Executive Summary

According to the Bureau of Labor Statistics, individuals with 4-year college degrees earn, on average, almost $25,000 more per year than those who never attended college, while those with professional degrees earn over $60,000 per year more than those who never attended college. Yet, given the steep price of a college education and the high amount of education-related debt that many individuals end out carrying for decades after they graduate, the decision to attend college and earn a degree is often questioned, especially by those who have to pay their own way through school.

For those who are fortunate enough to have parents and/or grandparents with the desire and means to pay some or all of the cost of a higher education, however, 529 plans offer a tax-efficient means of saving and paying for college expenses. Notably, distributions from 529 plans are tax- and penalty-free to the extent that they are used for the beneficiary’s qualifying education costs.

They also enjoy a number of unique features that set them apart from other tax-favored accounts, such as an IRA or 401(k), in that there are no annual contribution limits, but rather, a total maximum balance (which varies by state), after which additional contributions are prohibited. However, not only are those maximums quite substantial (currently ranging between $235,000 and $529,000), but individuals can “own” more than one 529 plan account, there is no limit to how large those tax-deferred accounts can grow and, from time to time, both the beneficiary (which can be only one person at any given time) and the account owner can generally be changed… often without any tax consequences. Moreover, in the event that multiple family members have qualified education expenses at the same time, partial transfers of 529 plan assets to a new beneficiary can be made.

Which means that individuals who have both the means and desire can ‘overfund’ one or more 529 plan accounts (either by making periodic contributions over many years or by a large lump sum contribution), effectively creating a “Dynasty 529 Plan”, which can be used to pay for qualified education expenses of not only their children and grandchildren (or any number of qualified members in their extended family), but potentially for multiple generations of family members to come!

Given the potential for perpetual tax-free growth, a Dynasty 529 plan can be an attractive strategy that affluent families can use in order to provide a legacy of education for their family. Advisors, however, must use special care when implementing such a strategy, as there are potential gift tax and Generation-Skipping Transfer Tax (GSTT) implications to navigate, maximum contribution limits to consider, and different features across states (where some states consider changes in ownership a distributable event). Meanwhile, there’s also a risk that any number of future events may derail a carefully crafted Dynasty 529 plan, including potential changes in 529 plan transfer rules, the possibility that Congress could decide to make a college education available to everyone at no cost, and the chance that future account owners may decide to simply cash out the plan for their own use (which could be mitigated, however, by creating a trust, which could serve as the account owner).

Ultimately, the key point is that, while the cost of higher education is more expensive than ever, a college degree is still one of the most reliable predictors of future income and wealth, and as such, helping family members obtain one is a common goal for individuals who understand the importance of education and are in a position to offer their help. And especially for affluent families, a Dynasty 529 plan can be an effective tool to capitalize on the significant and unique tax benefits and flexibility offered by 529 plans, making them an attractive option for providing legacy educational support for many generations to come.

In recent decades, costs to attend colleges and universities have skyrocketed and have easily outpaced inflation. Today, college is so expensive that many individuals give serious thought as to whether the cost of earning a degree will really be worth it in the long run.

Despite the high costs, though, obtaining a 4-year college degree is one of the best predictors of an individual’s income and capacity to build wealth. Notably, according to the most recent data available from the Bureau of Labor Statistics (2017), individuals with a bachelor’s degree earned, on average, nearly $25,000 more per year than those who had never attended college. Meanwhile, those who earned a professional degree earn, on average, more than $60,000 more per year than those who have never attended college.

Clearly, a good education can give a young person a major boost in life. As such, providing assistance with the costs associated with higher education is a primary goal for many parents and grandparents. Some individuals, however, hope to be able to help an even greater number of family members pay for the costs of obtaining a college education… potentially over many generations to come. In such situations, a strategy best described as a ‘Dynasty 529 Plan’ may offer the best opportunity to help such individuals achieve their goals in a cost-effective manner.

529 Plan Basics

When it comes to education planning, 529 accounts are generally considered one of the most, if not the most, tax-efficient ways of saving for future expenses. Contributions to such accounts receive no special tax break at the Federal level (though many states offer a deduction or credit for such contributions, particularly if made to an in-state-sponsored plan), but distributions, including earnings, that are used to pay for qualified education expenses are not subject to Federal income tax.

Qualified education expenses eligible for this tax-free growth treatment are generally expenses associated with higher education, such as tuition, fees, books, and supplies for college or graduate students, as well as room and board expenses for those enrolled at least half-time. In recent years, qualified education expenses have been expanded to also include other expenses, such as up to $10,000 of tuition expenses annually for K-12 education (via the Tax Cuts and Jobs Act) and up to $10,000 of lifetime qualified student debt (via the SECURE Act).

While 529 plan accounts share a number of similarities with other tax-favored vehicles (e.g., tax-deferred growth of investments within the account, tax-free distributions for qualified purposes, and the potential imposition of taxes and penalties if funds are used for something other than their intended purpose), 529 plan accounts are also subject to a number of unique rules.

For instance, unlike other tax-preferenced accounts, there is no annual contribution limit for 529 plans (though contributions in excess of the annual gift tax exclusion may require the filing of a gift tax return). Instead, contributions to such plans can continue to be made until the total balance in such plans has reached a state-specific total in the 529 plan.

