For most workers, employer retirement plan limits are what they are, with a salary deferral cap of $18,500 (in 2018), and the opportunity for employers to add even more on top in the form of matching, profit-sharing, and similar contributions (up to an aggregate limit of $55,000 in 2018). The general rule typically boils down to “save as much as you can, and be certain to capture any matching contributions at a minimum.”

However, for a subset of workers, there is a possibility of being covered by two (or more) different defined contribution plans at the same time. Either for those who have an employee job with two different businesses (each of which provides a 401(k) or similar defined contribution plan). Or because they have a “side hustle” in the gig economy that allows them to create their own “employer” retirement plan as a self-employed individual. Which raises the question of how to coordinate between the two (or more) plans.

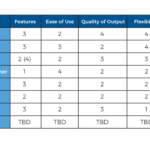

The first limitation on employer retirement plan contributions, under IRC Section 402(g), is the salary deferral limit of $18,500/year, plus a catch-up contribution of up to $6,000. This limit applies once per taxpayer across any/all plans they’re involved with (except for 457(b) plans, which are counted separately, and IRAs, which have their own standalone contribution limits).

The second limitation is known as the 415(c) overall limit, which is the (currently $55,000, plus any catch-up contributions) cap on the aggregate total of all contributions that go into the plan (including both salary deferral contributions by the employee, after-tax employee contributions, and any/all contributions from employers, from profit-sharing to matching contributions). However, unlike the 402(g) limit which applies once across all plans, the 415(c) overall limit applies separately for each plan.

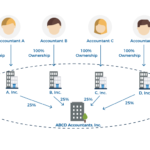

The caveat to the overall limit, though, is that if the employers are “related” to each other (either as a parent-subsidiary or brother-sister controlled group, some combination thereof, or an affiliated service group), the overall limit (along with other employer retirement plan testing rules and requirements) is applied once across all plans as well.

Which means that while individuals who work two employee jobs at independent companies can receive contributions from each, and employees who have their own side hustle can still create their own self-employed retirement plan with its own overall limit, entrepreneurs who own multiple businesses must be cautious not to run afoul of the controlled group requirements that would require them to aggregate all their businesses together and not “double-dip” by trying to reach the overall limit across multiple retirement plans from each separate-but-not-really-separate business!