Passed into law in December 2019, the “Setting Every Community Up For Retirement Enhancement (SECURE) Act”, introduced a plethora of substantial updates to longstanding retirement account rules. One of the most notable changes was the elimination (with some exceptions) of the ‘stretch’ provision for non-spouse beneficiaries of inherited retirement accounts. As prior to the SECURE Act, beneficiaries of inherited retirement accounts were able to ‘stretch’ out distributions based on their own entire life expectancy, but now most non-spouse beneficiaries will be required to deplete their accounts within ten years after the original owner’s death. (Unlike RMDs, though, the new 10-Year Rule offers flexibility around the timing of distributions, as it does not require annual withdrawals – funds can be withdrawn in any amount, at any time over the course of the 10-year term – as long as the entire amount is withdrawn by the end of the 10th year.)

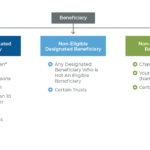

However, not all beneficiaries will be impacted by this new “10-Year Rule”. Instead, the SECURE Act identifies three distinct groups of beneficiaries: Non-Designated Beneficiaries (i.e., non-person entities such as trusts and charities), Eligible Designated Beneficiaries (i.e., individuals who are spouses of account holders, those who have a disability or chronic illness, those not more than 10 years younger than the decedent, minor children of decedents, or “See-Through” trusts), and Non-Eligible Designated Beneficiaries (i.e., any individual who qualifies as a Designated Beneficiary but is not on the list of Eligible Designated Beneficiary).

This distinction matters because Non-Designated Beneficiaries and those who are part of the newly created Eligible Designated Beneficiaries group are generally subject to the same rules prior to the SECURE Act (either the 5-year rule or stretching over life expectancy, respectively), it is the Non-Eligible Designated Beneficiaries that are now subject to the new 10-Year Rule, from trusts to adult children and more. Fortunately, the 10-year rule does still facilitate at least some flexibility – as the rule simply requires that all funds be distributed by the end of the 10th year after death of the original account owner, but the beneficiary has discretion over when to take the dollars out over that time window – though such a mandatory distribution window may introduce new challenges for certain types of See-Through trusts (where the flexibility eliminates ‘automatic’ annual conduit distributions to beneficiaries and could trigger the sudden liquidation of both the IRA and trust at the end of the 10-year window).

Ultimately, the key point is that, while there are now three distinct groups of beneficiaries under the SECURE Act, only one of these groups (i.e., the Non-Eligible Designated Beneficiaries) must now contend with the new SECURE Act 10-Year Rule for inherited retirement accounts. For the other two groups (i.e., Eligible Designated Beneficiaries and Non-Designated Beneficiaries), very little has changed for Non-Designated Beneficiaries, and Eligible Designated Beneficiaries still follow the same rules (with few exceptions) as the pre-SECURE Act Designated Beneficiaries.

Welcome back to the 163rd episode of Financial Advisor Success Podcast!

Welcome back to the 163rd episode of Financial Advisor Success Podcast!