Executive Summary

For many financial advisors, marketing themselves is often a challenge because the primary service they offer – providing clients with advice – and how they offer it are invisible and intangible. Which means that prospective clients can’t always make a fair evaluation when they are limited to assessing only the look and feel of the advisor’s business, but not the services the advisor actually provides. And when prospective clients can’t ‘see’ how advisors give advice, they often don’t understand the value that the advisor has to offer.

To overcome this issue, advisors have traditionally turned to one of the “three B’s” of marketing – Boldness (using pronounced marketing messages or media others aren’t willing to use), Blanketing (spending money to spread their message across a wide audience), and Building (leveraging relationships to generate referrals and word-of-mouth business) – to compete with the competition. But conquering just one of the three B’s can be both time- and money-intensive for an advisory firm targeting a broad pool of prospective clients (e.g., retirees and pre-retirees). Instead, advisory firms of any size can easily conquer all three B’s by carving out a niche that no one else serves.

Working with a niche narrows the potential competition, making it more likely that the advisor’s efforts to be Bold will be more likely to be noticed. In addition, serving a niche makes it easier for an advisor to Blanket their message because the population they need to reach is much smaller than targeting a broader pool of prospects. Finally, having a niche makes it easier to Build relationships by generating referrals because the niche gives other professionals a way to differentiate the advisor from their competitors, and opens new referral opportunities from Centers Of Influence (COIs) who work with individuals in the niche!

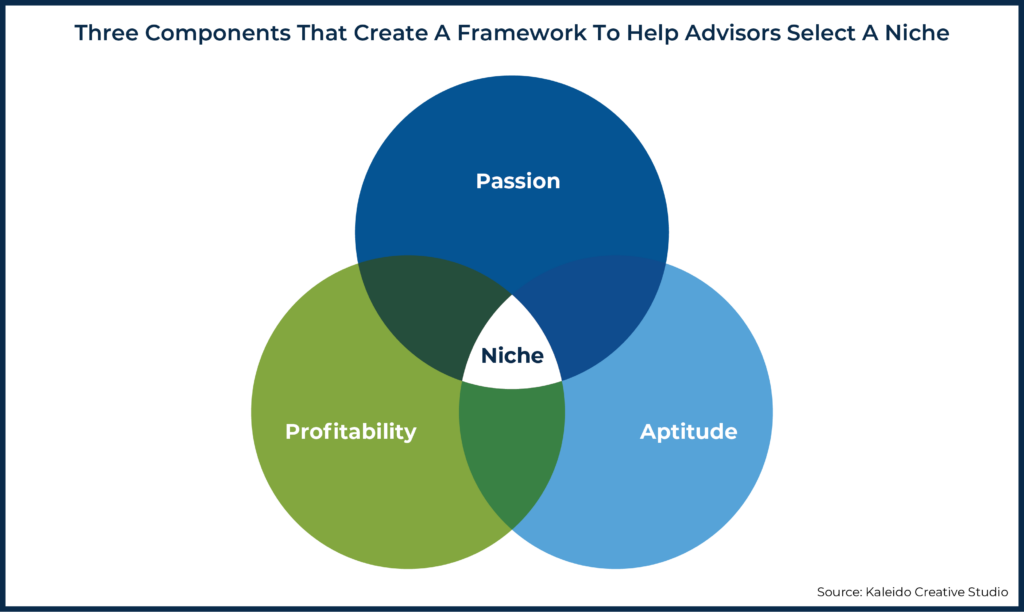

When brainstorming potential niches, it can be helpful for advisors to consider areas that reflect their passion (which generate energy and excitement that can spread to prospective clients), aptitude (which comes from the advisor’s natural talents, as well as their professional and broader life experiences), and profitability (which ensures that clients in the niche will be able to pay the fees needed to make the business profitable). Once the advisor has potential niches in mind, they can then research these areas to find the niche that is the best fit for them. Interviewing clients and contacts who fall into the niche, as well as COIs with extensive experience in the niche area, can help the advisor decide whether that given niche is potentially viable. Some criteria that can be used to help determine whether a niche market has potential include: whether individuals in that niche have pain points regarding their problem that the advisor can address, whether the niche is easy to find for marketing purposes, whether the niche market is growing, and whether it is possible to dominate the space due to a lack of competition.

