Executive Summary

For “lower income” individuals whose income falls within the bottom two ordinary income tax brackets, the Internal Revenue Code applies a 0% long-term capital gains rate to the extent their gains also fall within the lower two brackets. However, the 0% rate only applies as long as the income actually does fall within those lower brackets – which means “too much” in capital gains will eventually cross out of the 0% rate and into the higher tax brackets.

Nonetheless, the potential for 0% long-term capital gains rates means that for those who are eligible, the best thing they can do every year is not harvest capital losses – the “typical” capital gains strategy – but instead to harvest gains! By selling investments that are up, and buying them back again immediately (without any wash sale rules to navigate!), the taxpayer can effectively get a step-up in basis on current investments without any (Federal) tax liability!

Of course, the caveat to this strategy is that while long-term capital gains may be eligible for 0% rates for lower income individuals, it is still income itself, potentially impacting certain deductions and tax credits, and the taxation of Social Security. In addition, harvesting capital gains must be coordinated with other strategies, like partial Roth conversions, which can potentially drive up long-term capital gains rates and make capital gains harvesting less effective. Still, though, the potential to claim a free step-up in basis is not one to be missed, for any years where income is low enough to take advantage of the rules, whether due to just having income low enough to qualify, having a “temporarily” low income year due to a job loss or change, or simply looking to harvest capital gains once retired when wage income is gone and required minimum distributions have not yet begun!

Mechanics Of The 0% Long-Term Capital Gains Tax Rate – The 0% Rate Is Not Unlimited!

The 0% long-term capital gains rate was created under the Jobs Growth and Tax Relief Reconciliation Act of 2003 (also known as President Bush’s second major piece of tax legislation), with a delayed implementation of 2008. The rule was scheduled to expire with the rest of the “sunset” provisions at the end of 2010, but was extended two more years under the first “fiscal cliff” legislation (the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010), and then was ultimately made permanent under current law as a part of the second fiscal cliff legislation, the American Taxpayer Relief Act of 2012.

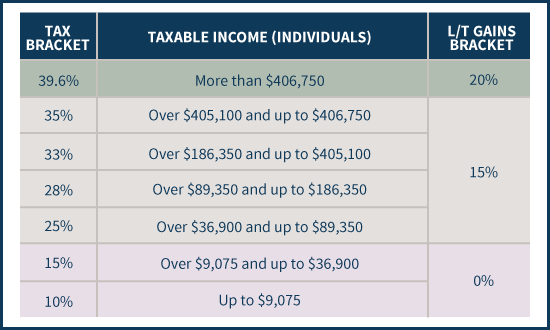

Technically, the 0% long-term capital gains tax rate is just one of three tax brackets that can apply to long-term capital gains. The thresholds for determining which bracket applies to a long-term capital gain are drawn from the tax bracket thresholds for ordinary income brackets, as shown below (for married couples).

As with the ordinary income brackets, the long-term capital gains brackets are graduated, and income that crosses out of one bracket falls into the next. Thus, for instance, just as a married couple having $500,000 of ordinary income would cross the 10%, 15%, 25%, 28%, 33%, 35%, and 39.6% ordinary income brackets, so too would that married couple having $500,000 of long-term capital gains span all three capital gains rates, with the first $73,800 in the 0% bracket, the next $383,800 taxed at 15% (up to $457,600 of total income), and only the last $42,400 would be taxed at the top 20% rate. (Michael’s Note: In this situation, the separate 3.8% Medicare surtax would also kick in for the upper capital gains income levels, effectively resulting in four capital gains tax brackets.)

Notably, because the 0% long-term capital gains rate only applies until crossing the threshold of $73,800 taxable income (for married couples), the reality is that the opportunity for 0% capital gains is inherently limited – as with other low tax brackets, it only applies until there’s enough income to cross out of that bracket, and any additional income falls in the next higher bracket. It’s not an unlimited opportunity to recognize capital gains at a 0% rate just because the taxpayer is initially in a low bracket! Similarly, this means it’s also important to recognize that while long-term capital gains falling at the lower income levels may be eligible for a 0% tax rate, it is still income for tax purposes, not only for determining which bracket to apply, but also for state income taxes (which may not be a 0% rate!), as well as determining Adjusted Gross Income (AGI) and any tax-related adjustments or thresholds based on AGI.

