Welcome back to the 317th episode of the Financial Advisor Success Podcast!

Welcome back to the 317th episode of the Financial Advisor Success Podcast!

My guest on today's podcast is Jennifer Climo. Jennifer is the CEO and a Senior Advisor for Milestone Financial Planning, an independent RIA based in Bedford, New Hampshire, that oversees $360 million in assets under management for 225 client households.

What's unique about Jennifer, though, is how, after more than a decade of building her own successful solo practice, she intentionally decided to merge her practice with another solo practitioner when an unusual crisis opportunity presented itself, and handle the more complex business management dynamics that followed, so that she could fulfill her goals of scaling and growing her practice beyond her and building an enterprise that would outlive her.

In this episode, we talk in-depth about how, after the sudden passing of a successor for a close friend and solo advisor that she met through a local study group of NAPFA advisors, Jennifer decided to merge their practices so that she could not only help her advisor friend and the clients she served, but create a positive opportunity for Jennifer’s own practice to scale up, how, during the first year after the merger, Jennifer realized her new partner still needed a needed a succession plan, and created a unique buyout structure that offers a 40% down payment and retirement payments of 15%-of-profits for life (which also helped to entice future partners who only needed to cover 40% of the purchase price buy-in themselves), and how Jennifer’s unique succession structure has now attracted another of her NAPFA study group partners who was also looking to retire, which prompted a second merger and has allowed her to grow and scale her business even further.

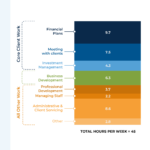

We also talk about how, in addition to her unique succession structure, Jennifer created an operating agreement for her firm (based on the teachings of Philip Palaveev and Mark Tibergien) when she added a partner, that outlines the financial management of their P&L as targeting 40% advisor compensation, 35% overhead expenses, and 25% in profit margins, how, though the merging of the practices created several pain points for Jennifer and her partners (as they all used different advisor technology and had differing fee schedules), she leveraged these issues as opportunities to find the right technology for the blended practice to develop better, easier, and more efficient processes, and eventually was able to incrementally raise fees and increase the firm’s overall profitability as they served clients more effectively, and how, even though Jennifer’s initial intention to join her NAPFA study group was to glean insight on practice management techniques and processes from other advisors, her continued connections with those advisors over the years created a close-knit and trusted community that has proven to give Jennifer even greater opportunities for her business in the long run.

And be certain to listen to the end, where Jennifer shares how she was surprised at how far she has come in her career and business as though she admits she put in the hard work and dedication, she never realized it would lead to her running a multi-million-revenue practice and doing so as a female business owner, how, after discovering a valued, long-time employee was unhappy and struggling, Jennifer learned the hard way the importance of dedicating time to not only teach and train employees, but to also listen and communicate properly so that she can create a better work environment and happier employees to aid retention, and why Jennifer feels it’s important for newer, younger advisors to not be deterred by naysayers in life and in the financial services industry, and instead, should focus on the skills they do have and how they can use those skills to advance in their own careers.

So, whether you’re interested in learning about how Jennifer handled the logistics of merging two practices in just 7 years, how Jennifer structured ownership agreements and profit splitting, or how Jennifer plans to continue to scale and grow her business, then we hope you enjoy this episode of the Financial Advisor Success podcast, with Jennifer Climo.

Welcome back to the 316th episode of the Financial Advisor Success Podcast!

Welcome back to the 316th episode of the Financial Advisor Success Podcast!