Executive Summary

Home ownership has long been viewed as a foundation of building wealth. For many Americans, the equity in their home is the single greatest asset on their balance sheet, often dwarfing the amount of investment assets they hold in savings and retirement accounts. But does that really mean that home ownership is the best long-term investment around, and a step that everyone should take if they wish to build financial success in the future? Not necessarily. Because in reality, the real reason home ownership is the average American's greatest asset is not because of appreciation in the value of housing; it's simply because of leverage.

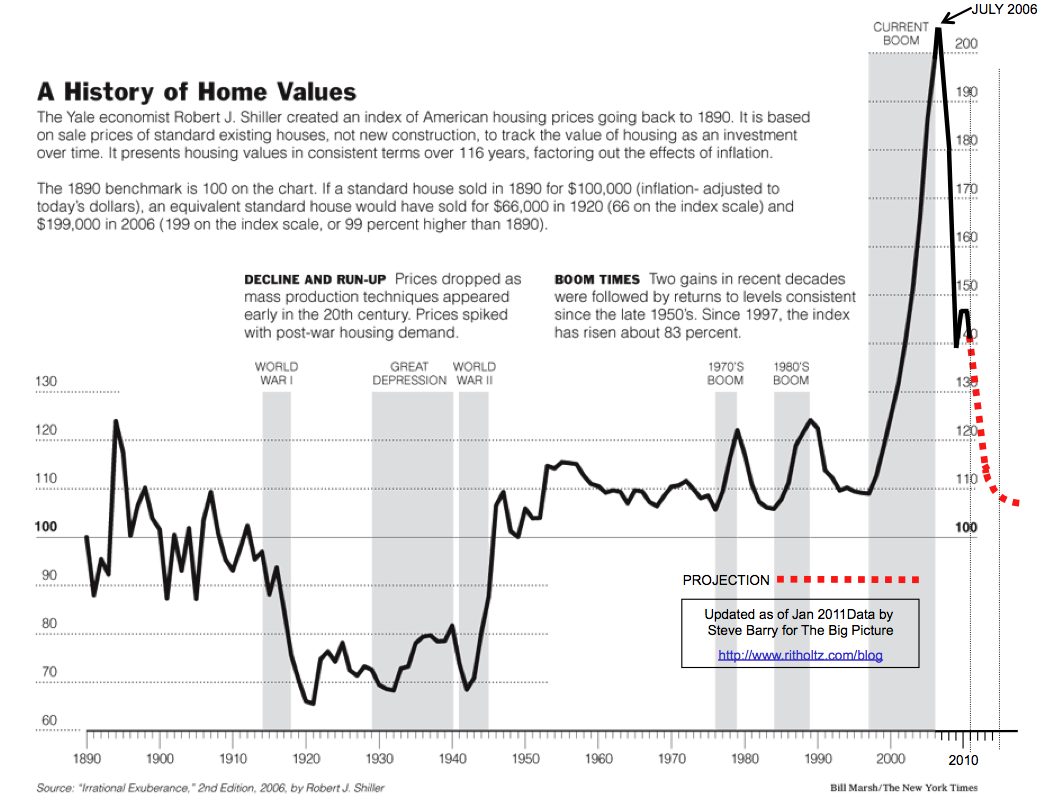

The inspiration for today's blog post comes from an MSNBC article that ran yesterday entitled "Despite Bust, Americans Still Believe In Housing" stating that 81% still believe a home is the best long-term investment. Yet at the same time, a recent graphic - seen below - has been making its way around the internet lately, showing that once adjusting for inflation, the reality is that on a real, inflation-adjusted basis, housing prices have not been appreciating since the 1890s, aside from some temporary swings above and below the zero-line (with a very notable bubble-looking swing upwards in the last 10 years that is still being worked off).

So how can this be reconciled? 81% of Americans think housing is the best long-term investment, yet 120 years of investment history shows that housing can't even beat inflation over an extended period of time! Even the safest of government bonds have historically provided some real return premium over inflation. Arguably, this chart would make the case that housing is actually one of the worst long-term investments around; one of the few financial assets that can't even generate a sustainable positive real return!

It appears to me that the key to reconciling this lies in one simple fact: the personal residence is one of the only assets that most Americans buy, with leverage. In other words, we borrow money to buy the asset. In point of fact, it's a process we've institutionalized in this country; how many people do you know who have ever bought a house and paid 100% of the price in cash? I'd venture to say virtually no one, and to say the least the few who have done so are usually already older and wealthier; a full-cash purchase for someone's first home is a true rarity!

