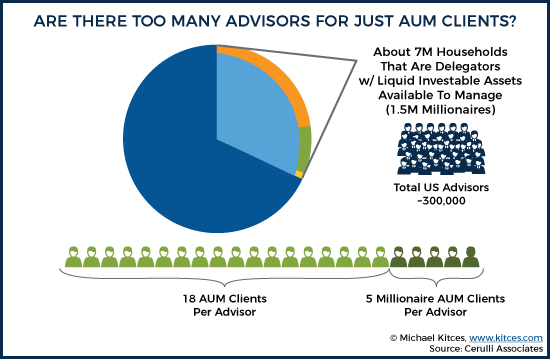

And given that Cerulli Associates estimates there are only about 311,000 financial advisors in total… to serve those roughly-7-million households… it means there are only about 23 AUM-fee clients available per financial advisor in the marketplace, of which (only) 5 will be millionaires!

In the past, these limitations of the size of the mass affluent (and wealthier) marketplace weren’t necessarily as problematic for financial advisors. Because advisors served a wider range of clientele under the commission-based model than “just” those who had at least $100,000 of liquid investable assets. But ironically, while the AUM model happens to be remarkably robust and scalable… it doesn’t work when all financial advisors converge on the same model at the same time!

Expanding The AUM Model To AUA And Net-Worth Billing

While the AUM model can be an effective model to provide financial advice for those who have investment assets to be managed in the first place, the big caveats – as noted above – is that even if clients otherwise have the financial wherewithal to pay (i.e., they have the net worth outside of their primary residence), they don’t necessarily have a liquid investment portfolio to transfer, and/or don’t want to transfer it just to receive financial advice (because they want financial planning advice outside of the portfolio itself or simply want professional validation of the research they’ve been doing themselves).

In recent years, this has opened up a new advisor business model: instead of charging 1% on the investment assets being managed, charge 1% on all of the assets being advised upon. Because an “Assets Under Advisement” (AUA) charge no longer has to be constrained to liquid investable assets and doesn’t require the client to liquidate or transfer the portfolio directly to the advisor’s management in order to receive advice on it. Which means it opens up a large segment of consumers who aren’t self-directed but couldn’t be effectively serviced under the AUM model!

For some clients currently on the AUM model, who may not have actually wanted to turn over their portfolio – i.e., they were validators who reluctantly agreed to their AUM model because it was their “only” choice – there may be a competitive opportunity to attract AUM clients away to a more holistic AUA relationship. But the real opportunity of the AUA (i.e., a percentage of net worth) billing model is the potential to attract that sizable swath of the pie who have the net worth, but never had the liquidity (or the inclination towards delegation) to hand over the portfolio to be managed in the first place.

In other words, the opportunity of the AUA or net worth billing model is not to compete against the AUM model, but to open up adjacent opportunities to work with clients who would have never bought into (or literally couldn’t buy into) the AUM model to begin with.

Notably, when the base of assets being advised upon expands (from “just” the managed portfolio to more of the client’s entire net worth), in practice the model may no longer specifically rely on “1%” as the benchmark fee. Instead, to the extent that other assets come into the mix – from businesses to investment real estate to outside 401(k) plans, which increases the potential asset base – the feasible advisory fee can be a smaller percentage, while still generating the requisite revenue per client. For instance, charging 0.5% of net worth instead of 1% of investable assets still generates the same revenue per client if the client’s managed portfolio was on average “just” half of their total net worth.

Unfortunately, though, the process of billing on total net worth and assets under advisement can be messier, because there aren’t automated systems to facilitate the valuation and invoicing and billing of net-worth-based fees the way there is for portfolio-based fees under the AUM model. In addition, the challenge arises that clients have a financial incentive to not fully disclose all of their assets under the net worth model. As with the traditional AUM model, if the client wants the account to be managed, the advisor will obviously know about it, be able to see it, and interact with it (to manage it), and can then automate the data feeds to properly calculate the fee and bill on it.

But with a net worth model, on the other hand… if clients believe they don’t “need” advice/help with that asset – for instance, an idle piece of undeveloped family land that they don’t plan to do anything with for a long time anyway – there is a temptation to not disclose it in order to avoid having it billed upon. Which some advisors address by deliberately excluding “idle” assets (like a primary residence) from the fee, but that in turn further adds to the complexity of the billing process. Similarly, some assets may be difficult to value (in order to assess a fee as a percentage of the value), such as a closely held family business. And clients may again resent being billed on increases in the value of their business, outside of the scope of their “personal” financial planning advice relationship.

