Executive Summary

At the end of 2018, Americans had nearly $9 trillion in IRAs. Most of that money was (and continues to be) invested in “traditional” types of investments, such as stocks, bonds, mutual funds, ETFs, and annuities. But for those investors who wish to look elsewhere for returns, IRAs can provide a substantial amount of flexibility.

One investment option that is particularly popular when it comes to non-traditional IRA assets is direct-owned real estate. Direct-owned real estate refers to properties in which an owner (or a company controlled by that owner) has direct title to the property. But while the allure of non-traditional, non-stock-market-based investments like direct real estate can be an attractive proposition for many investors – especially in times of increased market volatility – such investments can also create unique planning challenges not normally associated with traditional investments.

Notably, though, direct-owned IRA real estate increases the likelihood of running afoul of the prohibited transaction rules. IRA owners, for instance, are prohibited from personally using their IRA-owned real estate, or performing even the smallest of repairs on the property themselves. Purchasing or leasing such properties personally is also off-limits, even when such arrangements are done as an “arms-length” transaction at a fair market value/rate.

But the list of potential challenges doesn’t stop there. Cashflow problems are also more prevalent when low-liquidity assets like direct-owned real estate are purchased within an IRA. The IRA, for instance, must have enough cash on hand to cover all of its “investment” expenses, including repairs and maintenance, taxes, and even the purchase of a property in the first place. And while an IRA can secure financing in the form of a non-recourse loan (i.e., a mortgage), such loans tend to limit the amount of capital that can be borrowed and can lead to Unrelated Debt Financed Income, which can complicate things even further by creating an income tax bill that must be paid by an investor’s IRA! All while other tax benefits normally associated with real estate, such as depreciation and the 20% pass-through deduction, are forgone (since the investment is owned in the tax-deferred IRA “shell”).

Real estate is also more difficult to value than assets that are frequently traded across an exchange or other platform. Which is unfortunate, because formal valuations of direct-owned IRA real estate are often required in the event an IRA owner takes a distribution, including (and especially when) there is a Roth conversion or a Required Minimum Distribution (RMD) obligation, adding an additional cost layer for otherwise-basic tax reporting.

Despite these risks, however, some investors still view these alternative/non-traditional IRA investments as their best avenue to grow their retirement savings... and do so with their IRAs if only because that’s where the available dollars are to invest in the first place. For such persons, a thorough understanding of these technical and tax compliance challenges is critical.

The flexibility of what IRAs are permitted to invest in – including direct-owned real estate – provides an increased level of control that may be a “plus” for many investors, but it can be a double-edged sword, particularly when it comes to such investments that are made with IRA funds. That’s because IRAs are subject to a group of rules known as the “prohibited transaction” rules.

The essence of the prohibited transaction rules are relatively straightforward: they’re designed to prevent fiduciaries of the IRA from engaging in transactions with the IRA that could run afoul of the fiduciary’s obligation – akin to other fiduciary rules, by prohibiting certain types of transactions, the conflict of interest is outright avoided. Yet in practice, the prohibited transaction rules are among the most complicated, and also the least forgiving, of all the rules that govern IRAs. In large part because the IRA owner themselves is always treated as a fiduciary to their own account… which means prohibited transactions limits what an IRA owner can directly do with his/her own retirement account.

IRC Section 4975(c) details the various types of (prohibited) transactions that an IRA owner may not engage in with respect to their IRA. The list, which also applies to other types of tax-favored accounts, such as 401(k)s and other employer-sponsored retirement plans, as well as health savings accounts (HSAs), includes buying or selling to/from one’s IRA, lending or extending credit to one’s IRA, the furnishing of goods and services between an IRA and its owner, and the use of an IRA’s income or assets for the IRA owner’s benefit.

In short, an IRA owner should not benefit from their IRA, other than via distributions received from the account, and the IRA, itself, should not benefit from its owner, other than via contributions to the account made by that owner. To do otherwise constitutes engaging in a transaction for which the IRA-owner-as-fiduciary has a potentially-untenable conflict of interest with their own account.

