Executive Summary

New client growth is the lifeblood of financial planning firms and there are myriad strategies for attracting qualified prospects, but many of these come with a hard-dollar or time cost for the firm. Which is why many advisors seek to leverage client referrals, where their clients refer family members, friends, or colleagues to the advisor. At the same time, asking clients to make referrals (and having the referred individual actually reach out to the advisor) can be challenging. With this in mind, advisors can use several ways to ask for referrals and tactics to increase the chances that their clients will make more successful ones.

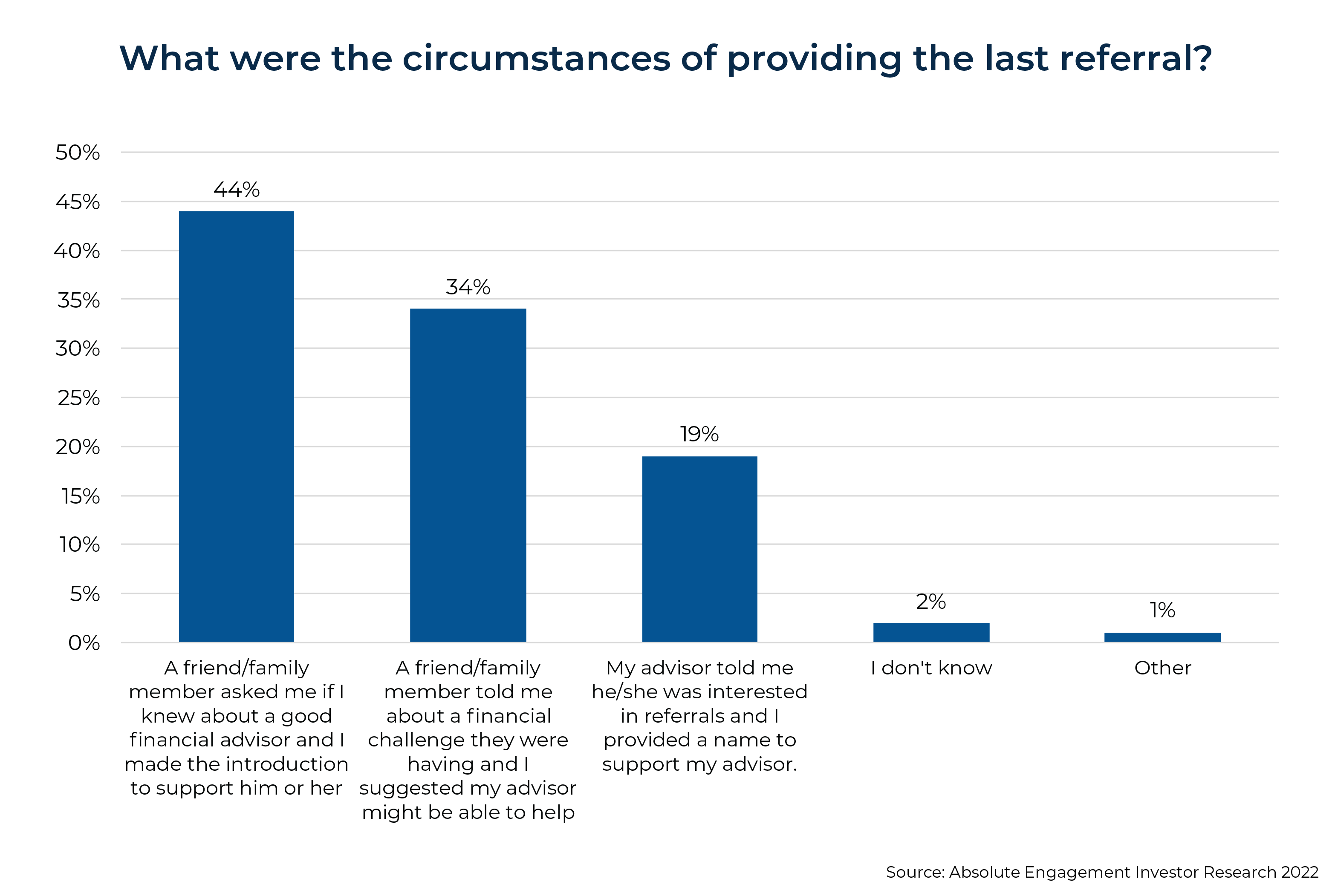

Giving and receiving referrals can be thought of as a pro-social, virtuous loop, where both the giver and receiver of the referral receive benefits from the exchange, where giving a referral can help someone who needs it and at the same time feels good to provide help. This suggests that in addition to the advisor receiving referrals, clients, too, can benefit from the positive feedback of giving referrals and the emotional satisfaction of helping their friends and family (as research has found that financial planning clients most commonly refer friends or family members who either asked for a recommendation for an advisor or told them about a financial challenge they were having, leading the client to suggest their advisor might be able to help).

Importantly, asking a client for referrals won't guarantee that the referral will actually contact the advisor. For instance, research has found that while 25% to 35% of financial planning clients make referrals, advisors only meet referrals from 3% to 5% of their client base. This may be because the recipient didn't request a referral in the first place or because the client provided an advisor's contact information without explaining how they may have benefited from working with the advisor or why the advisor might be able to help the recipient.

One way an advisor can improve the outcomes of client referrals is to ask their clients 'referral story' questions, which can help clients articulate to potential referral recipients their own personal connection to financial planning, their experience with their advisor, and the benefits of their work together. By asking clients to identify a specific issue they worked on with the advisor, the steps they took to address the issue, and the greatest impact they got from solving it, clients can start crafting their own referral stories that can provide more context to the recipients of their referrals. Advisors can also improve their referral outcomes by asking for feedback – even framing it as asking for advice – from their clients (e.g., asking for advice on how they might go about meeting and working with others like them). And by doing some research on their referrals, advisors can ask for introductions to only those who they believe would make good clients.