On the other hand, though, the fact that advisors under a net worth model can get “paid” for charging on a client’s total net worth, including the value of a business, creates new incentives to give more holistic advice on the business (and other aspects of the client’s balance sheet) in the first place, potentially opening up new value-added services. After all, the irony is that despite the overwhelming impact that an entrepreneur’s business can have on their long-term financial success, the CFP Board’s Topic List doesn’t even include “business consulting/advice,” outside of just doing business-related insurance products like buy-sell agreements and employee benefits! Because in the past, financial advisors couldn’t effectively get paid for holistic business advice by charging on just portfolios and commission-based products… but can, with a net-worth-based AUA fee!

Further Expanding The Pie By Billing 1% Of Income Instead Of 1% Of Assets

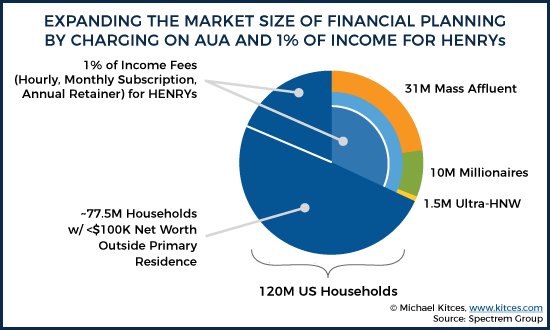

While the appeal of an AUA-style model of billing a percentage of net worth is that it expands the available market of consumers… it still is limited to only the subset of households that are at least mass affluent, with more than $100,000 of net worth outside of their primary residence on which an asset-based (net-worth-based) advisory fee can be assessed. And while that’s a sizable portion of the total market… it still ignores the other roughly-2/3rds of the pie that simply do not meet the net worth definition of “mass affluent” in the first place!

Of course, the reality is that to give financial advice and get paid for it, the client must have some financial wherewithal to pay for the advice – thus why financial advisors have typically worked with more affluent clients in the first place.

But the fundamental problem with the traditional approach – in essence, various forms of balance-sheet-based billing (on either “just” investable assets, or a broader slice of the client’s entire net worth being advised upon) is that it completely ignores the fact that many consumers could simply pay for financial advice directly from their income instead!

The quintessential example would the young doctor or lawyer, who has finished school and begun their professional career, and may be earning a substantial $250,000/year income… but also has a 6-figure student loan debt, and won’t have any portfolio to manage – or even a positive net worth – for a long time to come.

But with a healthy 6-figure income, such an individual could easily pay 1% of their income to receive financial planning advice about that student loan, learning to budget their now-substantial income, planning for a future wedding and merging household finances with a future spouse, saving for a house, negotiating a mortgage, starting college savings plans and buying life insurance when children arrive, and navigating all the other life changes that may impact their finances in the coming decade. Not to mention advice about their career itself, including employee benefits decisions, handling salary negotiations, choosing whether to work for a large firm or go independent, etc.

Of course, many clients who have high income also have a substantial net worth, but the fact that some individuals have a healthy income but not a substantial net worth yet – known in the industry as “HENRY” clients, short for “High Earner, Not Rich Yet” – suggests that there is an additional portion of the prospective pie of clients that may become unlocked by simply allowing them to pay for advice from their income (because they do have the financial wherewithal to pay) instead of their assets (that they haven’t accumulated yet).

In other words, rather than simply taking on such high-income-low-asset individuals as “accommodation” clients, the opportunity of the 1%-of-income model is to proactively charge them for real (and profitable) advice, where in this example the 1% fee generates a revenue of $2,500/client, or $200/hour as long as the advisor “only” spends 12 hours per year (an average of 1 hour per month) interacting with the client and providing ongoing advice.

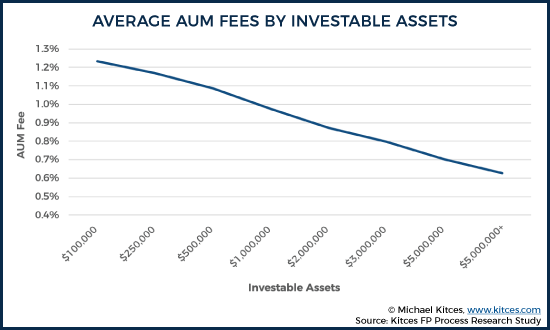

Tiering Income-Based Advice Fees: From HENRY To EWAN

An important caveat to the proverbial “advisors charge 1% fees” is that in practice, not all advisors charge 1% to all clients. Not only because there is at least some variability of fees from one advisor to the next based on the depth and breadth of services (e.g., advisors who charging less than 1% for investment-only services, others who charge more for comprehensive wealth management services). But also because fees themselves are typically tiered based on the client’s available assets to manage in the first place, with a median fee of 1.3%, to a 1% fee on a $1M portfolio, scaling down to a fee of 0.6% on a $5M+ portfolio.

Similarly, percentage-of-income fees would likely scale as well, with higher fee percentages on lower incomes, and lower fee percentages at higher income levels.

