Executive Summary

The Irrevocable Life Insurance Trust (ILIT) has long been a staple of estate planning – a means of avoiding the death benefit of a life insurance policy from being subject to estate taxes by having it owned not by the insured or family themselves, but an independent third-party trust holding the life insurance for the family’s (beneficiary’s) benefit instead. Which was necessary in a world where, as recently as 10-20 years ago, even basic term insurance for a 30-something-year-old breadwinner to protect the children in the event of an untimely death could cause an estate tax liability.

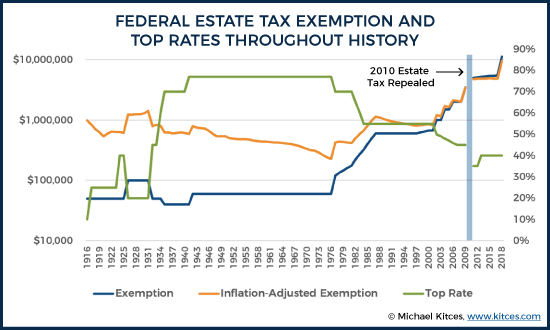

But the drastic increase in the estate tax exemption, especially with last year’s doubling to $11.2M (or $22.4M for a married couple with portability) under the Tax Cuts and Jobs Act of 2017, has not only removed more than 99% of households from Federal estate tax exposure, but has rendered a large number of existing ILITs unnecessary for families who once had an “estate tax problem” in the past (when exemptions were lower) but won’t be in any foreseeable future.

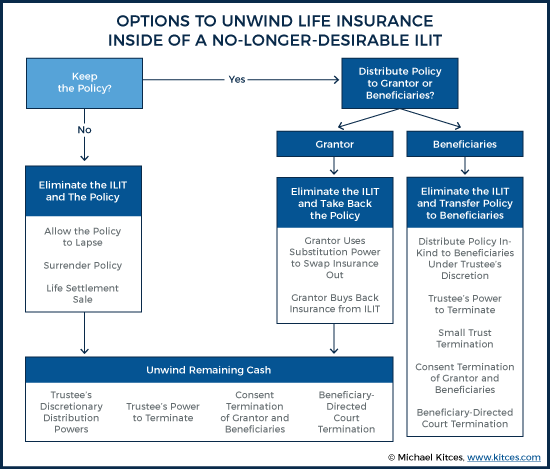

And the good news is that despite the “irrevocable” label in its name, in many cases it is possible to either “rescue” life insurance out of an ILIT that’s no longer needed, or to unwind the ILIT altogether. In some cases, it may be as straightforward as the grantor simply substituting the life insurance policy out of the ILIT in exchange for cash of equivalent value (or alternatively buying the policy back). In other scenarios, if the life insurance itself is no longer needed, it may be easiest to simply let it lapse, rendering the ILIT irrelevant because it would no longer have any assets left to oversee. And if the life insurance policy has cash value, it can simply be surrendered or sold in a life settlement transaction, with the cash potentially distributed to beneficiaries (at least if the trustee has discretion to do so). Alternatively, if the beneficiaries themselves want to keep the policy, it may be feasible to distribute the policy in-kind under the trustee’s discretion, or to terminate the trust outright (either under the terms of the trust, as a consent termination of the grantor and beneficiaries, or court-directed termination at the direction of the beneficiaries).

Of course, the caveat is that the trustee must still honor the terms of the trust, and if the trust is more restrictive in preventing various “unwinding” or policy rescue options, the parties are still bound by the terms of the trust (unless, perhaps, the ILIT can be decanted to a new trust under state law). Nonetheless, the fact remains that while the “irrevocable” nature of an ILIT means the terms of the trust itself cannot be changed, that doesn’t mean the grantor, beneficiaries, and trustee can’t work within the terms of the trust and state law to eliminate an ILIT that is no longer necessary in today’s estate tax environment!

Origins Of The Irrevocable Life Insurance Trust (ILIT)

With the recent changes under the Tax Cuts and Jobs Act of 2017, the Federal estate tax exemption in 2018 is now a whopping $11.2 million, which increases to $22.4M for a married couple with portability… effectively narrowing the scope of the estate tax to fewer than 1% of all households.