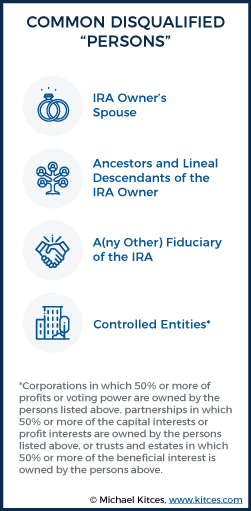

The same fiduciary prohibited transaction rules also apply to other “disqualified persons”, as defined by IRC Section 4975(e)(2). Beyond an IRA owner his/herself, disqualified persons include:

The same fiduciary prohibited transaction rules also apply to other “disqualified persons”, as defined by IRC Section 4975(e)(2). Beyond an IRA owner his/herself, disqualified persons include:

- The IRA owner’s spouse

- Ancestors and lineal descendants of the IRA owner

- A(ny other) fiduciary of the IRA

- Corporations in which 50% or more of profits or voting power are owned by the persons listed above, partnerships in which 50% or more of capital interests or profit interests are owned by the persons listed above, or trusts or estates in which 50% or more of the beneficiary interest is owned by the persons listed above.

In general, when a prohibited transaction occurs in an IRA, the “penalty” for an IRA owner/beneficiary is that their IRA/inherited IRA is deemed distributed as of January 1st of the year in which the prohibited transaction first occurred.

Thus, in such instances, the “guilty” individual’s entire IRA would be subject to income tax, and if applicable, the 10% early distribution penalty as well. In addition, since the tax-deferred “wrapper” of the IRA/inherited IRA ceases to exist as of January 1st of the year in which the prohibited transaction first occurred, all interest, dividends, and capital gains earned after that time would be subject to their “regular” tax rates… even if “on paper” they occurred inside an IRA because the prohibited transaction was not yet discovered! (Notably, a 15% initial penalty, and an additional 100% penalty if not timely corrected, apply to prohibited transactions engaged in by persons other than an IRA owner or their beneficiaries, as well as when prohibited transactions occur with other types of retirement accounts, such as qualified plans.)

An IRA Owner Cannot Use Direct-Owned Real Estate For Personal Use

IRC Section 4975(c)(1)(D) states that a prohibited transaction occurs when there is a “transfer to, or use by or for the benefit of, a disqualified person of the income or assets of a plan.” In the context of direct-owned real estate, this means that an IRA owner cannot use IRA-owned real estate for personal use (nor, for that matter, can any other disqualified persons, as outlined above).

And unfortunately, there is no de minimis exception to the “no personal use” rule. Consequently, any personal use by an IRA owner or by other disqualified persons results in a prohibited transaction!

Example #1: Homer is a 55-year-old IRA owner. Several years ago, Homer used his IRA to purchase an apartment building in Cleveland, Ohio, which is regularly rented to travelers using online websites. Homer’s daughter, Lisa, was recently accepted to Harvard. Homer plans to drive her to campus for her first semester.

Conveniently, Cleveland is located at roughly the midway point between Homer’s home in Springfield, Illinois, and the Harvard campus. With that in mind, he is considering spending the night at his (IRA-owned) Cleveland apartment on his way to take Lisa to school.

The moment Homer crosses the threshold of the front door to the apartment to stay for the night, though, he has used the assets of his IRA for his personal benefit. And as result, a prohibited transaction has occurred, and Homer’s entire IRA will be deemed distributed as of January 1st of the year. (D’oh!)

An IRA Owner Cannot Buy Or Sell The IRA-Owned Direct Real Estate To/From Themselves (Or Other Disqualified Persons)

Similar to the rules that prevent use of an IRA-owned asset by an IRA owner and/or other disqualified persons, IRC Section 4975(c)(1) prevents the “sale or exchange, or leasing, of any property” between an IRA-owed asset and an IRA owner and/or other disqualified persons. This restriction is absolute and makes no distinction between sales or leases conveyed at a discount versus those at fair market value. Both are prohibited transactions. In other words, even if the IRA owner does a transaction with his/her IRA at a fair market rate, it is still prohibited.

Example #2: Sandy is a 65-year-old IRA owner who, 15 years ago, used his IRA funds to purchase a vacation home in Key West, Florida. He (via his IRA) currently rents the house out a rate of $5,000 per month.

Sandy, however, recently retired and would like to spend more time in Key West, himself. He loves the IRA-owned vacation home, and thinks it would make a great place for him to stay when in town.