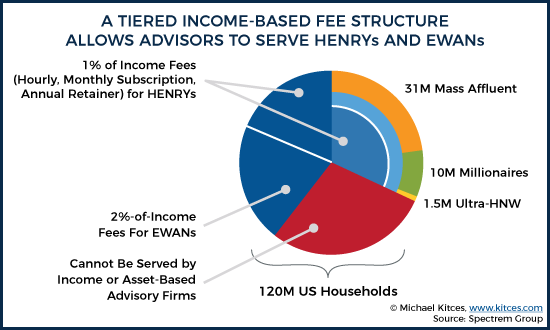

For instance, an advisor’s income-based fee might start at 2%/year for lower income clients, reaching 1% of income for higher income individuals, and dropping below 1% for the highest income individuals. Given a median household income of just over $60,000/year in the US, a 2%-of-income advisory fee would generate a minimum revenue per client of $1,200/year, enough to support several 1-hour interactions (in-person meetings, or phone calls, or video chats) per year with clients to provide ongoing advice. (And similar to the revenue/client an advisor would generate with a $100,000 asset minimum.)

As income rises from there, the client becomes even more economically viable for the advisor to service more deeply – at $100,000/year of income, the advisory fee would be $2,000. And the advisor could add subsequent breakpoints – such as dropping the fee to 1.5% of income above $100,000/year, and 1% on income above $250,000/year (although the blended fee at that point would already be $4,250/year from the lower income tiers), akin the fee breakpoints typically applied to AUM fee schedules as assets rise. Or alternatively, the advisor might just have a 1%-of-income fee with a minimum income of $400,000/year and focus on working with more affluent HENRYs (just as some advisors work with more affluent higher-asset households). But even with “just” an average fee of $2,000 revenue/client working with 100 clients, there’s a potential for $200,000/year in revenue for what otherwise would be an extremely low-cost-to-service clientele, as the advisor wouldn’t even necessarily need the (relatively expensive) software tools to manage portfolios today. The advisor would predominantly just be paid for their time to actually give the advice – at what still amounts to a very healthy hourly rate and an above-average take-home income for the typical advisor!

The upshot of this shift to a percentage-of-income advisory fee, and especially one that is tiered (to make it more economically feasible to service clients further down the income spectrum), is that it shifts the income-based model even further down the income spectrum, from the HENRY (High Earner, Net Rich Yet) to the EWAN (Earner Wanting Advice Now)!

As while a $1,200/year (or $100/month) advice fee might seem high to a middle-income household… the reality is that even middle-income households can easily make a financial mistake that costs it 2% of its income, such that paying a 2%-of-income advisory fee to help make better decisions about the other 98% is still a net positive. Especially given such households will already pay a similar $1,200 commission for “just” rolling over a modest $24,000 IRA (into a 5%-commission A-share mutual fund), for which the consumer often receives no more than a single implementation meeting to complete the transaction (without any ongoing advice). And when the fee can be broken down to a simple monthly subscription fee (e.g., $100/month) that can be billed automatically to their credit card or bank account.

As while a $1,200/year (or $100/month) advice fee might seem high to a middle-income household… the reality is that even middle-income households can easily make a financial mistake that costs it 2% of its income, such that paying a 2%-of-income advisory fee to help make better decisions about the other 98% is still a net positive. Especially given such households will already pay a similar $1,200 commission for “just” rolling over a modest $24,000 IRA (into a 5%-commission A-share mutual fund), for which the consumer often receives no more than a single implementation meeting to complete the transaction (without any ongoing advice). And when the fee can be broken down to a simple monthly subscription fee (e.g., $100/month) that can be billed automatically to their credit card or bank account.

Ultimately, the key point is that while a shift from the AUM model to the AUA model (charging a percentage of assets under advisement, or a fee based on a percentage of the client’s entire household net worth) does begin to expand the reach of financial planning advice, it still remains largely concentrated amongst the top 1/3rd of households who are at least “Mass Affluent” with more than $100,000 of net worth outside of their primary residence. However, a shift from charging 1% of assets under management, or net worth or assets under advisement, to charging 1% of income instead, fundamentally opens a wider portion of the marketplace, to not only the HENRYs but also the EWANs who simply want to pay for at least some advice, directly from their income.

Of course, the caveat to all of these models is that advisors must actually have the training and experience to actually provide value for their advice fees. Especially in a world where advisors charge clients a percentage of income rather than of a portfolio… placing the focus solely and entirely on whether the advisor’s advice is really worth the fee being charged. Yet, on the other hand, the fact that the advisor would be paid primarily or solely for his/her advice and time creates the potential for significant operational leverage and efficiencies to make even middle-income clients profitable… and in the process, expand the true reach of financial planning advice!