However, 20 years ago, the scope of the estate tax was far wider. The estate tax exemption was a mere $625,000 (or just shy of $1,000,000 in today’s dollars), having just risen $25,000 from the $600,000 threshold it had been locked in at for the preceding 10 years. With median household income at the time approaching $40,000/year, this meant even a young married couple who simply had 15X their income or more in life insurance to protect their children had “an estate tax problem,” even if they had no other assets. Because the death benefit of the life insurance alone could be enough to push the family over the estate tax threshold, especially if both parents were working and both had life insurance and both died in a common accident. (And if they had savings, retirement accounts, home equity, or any other assets, they were even closer to facing a Federal estate tax with even less life insurance protection on top!)

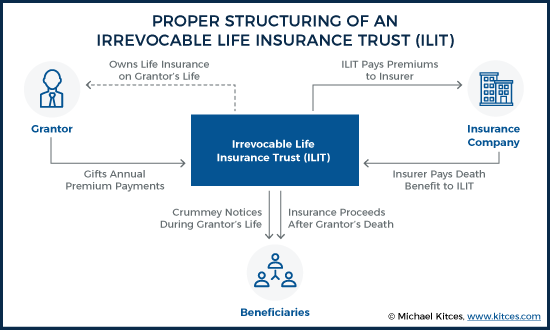

The solution to this dilemma was relatively straightforward: don’t own the life insurance in the first place. Instead, have an Irrevocable Life Insurance Trust (ILIT) own the insurance instead, which would keep the life insurance death benefit out of the grantor’s estate as long as he/she wasn’t the beneficiary of the policy (because it would be payable to the ILIT instead) and as long as the grantor had no “incidents of ownership” (e.g., the ability to control the policy, set the beneficiaries, etc.) over the policy that would cause it to be included in his/her estate under IRC Section 2042.

Thus, even if something untimely happened, the life insurance proceeds would avoid any Federal estate taxation, because the policy wasn’t owned individually; it was owned by the ILIT instead. Even though the ultimate beneficiary of the ILIT may still be the same children or other heirs who would have been named beneficiaries directly. The life insurance death benefit itself could avoid estate tax exposure if it was owned inside of the ILIT rather than by the insured directly.

The caveat, however, was that if the life insurance policy was owned by the trust – and not the individual who was insured – then he/she couldn’t just make premium payments for the life insurance either. Because those were no longer just life insurance premium payments; instead, they constituted “gifts” to the ILIT and its future beneficiaries to pay for the ILIT’s life insurance policy! Except, because the money was being gifted to the ILIT and couldn’t be used by the beneficiaries until the distant future (once the insured individual died and the ILIT was ready to pay out the life insurance proceeds), the annual premium gifts weren’t eligible for the $15,000/year (or $10,000 back then) annual gift tax exclusion under IRC Section 2503… which meant every premium payment itself to the ILIT might constitute an additional gift that used a portion of that $625,000 estate (and gift) tax exemption!

To remedy the situation of otherwise-gift-taxable premiums for ILIT-owned life insurance, ILITs would typically grant the beneficiaries a limited period of time that they could access the premiums immediately after they were gifted – known as “Crummey powers” after the famous court case that established the strategy to turn the premium payments into a “current” gift eligible for the IRC Section 2503 annual gift tax exclusion. But that, in turn, created the hassle of sending “Crummey notices” to remind every beneficiary every year of their opportunity to use (or lose) their temporary window to access the cash for the life insurance premiums!

The end result was a substantial amount of administrative hassle, to handle even relatively basic estate planning situations with life insurance involved, including creating the ILIT, purchasing the life insurance into the ILIT (or transferring existing insurance to the ILIT and hoping to outlive the 3-year lookback under IRC Section 2035), and then managing the annual process of having the trustee for the ILIT receive premium payments and send out Crummey notices before completing each premium payment for the life insurance. But with a potential estate tax savings of 55%(!) of every dollar of life insurance death benefit above the $625,000 threshold… it was usually deemed to be worth the trouble!

The (Ir)Relevance Of Old ILITs Today

In today’s environment, with an estate tax exemption of $11.2M (or up to $22.4M for a married couple with portability), the ILIT is far less relevant than it once was. “Normal” insurance coverage to protect children and surviving spouses in the event of an untimely death is no longer the trigger for estate taxes they once were.

