The “traditional” view of recent decades is that going to college is part of the American Dream, and the essential pathway to better job opportunities with higher income potential. Yet at the same time, there's growing talk of the financial hardships for students these days, from ever-increasing tuition, to high levels of student debt. Still, under the auspices that a college education is essential to unlocking future income opportunities, students continue to enroll in record numbers. Which raises the question: is college really still a good "investment", or not?

In this guest post, Dr. Derek Tharp – a Kitces.com Researcher, and a recent Ph.D. graduate from the financial planning program at Kansas State University – examines recent research on the Return On Investment (ROI) from investing in a college education, and particularly the differences in ROI that students may experience based on their own abilities as students, along with their area of study, the type of institution they attend, and the funding that is available to them.

Notably, while the "traditional" view is that a college education is all about building knowledge and developing skills (the "human capital" theory of education), in his 2018 book, The Case Against Education, economist Bryan Caplan examines prior research on education and concludes that the primary function of higher education is actually just to signal certain traits of students to prospective employers – particularly intelligence, work ethic, and conformity (known as the "signaling" theory of education). But setting aside the debate over whether education is primarily a means of developing human capital or signaling (which has some important implications for social returns to investment in education), Caplan's book contains what might be the most detailed analysis of private returns to investment in education (i.e., the ROI of a college degree for individuals), which is highly relevant to any financial planner who advises clients (or their children, or grandchildren) on whether it's really still worth trying to invest in a college education in the modern era.

Because while the data is fairly clear that those who go to college do tend to have higher incomes in their working careers, simplistic methods for calculating the ROI from investing in a college education often suffer from "selection bias", which refers to the fact that those who choose to go to college are not selected at random. For instance, on average, those who choose to go to college tend be more intelligent and harder working than those who do not (a result of the college admissions screening process). Of course, this certainly isn't true of everyone who does not go to college, but because it's true on average, we would expect those who go to college to (on average) earn more in the labor market, regardless of whether college actually improved their skills or knowledge, simply because of the intelligence and work ethic they brought with them to college to begin with. Thus, it is important to correct for this "ability bias" when determining the ROI of a college education; Caplan's calculations, though, go much further than that, adjusting for a wide range of other factors that are often overlooked – from health and happiness, to the probability of unemployment, and even college boredom (or lack thereof).

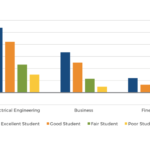

With this framework in place, Caplan then determines the ROI of a college education across a wide range of scenarios, including student quality (e.g., an excellent student vs. a poor student), type of degree (e.g., Bachelor's vs. Master's), a student's area of study (e.g., engineering vs. fine arts), college quality (e.g., top-tier vs. bottom-tier), and institution type (e.g., public vs. private). In short, Caplan finds that college is a good investment for good students, a mediocre investment for mediocre students, and a bad investment for bad students, who are especially prone to paying for some of college and then not even finishing (incurring the cost/debt but not even getting the signaling benefit of the degree). Beyond that, only the best students should pursue a Master's degree, field of study does matter (though more so for low-quality students), college prestige has a potentially surprisingly small impact, and the best investments are generally found at the top public university where an individual is eligible for in-state tuition (not a leading private college).

Ultimately, Caplan's analysis has many important considerations for those who may help students choose what type of education to pursue... from not pushing students who are a poor fit to attend college (as this is often the worst case scenario from an ROI perspective, where students may take on all of the expense of a college education yet gain none of the benefits), to helping students who are a strong fit to decide what path makes the most financial sense (and Caplan even makes his spreadsheets publicly available, incase anyone wants to tweak his model to better fit their situation). But the key point is to acknowledge that the ROI of a college investment varies greatly based on the characteristics of a student - primarily by amplifying the positive results for good students, while mostly amplifying the downside risk for bad students - and many other factors that are often overlooked. College may be a great investment for some, but it is not for all!

Welcome, everyone! Welcome to the 61st episode of the Financial Advisor Success Podcast!

Welcome, everyone! Welcome to the 61st episode of the Financial Advisor Success Podcast!