Coordinating 0% Long-Term Capital Gains Rates With Ordinary Income Tax Brackets

While the three long-term capital gains tax brackets of 0%, 15%, and 20% are relatively straightforward to apply – with 0% on the first $73,800, 15% on the next $383,800, and 20% on the rest (plus a potential 3.8% Medicare surtax on top of the 20% rate and some of the 15% bracket!) – the rules are more complex when an individual also has ordinary income as well. At that point, there are multiple types of income, all mixing together to increase total income, but each with their own tax brackets!

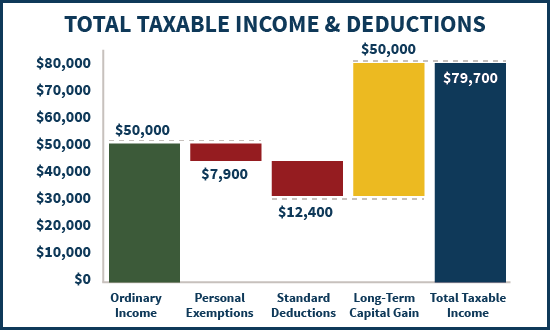

Under the Internal Revenue Code, this is resolved by applying ordinary income (to fill the bottom tax brackets) first, and then adding the long-term capital gains on top. To the extent there are any tax deductions, those deductions are applied to the ordinary income first, and only apply against long-term capital gains directly once ordinary income has been reduced to zero.

Notably, this is actually the most favorable sequence possible, as it ensures ordinary income (which is otherwise taxed at the highest rates) gets the lowest brackets; while the long-term capital gains do get pushed into the “higher” brackets, since long-term capital gains are already eligible for preferential tax rates, this still comes out with the greatest tax savings.

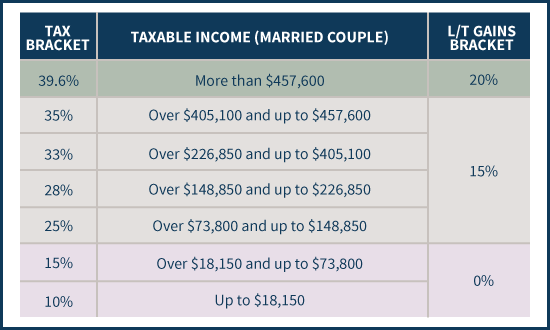

Example 1. Imagine a married couple who have $50,000 of ordinary income, and then recognize a $50,000 long-term capital gain. They will each be eligible for a $3,950 personal exemption (a total of $7,900 for the two of them), and the $12,400 standard deduction. Thus, their total deductions will be $3,950 x 2 + $12,400 = $20,300, which means their ordinary income will be $50,000 - $20,300 = $29,700 and their $50,000 of long-term capital gains go on top.

From there, the ordinary income fills up the tax brackets first, which means the first $18,150 falls in the 10% ordinary bracket, and the next $11,550 is in the 15% bracket. From there, the long-term capital gains kick in, which means the next $44,100 are eligible for the 0% long-term capital gains rate (up to the $73,800 threshold that forms the top of the "0% capital gains zone" shown below) and then the last $5,900 are taxed at the 15% long-term capital gains rate.

Ultimately, thanks to the favorable stacking sequence, the couple’s total tax bill will be only $18,150 x 10% + $11,550 x 15% + $5,900 x 15% = $4,432.50, or an effective tax rate of only about 4.4% on $100,000 of total income!

Harvesting Capital Gains At 0% Long-Term Rates

While the scope of the 0% long-term capital gains tax bracket is limited – it only applies for married couples up to $73,800 of income (after deductions) and $36,900 for individuals – the availability of the 0% rate still presents significant tax planning opportunities.

One of the most immediate is the opportunity to harvest capital gains – not losses – to the extent that those long-term capital gains will fall in the lowest bracket eligible for the 0% rate. While harvesting losses is messy – due to the requirements to navigate the “wash sale” rules, which can be especially harsh if done across a taxable investment account and an IRA – the reality is that harvesting capital gains is easy: sell the investment, and buy it back again immediately. If it’s a stock or ETF that is easily market traded, the investor may be out for no more than literally mere seconds; for a mutual fund, the investor will generally be out for 1 day (as mutual fund companies may not know how to handle a buy and sell order that both arrive at the mutual fund on the same day at the close of business!). Congress does not have a rule that says the taxpayer can avoid reporting income on their gains when they buy the position back again – in fact, the Internal Revenue Code has very specific requirements on what circumstances can avoid recognition of income because the proceeds are reinvested (e.g., Section 1031 or 1035 exchanges). Yet in the context of a 0% capital gains tax rate, selling the investment and recognizing the gain and buying it back again can be great tax planning!