Of course, that’s not to say that no one is exposed to the estate taxes anymore, or that ILITs are no longer relevant. In the subset of states that still have a state estate tax (often with much-lower exemptions), there may still be a need to have even normal family-protection term insurance in an ILIT.

But in most cases, ILITs are no longer necessary unless the family already has a net worth to expose them to estate taxes, for which any additional life insurance death benefits just compound the problem. And in those cases, ILITs aren’t just about sheltering the life insurance death benefit from estate taxation, per se, but are used because the life insurance may be needed to provide liquidity for the rest of the family estate tax liability in the first place. In this context, the life insurance inside of the ILIT may help after death by loaning cash to the estate, or buying out assets (e.g., a family business) from the estate, providing the estate the liquid cash it needs to pay the estate tax bill without triggering a fire sale of (potentially illiquid) family assets.

Nonetheless, the more-than-10X dramatic rise in the estate tax exemption over the past 20 years (even on an inflation-adjusted basis), plus the introduction of portability of the estate tax exemption for married couples (effectively doubling the estate tax exemption again), creates a situation where many people who created ILITs years or decades ago may still have them – as they are “irrevocable” once created – but no longer need them for estate planning purposes. At this point, they’re often just an administrative hassle and cost, without necessarily providing any (estate tax or other) benefits.

Unwinding An Old ILIT And Rescuing ILIT-Owned Life Insurance

So what can be done to revoke an irrevocable life insurance trust… either because the life insurance itself is no longer needed, or if the life insurance is still desirable, the ILIT structure around it if no longer necessary?

Notwithstanding the name, the reality is that there often are paths to make adjustments (or even outright terminations) for ILITs that may no longer be needed. However, the exact options vary depending on the precise terms of the trust, as well as what may be permitted (or not) under state law.

ILIT Rescue: Buy Back (Or Substitute Out) The Life Insurance Policy

Often the simplest way to unwind an ILIT is to extract the life insurance policy out of it by having the grantor either buy the policy back or “substitute” another asset for an equivalent value in exchange for the life insurance policy.

In fact, the power to substitute replacement assets of equivalent value into a trust under IRC Section 675(4) is often used as one of the key powers to make an ILIT into a grantor trust in the first place. Especially since Revenue Ruling 2011-28 affirmed that the power of substitution is not treated as an “incident of ownership” that would cause the life insurance to be included in the decedent’s estate under IRC Section 2042 in the first place.

Accordingly, one of the most straightforward ways to extract a life insurance policy out of an ILIT is to simply swap out the life insurance policy for an asset of equivalent value (e.g., cash). Notably, the substitution should still be for an asset (or cash) of equivalent value… which at a minimum means the policy’s cash surrender value, and if there’s been an adverse change of health and the insured is older, potentially a valuation more akin to what the policy could be sold for in a life settlement to a third party. On the plus side, since the ILIT is a grantor trust – which means the trust itself is treated as an extension of the grantor’s own identity for income tax purposes – there’s no taxable event associated with the substitution to extract the life insurance policy out.

Alternatively, if the ILIT doesn’t have a substitution power, it may also be feasible for the grantor to buy the policy back from the trust for its fair market value. Here, again, the purchase would not be treated as a taxable event, since the ILIT as a grantor trust is already the grantor’s alter ego for income tax purposes (and you can’t have a taxable event for doing a transaction with yourself!). In addition, since the grantor is the insured who’s purchasing the policy, the death benefit will remain tax-free and not be subject to the transfer-for-value rules under IRC Section 101(a)(2).

Notably, though, while a substitution or purchase of the life insurance policy does extract it out of the ILIT, and eliminates the need for future premium gifting and Crummey notices, it doesn’t fully eliminate and unwind the ILIT itself… as the ILIT will still end out holding the cash (or other substituted value) proceeds from the transaction. Completely unwinding the ILIT will require additional steps to extract all of the assets out of the trust… as discussed further in later sections below.

Lapse The (Term) Policy That’s No Longer Needed

The next option to “unwind” an ILIT, especially if the life insurance itself is no longer needed, is simply to stop making premium payments and allow the insurance policy itself to lapse. As typically the only asset in an ILIT is the life insurance policy that it owns. So at the point that the policy lapses – especially if it’s a term insurance policy with no cash value – the ILIT may technically still be in existence, but it will literally own nothing, so practically speaking the ILIT can simply be ignored from that point forward.