The maximum balance up to which contributions can be made varies considerably between plans maintained by different states and is (at least in theory) tied to the expected cost of a beneficiary’s higher education costs. More than a dozen states have 529 plan limits of $500,000 or more, with California’s limit being the highest at a not-so-coincidental $529,000. Meanwhile, at the other end of the spectrum, several states still have cumulative limits of less than $300,000, including Georgia and Mississippi, which are tied for the lowest total allowable maximums at ‘just’ $235,000. Once a beneficiary’s account reaches the maximum amount specified by the plan, future contributions are prohibited, though the balance may continue to grow via earnings (potentially far beyond the original 529 plan limit).

Another unique aspect of 529 plan accounts is that there is no age at which amounts must begin to be distributed. Unlike most retirement accounts (other than the Roth IRA), there are no required minimum distributions beginning at age 72. Unlike Coverdell (Education) ESAs, funds don’t need to be distributed when the beneficiary reaches age 30. And unlike HSAs, after death, a new non-spouse family member can continue to receive favorable tax treatment indefinitely!

To that end, 529 plan accounts offer substantial flexibility both in terms of for whom the funds in the account may be used, as well as who can have control over those funds. More specifically, both the “owner” and the “beneficiary” – the individual for whom the money in the 529 account may be used for qualified education expenses – of a 529 plan account can generally be changed, and often without any tax consequences.

Rules For Changing 529 Plan Beneficiaries

A 529 plan account is only allowed to have one beneficiary at any given time. However, the beneficiary of a 529 plan can be changed to another family member or, when it makes sense, to a trust.

Accordingly, although a 529 plan is designed to save for the education costs of a single individual (as distributions from 529 plans are generally only tax-free to the extent that they are used to pay for that beneficiary’s qualified education expenses), that individual does not need to be the person for whom contributions into a 529 were initially made. Furthermore, by utilizing the ability to change the beneficiary, a single 529 plan account can effectively be used to cover the educational expenses of multiple individuals over time.

Example#1: Doug was born in 1997, and almost immediately, his parents created a 529 plan account for his benefit, with his mother named as the owner, and began contributing to it regularly. Six years later, Doug’s brother, Larry, was born.

Although the brothers’ parents planned to help both children pay for their undergraduate education, to keep things simple, they decided to do so using one account. As such, they simply doubled their ongoing contributions to the account established for Doug.

Earlier this year, Doug completed his undergraduate degree. Larry, meanwhile, is on pace to enter college next fall. While the funds in Doug’s 529 plan account cannot be used to pay for Larry’s education, this is of minimal concern.

The boys’ mother, as owner of the account, can simply change the beneficiary of the account from Doug to Larry. Once the change of beneficiary is complete, any distributions from the account used to pay for Doug’s qualified education expenses will be tax- and penalty-free!

In fact, given this beneficiary-change opportunity, expecting parents who are eager to start saving for their unborn children can establish accounts naming themselves as both account owner and beneficiary, and once their children are born, can re-designate the newborn child as the account beneficiary for their future college use.

Example #2: Katy is newly married and is hoping to have children in the next few years. She has already decided that helping her children pay for college one day is an important goal, and she understands the importance of starting to save for this goal as early as possible.

Accordingly, Katy decides to establish a 529 plan account naming herself as both the owner and the beneficiary. She subsequently makes a $5,000 initial contribution and continues to make $5,000 contributions annually for four years, until the birth of her first child. At that time, Katy can transfer the balance of the 529 plan account for which she is named the beneficiary to a new 529 plan account for which her child is named as the beneficiary.

The ability to use a single 529 plan account to support the education of multiple individuals is further bolstered both by the fact that there is no limit to the number of times that a beneficiary can be changed, and by the fairly broad definition of “family member” used to determine the pool of potential ‘new’ beneficiaries. More specifically, IRC Section 529(e)(2) stipulates that the beneficiary of a 529 plan account may be changed to the current beneficiary’s:

- Spouse

- Child, or the spouse of such child

- Brother, sister, stepbrother, stepsister, or the spouse of any such person

- Mother, father, the ancestor of either, or the spouse of any such person

- Stepfather, stepmother, or the spouse of either such person

- Nephew, niece, or the spouse of either such person

- Aunt, Uncle, or the spouse of either such person

- Son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, sister-in-law, or the spouse of any such person

- First cousin

In the event that a 529 plan beneficiary is changed to an individual who is not an eligible family member, as listed above, the change will be treated as a distribution of the 529 plan assets. Both ordinary income tax, and a 10% penalty, will generally be owed for any earnings.

Fortunately, from an operational perspective, changing the beneficiary of a 529 plan account is generally a relatively easy process. Many programs allow the owner of a 529 plan account to update the beneficiary online by providing certain ‘basic’ information, such as the new beneficiary’s name and Social Security number, as well as investment allocation instructions. In situations where the beneficiary cannot be updated online, the change can usually be made by simply mailing or faxing in a standard form provided by the 529 plan administrator.

Income And Gift Tax Consequences Of Changing The Beneficiary Of A 529 Plan

If the owner of a 529 plan account decides to change the beneficiary to any of the individuals described above, there are no penalties or income tax consequences. Transfer tax (e.g., gift tax, generation-skipping transfer tax) consequences, however, can be a bit more nuanced.

Gift Tax Consequences Of Changing A 529 Plan Beneficiary

Despite the fact that IRC Section 529(c)(2)(A)(i) treats 529 plan contributions as completed gifts to a beneficiary (and thus, as belonging to that beneficiary), the owner of a 529 plan account (to whom the funds don’t actually belong!) can switch beneficiaries to an eligible family member of the same generation as the current beneficiary without any gift tax consequences!