So imagine an investor has $50,000, and can choose from three investments in an environment where inflation is expected to be 3%; the investor can buy either: a stock with an expected return of 10% (which is 7% after inflation), a bond expected to earn 5% (which is 2% after inflation), or a residence that earns 3% (no appreciation above inflation). Given this comparison, the answer is pretty straightforward: the highest expected return is from the stocks, and the lowest is from the residence. (Of course, in reality there is also a difference in the volatility and risk involved, but for now we're assuming "very long term" investing where we can ride out the short-term bumps.)

However, let's look at how this purchase would likely go in today's world. A $50,000 investment in stocks allocates $50,000; a $50,000 investment in bonds allocates $50,000. However, a $50,000 contribution towards a home would likely be a 20% downpayment on a $250,000 house! So what happens now? The stocks earn 10%, growing to $55,000. The bonds earn 5%, growing to $52,500. The whole house grows 3%, rising in value to $257,500, and after subtracting out the $200,000 that was borrowed, the equity in the home is $57,500. Lo and behold! Thanks to the benefit of 5:1 leverage with a 20% downpayment, we've turned a $50,000 investment into $57,500, which is a whopping 15% return on the investment, outperforming stocks and bonds! And of course, for much of the past two decades, downpayments have been even lower than 20%, and consequently the leverage - and returns on investment - have been even higher!

But the bottom line is that the real reason the personal residence becomes a wealth-builder is not because this form of real estate investing generates high returns. It's simply because it's an investment we buy with a huge amount of leverage, such that even a mediocre return that can't beat inflation turns into a tremendous increase on the dollars actually invested out of pocket.

Of course, there is an important caveat I haven't capture above, which is the impact of ongoing mortgage payments and the cost of interest, but we'll discuss that separately in a future blog post.

So what do you think? Is home ownership really the best path to long-term wealth? Is that because the home is a great investment, or are Americans simply addicted to the returns of leveraged investing?

Hi Michael,

You forgot one more very important feature of home ownership in wealth creation – forced savings!

It is the ultimate pay-yourself-first strategy – those mortgage payments come out every month, and as long as you keep the house long enough that your mortgage payments are actually contributing to the home equity, you are now on a monthly savings plan.

I think this is a great topic. I find it hard to accept that so many people are so dumb as to view housing as a good investment when it is as bad as some argue.

The leverage point is valid. But it works in two directions. If you bought before the price crash, you will have a loss for many years to come. And the leverage you “enjoyed” permitted you to lose much more than you could have lost without leverage.

I think the forced savings idea is a good one. People do come to own homes in time. If they had to save the full purchase price, they probably wouldn’t.

I also think that people feel more comfortable investing in their residence. They feel they understand what is going on more than they do when investing in stocks. They don’t care about the volatility so much because they have no intent to sell for a long time.

Rob

The one item not mentioned here is the total loss of money if you do not own your own residence. You are paying someone else s mortgage.

I think another point here is people need trust tangible assets. Since they can buy a home, and go kick it, it seems like a better investment.

I also agree with the forced savings component. Unfortunately, most people do need this in order to save anything, so it is useful in that regard.

This is a great reason for clients to be encouraged to carry a 30yr mortgage on their homes and not be in any too big a hurry to pay it off. By paying the smallest possible monthly payment to live in their home they have the most left in their pocket each month to pay down expensive debt, invest in their retirement accounts, other investments, etc. In today’s low interest rate environment the after-tax cost of borrowing is less than the historical rate of inflation and locking it in for the next thirty years is the best way to optimize a client’s cash flow so that the savings can be used to help finance their future goals.

Actually, its imputed rent, at least for markets having reasonably balanced rent/buy ratios, especially after the mortgage is paid off. I’m always baffled at the obsession over home values, instead of the tax free imputed rent that stays in your pocket each month.

There are plenty of good financial reasons to own your home; a leveraged hedge on inflation, low interest rates and deductible interest create the potential for long term financial gain. On the other hand public attitudes about saving, spending, debt, luxury, moving and refinancing have jeopardized what was once a family’s nest egg. Further, housing as a tool for stimulating the economy along with financial products like mortgage backed securities and subsequent derivative products have made housing values far more volatile. Buy within your means, put at least 20% down, don’t pull money out and plan to stay in one home for a long time. That will work out well.