Unfortunately, though, the situation is more complicated if the ILIT owns a permanent insurance policy, as there again is existing cash value that must be contended with. If the ILIT policy is a universal life policy, it is feasible to simply stop making premium payments, and allow the cash value to cover the policy expenses as long as it can. Whenever the cash value runs out, the universal life insurance policy will lapse (with no value and thus also no tax event)… but ostensibly, if the coverage was no longer needed anyway, that’s an acceptable resolution.

In the case of a whole life insurance policy, though, premium payments must be made to continue the policy in force. And while loans can be made against the policy to then re-deposit in the form of new premiums, doing so will accrue a loan against the life insurance policy that more quickly erodes its remaining cash value and hastens its demise. And while that may be “fine” if there was no intention or desire to keep the life insurance anyway, lapsing a whole (or any other type of) life insurance policy with a loan may cause a tax event (as the cumulative value of the loan is treated as net proceeds that, if greater than premiums, resulting in a taxable gain)… unlike a universal life insurance policy that tends its value (and tax liability) down to zero once premium payments stop.

Surrender (Or Sell) The Cash Value Life Insurance Policy

The alternative for permanent life insurance policies with cash value is simply to proactively surrender the policy instead… which both eliminates the need for any new premiums and preserves the existing cash value (rather than letting the permanent policy lapse by eroding the cash value down to $0 for life insurance coverage that ostensibly was no longer needed anyway).

For policyowners who are at least 60-something years old, another option is to sell the life insurance policy, rather than merely surrender it, as life settlement transactions can sometimes pay even more to the policyowner (in this case, the ILIT) than just the cash value alone. Notably, a life settlement transaction generally only works for those who are older (age 60+ or more commonly 65+, and thus have a shorter life expectancy and nearer-term payout potential for the life settlements buyer). Furthermore, there’s rarely any material payment from a life settlement transaction above the cash value (especially after transaction costs) unless the insured has also had a material (and adverse) change in health. Still, for older insured individuals who have had an adverse change in health, a life settlement transaction may provide the ILIT far more cash than “just” surrendering. Though of course, if there’s been a material adverse change in health, the implied rate of return for holding the life insurance policy may make it even more compelling to keep after all!

Nonetheless, for those who unequivocally do not want to continue the life insurance, and/or no longer want the commitment of making ongoing premium payments (even if technically they may have a good Return On Investment to the ILIT and its beneficiaries), surrendering the policy or selling it as a life settlement is another option. In fact, it’s sometimes even feasible for term insurance policies to be sold in a life settlement (despite otherwise having no cash value) if they can be converted to a permanent insurance policy and the insured is older with an adverse change in health (and at that point, any life settlements purchase value is better than allowing the term policy to simply lapse with a value of $0!).

The caveat, however, is that both surrendering and selling the life insurance policy can also trigger a taxable gain (to the extent the surrender/sale value exceeds the premiums paid), and once an ILIT’s life insurance policy is surrendered or sold, the ILIT again may no longer need to deal with premium gifts and Crummey notices, but as in the case of a substitution or sale back to the grantor, the ILIT will still continue to exist… simply owning a pile of cash, instead of the life insurance policy the cash came from!

Distributing The Life Insurance Cash (Or Even The Policy Itself) Out Of The ILIT

For those who don’t want to just terminate the life insurance policy itself (to end premium gifts and Crummey notices), or have ended the life insurance but still have cash in the ILIT and are looking to eliminate the ILIT altogether, another option is to distribute the life insurance (or its surrender/sale cash proceeds) out of the ILIT to the beneficiaries. This effectively de-funds the trust, rendering it irrelevant (as the trust may still exist, but without any assets, it can effectively be ignored).

Unfortunately, though, the trustee of an ILIT is still bound to the terms of the ILIT itself regarding what can and cannot be distributed to the beneficiaries. Which means the ILIT trustee can’t just “decide” to disband it. Instead, the ability to eliminate the trust altogether depends entirely on the terms of the ILIT and its flexibility to make those liquidating distributions in the first place.

