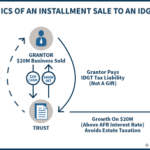

For high-net-worth individuals who built their wealth through entrepreneurship and creating a business with substantial value, a significant challenge is not only that the business will someday be subject to estate taxes, but that the continued growth and success of the business just compounds the problem further.

Accordingly, an increasingly popular strategy in recent years to manage this issue is the Intentionally Defective Grantor Trust (IDGT), a unique type of trust structure where the income of the trust is still the grantor’s for income tax purposes, but the assets of the trust are excluded from his/her estate for estate tax purposes. In other words, the trust is “effective” for estate taxes, but “defective” for income taxes.

The benefit of this arrangement is that the value of the trust, and any growth thereon, are excluded from the grantor’s estate. But the fact that the trust is “defective” for income tax purposes is also a good thing, as it means the grantor can pay all of the IDGT’s income tax bills (without being deemed a gift), and can sell the family business to the IDGT in exchange for an interest-only installment note, without triggering capital gains taxes (since the grantor is effectively just selling the business to themselves).

Which means in essence, establishing an IDGT and then selling the grantor’s business to it, in exchange for a promissory note, means the grantor has transmuted his/her assets from a potentially high-return high-growth family business into a low-yield bond (given today’s low Applicable Federal Rates that are used to determine the interest rate for the installment note sale).

And in the long run, this can produce a substantial estate tax savings, to the extent that the business inside the IDGT outgrows the relatively low hurdle rate associated with the installment note. In fact, the strategy can be further leveraged by obtaining valuation discounts on the sale of the family business as well, though notably a recent proposed Treasury Regulation would crack down on such discounts, potentially as early as 2017. Nonetheless, even without a potential valuation discount, the opportunity for estate tax savings in using an IDGT is significant in the long run, simply for the ability of a successful family business to outearn and outgrow today’s ultra-low interest rate environment!