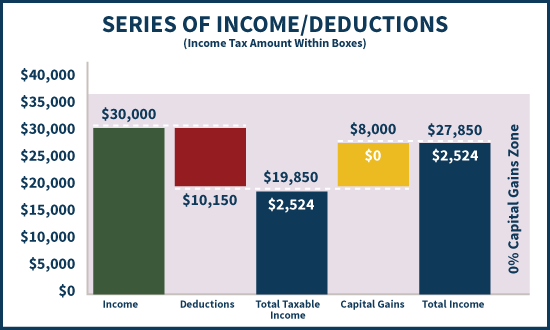

Example 2. Imagine an individual who has only $30,000 of income; this will be reduced to only $19,850 after the standard deduction and a personal exemption, and subject to $2,524 in taxes at a combination of 10% and 15% ordinary brackets. If this individual also has an investment portfolio that includes an S&P 500 index fund with a cost basis of $10,000 and a current value of $18,000, the opportunity is to sell the fund, and buy it back immediately! Without otherwise changing her investment position, the individual will now have an $8,000 long-term capital gain, pushing her income up to $27,850. However, since the gain is eligible for a 0% rate (as the 0% capital gains zone goes all the way up to $36,900 of ordinary income for individuals!), there will be no additional taxes due; the total tax liability will be the same $2,524, and what might have been $1,200 of long-term capital gains taxes (at a 15% rate in the future) just vanish altogether!

In the meantime, the act of selling the investment and buying it back again steps up the cost basis to the new current $18,000 value, reducing any future gains (or creating a higher basis to harvest future losses). The end result: the individual receives the equivalent of a step-up in basis at death, but without dying, and without facing any taxes along the way! (Michael’s note: A small state income tax liability may be due, although the Federal tax rate will remain at 0%!)

While the opportunity to harvest long-term capital gains at the 0% remains limited – only up to the tax bracket threshold – it arguably is an opportunity that investors should look to take advantage of every year, right up to that threshold! In other words, in any and every year that investors are in the 0% long-term capital gains tax bracket, they can aim to create enough capital gains to fill that 0% bracket every year – and keeping the rest deferred to the future. Notably, this 0% rate would also apply to any qualified dividends paid out in the year (which are eligible for long-term capital gains rates!).

One important caveat to the strategy, though, is that investors should be cautious about simultaneously trying to do multiple harvesting strategies, such as harvesting capital gains and also doing a partial Roth conversion at the end of the year. The reason is that, as noted earlier, ordinary income always fills the lower brackets first, and capital gains stack on top.

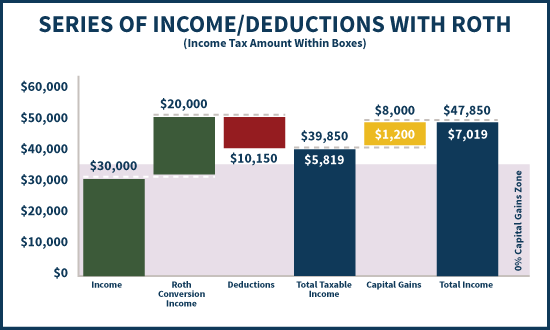

Example 3. Continuing the prior example, if the individual also did a $20,000 Roth conversion, ordinary income would be driven up to $39,850 after deductions. This would fill the remainder of the 15% ordinary income bracket, with a small amount of income falling into the 25% bracket. Now, the $8,000 long-term capital gain will stack on top, but be subject to the 15% long-term capital gains tax bracket. Which means by adding “just” $20,000 of ordinary income (from the Roth conversion), the individual’s tax bill will jump up to a whopping $7,019, or a $4,495 increase equivalent to a 22.5% tax rate on the $20,000 of income!