If, on the other hand, the new 529 plan beneficiary is an eligible family member who is one or more generations below the current beneficiary, then while there won’t be any income tax consequences as a result of the change, the value of the assets transferred to the new beneficiary is treated as a taxable gift. Thus, any amount that is in excess of the annual gift tax exemption ($15,000 for 2020), which is transferred from the 529 plan account of one beneficiary to another beneficiary one or more generations ‘younger’, will necessitate the filing of a gift tax.

But who should file the gift tax? Who is the donor!?

Interestingly, despite the fact that 529 plans have now been around for more than two decades, this is a question for which the IRS has never finalized its answer.

The Internal Revenue Code is clear that a contribution to a 529 plan account is a completed gift. This would, naturally, lead one to assume that the donor for a subsequent 529 beneficiary change would have to be the original 529 plan beneficiary. However, while the funds in a 529 plan account technically belong to the beneficiary, it’s the owner of the account who can decide to change the beneficiary and effectuate the resulting transfer. That makes it sound like the owner should be the donor for the purpose of filing and reporting the transfer for gift tax purposes!

Alas, while a final verdict has yet to be delivered, Proposed Treasury Regulations from 1998 give us our best glimpse into the IRS’s thoughts. And those Proposed Regulations say it’s the beneficiary who should be considered the donor!

More specifically, Proposed Treasury Regulation 1.529-5(b)(3)(ii) states, in part:

A transfer which occurs by reason of a change in the designated beneficiary, or a rollover of credits or account balances from the account of one beneficiary to the account of another beneficiary, will be treated as a taxable gift by the old beneficiary to the new beneficiary if the new beneficiary is assigned to a lower generation than the old beneficiary, as defined in section 2651, regardless of whether the new beneficiary is a member of the family of the old beneficiary. [Emphasis added]

Thus, absent further guidance since the 1998 original, it is reasonable to assume that the IRS’s position in the Proposed Regulations remains the same, and it is the ‘old’ beneficiary of such a plan who should be considered the donor of a gift when a new beneficiary (one or more generations younger) is named.

Example #3: Chip, a 31-year-old newly-minted father, is the beneficiary of a 529 plan account that his mother opened for him in 2000. His mother has served as the account owner ever since. Believing Chip’s academic days to be behind him at this point, Chip’s mother changes the beneficiary of the 529 plan account, which has a current value of $50,000, from Chip to Chip’s daughter.

Since Chip’s daughter is (obviously!) one generation below Chip, he will be treated as having made a $50,000 gift to her… despite the fact that Chip, himself, never actually had control over the $50,000, nor directed the gift!

It may not seem fair, but that’s just the way it is. (Besides, whoever said taxes were always fair in the first place?)

Generation-Skipping Transfer Tax Consequences Of Changing A 529 Plan Beneficiary

In addition to the gift tax, changes to a 529 plan beneficiary can also result in the application of the Generation-Skipping Transfer Tax (GSTT). More specifically, if the beneficiary of a 529 plan account is changed to an eligible family member who is more than one generation younger than the previous beneficiary, the transfer will be subject to GSTT.

The GSTT is an additional transfer tax imposed in addition to the gift (or estate) tax. The annual gift tax exclusion does, however, apply to the GSTT, and individuals also have a lifetime GSTT exclusion amount ($11.58 million in 2020). As such, few changes in 529 plan beneficiaries result in the actual payment of GSTT taxes (though for affluent families, the use of the lifetime GSTT exclusion amount could potentially result in a GSTT impact in the future if subsequent generation-skipping transfers are made during life or at death).

Rules For Changing 529 Plan Owners

When it comes to 529 plan accounts, there are two key individuals: the beneficiary of the account, as discussed above, and the owner of the 529 plan account. The owner and the beneficiary can be the same individual, but oftentimes, the owner and beneficiary ‘spots’ are occupied by different persons, such as when a parent is the owner of a 529 plan account established for a child.

Of course, as noted above, when it comes to 529 plan accounts, the “owner” of the account isn’t really an owner in the same way that we normally think of such an individual. The funds in the account don’t really belong to the owner. They belong to the beneficiary of the account, and are generally included in the beneficiary’s estate. The owner, on the other hand, is best viewed as the controller of funds belonging to the beneficiary.

Nerd Note:

In general, individuals are able to give up to the annual gift tax exclusion amount $15,000 in 2020) to an individual without incurring gift tax or ‘eating into’ their lifetime exclusion amount. An exception to this rule, however, allows an individual to frontload (sometimes referred to as “superfunding” or “gift-tax-averaging”) a 529 plan account with up to five years’ worth of annual exclusion gifts, also without ‘eating into’ any lifetime exclusion amount. While the entire contribution of up to five times the annual exclusion amount can be made at once, only one years’ annual gift tax exclusion amount is removed from the donor’s estate each year. Thus, if an individual contributes 5 x $15,000 = $75,000 to another person’s 529 plan account in 2020, but dies during the fourth year, $15,000 of the original gift will continue to be treated as part of the donor’s estate (as the owner only actually lived long enough to fulfill 4 x $15,000 = $60,000 of the 5-year-averaged gift, and thus still retains the 5th year’s $15,000 for estate tax purposes).

Like the beneficiary of a 529 plan account, the owner of such an account can also generally be changed.

Why “generally?”

In short, different plans have different policies regarding changes in ownership. Some plans, for instance, will only allow a change of ownership upon death or incapacity of the current owner. Nevertheless, and despite the potential for variation, the overwhelming majority of 529 plans allow changes in ownership to be made relatively easily. A similar majority of plans also allows for any U.S. resident who has reached the age of majority to be named as the new owner of the 529 plan account. Family relationships need not exist between the former and new owner (as they do to avoid income tax consequences for a change between former and new beneficiary).