Ultimately, the key point is that while marketing can be a challenge for advisors, those who focus their efforts on a suitable niche will find it easier to be Bold so that they are noticed, to Blanket prospective clients with their value proposition, and to Build relationships that generate referrals. By targeting a specific type of client and reducing the amount of competition, the advisor’s business can thrive as ideal clients enthusiastic about working with them pour in!

Marketing can be hard for financial advisors because they sell an invisible, intangible service. Unlike a physical product, where it tends to be easier to judge the quality – you can see it and pick it up to know what it feels like – you can’t judge an advisor’s quality by the look and feel of the advisor or their office.

As a result, when a prospect does try to evaluate, they often find that most financial advisors look and sound the same to them, making it difficult for the prospect to choose the right advisor. Most financial advisors offer the same basic services (financial planning, investment management, retirement planning, etc.), work with the same typical client (high net worth, probably nearing retirement), for the same similar price (1% of AUM or so). Most financial advisors also claim (accurately or inaccurately) that they are good at the most important services a prospective client is looking for, including comprehensive financial planning and investment management, in the exact same way as every other advisor making the same claim.

Let’s face it: Prospects have too many similar choices. On top of that, unless prospects themselves are in a field that requires them to interact with a lot of financial advisors – for example, CPAs – chances are that they probably have never evaluated more than 1 or 2 (if any) financial advisors before, meaning they don’t have the experience to do so. In other words, most prospects aren’t qualified to evaluate which financial advisor is best.

And when prospects can’t evaluate based on qualification, they will resort to other factors to aid their decision-making. These factors can include (1) the lowest price; (2) whether they personally happen to like one advisor more than other advisors they meet with; (3) someone they know gave them a recommendation; (4) they like one advisor’s marketing the best; or (5) they choose an established (probably national) brand they think is a ‘safe’ choice.

The Three B’s Of Advisor Marketing

Because of this difficulty in being able to differentiate in the eyes of the prospect, advisory firms have traditionally employed one of the “three B’s” of marketing to compete with the competition:

- Boldness: Standing out by doing the marketing others aren’t willing to do;

- Blanketing: Gaining awareness by spending enormous amounts of money to spread their message that they’re a safe, trustworthy choice; or

- Building: Leveraging relationships to generate referrals and word-of-mouth business.

Boldness In Marketing

Bold firms can’t help but stand out from the sea of sameness. They are courageous and eager to do what no one else is doing (or is even willing to do). If advisors adopt a bold strategy, it can mean being more creative in their marketing campaigns, or even more controversial in their marketing message.

In his InvestmentNews article “A Tale of Two Advisers, and Why Boldness Wins,” Robert Sofia shares a marketing campaign that his company, Snappy Kraken, pitched to a financial advisor. The campaign was to advertise a seminar on retirement and inflation, and Snappy Kraken gave him a bold postcard of a pink piggy bank balloon with the message “Inflation. Will it rob you?”

The advisor didn’t want the boldness and retreated into the same-old, bland messaging that included a score of bullet points (ideally to highlight a long list of features, but in practice more likely to overwhelm and numb the minds of potential prospects). Meanwhile, a second advisor did go for the bright-pink pig. They embraced the bold.

The result? The advisor who went bold got four times the response rate of the advisor who feared standing out! By trying to avoid offending anyone, they also failed to be very interesting to anyone.

There is so much room in the industry for boldness because there is so much sameness. Just think of how many advisor websites and advertisements feature a couple walking hand in hand on the beach with the words “financial peace of mind” written next to them.