Ultimately, the key point is that while client referrals can be one of the most cost-effective methods for attracting prospective clients, successful referrals do not necessarily come automatically. But by helping clients craft their own referral story and enlisting their support in generating referrals, advisors can increase the chances of getting more referrals – and introductions to the best referrals – going forward!

When it comes to asking for referrals from clients, deciding how to frame the question most effectively is often top of mind for many advisors. Advisors commonly ask about the best way to ask clients for referrals, about the psychology of referrals, and if there are any silver-bullet referral strategies. While there are no silver bullets, research on referrals, especially in the context of financial planning, has provided a few effective ways for advisors to ask for referrals and to develop a referral strategy.

Giving Referrals Is A Natural Pro-Social Behavior (Even In Financial Planning)

Most of us have probably given referrals to others seeking a recommendation for something at some point. Humans are social creatures, and our general nature is to accept and engage in pro-social behavior, which, at its core, is being friendly and helpful. And that is often what a referral involves: when someone offers a reference, they usually do so with kind intent to help another. We often do this simply to help others who need or ask for referrals, but it also benefits the person giving the referral as well, because it can bring them personal satisfaction from the joy of helping someone in need, and it can sometimes even come with reputational benefits.

Giving and receiving referrals can be thought of as a pro-social, virtuous 'loop', as the person giving the referral and the one receiving it both benefit from the exchange: It is helpful to give a referral to someone who needs it, and it feels good to provide help. For example, imagine that you are with a friend whom you consider to be financially organized. After expressing your admiration for how well they manage their finances, you ask them for some advice about some personal financial questions that you have been struggling with. They say that their positive financial situation is at least partially due to working with their financial planner, and the conversation ends with your friend offering to introduce you to their financial planner.

In this example, the virtuous loop starts with sharing appreciation for your friend and asking for help, which suggests trust and at least some level of vulnerability. It also makes your friend feel good to know that you hold them in high esteem. They close the loop with the referral. You get connected to an advisor who can help you with your problem, and your friend feels appreciated and happy to have helped you. Everyone feels better after the referral exchange.