In this last example, the reason for such a high tax rate is because the additional income was not only itself subject to a (mostly) 15% tax bracket, but also caused 15% tax rates to apply to the long-term capital gains, too! The additional ordinary income in the bottom ordinary brackets actually drive up the capital gains taxes, too, by pushing them into a higher bracket as well (driving the marginal tax rate as high as 15% + 15% = 30%!)!

Ultimately, the fact that “other” ordinary income can drive up long-term capital gains rates doesn't necessarily mean it’s bad to harvest long-term capital gains. It simply means that such strategies must be coordinated with other income-creation strategies as well; for instance, just converting enough of a Roth conversion to absorb deductions (if deductions exceed income altogether!), and then harvesting capital gains on top up to the maximum amount at the 0% rate!

On the other hand, it’s also important to recognize that when taxpayers are eligible for 0% capital gains rates, they should be cautious not to harvest capital losses, either, as there’s no reason to harvest a loss, and step the cost basis down, when there’s no tax savings anyway!

Other Planning Implications And Caveats Of The 0% Long-Term Capital Gains Tax Rate

The opportunity to harvest long-term capital gains at 0% rates can be highly appealing, even if it must be done opportunistically when a low-income situation presents itself – which might be a year of low income between jobs, or simply for those who haven’t grown their income enough to exceed the threshold, or perhaps after retirement when other wage income goes away (but before required minimum distributions begin).

On the other hand, the caveat is that even at a 0% rate, harvesting long-term capital gains does still count as income. This means it counts as income for state income tax purposes – which may prevent it from being a “true” 0% rate. It is also income for all other purposes as well – which means it increases Adjusted Gross Income (AGI) and can impact tax deductions (e.g., the medical expense or miscellaneous itemized deductions) or the phaseout of tax credits (from the American Opportunity Tax Credit, to the phaseout of premium assistance tax credits for health insurance). Because 0% long-term capital gains still increase income, they can also trigger the indirect taxation of Social Security benefits by causing them to be included in income, which can turn a 0% capital gains rate into 7.5%, 12.75%, or even 21.25% marginal rate! And for those qualifying for the Earned Income Tax Credit (EITC), be cognizant that your investment income must be $3,350 or less to remain eligible.

Given all of these caveats, the reality is that the opportunity to harvest 0% long-term capital gains rates will not present itself every year, and/or it may not actually be worthwhile to take advantage of. Nonetheless, since 0% long-term capital gains still amount to a free step-up in basis just by taking advantage of the rules that are there, it’s an important opportunity not to miss, as it can still result in thousands of dollars of tax savings in capital gains every year it can be done!

Very valuable post! It’s virtually impossible to learn how this stacking system works by reading the code, pubs or even those tax guides.

Thanks Charlie! I hope it helps!

– Michael

Charlie – check out our new software that launched last November, IncomeSolver.com. You can dynamically calculate the effective margin rates and see them in Tax Maps. The software is based on my research with Reichenstein and you can create tax efficient withdrawal strategies filling up low tax years to dedicated effective margin rates or tax brackets while coordinating SS, Medicare/Health expenses and roth conversions. Our next study group is the 3rd week of Feb…call me if you want more info. Regards, Bill

Excellent – thorough and clear.

Even if a person is well below the top of the 15% marginal federal tax bracket, it seems that tax loss harvesting could still be beneficial to the extent that up to $3,000 could be used to offset other current-year income. Am I missing something?

Also, I tried to harvest some LT capital gains within the 15% bracket last year and discovered that the gain was completely absorbed by a capital loss carryover I had, so the gains were not really federal tax-free after all. Lesson learned.

In addition, I have large LT capital gains on many bonds I own outright (not in mutual funds), but the turnaround cost of about 2% (i.e., bid-ask spread + commissions) makes tax gain harvesting unappealing.

Any general thoughts about whether it’s better to harvest capital gains versus filling up the 15% marginal bracket with Roth conversions? I realize that’s likely specific to individual circumstances, but not sure if there’s a general framework to use in approaching that choice.

Yes, if you compare the Roth conversion to the harvested CG as both are invested for 20 years, then both sold , and then paying 15% on the CG as by then including SS income is too high for another 0%. The roth wins.