And the problem is that in many (or even most) cases, ILITs are limited from making any distributions until the death of the insured, as the whole point was/is that the ILIT won’t have any cash to distribute until the insured dies anyway!

However, in some cases, the ILIT may actually allow an outright distribution to the beneficiaries before the owner passes away, at least at the discretion of the trustee. Such scenarios are especially common when the ILIT was created several decades ago, perhaps for children who then were minors, where the assets would be held in trust until a future age (e.g., 25 years old, 35 years old), but now the children actually are old enough to receive an outright distribution from the trust. Which potentially provides the trustee both the option to surrender or sell the life insurance policy and distribute the cash proceeds to the beneficiaries in their respective shares. Or even the opportunity to distribute the life insurance policy itself in kind and let the now-adult-and-responsible beneficiaries own the policy outright themselves. (And the original grantor can even gift ongoing premiums to them as well if desired, without the hassle of trust accounting and Crummey notices!)

In other situations, the trustee may have been granted the discretion to make principal distributions from the trust (separate from or regardless of the age of the beneficiaries), which similarly makes it feasible for the trustee to either distribute the life insurance policy in kind (as part of the trust’s principal), or its cash proceeds after sale or surrender.

Ultimately, though, the feasibility of unwinding the trust by simply making distributions depends entirely on the exact terms of the trust, and what flexibility is (or is not) granted to the trustee. Since the trust is irrevocable, for better or worse these terms are typically “take it or leave it” based on how the trust was originally written. (Although some states may allow the ILIT to be "decanted" to a new trust for the same beneficiaries with more liberal distribution provisions.)

(Petition The Court To) Terminate The ILIT Altogether

If it’s not feasible under the terms of the trust to simply distribute its assets under the trustee’s discretion, the next option is to “force” a termination of the trust.

In practice, the exact rules and conditions under which a trust can be terminated will vary by the terms of the trust itself, and/or the state in which the ILIT is based (according to the terms of the trust).

In general, though, there are four common pathways to terminating an ILIT:

1) Trustee’s Power To Terminate. Some ILITs grant trustees the flexibility to make distributions of some or all of the trust’s assets. Others may grant the trustee the discretion to terminate the trust altogether. Although the ability to terminate an ILIT is not common and may be subject to additional restrictions (e.g., a special independent trustee who must affirm the decision to terminate), it is a possibility that merits reading the trust document to find out.

2) Trustee’s Power To Terminate A Small Trust. Because there are ongoing accounting and tax filing costs, sometimes along with trustee fees that must be paid to maintain a trust, it is common for most trust documents to have a provision that allows the trustee to terminate in the event that it is no longer “economical” to maintain the trust because it is too small. In the case of an ILIT with a cash value life insurance policy with material value, this may not be feasible, but an ILIT owning a term insurance policy with no cash value may fit the trust document’s “small trust” requirement, permitting a termination (and distributing the term insurance policy to the beneficiaries).

3) Consent Termination By Grantor And Beneficiaries. Although the exact rules vary by state, most states allow trusts to be terminated by the mutual consent of the trust beneficiaries and the trust’s original grantor. However, a consent termination requires the affirmation of all (current and even distant remainder) beneficiaries, which may be difficult or impossible if some of the beneficiaries are uncooperative or hard to reach, or simply are children who are minors and may not be able to give consent under state law (or may require a Guardian Ad Litem to do so). In addition, the beneficiaries must still receive whatever their respective shares would have been at the time (which can be messy with a large number of current and remainder beneficiaries). In addition, the grantor must give consent as well, which makes a consent termination impossible if the grantor either won’t cooperate or simply has already passed away and is no longer around to give consent.

4) Beneficiary-Directed Court Termination. The last (and typically most costly) pathway to terminate, when the beneficiaries wish to do so but the grantor will not (or cannot) consent, is to seek a court to agree to terminate (or otherwise modify) the trust. A court termination still requires all beneficiaries to agree to the termination, and the courts will generally not approve a termination that would otherwise violate a “material purpose” of the trust (e.g., if the ILIT was designed to pay for kids to go to college and some of the children haven’t gone to college yet, a termination will be denied as it would frustrate the material purpose of the trust to fund college) unless the beneficiaries can demonstrate other factors that “substantially outweigh” the original material purpose (e.g., the child who hasn’t gone to college yet is now disabled, won’t be going to college, and needs the money for special needs support now).

