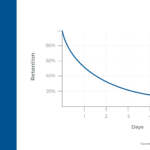

Financial advisors who want to grow their firms faster can examine a wide range of advisor marketing strategies and sales tactics. But the reality is that if an advisory firm is struggling to grow, often the problem isn’t actually a matter of better marketing; instead, it’s about developing a better client service process. Because while the most significant value proposition of a real financial advisor is ultimately to help their clients live better lives, having a consistently remarkable client service process is what allows a financial advisor to successfully elicit the positive feelings experienced by their clients, which are essential in establishing lasting trust and driving the referrals necessary to bring about growth. And simply put, the fact that an advisory firm has high retention of existing clients doesn’t mean its client service process is good enough to bring new client growth as well.

In this guest post, Angie Herbers – Chief Executive and Senior Consultant at Herbers & Company, an independent management and growth consultancy for financial advisory firms – explains how the Client Service Process is actually the key to growth, and how it consists of not only the client service experience itself, but also the Operations Experience – the behind-the-scenes activities that clients may or may not see directly, but that they can certainly feel the effects of through every interaction they have with the firm. And in order to create an exceptional client service process based on cultivating trust, there are four components that must be mastered, in the following order: 1) Understanding, 2) Control, 3) Discipline, and 4) Stability.

The first stage of trust is Understanding, and involves the advisor not just having a solid grasp on what the firm does and who it works with, but also a deep connection to and alignment with the firm’s motivation, of why it does what it does and chooses to work with the clients it has. Next comes Control, in which financial advisors decide what services they will (and will not) provide for clients, with the confidence that those services align with the firm’s (and their own) motivation and purpose. In this stage, advisors also help clients realize that they, too, have a level of control in choosing to follow the advice they are given (or not), and this autonomy serves to deepen further the trust being cultivated between client and advisor. The next stage is Discipline, in which advisors and their staff need to continually uphold all the details, big and small, of the client service process promised to clients, which, over time, create the “living client” who trusts the firm culture and process so intrinsically that they essentially mirror the actions and feelings of the firm at all times. The last stage involved in cultivating trust is Stability. For the advisor, stability represents a solid belief that, whatever transition the business may face, it will maintain the integrity it needs to continue to grow. Similarly, the client has full faith that, whatever transitions they themselves face in their lives, their advisors will provide the stability to always guide them through the experience.

Ultimately, the key point is that the client service process is the primary area where advisors should focus in order to grow their firms. And while other components like marketing, sales, and human capital are all very important, they will not mean much if the client service process is faulty. Because it is the client service process, which includes both the client service experience and the firm’s operations experience, that is most crucial in establishing positive emotions between the client and advisor, on which long-term trust and a strong, lasting client-advisor relationship are built.

Welcome back to the 173rd episode of Financial Advisor Success Podcast!

Welcome back to the 173rd episode of Financial Advisor Success Podcast!