If you pay for the conversion with X from outside funds, and then add the same amount of X to the capital gains and invest both roth and capital gains at same rate, the roth wins in 10 yrs, and then pulls ahead faster.

Check your state rules, as some States would not tax the withdrawal for roth conversion, but will tax the capital gain, so this magnifies the effect of the roth conversion winning.

I coded this up in a spreadsheet using 2018 married filing joint tax brackets. Here’s what I learned (I’m gonna use a simple example and ignore healthcare subsidy issues): Assume your income perfectly fills up the 10% bracket (19050). Next assume your Roth conversion is small enough (e.g. 40000) to reside entirely in the next next bracket (15%). So – your effective Roth tax rate is 15%.

Now – how much capital gains to harvest? Whatever won’t put your cap gains into the 15% tier. If it does, that Roth conversion is effectively taxed at a higher rate than 15%. To put it a bit more carefully, ensure the cap gain added to your ordinary income (income plus Roth) is not above 77200 (15% cap gain tier).

In this example, you can take a 18350 cap gain before going into the 15% tier (19050+40000+18350) = 77200. Any higher and your Roth conversion effectively takes a higher tax hit than 15%. You can see the interplay between income & conversion & cap gain. The three need to stay below 77200. Now of course, if you take, say, a 19000 cap gain in the example above, that’s barely over the threshold, and the Roth equivalent rate is still nearly 15%.

Thank you for this very informative article. I had some sense of this strategy, but never really understood the details until reading this.

As another commenter mentioned, the existence of capital loss carry-overs adds a separate level of complexity. How about an article on the best way to take advantage of the accumulated loss carry-overs: should I harvest gains now to “use-up” the losses all at once, or let them dwindle over the next few years as I draw down my portfolio (I’m retired) with the additional benefit of reducing “ordinary” income (primarily interest and dividends with some limited consulting income) by $3,000 each year?

I agree with SH in SF – – love to learn more about how to effectively use the tax loss carryforward. I have room in the 0% Long Term Gains ceiling, but My Capital Loss Carryforward is being used up instead of me taking advantage of the room in the 0% brackets

This issue recently came up with a client I had. They were able to sell investment property for a healthy profit and pay 0% cap gains, simply because taxable income was within the threshhold amount.

Eddie Patel

http://www.eddiepatel.com

Michael,

Another great post, I think we often forget how high the AGI threshold is here for MFJ. One thing to remember is the state tax for those of us residing in those less friendly tax states, With that said, still a viable strategy for most once IRAs fully converted to Roth.

Mike Rubin

This is incredibly helpful, Michael. Thank you.

There’s also the possibility of gifting (for example, to parents who are in need of support or who might like to take a nice vacation and who might be in a lower bracket.)

I’m wondering if you can help me understand something. I’ve just used TurboTax for my 2014 taxes. My wages and salary came to $11,991. With dividends, IRA distribution and a net loss of $-917 from a small business, my income is at $17,106. I am filing as head of household, therefore I am in the 15% tax bracket. With this income and my deductions, TurboTax suggests I’ll be getting a refund of approx. $4600.

Now, let’s add in my capital gains of $17,096. It’s my understanding that my capital gains will not be taxed since I am still in the 15% tax bracket. I would expect nothing to change on my return. However, when I add in the capital gains, my return drops from $4600 to $1300.

If I’m not supposed to be taxed on the capital gains, then why does my return get reduced by $3300? Can you offer an explanation?

An oversimplified answer (suggest close reading of the article again), but I believe your error is that you did not count the capital gains amount in determining your total income in the first place (then need to determine taxable income).

For low income taxpayers nearing retirement there is real and huge danger in taking capital gains. The problem is the health care subsidy repayment, which considers 100% of cap gains for the calculation, and it is not progressive like income tax, it is regressive: A worst case scenario? At age 64, a couple (me) with 2 jobs, 22K in wages, 9K in social security, and 12 K in pension income, prepares for retirement by changing brokers, reallocating investments, and purchasing an annuity. Boom: 26 K in “extra” cap gains are “realized”, over the yearly usual 8K. Put 13K into IRAs and I’m left with 65K AGI, taxable income, after all deductions, of 40K. 0% cap gains tax, total tax of just $1400, which is about what was withheld. $3000 over the “Obamacare cliff” (google it) and I owe $8500 to the IRS. For $3000 less cap gains I’d owe only $2500 back (still unfair). I take the gains of funds I still have stake in, switch the shares around, generate short term gains, and Boom: I owe another $800 in tax and am still $700 over the cliff, and now the IRS wants $9200!!! Add the total premiums (25% of our taxable income) to our out of pocket med and dental, and our 2014 med expenses are $18300, or 46% of our taxable income.