Which supports research conducted by Julie Littlechild of Absolute Engagement, who studies the referral process in financial planning. Her work has suggested that friends and family members tend to ask each other for financial advice and referrals. Littlechild surveyed more than 1,200 financial planning clients and asked them about their referral activities. She found that clients who give referrals do so because friends or family members – not advisors – ask them to. And this makes sense, because a person giving a referral to someone they know well can usually offer information that is more useful and relevant compared to someone who doesn’t know the person in need of a referral very well.

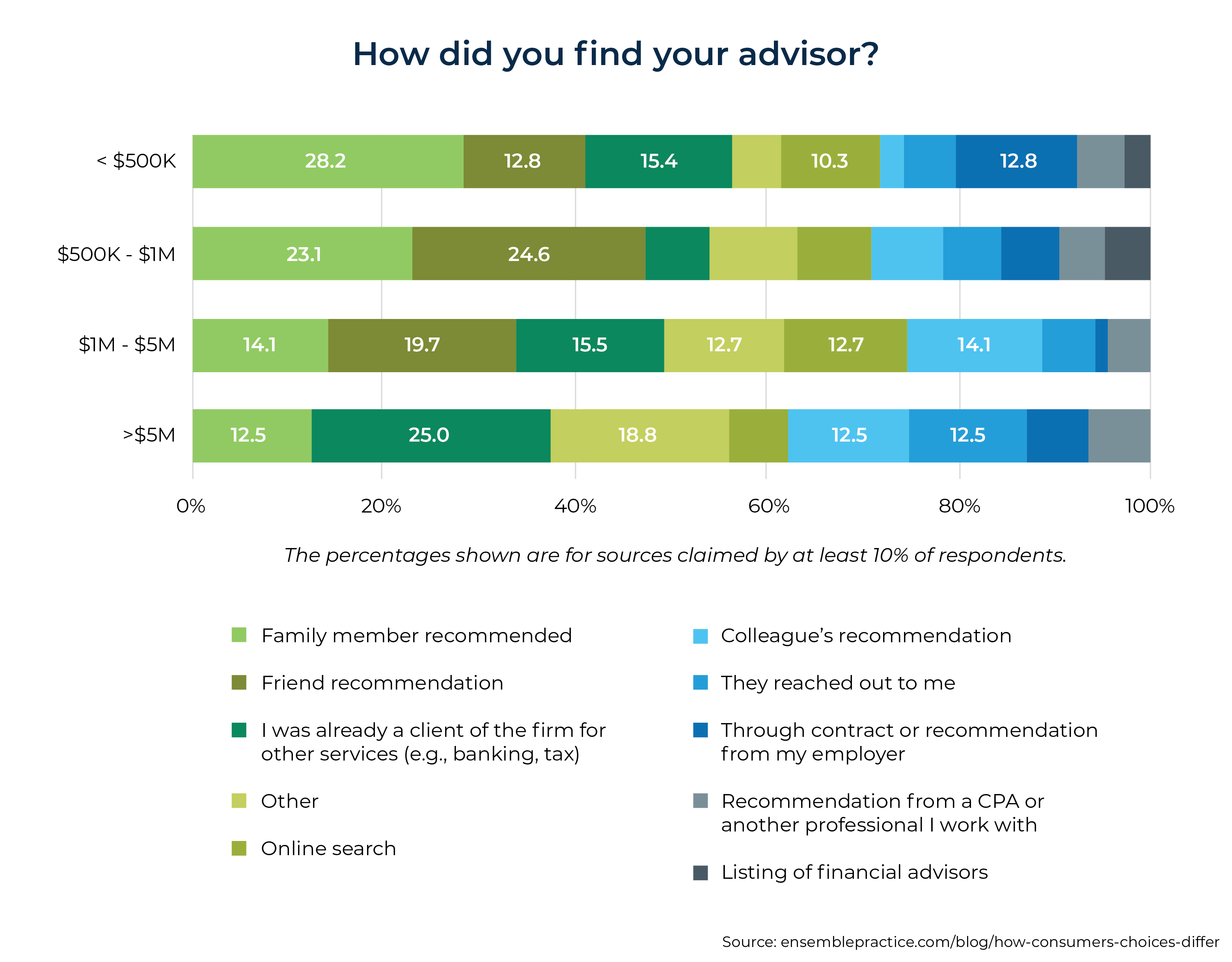

Researcher and financial planning consultant Philip Palaveev has also looked at referral activity, and his 2021 study on consumer choices revealed that consumers of financial advice often find their financial advisor through their personal networks. Interestingly, how clients found their advisors tended to vary by net worth and gender of individuals seeking the referral, but for individuals with a net worth less than $5 million, referrals were most often given by family and friends (41% for those with net worth under $500K, 47.7% for net worth between $500K and $1M, and 33.8% for net worth between $1M and $5M). By contrast, individuals with a net worth of over $5 million most often connected with their advisor because they were already a client for the same firm for other services (25%), whereas only 12.5% found their advisor through family members, and none reported friends as a source of referral.

The key point is that while clients do give referrals, they often do so when friends and family – and not usually their advisors – are the ones who ask for them.

Referrals That Are Personal And Social Are Most Effective

Despite the finding that most referrals are given because family and friends (and sometimes colleagues) ask for them, referrals that advisors request do get made. But when they do, it turns out that advisors don’t often end out meeting with many of these client referrals. Julie Littlechild’s research on the referral behavior of financial planning clients has spanned over several years to examine these ongoing trends and has found that while 25% to 35% of clients have given referrals to their financial advisor, advisors only meet 3% to 5% of the referrals from their client base. Why is there such a huge discrepancy?

The reality is that giving a referral and setting up an introduction are 2 distinctly different things. When clients give a referral, the referral may involve simply sharing a name or a business card; introductions to the advisor are not usually made. Additionally, while financial planning clients may give plenty of referrals to their friends and family, this says nothing about how ready or willing the friend or family member may be to follow through on the referral. So while more than 25% of clients may make referrals, only a very small percentage of referrals actually meet with the advisor.

Furthermore, referrals are often made when they aren't even asked for – 34% of clients reported giving a referral when they thought their friend or family member could use one, and not because the friend or family member actually requested one.