In fact, advisors often ask me what their competition is doing… so they can do the same. By default, advisors like most people want to fit in. They want to do what everyone else is doing, because if others are doing it and are seemingly successful, it must be a ‘safe’ strategy to pursue.

By contrast, for most financial advisors, boldness is risky and scary. If you put yourself out there in a noticeable way, you will get noticed… potentially embarrassing yourself, or putting your reputation on the line. And what happens if the strategy doesn’t work, and you can’t show an increase in leads? Then you may feel that you put your reputation on the line for nothing!?

Boldness can also be expensive. Most advisors are more logical and analytical than creative and artistic, which means they may have to hire help to implement bold campaigns. Which is difficult, because truly bold, creative ideas are rare, and therefore potentially expensive when outsourced.

Which means in the end, Bold can be a very effective marketing strategy. But as a higher-stakes strategy, it does require real boldness on the part of the advisor, too.

Blanketing A Marketing Message

When companies spend enormous amounts of money so that their message everywhere gets noticed, it’s called ‘blanketing’. These companies may have workshops, radio shows, billboards, digital ads, podcasts, TV commercials, magazine ads, and more. Retail brokerage firms like Schwab and Fidelity do this, as well as large RIAs like Fisher Investments. Some individual advisory firms entail a similar strategy within their own local markets. These companies make up for their lack of boldness by plastering their names everywhere their prospects might see it, so that they can’t help but stick in people’s minds.

The problem with blanketing is that it can be incredibly expensive. Single TV ads alone are costly to run, not to mention that they must be run enough times so that people remember seeing them. Layering in all the other types of advertising that advisors need to do to blanket –billboards, digital ads, magazines, etc. – and the price tag adds up quickly.

In smaller markets, blanketing can be less expensive since there are fewer people to reach. If we take the old marketing rule of 7, which states it takes at least seven interactions with a business before a customer makes a purchase, blanketing may be a lot cheaper for an advisor who lives in a town with 20,000 people. However, for an advisor in a metropolis of 2 million people, blanketing can be cost-prohibitive. Additionally, many contemporary marketers argue the number of required interactions is much higher today, so the expense becomes even greater. The hard truth is that most RIAs don’t have the money that Fisher Investments, Fidelity, or Schwab has to pull off a blanketing campaign, nor do they operate in cities that are small enough for them to blanket in a cost-effective manner.

Building Relationships For Referrals

Most financial advisors gravitate toward building relationships to generate referrals or word-of-mouth leads because, after all, financial advisors are in the relationships business. And building relationships doesn’t take a lot of dollars in upfront marketing costs.

Building involves nurturing Centers Of Influence (COIs) and clients for referrals. It requires networking and getting involved in the community to build a solid reputation. The strategy’s premise is that a good reputation will lead to new business. And usually, a few strong relationships can generate a solid stream of leads.

But building can be difficult when the advisor is working with a wide variety of clients (e.g., anyone with at least $500,000 in investable assets). This is because other advisors employ the same strategies, target the same prospects, communicate the same message, and search in the same places for those prospects.

The end result is that most advisors are looking to build relationships with the same types of Centers Of Influence – most commonly CPAs and attorneys – and even the same individuals. These COIs inevitably have dozens of financial advisors they know calling upon them, so the chances they send one particular advisor a client are slim, unless the advisor has a very strong relationship with them.

Meanwhile, clients usually have only one advisor relationship, so they are happy to refer to their advisor. But most clients only have ‘so many’ people they know that can be referred before their own personal network is tapped out. The vast majority of clients won’t have a large enough network of qualified prospects to be meaningful lead sources on an ongoing, sustained basis.

Conquer The 3 B’s By Eliminating The Competition

Most firms are lucky if they can manage to conquer even just one of the three B’s. But, in reality, there is a way for advisory firms of all sizes to easily conquer all three – by carving out a niche that no one else serves, thus eliminating the competition altogether.