I never feared cap gains, the rate is low, or zero, and the tax is due eventually anyhow. But Obamacare subsidies are insanely different.

I’m trapped. I’m screwed. It’s just so wrong. I’m not paying, I’m not filing. I’m going to jail, and I’ll deal with this for the rest of my life.

If I sell a stock that will give me a capital gain, but turn around and buy the same stock because it dips, do I have to claim a capital gain on the initial sell? If not, is there a time limit to purchase the same stock? Additionally, could I buy a similar stock in the same sector (e.g., airlines, or energy)

FANTASTIC article that will save me THOUSANDS going forward. Thank you!!!!! Now I know I need to sell all my long term gains up to that threshold amount every year rather than hoarding them and letting the profit get too high. The increased basis will be a godsend.

Happy to be of service! 🙂

– Michael

If I have a short term capital loss in the same year, how does that affect this strategy? The short-term loss is smaller than what I would be harvesting as a long term gain.

Avoid filing Form 8938 and FBAR too! https://www.linkedin.com/pulse/new-irs-form-8938-created-fatca-2010-can-filing-avoided-tax-havens?trk=pulse_spock-articles

Great article. Am I wrong or do most people not fully understand how the capital gains tax is calculated. I have heard many times that if your income is in the 10-15% bracket, then the LTCG is taxed at 0%, no matter the amount. My bank’s online calculator even gets it wrong.

Timmy,

Indeed, lots of mistakes and misconceptions here. :/

– Michael

I inherited a 2 family property in July 2015 from my mother valued at 1,000,000. I “condoized” it and will sell in total for 1,500,000. My personal income is only SS of 10,000. I live in MA. What will my capital gains taxes be?

Thanks

I was doing some tax planning for 2017 and discovered that I will indeed find myself in this situation:

“In this last example, the reason for such a high tax rate is because the additional income was not only itself subject to a (mostly) 15% tax bracket, but also caused 15% tax rates to apply to the long-term capital gains, too! The additional ordinary income in the bottom ordinary brackets actually drive up the capital gains taxes, too, by pushing them into a higher bracket as well (driving the marginal tax rate as high as 15% + 15% = 30%!)!”

The good thing is I discovered this now and have some time to try and move some things around to partially reduce this situation.

It’s a good point that others might miss unless they do some detailed tax planning. While I had read this post two years ago, it was not until now that I realized I’m actually getting caught in this. More value accruing to me from your blog posts Michael. Thank you!

Happy to help, Mike! (Even if it’s not entirely good news!)

– Michael

Is it AGI or taxable income? Turbotax estimator is telling me with 50K or capital gains (and nothing else so 50K would be my AGI) and 10K in deductions, for 40K taxable income (just over the 0%->15% threshold) will result in what is close to 0 tax liability. However I read somewhere a while back that its AGI that matters not taxable income when applying this. I’m at 36K now and if I can harvest 13k more and not pay more in taxes, I’d like to. But if I mess up, I’m stuck with 13K taxed at 15%.

I’ll give this a shot.

The cutoff for determining whether one pays tax at 0%, 15% or 20% on capital gains is based upon “taxable income” – not AGI.

As a single filer (which you appear to be), once your taxable income crosses above $36,900, the portion of your capital gains which causes your taxable income to exceed $36,900 will be taxed at 15%. So by my math, if your taxable income is $40,000, then $3,100 of your capital gains will be subject to a 15% tax ($465 in tax).

If you have another $10,000 in capital gains, then your taxable income will increase to $50,000 and the portion of your capital gains subject to a 15% tax will be $13,100 (tax of $1,965).

Hope that helps clarify.

It’s based on taxable income (after all deductions). Not AGI.

– Michael

Michael great article, thanks! For a second I was hoping that I could have a zero% tax on a million dollar gain, as have no ordinary income, but too good to be true. However your idea about selling profits to step up basis of investments is brilliant, thanks. Wish read this 29 days ago, but will use this in future.

