For many businesses and industries, it’s crucial to do a proper analysis up front to estimate the size of the “target market” – how many total potential customers are there and how much would they spend on your products or services, so the company can figure out if there’s a big enough market opportunity amongst those tens or hundreds of thousands of consumers (or more) to make it worthwhile to launch that new product or service for them.

In the context of a financial advisor, though, the reality is that the sheer intensiveness of the time it takes to serve financial planning clients in an ongoing advice relationship means most advisors will struggle to ever handle more than about 50-100 "real" client relationships on an ongoing basis. And even if the advisor gets highly efficient – e.g., through technology – there’s some evidence to suggest that our brains themselves simply may not be able to keep track of materially more than 100 client relationships (on top of all the other family/friends relationships in our lives).

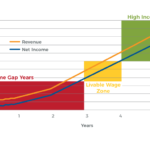

The good news, though, is that the limitation of “just” 100 clients still leaves ample room for the typical advisor to serve the nearly 30 million mass affluent (or wealthier) households and earn a very successful living. After all, an advisor spending "just" 12 hours per year on each client (which across 100 clients is 1,200 hours/year), and charging $150/hour for their services (whether via an hourly fee, annual or monthly retainer, or AUM fees) can generate $180,000/year of revenue, and the most efficient advisors would be able to take home nearly 80 cents on the dollar (or almost $150,000 of it) after business expenses.

And for advisors who can move “upmarket” and serve even more affluent clientele, the requisite number of clients just drops further – and/or the advisor has even more earning potential. After all, 50 retiree clients paying “just” $5,000 per year (as an annual retainer, or perhaps in AUM fees from their $500,000 retirement rollovers?) gives an advisor a potential of $250,000 of gross revenue and take-home pay of more than $200,000 annually! And the higher the average revenue per client from there, the more the earning potential, even with "just" 50 great clients!

Of course, the caveat is that it can still take a long time to get to that 50-100 clients. Adding 1 client every month would still take 8 years to reach a 100 client capacity; even if the pace of new clients accelerates after the first few years, it may still take 5-6 years to build that client base. And trying to reach 50 more affluent clientele may still take just as long, as there are fewer clients needed, but they may be harder to reach (or it takes longer to establish the credibility to attract and retain them).

On the other hand, the fact that it “only” takes 50 great "A-level" clients for financial advisor success means that advisors have the luxury to pick almost any conceivable niche specialization… because it takes no more than 50 people on the planet, who are willing to pay to have that particular problem solved, to be financially successful as an advisor! And the more those niche clients can afford to pay, further increasing revenue/client, the more the upside income potential of the 50-great-client practice!

So who will you find to be your 50 great clients?

Welcome back to the twentieth episode of the Financial Advisor Success podcast!

Welcome back to the twentieth episode of the Financial Advisor Success podcast!