Unfortunately for Sandy, he cannot rent the vacation home from his IRA, even if he continues to pay the same $5,000 per month fair-market rent. Furthermore, he can’t even purchase the home from his IRA, even if that purchase was made as an arm’s length transaction at fair market value.

In fact, there is only one way for Sandy to use the IRA-owned Key West home without running afoul of the prohibited transaction rules: he’d have to distribute the home, in-kind, from his IRA. This, however, would result in ordinary income tax being owed on the fair market value of the home (more on this in a bit) when distributed, as with any other taxable distribution.

An IRA Owner Cannot Extend Credit To, Or Receive Credit From, Their IRA

Another common prohibited transaction concern for IRA owners investing in direct-owned real estate revolves around credit. Per IRC Section 4975(c)(1)(B), a prohibited transaction occurs whenever there is a direct or indirect “lending of money or other extension of credit between a plan and a disqualified person.”

Direct extensions of credit are fairly obvious and easy to spot. Such transactions would include an IRA borrowing money from the IRA’s owner, or another disqualified person. Indirect extensions of credit, however, are generally tougher to spot. One common scenario in which an IRA and an IRA owner engage in an impermissible indirect-extension-of-credit prohibited transaction is when the IRA owner personally guarantees an otherwise legitimate IRA loan.

Example #3: Linda is an IRA owner who would like to purchase a $1 million commercial building with her IRA that will be rented to non-related persons. Linda, however, only has $800,000 in her IRA, and so in order to make the purchase, Linda’s IRA takes out a $300,000 mortgage (which is perfectly permissible as long as the loan does not involve a disqualified person and is simply borrowed from a neutral party like a bank).

Unfortunately, Linda doesn’t read the terms of the loan agreement with her IRA as closely as she should. And in the fine print, the loan agreement states that in the event of a default and foreclosure, the bank will first sell the IRA-owned property in an attempt to recover its debt. If, however, after the sale of the home there is still an unpaid balance, the bank has the ability to collect by “going after” any of Linda’s personally owned assets and/or income.

That ability – for the bank to recoup amounts lost by attaching Linda’s personal assets – is a prime example of an indirect extension of credit creating a prohibited transaction. Here, despite Linda’s best efforts to do things right, the entire value of her IRA would be deemed distributed before the ink on her signature on the loan agreement dried, because her personal guarantee of the loan means she was a (prohibited) part of the extension of credit to her IRA.

An IRA Owner Cannot Do Any Work On Direct-Owned IRA Real Estate Themselves

Oftentimes, individuals interested in direct-owned real estate seek to make a profit by purchasing properties in need of substantial improvements, making some, or most, of those improvements themselves, and then “flipping” the newly renovated property for a (hopefully) tidy profit. That strategy of investing “sweat equity” to increase the property value may work fine when it comes to investments made with non-qualified funds, but it will decidedly not work for investments made with IRA funds.

IRC Section 4975(c)(1)(C) prohibits the furnishing of goods, services or facilities between an IRA and a disqualified person. Simply hammering in a loose nail would be a “service” provided to the IRA, and like the other prohibited transactions discussed above, there is no de minimis exception for “small jobs” or the like.

Thus, the performance of any work on a direct-owned piece of IRA real estate by the IRA owner would result in a prohibited transaction and the disqualification of the IRA, itself. Note that the same would also be true if the IRA owner was a contractor, and instead of doing the work himself, used his IRA money to pay his employees to do the same work.

Unique Cash Flow Problems For Direct-Owned Real Estate In IRAs (Due To The Prohibited Transaction Rules)

The example above, in which Linda “needs” more money in her IRA to effectively purchase and manage her desired direct real estate investment, highlights another one of the other major problems that can arise with direct-owned real estate in IRAs: cash flow issues.

Cash flow issues are somewhat unique with direct real estate compared to other types of IRA investments due to the direct nature of managing and operating the rental real estate itself. For instance, when an individual purchases a traditional investment with IRA money, like Microsoft stock, that’s generally the extent of the total cash outlay. If Microsoft has to recall one of its computers and is tight on cash flow, it has to deal with that problem at the corporate level and doesn’t require its shareholders to come up with additional funds to handle the recall.

