One of the fundamental principles of long-term investing is the recognition that, while markets may go up and down and be volatile in the short-term, eventually the volatility tends to average out into favorable long-term growth rates. Accordingly, the conventional wisdom in the face of market volatility is simply to keep invested and stay the course. Of course, those who are approaching or transitioning into retirement need to be cognizant not to draw down the portfolio too much waiting for those returns to average out – a phenomenon known as sequence of return risk – but as long as investors stay a little flexible on their retirement goals, and spend reasonably conservatively, that sequence of return risk can generally be managed.

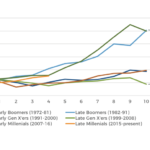

However, the fact that investors will for the most part simply have to accept whatever returns the market gives – and in whatever sequence it provides them – means that different generations of investors may have substantively different experiences with long-term investing simply based on whatever happens to occur during their particular investment sequence and the "investment cards" they're dealt.

In turn, this effect is further amplified by the fact that early investment experiences often shape a lifetime of investment behavior – from Baby Boomers that experienced favorable market returns coinciding with the rise of the 401(k) and have stuck with markets during their difficult years, to late Gen X’ers and Millennials who have had to wait as much as a decade or more simply to see the markets recover to where they started when they first begin investing (hearkening back to the experience of a Lost Generation of investors after the Great Depression who never returned to stocks after the scarring experience of the crash of 1929 and its slow recovery during the Great Depression). And in fact, a growing volume of data on investor behavior is suggesting that younger investors are indeed far more skeptical of stock markets and long-term investing… a challenge that may not necessarily reverse itself even as the market improves (just as the bull market of the 1950s and 60s didn’t necessarily win back Depression-era investors).

The fact that the generational timing of young adulthood – and the market returns that coincide with it – may have such a long-term behavioral influence notably also extends to financial advisors themselves, as Baby Boomer advisors in their early 60s today saw a raging bull market for the first 20 years of building their careers, while younger Gen X and older Millennial advisors have had to wait 10-15 years just to see the markets recover to where they invested their first clients! Which raises the question of whether advisor attitudes about the value of providing investment management, and the active vs. passive debate, may also be heavily shaped by the advisor’s generational experience and the timing of when they happened to launch their advisor career?

Ultimately, though, the key point is simply to recognize that mere birth year may actually be responsible for a far more outsized portion of our lifetime investment behavior and experience than is commonly acknowledged. As even if a long-term portfolio can mathematically recover from almost any sequence of returns, it doesn’t mean that certain generations of investors – and advisors – will behaviorally do so themselves, based on whatever early-years' experience the market happens to give them during their formative years?

Welcome back to the 91st episode of the Financial Advisor Success podcast!

Welcome back to the 91st episode of the Financial Advisor Success podcast!

Welcome back to the 91st episode of the Financial Advisor Success podcast!

Welcome back to the 91st episode of the Financial Advisor Success podcast!