Changes To The Owner Of A 529 Plan Account Are Unlikely To Result In Income And/Or Transfer (Gift/GST) Tax Consequences

Despite the flexibility of 529 plans to permit a change in ownership in addition to a change in beneficiary, the Internal Revenue Code and subsequent IRS notices and Treasury regulations provide substantive guidance on the consequences of a change in beneficiary, while the IRS has never addressed the income tax consequences of a change in ownership of a 529 plan account. At all. Ever. Anywhere.

So, what then, is the rule? (If only based on general principles of tax law?)

From a practical perspective, it essentially comes down to understanding how the specific 529 plan account, for which a change in ownership is sought, views the change in ownership. In most instances, plans will process such changes without reporting a distribution to the IRS. In such instances, it is widely accepted that the IRS will not challenge the transaction.

By contrast, a limited number of 529 plan providers will treat a change in ownership as a distributable event and will issue Form 1099 to the owner. And while a taxpayer may be able to try and report such a distribution as a tax-free rollover, or simply to challenge the 529 plan provider’s interpretation of the rules, fighting a 1099 is often an uphill battle.

Thankfully, on the gift tax and GSTT side of the equation, there is at least a little more to go on. While, once again, there has been no formal guidance issued by the IRS on the subject on which taxpayers can rely, the Proposed Treasury Regulations strongly hint that the IRS views the transfer tax question through the eyes of the beneficiary. As such, it seems reasonable to conclude that there should be no transfer tax consequences upon a change in 529 plan account ownership (as long as the beneficiary themselves remains unchanged).

Introducing The ‘Family Dynasty 529 Plan’

The significant flexibilities afforded by the ability to (generally) change both the 529 plan account owner and beneficiary can be used to great advantage by those looking to provide family members with tax-advantaged education assistance. In fact, individuals with both the desire and resources to provide multiple family members – and perhaps multiple generations of family members – the means to pay for their education can utilize the 529 plan rules to create what one might call a “Family Dynasty 529 Plan”.

So, what is the “Family Dynasty 529 Plan”?

Simply put, it’s the idea of ‘overfunding’ one or more 529 plan accounts that, between contributions and earnings, can be used to pay for multiple – or better yet, many generations of – family members’ future education expenses. Depending upon the situation (and the ‘creator(s)’ available financial resources), this ‘overfunding’ could take place with periodic contributions over many years, or via a large contribution – or perhaps multiple large contributions – in just a single year.

Over time, as (eligible) family members seek education for which there would be qualified education costs, the beneficiary of the 529 plan account could be changed to allow the funds to be used for the benefit of that individual. In the event that multiple family members have qualified education expenses at the same time, partial transfers of 529 plan assets to a new beneficiary can be made.

Example #4a: Greg and Mandy, each 55 years old, are married and have two children. The couple is financially secure, has already saved enough in 529 plan accounts for each child to put them both through college, and has the means to contribute annually towards other goals.

Education has always been important to Greg and Mandy. As such, they are considering options to provide for education expenses for future generations. While they have no grandchildren yet, they hope for and anticipate becoming grandparents one day.

After analyzing various options, Greg and Mandy ultimately decide to utilize the Dynasty 529 Plan to accomplish their goals. In an effort to minimize future gift tax and/or GSTT issues, the couple continues to fund the two 529 plan accounts that they own and for which their children are named as beneficiary (note: compared to creating new 529 plan accounts for which Greg and/or Mandy were named as beneficiary, naming their children as beneficiaries minimizes future transfer taxes by accumulating the 529 plan funds at one generation beneath Greg and/or Mandy right from the start).

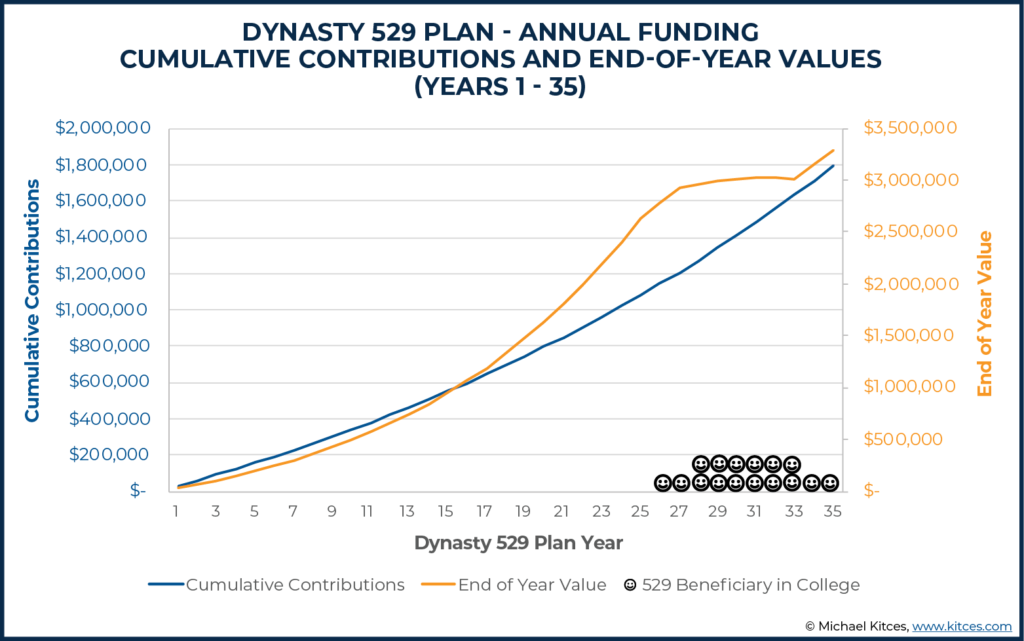

Suppose, for instance, that Greg and Mandy continue to make gifts annually to the existing 529 plan accounts in an amount equal to the annual gift tax exclusion ($15,000 to each 529 plan account for 2020). Further, suppose that the couple continues to make contributions equal to the annual gift tax exclusion to two 529 plans each year, for 35 years, until Mandy, the longer survivor, dies as age 90.