The same is not true, however, for direct-owned real estate held inside an IRA. When such investments require capital – say, for instance, to fix a leaky roof – the IRA itself must have, or be able to secure, the necessary cash. And since, as noted earlier, an individual must remain at arm’s length from their IRA, that cash cannot come from the IRA owner themselves (or another disqualified person). Using personal assets to pay for maintenance, repairs, or other bills of the real estate property is strictly prohibited.

Non-Recourse Financing Limits The Amount That Can Be Borrowed

The potential cash flow challenges associated with direct-owned IRA real estate can begin even before a property is purchased. Many successful real estate investments depend, at least to some degree, on debt to either make the investment feasible, or make it “worth it” (when compared to other potential investment opportunities) with the benefits of debt leverage. There are unique obstacles to contend with, however, when securing financing for an IRA investment into direct-owned real estate.

As noted above, an IRA owner cannot personally guarantee any debt associated with their IRA. Thus, if any an IRA owner wishes to have their IRA secure a loan to aid in the purchase of a piece of real estate, that debt must be structured as a non-recourse loan solely to the IRA itself.

A non-recourse loan is a loan where an asset is pledged as collateral to secure the loan, but in the event of a default, the borrower is not personally liable for any additional unpaid amounts (beyond the lender’s ability to foreclose on the pledged asset itself). With respect to direct-owned real estate held inside an IRA, the property for which the loan is originated to help purchase serves as the collateral.

In the event the IRA defaults on the loan, the lender can foreclose on the property (serving as collateral) and sell it to repay any unpaid amounts. If, however, the proceeds of the sale of the property are not enough to satisfy the outstanding balance of the loan, the lender cannot recover further amounts from the IRA owner, and is forced to “eat” the loss.

From a lender’s perspective, this clearly makes a non-recourse loan to an IRA riskier than a loan in which it may hold the borrower personally liable for any unpaid amounts. And as a result, many lenders will not originate loans to IRAs to purchase real estate. Period.

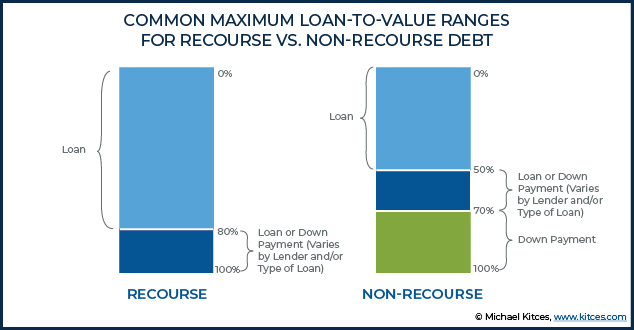

In turn, even those lenders that will originate such loans must do something to help them mitigate the additional risk. And typically, that means limiting the amount of the loan relative to the overall value of the property (at the time the loan is originated) to a greater degree than is normally the case with a recourse loan.

The amount a bank is willing to lend relative to the value of a property is known as the loan-to-value ratio. Traditionally, people have viewed 20% as a key amount to “put down” as a down payment in order to obtain financing (and avoid Private Mortgage Insurance), resulting in an 80% loan-to-value. The reality, however, is that many homebuyers put down far less. In fact, roughly two-thirds of first-time homebuyers put down just 6% or less(!), resulting in loan-to-value ratios far in excess of 90% (since the lenders know that they will have recourse back to the borrower personally if there is a default and the real estate collateral alone can’t make the lender whole).

By contrast, the amount that lenders are typically willing to lend in non-recourse IRA loans is generally a much lower percentage of the to-be-purchased-property’s value (leaving more initial equity in the property against which they can recover if the IRA defaults on the loan). Many IRA loan originators cap their loan-to-value ratio at or near 50%. And even the most aggressive of such lenders typically cap out at a 70% loan-to-value ratio.

Thus, an IRA must have much more cash “on hand” to make a purchase than would be the case if the same property were purchased outside the IRA with a recourse loan.

Example #4: Martin is a 65-year-old IRA owner who feels like he has a good handle on the local real estate market. He would like to purchase a $1 million commercial building to rent.

After exploring his options, Martin has found a lender willing to offer him an $850,000 mortgage (85% loan-to-value) if he purchases the property with a recourse loan outside of his IRA. Thus, ignoring closing costs, Martin would need $150,000 in “regular” cash to make the purchase.