A niche transforms an advisor from a small fish in a big pond – where they have to be bold, try to blanket, or spend a lot of time building a wide range of relationships – into a big fish in a small pond… where it is easy to be bold, blanket the market, and build referral relationships!

A Niche Makes You Bold

When advisors work with a niche, they automatically get noticed because they are the only one (or one in a very few) competing in their space. There is little, if any, competition. The essence of being bold is being unique. Advisors with a specialization are naturally ‘bold’ because no one else is able to talk about their specialty the way they do, and no one else is offering the exact specialized solution they are offering.

Think about it this way: Let’s say a financial advisor in Texas only works with clients living a U.S.-Mexico cross-border lifestyle. Their bold message is simple and memorable: “Live the Best of Both Worlds. Wealth Management for Cross-Border Families.” The average consumer has never heard anyone else talk about this very specialized service, and instantly thinks of the advisor any time one of their friends or family mentions they’re thinking about living a cross-border life. Word quickly spreads because this advisor is naturally top of mind whenever this one thing they’re known for comes up in conversation.

A Niche Makes It Easier To Blanket

It’s not hard for advisors to blanket with a niche, because they don’t have to reach a very large population, which means it’s far less expensive to blanket their message consistently.

Example 1. Fred is a financial advisor who wants to reach every millionaire-next-door pre-retiree in his community, which is 100,000 people.

It costs $1 each time he reaches them, and using the marketing rule of 7, he figures that he must reach them an average of seven times before they even remember him, let alone take action.

Thus, Fred will need to pay $1 × 7 outreach efforts × 100,000 prospects = $700,000 total to reach his desired audience.

In reality, it will likely cost more than $1 per impression and will generally take more than seven times for prospects to even notice, because Fred’s message is so generic in trying to appeal to everyone, most people won’t even notice and may end up ignoring at least some of his marketing efforts along the way.

Now consider an advisor who has chosen a niche.

Example 2. Barney is a financial advisor who wants to reach every faculty member over the age of 50 employed at his state’s university system, which he has estimated to be 10,000 people.

He pays the same $1 per impression as Fred, the generalist advisor in Example 1. He also figures that he will need to reach his prospects an average of seven times before they consider taking any action.

Thus, Barney pays $1 × 7 outreach efforts × 10,000 prospects = $70,000 total to reach his desired audience.

In contrast to Fred’s marketing efforts, Barney’s message focuses on the painful problem of navigating through the state university’s confusing system of retirement benefits that depend on when the faculty member was hired – a problem that is unique to prospects in his niche. Thus, prospects notice his marketing, and are not only more likely to notice, but also more likely to take action.

Compared to Fred in Example 1, Barney saved $630,000, which means he can reach his niche market 63 more times than Fred can reach his larger audience. And if an advisor reaches someone 70 times, they will definitely remember the advisor’s name!

Ultimately, by shrinking the pond, niche advisors make more impact with only ideal clients… and do it with fewer dollars.

A Niche Enables You To Build (Relationships)

When advisors focus on a niche, getting referrals from other professionals tends to be much easier. There are two reasons for this.

First, when advisors specialize in solving one problem for one type of client, even COIs with strong existing relationships with other financial advisors will know to refer to that particular advisor when they come across someone in their niche. After all, it’s hard for the COI not to refer a client with a very specialized problem to the one advisor they know who memorably specializes in solving that problem!

Second, advisors can pursue “nontraditional” COIs, who probably never hear from most generalist financial advisors! For instance, as advisors think of Centers Of Influence in their networks, they can look beyond professionals like CPAs and attorneys. Using my example of the cross-border lifestyle advisor, COIs could include high-end immigration attorneys or customs brokers (if they own a business). These professionals have direct experience working with clients in the advisor’s niche and understand their unique challenges.

Maybe these COIs aren’t as aware of the financial challenges, but they know the major concerns that weigh on the minds of those families. That’s the kind of network advisors can tap into… that wouldn’t make sense for other advisors to attempt. And building referral relationships with those COIs is a lot easier… because again, no one else is even doing what the advisor can do.