I am an inventor and IP is given long term cap gains rate even if it 3 months old. Do you know if your article equally applies to IP as its taxed as LTCG in terms of zero tax rate for first $50K or whatever the limit is?

I gave this example to my accountant and was told it wouldn’t work but he couldn’t make clear why. If I am able to arrange my income so that I have nothing but long term capital gains, am under $75,300 and file jointly I shouldn’t pay income tax on any of it. Where has my logic gone wrong? Thanks!

I”m getting confused by the explanation of 15% + 15% (and concerned by the potential ease of error).

Let’s say we have an adjusted gross income of $60,000 and a taxable income of $40,000. I sell $40,000 in stock (not in a retirement fund, just stock), and from that earn $20,000 in capital gains. I then repurchase the $40,000 in stock. Will selling the stock cause any change in my federal income tax?

Michael, how does SS income factor in to the discussion? I understand how the Provisional Income formula determines taxation of SS income but I’m unclear as to how it factors into determining the capital gains tax rate. Is every dollar of SS counted as income in “filling up the brackets” or only the portion of SS that is taxable, per the Provisional Income formula?

Richard,

Good question!

Only the taxable portion of Social Security is counted when “filling up the brackets”. HOWEVER, because even 0% capital gains income is still INCOME, the capital gains that you harvest WILL increase provisional income (which may cause some Social Security benefits to become taxable, and effectively makes the capital gains have a higher-than-0% marginal tax rate even if the gains themselves are eligible for 0% rates).

– Michael

Great info! I’ve been searching all over for this type of discussion. I can’t seem to find out how it works with business loss that affects ordinary income. ie’ I have 2 businesses with loss’ (one S corp, one partnership) resulting in negative ordinary income but LT capital gains income of 7 figures. How does this work?

This statement seems wrong if you happen to be in the 3rd bracket: “Notably, this is actually the most favorable sequence possible, as it ensures ordinary income (which is otherwise taxed at the highest rates) gets the lowest brackets; while the long-term capital gains do get pushed into the “higher” brackets”. E.g. assume you had exactly $73800 of LTCG and $73800 of regular income in the example above. Paying 0% and then 25% is better than the other way around.

Just retired and finally have a reason to think these things through. Excellent article – I even coded this up in a spreadsheet so I can play “what if” scenarios about Roth conversions during years of low income, and various capital gains. Excellent, Excellent.

Michael, does this work the same with the sale of rental property as for other assets? My ordinary taxable income would be about 30K, so I could have about 43K or so of a capital gain at 0%. But it seems like the tax is based on the sale price of my property minus the cost basis, in my case a gain of approx. 100K. So would my gain drop down to 67K, and the tax be 67K x 15%? And also, what about depreciation recapture? Any benefit to be had there with the 0% rate?

Thank you for any help!

I’m reading this 4 years after publishing, but still find this article and its principles very relevant and useful! Really appreciate the detailed examples with visuals – this will help me as I am now planning how to manage brokerage drawdowns with potential Roth conversions!

Thanks for the article Mike. With the examples and diagrams, it was very easy to understand. I’m retired and so I have control over when I liquidate my investments and this article was very helpful. I’m also trying to balance how much to do a Roth versus doing the gain harvesting so the follow up post was helpful on that too.

The article is very good and I understand it. My question is elementary. Where are all these calculations done in the return? I don’t see it in Schedule D, Form 8949, etc? Thanks.

I did more research. Using Turbotax for 2019, there is a form called Qualified Dividends and Capital Gain Tax Worksheet were it is calculated. One need to do a preliminary calculation before harvesting your long term cap gain. Social security taxable income will be affected as well as your state tax. One need to do preliminary calcs.

Great article – exactly what I’ve been looking for! Any chance of updating it to reflect current tax laws?

Hi Michael – would love to see an update to this article featuring the current tax rates!

Very clear article. Great !! Thanks for sharing this.

Checking one extension idea that's not covered explicitly: Standard Deduction will reduce LTCG even when there is no income. e.g., a simple example with a married couple filing jointly with no income and standard deduction.

2024 LTCG 0% = 94,050

2024 Standard Deduction = 29,200

Meaning there would be no federal tax for capital gains up to 123,250 of LTCG.