Let us further imagine that each of Greg and Mandy’s children has two children of their own and that all four grandchildren go to college for four years, in the years illustrated in the chart below. If we assume that the cost of education, per student, per year, is $30,000 in today’s dollars, and is inflated at 5% annually, we can see that Greg and Mandy will have accumulated more than enough money to pay for their four grandchildren’s college education. In fact, after the last grandchild graduates, there would still be more than $3 million in 529 plan accounts! All of which grew entirely tax-free for education purposes!

Nerd Note:

Annual costs for higher education vary dramatically, based on a variety of factors, including whether the school is public or private, and, if public, whether the student will receive the in-state or the out-of-state rate. According to data compiled by education.org, the average ‘sticker price’ (no scholarships or other financial aid received) of tuition, fees, room, and board was $30,500 for the 2019-2020 academic year.

But why stop there?

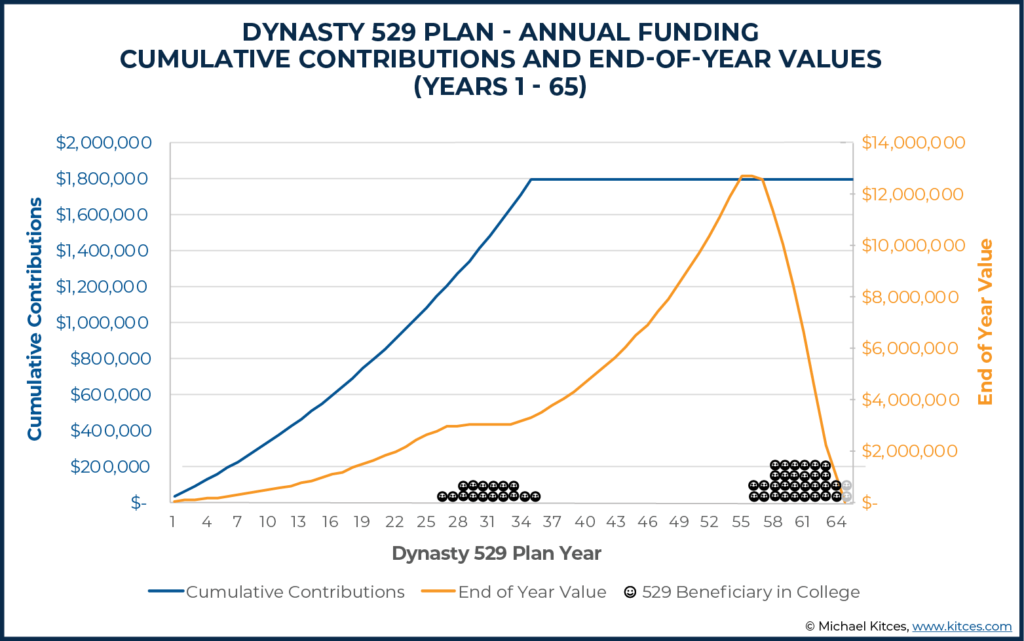

Let’s now imagine that each of Greg and Mandy’s grandchildren has two children of their own and that each of those great-grandchildren goes to college for four years. Amazingly, as illustrated in the chart below, the couple will have saved enough money during their lifetime to fund nearly all of their eight great-grandchildren’s college educations as well (in the final year of the 529 Dynasty plan shown below, when the last two great-grandchildren are in college, there is a shortfall of roughly 13% of that year’s total education costs).

For those with the means and desire, forgoing annual smaller contributions in lieu of a single year of large contributions at the start can also be an attractive option.

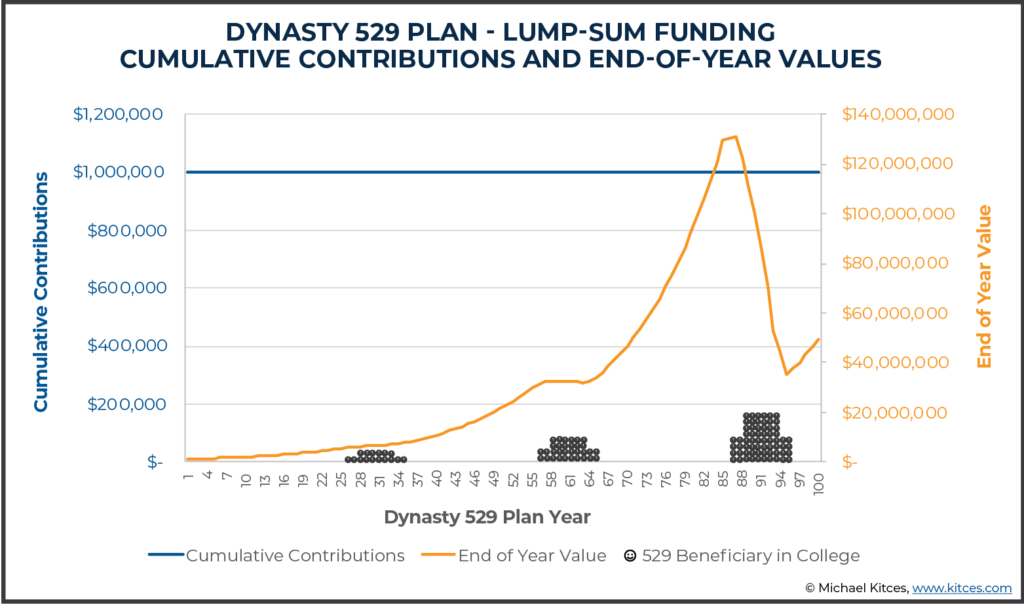

Example #4b: John and Babs, each 55 years old, are married and have two children. The couple is financially secure, has already saved enough in 529 plan accounts for each child to put them both through college, and recently inherited $1 million of life insurance death benefits.