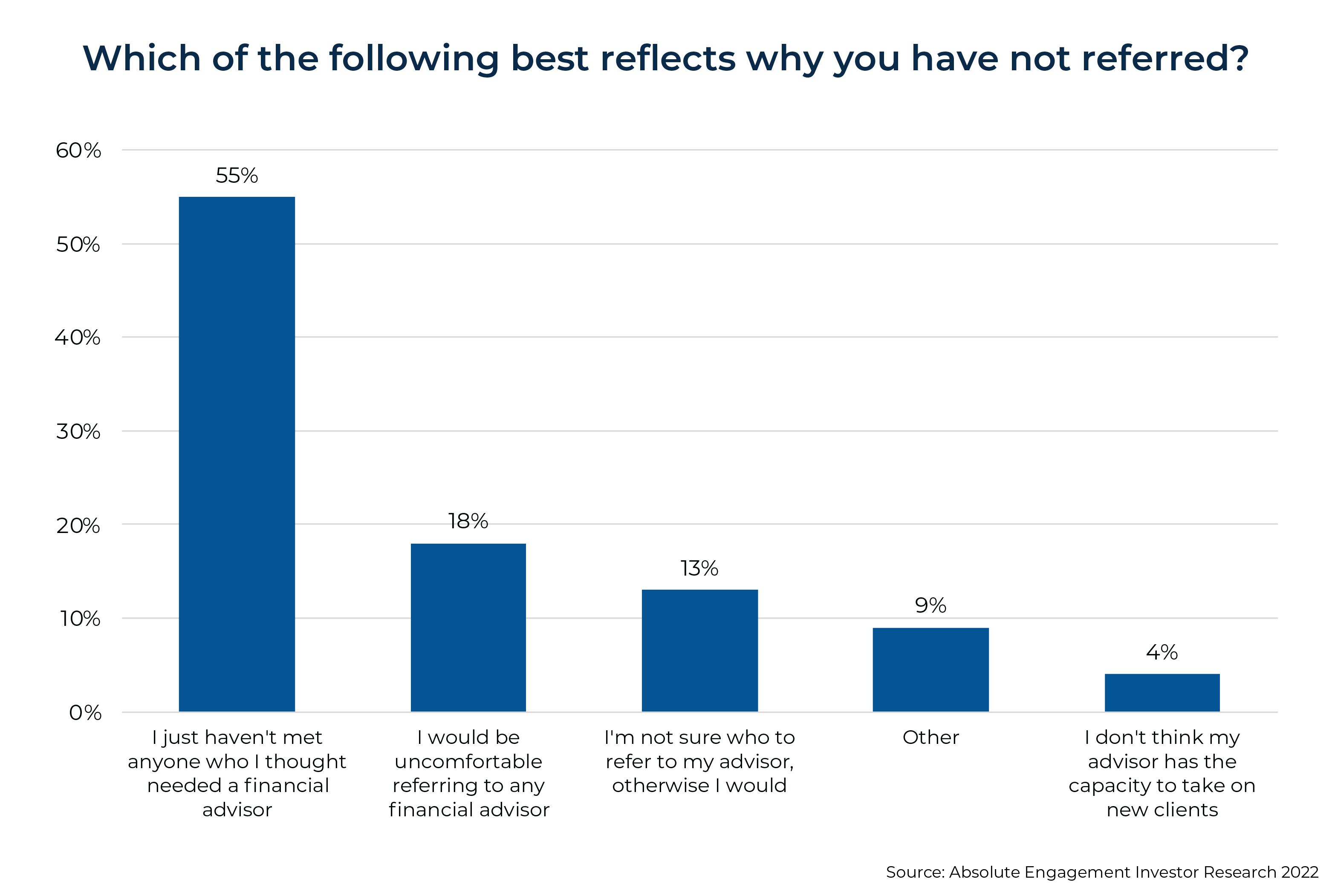

One issue that advisors often face when asking clients to make referrals is that clients don't always believe that they have people who they can refer to the advisor. This is supported by Julia Littlechild’s research, showing that 55% of the financial advisory clients she surveyed didn’t know anyone who they thought needed an advisor, 18% said that making referrals made them feel uncomfortable, and 13% said they weren’t sure who they should refer.

Another obstacle that advisors may face is motivating clients to make referrals. Because even though an advisor may provide stellar financial planning service, a job well done may not always be enough to inspire a client to give referrals on the advisor's behalf. In addition to recognizing the benefit of their advisor's technical ability, clients who establish a personal connection with their advisor are more likely to truly want to help them. Because when a personal connection exists, they are more likely to feel a greater reward from the pro-social, virtuous loop of giving referrals. They sincerely want to help their advisor – and they will be more likely to give a referral and an introduction… that will actually result in a meeting with the advisor!

How To Motivate Clients To Ask For Referrals

While clients may not always know who they can refer when advisors ask them for referrals, advisors can encourage them by using strategies that help them to articulate their own personal connection to financial planning and the benefits of working together with their advisor. Asking clients 'referral story questions', as Julie Littlechild refers to them, not only helps clients relate how people in their network might benefit from a referral to the advisor but also helps advisors broach the conversation in such a way that expresses their care and concern for their clients’ opinions while transforming a potentially uncomfortable discussion into a positive, virtuous experience.

Advisors can help make it easier for clients to offer referrals by helping them develop their own 'referral story’ by asking the following 3 questions:

- What problem did we work on or address?

- What did we do to address that issue?

- What do you feel was the greatest impact coming from this work or accomplishment?

These questions can be asked intermittently throughout a meeting as a way to talk about something that has been going well before even mentioning referrals. They are good questions that let the advisor check in with the client, gradually helping the client recognize the important impact their advisor has had in helping them. And when the advisor does ask their client for referrals (discussed in more detail later), the client will likely find it easier to offer referrals by conveying their own valuable personal experience.