Win More Clients By Being A Big Fish In A Small Pond

Let’s face it: Unless an advisor is the owner of the biggest RIA in the geographic markets they compete in, they are most likely a small fish in a big pond. And it will be very challenging to change that dynamic.

An easier alternative is to shrink the pond, making it easier to become a big fish by deliberately swimming in a smaller pond. Advisors will benefit from being in a situation where they can have “more power, influence, knowledge, and experience” than other advisors within a small group. The key for advisors who want to pursue a niche is to define what they want their pond to look like… by choosing the right niche.

So what makes a good niche? A good niche is one where everyone faces one common problem. The problem should require unique or complex financial planning strategies that other advisors aren’t serving (at all, or at least not at a high level of competency). Ideally, a niche should include clientele facing a problem that most other advisors can’t service profitably, because they lack the business structure and knowledge to execute efficiently. Which makes it something a focused advisor can, in time, master, deliver efficiently, and dominate.

Good niches may not immediately fall into a traditional AUM model, and may require a creative (but still profitable) alternative fee structure. Ultimately, though, this can help keep the competition away (when they’re all built around an AUM model that can’t serve those clients). Though to the extent the advisor focuses into a niche that builds wealth, it also generally will lead to AUM in the future.

For example, a niche could focus on clients who are business owners selling their company to a family member. This niche has more complexity than most advisors want to touch until the sale of the business is done. This is because these types of sales often require unique financing structures, capital gains tax strategies, and maneuvering around complicated family and employee dynamics.

Advisory practices that focus on this niche would also require a nontraditional fee model, as the client’s assets are often tied up in the business (which hasn’t yet had a liquidity event to turn into portfolio assets that can be managed). Because advisors deserve to get paid what they are worth for their expertise and hard work to help clients make this transition, many advisors avoid this market altogether simply because the niche doesn’t fit the popular AUM model.

But if an advisor can structure their practice to help these business owners during their transition, they will have the cash to fit into an AUM model after the sale is complete.

So how do advisors choose their niche?

Step 1: Brainstorm Potential Niches By Considering Passion, Aptitude, And Profitability

I’ve created a framework to help advisors narrow down the possibilities of potential niche markets that they can further stress-test. By exploring what lies at the intersection of their passion, aptitude, and profitability, they will eventually see a shortlist emerge.

One place for advisors to start is to look at their existing clients to see if any patterns emerge. However, the best niche is probably not one where advisors have a lot of clients. If they analyze just their client base, they’ll probably end up with the conclusion that they work best with pre-retirees and retirees. Instead, successful niche advisors need a market not served well by other advisors (and retirement planning is already well-covered)! Which means it’s probably one where the advisor only has a handful of profitable clients… but a lot of passion and aptitude to pursue further.

Let me walk through our “Selecting a Niche” framework for brainstorming niches. Advisors can ask themselves questions in three different categories, which include passion, aptitude, and profitability.

Passion

We start with passion because it can be a strong driver – incorporating our passion into our work is something everyone hopes for, but that few achieve. Yet, passion can bring healthy energy and excitement, which is contagious – and can serve as a powerful motivator for prospects to choose an advisor!

To better understand how an advisor’s passion can help them identify an ideal niche, consider these questions:

- What are my interests and passions?

- Who am I passionate about working with?

- What types of people do I naturally network with or spend time with?

- What would I be doing if I weren’t a financial advisor?

- Which types of clients are enjoyable and easy (for me) to serve?

- Is there an area that I have a strong interest in?

Aptitude

Next, think through your aptitude. Aptitude comes from natural talents, current and past professional experience, and even life experience. Ask yourself:

- What types of clients do I have experience working with?

- What specializations do I have that my clients value most?

- What unique educational background do I have?

- What makes me an exceptional financial advisor?

- What is unique about my career and life experience?