Providing education for future generations has always been an important legacy goal for John and Babs, and after considering various options, they decide to utilize the Dynasty 529 Plan by making a $500,000 contribution to each of their two 529 plans already established, with Babs as the owner and their two children as beneficiaries. (Notably, this contribution is well above the annual gift tax limit, but John and Babs have decided that their $11.58M lifetime gift tax exclusion is more than enough to absorb these Dynasty 529 plan gifts.)

As illustrated in the chart below, John and Babs have four grandchildren, whose college educations are easily covered by the estimated 529 plan balances at the time. In fact, if each of John and Babs’ four grandchildren had two children of their own, and then each of those eight great-grandchildren had two children of their own, all four grandchildren, eight great-grandchildren, and 16 great-great-grandchildren’s education’s would be covered by the Dynasty 529 Plan… and with ‘room’ to spare! And all that growth is achieved on a tax-free basis!

Implementing The Dynasty 529 Plan

The flexibility of 529 plan accounts, combined with the horsepower of what is essentially perpetual tax-free growth (when distributions are used for qualified education expenses), makes the Dynasty 529 Plan both possible, and a compelling option for affluent families who wish to provide a legacy of education. But theory is one thing, and implementation is another.

To that end, consideration should be given to the following issues when creating, implementing, and managing a Dynasty 529 Plan:

- Be mindful to which generation contributions are made (especially initially). The Dynasty 529 Plan is designed to be able to provide for multiple generations of students’ educations. To accomplish this, funds must be passed down through generations, resulting in potential gift tax consequences. Accordingly, to the extent that total annual contributions to the account of any individual do not exceed the annual gift tax exclusion (or, potentially, the 5-year superfunding option), preference should generally be given to making contributions to 529 plans benefiting younger generations.

In the event that desired contributions will exceed the annual gift tax exclusion, the flexibility of changing 529 plan beneficiaries can be utilized. For instance, contributions can be made to the account of a niece or nephew (in addition to the donor’s own children accounts, and all of the same generation), and later transferred from those niece/nephew accounts to the accounts of the donor’s (and likely the account owner’s) own children (for whom contributions equal to the annual gift tax exclusion would have already been made). Since the transfer would be among children of the same generation, there would be no gift tax consequences to spread out the initial contributions amongst other same-generation family members and then consolidate them to a smaller number of family beneficiaries later.

Nerd Note:

In order to avoid potential step-transaction concerns, whereby the gift to a 529 plan account for the benefit of the niece/nephew is later transferred to a 529 plan account for the benefit of the donor’s child, it would be advisable to allow substantial time – perhaps several years – to elapse between the two transactions.

- Be mindful of maximum contribution limits. If additional 529 plan contributions are desired in order to fund a Dynasty 529 Plan, but contributions to a particular 529 plan account are no longer allowed because the account value has reached the maximum amount allowed by the particular state’s plan, there are multiple options. As while accounts already at or above the in-state maximum 529 plan limit can still continue to grow on a tax-preferenced basis; only additional contributions are limited, and are only limited for that state’s plan and that Thus, one option is to create an account under the same or different plan for another eligible family member (i.e., a different beneficiary). Alternatively, if desired, an individual could establish and contribute to another 529 plan account in a different state, but for the same beneficiary. Perhaps somewhat oddly, accounts in one state do not impact the ability to contribute to 529 plan accounts of the same beneficiary in another state.

- Pick a plan that has favorable provisions. Normally, when choosing a 529 plan, most individuals have a strong preference for their in-state plan, especially if it offers a state income tax break. Investment options and expenses are generally given secondary consideration. And those factors –state income tax benefits, and investment options and expenses – are usually about it.

Given the nature of the Dynasty 529 Plan, however, additional plan features should be considered. For example, given the likelihood (in fact, near certainty) that there will be several account owners throughout the life of the plan, it is important to select a plan that does not view changes in ownership as a distributable event. In addition, given the volume of potential ownership and beneficiary changes that may occur over time, consideration should be given to the ease that each of these changes can be made (e.g., online versus requiring physical paperwork). And although these administrative factors may themselves change substantially over multiple decades, when situations arise that make an alternative 529 plan a better option for the Dynasty 529 Plan, the owner can always move funds from the current 529 plan to the new 529 plan without changing the beneficiary. In other words, when another plan becomes more favorable, the Dynasty 529 Plan, as a whole, can be ‘picked up’ and moved to the new state’s more-desirable plan.

Risks And Challenges To Implementing The ‘Dynasty 529 Plan’

No planning strategy is perfect, and the Dynasty 529 Plan is no exception. While there are clearly immense benefits that can be enjoyed through its successful implementation and maintenance, there are also a number of challenges and risks associated with the plan, some of which can be influenced by the Dynasty 529 Plan creator or subsequent account owners.