Introduce Referral Story Questions By Asking Clients For Insights And Advice

Advisors don't need to talk about referrals right away. They can take time to help clients build their referral story (without explicitly noting that they're doing so) while also building the relationship. And asking clients to share their experiences and insights can be a great way to introduce the referral story questions. This is because people tend to like giving feedback not only for the satisfying feelings that arise from helping someone in need but also for the positive regard from those who appreciate and benefit from the information shared.

Consider how Sarah brings up the 3 questions she wants to ask Ted in the following example:

Example 1: Sarah is a financial advisor, and she and her client Ted are finishing up their first review meeting. Ted started working with Sarah last year after he changed jobs and found Sarah when he needed help organizing his finances.

Sarah really enjoys working with Ted and recognizes that Ted has several contacts that would make for great referrals. Sarah decides to ask Ted the 3 questions to help him develop his own referral story, not just to check in with him on how things are going, but also to help Ted feel comfortable offering a referral when the opportunity comes up for him.

Sarah: So now that we have been working together for a year, I wanted to check in with you on your initial goal of being more organized. Can you tell me, on a scale of 1 to 10, with 10 being perfectly organized, how you are feeling now?

Ted: I am absolutely at a 10. I am just so much clearer on not only where I am but where I need to go. I really appreciate all of your help, Sarah. It has been great working with you.

Sarah: I really appreciate that, Ted. I have enjoyed our work together, too. And I actually want to ask you something that would help me, too. Would you be open to that?

Ted: Sure, what's up?

Sarah: Well, I want to learn more about how clients talk about our work together and understand what they value most. And because we've done so much together, I'd really value your input on this. I have 3 questions I'd like to ask you, which shouldn't be hard for you to answer. I'm most interested in the words you use to answer them, because the things I focus on when I talk about what I do can be different from what clients actually want to talk about when they're learning about financial planning. How does that sound to you?

Ted: Great! Let's do it.

Sarah: When we first started, what problem did we work on? What made you come in and begin working with me?

Ted: Well. I had changed jobs and I just felt like all of my stuff was everywhere, out of order. We worked on getting me financially organized. I wanted to understand all of my finances, and I wanted everything to be clear, visible, and easy to find.

Sarah: Great. Okay, so we worked on your financial organization – making your financial picture clear, seen, and understood.

Ted: Yes.

Sarah: And what did we do to address the issue?

Ted: [laughing] You made me find thousands of financial documents! But it was worth it because everything ended up nicely organized in the dashboard.

Sarah: Okay. So we tracked down your financial statements, which let us put everything into your client portal dashboard. I take it you find great value in that?

Ted: Yes, a lot of value.

Sarah: What was the greatest impact of this work for you?

Ted: Well, I don’t feel lost anymore. I feel a lot more in control of my situation. Like I have a financial nerd’s eye view of the picture… and from that view, I feel like it’s a lot easier to see where I need to go next. I was slogging through too many details and feeling so lost before we put everything in order.

Sarah: Great. I love that! "Financial nerd’s eye view"!

In the exchange above, Sarah has done 2 key things: 1) She has gained insight into how Ted feels about their work together and the value he places on that work; 2) She has helped Ted to articulate a positive story about his financial planning experience, which is especially important for what comes next – asking Ted to make referrals.

Because now, when Ted hears his friend at lunch mention that they are struggling with their own financial organization, Ted will remember Sarah through his referral story and will be able to offer a compelling reason for his friend to actually follow through on making an appointment to meet with Sarah. All he needs now is the understanding that his advisor actually wants him to make referrals on their behalf.

Furthermore, Sarah can continue the conversation in the example above by asking Ted for advice, such as where and how to meet people like Ted who have similar financial concerns. The conversation can feel good for Ted not just because of the pro-social opportunity he has been given to help Sarah, but also because he appreciates Sarah’s esteem for information she values.