“Irrevocable” Life Insurance Trusts Don’t Have To Be Permanent As Needs Change

The bottom line, though, is simply to understand that even an “irrevocable” life insurance trust still has the potential to be changed if it’s no longer necessary. In the past, this may have occurred because of a change in family circumstances (e.g., a divorce and second marriage with new family needs), or because the life insurance policy itself was in trouble (e.g., insufficient premium payments or prior loans were causing the cash value to erode or the policy to implode). But now, in a world where estate tax exemptions have increased by more than 10X in 20 years (even after inflation), many ILITs of old are simply no longer necessary because they weren’t needed for asset protection or other purposes and were solely designed to prevent an estate tax exposure that has been made moot by the rise in the estate tax exemption anyway.

Nonetheless, the fact remains that an ILIT is still a binding trust, and the trustee of the ILIT has a fiduciary duty to its beneficiaries to honor the terms of the trust. Which means it’s absolutely crucial to both read the exact terms of the trust to determine what options may be available or not (from the trustee’s power to distribute, to the grantor’s ability to substitute), and for the trustee to still act in a manner that protects the interests of the trust first (e.g., not selling the policy back to the grantor for a less-than-market value, especially if a larger payment could have been received in a life settlement transaction?). And the options on the table may also vary from one state to the next, depending on the exact rules of the state (especially if seeking a consent or court-directed termination).

Nonetheless, the fact remains that changes can often be enacted for an ILIT, from “rescuing” the policy out of the ILIT to eliminate the trust, or winding down the ILIT altogether, and given the ongoing costs they may entail (from trustee’s fees to trust accounting and tax returns), to the administrative hassle (especially if ongoing premiums with Crummey notices are still occurring), in an era of drastically higher estate tax exemptions, it’s worth reviewing taking a fresh look at existing ILITs to determine if they really still need to exist (and if not, the best way to wind them down if feasible!).

So my question is, if the trust is unwound, what happens to the (whole life) insurance policy that was in it? As the grantor, I am sure I would have the blessing of the beneficiaries and the trustee to do this-is it possible?

I did this [terminated my ILIT] in 2019. It followed the “Terminate the ILIT Altogether” section in the article. In particular, I did number 3, i.e. “Consent Termination by Grantor and Beneficiaries“.

The law firm charged about $5k for the Termination Agreement. I felt I was getting ripped off, but decided I didn’t have much choice. I think it was unlikely to find a different reputable law firm that would do a good job and charge a lower fee. In fact, this is such a rare event, I don’t think I would know when a law firm did a good job or not.

The law firm that set up the ILIT [and my estate plan] 25 years ago is quite different from today. The lawyer [name partner] I had back then is now retired and the estate procedural lawyer is now deceased. I was transitioned to 2 newer lawyers, but I was not impressed with either.

Anyway, back to your question. After the termination agreement was signed and notarized by the beneficiaries and the grantor [me], the whole life policy was surrendered for its cash value. [The ILIT trustee is one of the beneficiaries.] The cash value proceeds were sent to a bank account in the ILIT’s name.

The ILIT paid about $10k in taxes [Form 1041] on the gains from the life insurance investments. Then the proceeds were distributed to the beneficiaries. This took a year. Some proceeds were distributed early to the beneficiaries, but the ILIT has to keep enough cash to pay the taxes, lawyer, and other expenses.

In my case, the beneficiaries [my kids] were happy to get the ILIT proceeds now instead of waiting until I died. The life insurance policy value was about 5 times the current cash value, but they could have waited a long time to collect on the policy.

And there is no guarantee they would get the policy value. I was no longer funding the ILIT, so the insurance premiums were being paid from the cash value of the policy. As I age, the premiums increase and would eventually rise faster than the cash value of the investments.

A financial planner called Nationwide Insurance as a courtesy [with me in the room] in 2014, and got some policy projections from Nationwide. That projection showed the cash value peaked when I was 67 and that the cash value went to 0 if I lived to 89. Now projections are just that and have assumptions which may not be accurate. But I thought it was in my kids’ best interests to get the money now. I still think it was the right decision.

The article was very educational

if the life ins proceeds are distributed to the beneficiaries while the insured is still alive are the proceeds taxable?

The article was very educational