Congress Could Change The 529 Plan Laws On Transfers

One of the inherent challenges of tax planning is that the rules of the game are constantly being changed. To that end, there is no guarantee that the 529 plan rules will remain as flexible as they are today. For example, future legislation could clamp down on the ability to change beneficiaries without incurring income tax and/or a penalty.

Alternatively, Congress could simply place a limit on either the number of times the beneficiary of a 529 plan can be named/changed. Or it could restrict the ability to change the beneficiary to an individual of a younger generation. In fact, there’s nothing preventing Congress from simply eliminating 529 plans altogether, or from creating another (hopefully superior?) savings option.

Any of these possible changes could spell trouble for a Dynasty 529 Plan in the future. And while it seems unlikely that the 529 plan rules will become more restrictive anytime soon (as if anything, Congress has been expanding the rules in recent years), with a Dynasty 529 Plan conceivably lasting for half of a century or more; it’s a long time to hope Congress doesn’t do something to change it. Though notably, in general most changes would likely just curtail future beneficiary changes to keep passing the Dynasty 529 Plan down the family line, but wouldn’t necessarily ‘blow up’ the already-accumulated tax-free growth (at least to the extent it could be utilized for then-existing family members on qualified education expenses).

Higher Education Could Be Made Available To Everyone At No Cost

A second potential ‘problem’ for the Dynasty 529 plan is that higher education could one day be made available to all students at no charge. Notably, several presidential candidates in the most recent election cycle called for various amounts of college education to be made available to some, many, or all students at no cost.

Of course, even if such accommodations were eventually made available, they would almost certainly only cover education expenses at public universities and colleges. As such, the 529 plan assets might still have a use in paying for private universities and/or post-graduate studies, or at least for the room-and-board expenses associated with college (as while college tuition may become free, it’s less clear what would happen to still-529-plan-eligible room-and-board expenses in such a scenario).

However, if the primary goal of the Dynasty 529 Plan creator was to provide for their heirs’ college educations, and higher education options are made available at no cost, in retrospect, the creator may have preferred to use their financial resources in a different manner. Unfortunately, if such a change occurs, by the time it does (and if the plan’s creators are even still alive), it may be too late to reverse course without, at a minimum, incurring substantial income tax consequences on what by then may be years or even decades of cumulative growth.

On the other hand, it’s worth noting that tax-deferred compounding growth is still valuable in its own rights. In fact, if the Dynasty 529 Plan grows long enough on a tax-efficient basis, it’s quite possible that its value will still be similar-or-better than ‘traditional’ investments, even with the ordinary income tax (and 10% penalty) attached, thanks to the avoidance of the ongoing tax drag of investment, dividends, and capital gains that otherwise would have occurred along the way.

The Dynasty 529 Plan Sounds Great, But Can You Really Enforce It?

A third significant potential issue with the Dynasty 529 Plan is actually making sure it is appropriately carried out by future generations of account owners. Future account owners, for instance, might decide to forgo the intended use of the funds, in favor of simply non-qualified distributions to themselves for their own other wishes.

Example #5: Donald’s father, the creator of a Dynasty 529 Plan, recently passed away. Prior to his death, Donald’s father was the owner of several 529 plans, with a cumulative balance of over $400,000, and of which Donald’s children are named as beneficiaries. Upon Donald’s father’s death, Donald, who has long desired to be the owner of a Lamborghini Aventador S (MSRP $417,826), becomes the successor owner of the accounts.

While Donald is aware of his father’s intentions, he has long believed that children should pay for their own education… plus, he really wants the Lamborghini! Thus, while he is not the beneficiary of any of the 529 plan funds, as the current owner, Donald can force a distribution from the plans to himself. Donald will, of course, owe both income tax and a 10% penalty on any distributed earnings, but from his point of view, the after-tax amount of the distribution is all ‘found money’ that he never anticipated having anyway (and it’s still enough for the downpayment on his Lamborghini!).

Accordingly, Donald empties the various 529 plan accounts and uses the proceeds to help him purchase his Lamborghini of choice.

The Dynasty 529 Plan is dead.

Thankfully, this is one issue that can potentially be resolved with additional planning. More specifically, a trust can be drafted to serve as the owner (or the successor owner) of the Dynasty 529 Plan accounts. By doing so, the creator of the plan can ensure continuity of ownership beyond their own life. Additionally, future trustees will be bound by a Fiduciary duty to adhere to the trust’s terms, which can include language to protect the 529 plan funds from creditors, as well as to ensure that 529 plan funds are used only for higher education purposes.

It’s important to note, though, that, like many other aspects of 529 plans, the rules surrounding trust ownership of 529 plans are not well fleshed out. This can lead to different rules applying to different plans, such as who can contribute to the trust-owned 529 plan account. Accordingly, Dynasty 529 Plan creators seeking to use a trust as a current or future owner of 529 plan accounts should investigate any plan rules or restrictions that might impact that choice.

Trust ownership of 529 plan accounts can also create other operational challenges, depending upon how the trust is drafted. A trust, for example, may have multiple trustees that may be required to sign off on any distributions. Given that a Dynasty 529 Plan may require ongoing changes in beneficiaries, as well as distributions at regular intervals, this could prove problematic from a practical/administrative perspective. To that end, while a single trust may be established for multiple beneficiaries and may be the owner of one or more 529 plan accounts, a 529 plan account is still restricted to having only one beneficiary at a time.

Obtaining a degree from a quality institution of higher education is, for many individuals, one of the most expensive investments they will make over a lifetime. Despite the high costs, however, the attainment of a college-or-higher degree is one of the best predictors of future income and wealth.