Seek The Client's Advice When Asking Them For Referrals

Client communication expert Carl Richards has suggested an effective approach that advisors can use to ask clients for referrals. When the advisor is ready to have the referral conversation, they can first note how much they’ve enjoyed working with the client and that they want to figure out how to get more clients just like them. Then, advisors follow up with the question, "If you were me, how would you go about that?"

It is simple, but it works. It works especially well when the client has already developed a referral story and appreciates working together with their advisor.

Advisors can expect clients to hesitate, responding with a bit of "Hmm" or "Good question, I’m not totally sure". But it's important for advisors to stay quiet and give the client time to think about an answer. The key point is that asking for advice by posing this question lets the advisor explain they are seeking referrals while expressing their appreciation for the client and their desire for their client’s feedback. This is a good opportunity for advisors to reinforce the client's referral story and to remind them about the particular niche or client persona they seek.

If (when!) the client offers a referral, advisors can follow up by suggesting that they send an introductory email or perhaps invite the referral to a client event. This can increase the likelihood of the advisor actually connecting with the referral.

Ask For Help With Introductions

As noted earlier, people really love to help other people, especially when they have a personal connection with each other. When clients like their advisors and can relate to them on a personal level, they want to help them. Which means that advisors can target specific clients with whom they have established a good relationship and ask those clients for a favor that will help them personally.

One of the best ways to do this is to ask for an introduction to referrals that the client may make, especially to those that the advisor feels will become good clients. The trick to this strategy is for the advisor to do some research in advance so that they can be very selective about which referrals they want to pursue.

Consider how Sarah, Ted's financial advisor, uses this approach by leveraging social media in the following example:

Example 2: Sarah and Ted have become connected on LinkedIn. On Ted's LinkedIn profile, Sarah notices that Ted is also a board member of a charity organization with other board members who she believes would be ideal clients. Towards the end of their next meeting together, Sarah has the following conversation with Ted:

Sarah: Ted, I know you do a lot of work as a board member for Bird's Eye View International, and I wondered if you also know Linda, who's also on the board?

Ted: Yeah, I know Linda.

Sarah: Well, I'd like to reach out to her and find out if she might have any interest in working together. Would it be alright if I mentioned your name when I contact her?

Ted: Oh, for sure! Actually, Linda and I go way back. I can give her a call this week. I will tell her that you are going to reach out.

Sarah: Oh wow, that would be a huge help. Thank you.

Asking for help with introductions might take a bit of leg work for advisors, but this can save time and effort – for both themselves and their clients – by ensuring that introductions are requested only for referrals who have actual potential to become good clients.

Using Humor To Make A Difficult Conversation Easier

For many advisors, asking for referrals can be difficult and nerve-racking. This is very common and completely normal. A simple but effective way to help alleviate some of the nervousness and discomfort can be to have fun with the questions and inject a little laughter into the conversation.

Even though advisors may be doing a great job explaining their particular niche or who their ideal clients are, clients can still struggle with understanding who their advisor wants as a referral. Clients, too, might feel nervous and uncertain about finding referrals for their advisors. But the reality is that it won't hurt for the advisor to be bold, laugh a bit, and just ask.

By joking a bit and leaning into the oddness of the ask, advisors can reveal a bit of their own vulnerability but still be direct in their requests. If the client says they don't have anyone they can refer, advisors can graciously reply and express their gratitude. For example, an advisor could reply, "Well, if you do find someone who needs some help organizing their finances and a financial nerd’s eye view, just let me know. And thank you for letting me ask!" Despite the levity advisors may introduce into the discussion, clients will understand that the advisor is serious about finding referrals, and they will know what to look for in the future.

Ultimately, there is nothing wrong with asking clients for referrals – they occur naturally and offer a way for us to engage in pro-social behavior. Some clients will even appreciate the opportunity to help their advisor, along with those in their network of connections who might benefit from the referral. And even though asking for referrals may be difficult and uncomfortable at first, many advisors will find that consistently relying on strategies that involve asking clients for their insight, advice, and help will not only make the ask easier, but will also develop stronger connections with clients!