- What hole in the industry do I naturally fill?

- What complex financial planning scenarios have I solved for clients?

- What personal strengths do I have?

Profitability

Finally, we look at profitability because even if an advisor has the passion and aptitude for serving a particular niche, they won’t be successful if they can’t make money.

- What types of clients have enough income (even if they don’t have the assets) to pay for my minimum annual fee?

- What types of clients have enough investable assets to meet my minimum account size?

- What types of clients, if charged 0.5% of net worth, would meet my minimum annual fee?

- What types of clients are naturally attracted to the firm without much effort?

- What types of clients are most willing to pay my fees?

Advisors who take the time to thoughtfully brainstorm around each component will see commonalities that intersect all three of these categories at the end of the exercise. This is a good shortlist of potential niches to explore further.

Step 2: Interview Clients And Contacts In The Target Niche

Next, it is time to do some research. For each of the niches identified in Step 1, advisors can interview clients and contacts who fall into that niche, as well as COIs who have extensive experience with the niche. Advisors can say that they are considering focusing their practice on the niche and are interested in getting advice and feedback with the following questions:

- What do you think are the primary financial challenges the niche is facing?

- [For clients only:] What was happening in your life when you decided to seek our services?

- [For COIs only:] What is happening in your niche clients’ lives when they seek your services?

- Why do you think the niche would seek out a financial advisor?

- What do you think the niche is ultimately trying to achieve with their money?

- What financial services do you think the niche needs most?

- How could you go about finding more clients in the niche?

- What specific groups or organizations do these individuals belong to?

- What social media sites or online forums does the niche use?

- What other types of professionals does the niche use for advice?

Step 3: Evaluate The Viability And Suitability Of The Target Niche

Once advisors have qualitative data in hand, it’s time to evaluate the viability and suitability of their potential niche. Not all niches are created equal, and not all niches are good options.

Advisors want to make sure that they choose a niche market with real potential. To determine this, ask these questions about each niche:

- Pain: Is your niche feeling real pain regarding their problem?

- Purchasing power: Is your niche willing and able to pay your fees?

- Easy to target: Is your niche easy to find for marketing purposes (e.g., purchase lists, associations, groups, social media targeting)?

- Growing: Is your niche market growing?

- Urgency: Is it urgent for your niche to have their problem solved?

- Complexity: Is the primary financial problem for this niche something that takes a lot of time and research for the first client, but would be easy to replicate once you have developed the expertise and a process?

- Dominance: Is it possible to dominate this space due to a lack of competition?

- Credibility: Do you have a minimum amount of credibility working with clients in this niche (e.g., at least one client is, or you are, a member of the niche)?

- Access: Can you access the niche through your existing network and opportunities?

- Expertise: Do you have the basic skills and knowledge necessary to begin serving this niche?

Advisors can consider how many times they responded affirmatively to these questions. They don’t have to answer yes to all of these questions for a niche to succeed, but answering yes to fewer than six questions probably signifies that the niche is not a great choice.

If there are multiple niches being considered, the one with the most yeses will probably be the best choice.

Let’s face it: Marketing is hard for most financial advisors because they tend to look and sound the same to a prospect. To stand out, advisors can try the tactics every other advisor uses – being bold, blanketing their message, or building relationships for referrals. Or they can adopt the fourth option and focus their efforts on a suitable niche. Which naturally makes them more bold, easier to blanket, and more focused in building relationships, because they’ve made themselves a bigger fish by swimming in a smaller pond.

Simply put, in my experience, I have found the easiest solution to make marketing effortless is to specialize in a niche. Advisors can automatically conquer the three B’s and, at the same time, eliminate the competition by successfully implementing a niche strategy. They can stop the endless drain of time and money spent on marketing that gives nothing to show for their efforts. Instead, the advisor’s business can thrive as ideal clients enthusiastic about working with them pour in!

Simply the best article/course I’ve ever seen on how to narrow down and define one’s niche. Well done Kristen!