Perhaps not surprisingly then, helping provide for the education of family members is often an important goal for individuals who understand the value of a good education and have the means to help provide it. There are, of course, many ways for individuals to help accomplish such goals, from directly paying for the costs of higher education for family members as they are incurred, to establishing so-called education trusts.

For those looking to provide multigenerational support for higher education, another approach that should be considered is the Dynasty 529 Plan. While tax-free distributions of earnings from 529 plan accounts are only available to the extent that such distributions are used to pay for the qualified education expenses of the sole account beneficiary, the Dynasty 529 plan capitalizes on the ability to change that beneficiary to a broad array of family members, with little to no tax consequence.

The Plan further benefits from the 529 plan rules, which provide invested funds the unique ability to continue growing tax free in perpetuity… even after the death of the owner (and/or beneficiary)! Together, these benefits allow for the funds inside just a single 529 plan account to be used to pay for the education expenses of a potentially substantial number of family members, and over multiple generations.

Of course, like any planning strategy, the Dynasty 529 Plan is not without its risks, which must be carefully considered before engaging in such an approach. Nevertheless, the bottom line remains that the significant and unique tax benefits and flexibility offered by 529 plans make them an attractive option for providing for multigenerational education support.

A reminder that 529 plans are not just state-run. There also is Private College 529, a prepaid tuition 529 plan operated by a group of hundreds of private colleges coast-to-coast.

So you mentioned that you can do a partial transfer of 529s assets to a different beneficiary can be made, I was wondering if you could do a partial transfer of assets from an account with one owner (Grandparent) to another (Parent) as well (ideally after FAFSA is submitted each year)?

Glad to see you guys covering this! We covered this strategy in the Certified College Financial Consultant (CCFC) education course a few years ago and it is relevant now more than ever for advisors to view 529 plans as a great multi-generational legacy planning tool.

I’m hoping you can clarify what happens with taxes at death (or before) with a beneficiary change that has been stepwise. Ie, a grandmother opens account for her grandchild, Sarah. Upon her death (or whenever the account owner chooses), Sarah’s beneficiary status is changed to HER son, Bob. Sarah passed away with $20 million and therefore surpasses the gift and generation skipping tax limits. I assume the GIFT/estate tax applies, but does the Generation-skipping-tax also get applied because the money originally came from Sarah’s grandmother? Or since it is passed to one generation lower than the CURRENT beneficiary, is the GST avoided?

Thanks!

Could distributions also be used for private K-12 schools tax free? I thought the law was changed to accommodate distributions for this as well.

I’m still not clear on how this is intergenerational. If let’s say you named your child as beneficiary to the 529, you die and they become the account owners. Then your child wants to use the unused funds for their child, ultimately your child would need to change the beneficiaries on the unused funds to their child. Wouldn’t that constitute a gift and potentially gift taxes? How can you possibly make it intergenerational when you end up needing to use the gift tax and/or GSTT exemptions? Or when you pay for the the next gen’s college, does that transfer not trigger gift tax or GSTT since it is being used for higher education?

Hi Brian – You don’t want to change the beneficiary on the full account balance to the next generation. It seems like you need to gift the $15k gifting limit each year to slowly move it to the next generation. This keeps it under the gifting and GSTT limits.

Hi read the blog it found helpful Thank you.

Thanks for the awesome article.

https://startupindias.com/

Thanks for the helpful article. Great use of the tax code to protect hard earned wealth from taxing authority confiscation / transfer payments.

• Changing the beneficiary of a 529 plan account to an eligible individual does not result in any income tax consequences or penalties.

• If the new beneficiary is one or more generations below the current beneficiary and an eligible family member, then the value of assets transferred to the new beneficiary is treated as a taxable gift. Any amount in excess of the annual gift tax exemption (17k for 2023) will necessitate the filing of a gift tax return.

• Changes to a 529 plan beneficiary can also result in the application of the Generation-Skipping Transfer Tax (GSTT) if the new beneficiary is more than one generation below the previous beneficiary.

• The 529 plan may be subject to state inheritance tax, with the exception of Class A relationships (which includes grandparents, parents, spouses, descendants or stepchildren) in New Jersey.

• A successor custodian can be appointed to avoid probate, but they will still have to open a new 529 plan and transfer the assets. The new plan will be subject to gift and GSTT taxes if the amount transferred is greater than the annual gift tax exemption.

• A trust cannot own a 529 plan and avoid the GSTT.

I’m trying to gather how to execute this strategy – can you provide clarity? Listed below is “transfer at 17k a pop” if the asset is required to be transferred – how can that be done?

@Rachel:

Hi! Thanks for that info! More informative than anyone else writing about dynasty 529s!

Did you move further along with this?

Any other gotcha's to be aware of?

I had started 529s for my kids with this transfer to unborn grandkids idea years ago, not knowing of the 'dynasty' nickname, but thinking it was a cheaper way to get money to grandkids than a 'trust'? (but also not knowing about GSTT and gift tax). I wonder if my ignorance was a mistake (which way is cheaper?)

Our kids are grown, married & almost married so the passing down of the accounts will be happening at some point.

Couldn't you use a dynasty trust to own the 529? That would leave the trust document to manage the accounts and what can come out. they can also establish an account as a beneficiary reaches college to move money to in order to pay out.

I had a question about a change of beneficiary and superfunding. If I change the beneficiary of an account to a younger generation, is this considered a contribution for the purposes of 5-year superfunding? To make this tangible, let's say I have $100,000 in a 529 and change the beneficiary from myself to my daughter. Can I fill out a form 709 and consider that gift over 5 years?