Martin has also found a lender willing to make a loan to his IRA so that it could purchase the same property. Because the IRA loan would be non-recourse debt, the lender is “only” willing to extend a loan up to 60% of the property’s value (a 60% loan-to-value ratio). Thus, the maximum amount that Martin’s IRA could borrow to acquire the property would be $600,000, meaning he’d have to have $400,000 of cash inside the IRA ready for a down payment (compared to just $150,000 to buy the same property outside the IRA).

The IRA Must Have Cash On Hand For Ongoing Expenses

Of course, cash flow obligations for direct-owned real estate don’t end once a property is purchased. Property taxes and insurance must be paid. Regular maintenance, such as gardening, must be attended to as well. And as any homeowner can attest, things break, accidents happen, and unforeseen repairs are a virtual guarantee. There’s a reason they call homes “The Money Pit”, after all.

Critically, all of these expenses must be paid with IRA money as well! Thus, even after a purchase, an IRA owner must ensure there is enough IRA cash left over to pay ongoing expenses and to cover any repairs that may need to be made (given that the expenses will be due regardless of whether or how much income the rental property is generating).

And such repairs and maintenance sometimes turn out to be more expensive than an IRA owner initially anticipates. Particularly since many individuals purchasing rental properties use “sweat equity” to help defray costs and maximize cash flow; that is to say that they take care of some maintenance – such as mowing the lawn – or basic repairs themselves. But as noted earlier, when it comes to real estate owned by an IRA, the prohibited transaction rules prevent an IRA owner from doing any work related to the property him/herself. Even the simple changing of a lightbulb would violate the prohibited transaction rules, resulting in the immediate, and irrevocable distribution of the entire IRA in which the property is owned!

Lack Of Liquidity Can Present Challenges For RMD-Age IRA Owners

Another significant cash flow issue that can arise with respect to direct-owned IRA real estate is figuring out how to take an IRA owner’s required minimum distribution (RMD). For IRA owners, this issue only presents itself once the IRA owner turns 70 ½, but once that key age-marker is reached, RMDs are required each and every year until the IRA is depleted. (In addition, a beneficiary inheriting an IRA with direct-owned real estate would have to contend with RMDs beginning immediately in the year after inheritance!)

Initially, an IRA owner’s RMDs begin at less than 4% of the prior-year-end’s account value, but the percentage that must be distributed increases in each successive year. And the penalty for failing to take an RMD is a rather severe 50% of the shortfall (the amount that should have been taken, but was not). But what happens if the IRA-owned property is not generating enough cash to continue paying any debt obligations, maintain the property, and allow the IRA owner to satisfy their RMD?

Unfortunately, there is no exception to the RMD rules for “lack of liquidity,” and thus, the IRA owner would be subject to the 50% penalty for any shortfall (for which completing IRS Form 5329 and requesting relief due to “reasonable cause” will not apply). There are, however, a number of potential solutions to this problem.

The simplest way to resolve such an RMD issue would be to take the RMD for the direct-owned-real-estate-IRA-account from another of the IRA owner’s IRA accounts, which is permitted under the IRA aggregation rules for RMD purposes (though it must be from an IRA, as an RMD cannot be taken from a different type of retirement account).

If there are no other IRA accounts, the IRA owner could try to refinance the IRA-owned property to “pull out” cash from the property, that would then be available within the IRA as cash and could be distributed to satisfy RMD obligations.

Another possible option would be to convert the property from an IRA-owned asset to a Roth IRA instead, as Roth IRAs have no RMDs during the owner’s lifetime. For those IRA owners opting for this option, it is often best to make sure that the Roth IRA conversion is done in the year prior to the IRA owner’s 70 ½ “birthday,” since conversions done at a later date would only be able to be made after the RMD for that year was already distributed. Though it’s worth noting that even this approach comes with an “expiration date”… the Roth IRA owner’s death (unless the account is moved into a spouse’s own Roth IRA). As unlike Roth IRA owners, Roth IRA beneficiaries after death must begin taking RMDs in the year after death (which again creates the same RMD liquidity problems discussed earlier).

Alternatively, the IRA owner could try and distribute at least a portion of the real estate asset of the IRA in-kind to satisfy the RMD obligation. As unlike IRA contributions, which must be made in cash, distributions from an IRA – for RMD purposes or otherwise – can be made in cash, or in-kind. Admittedly, however, this can be rather problematic when it comes to direct-owned real estate.

Imagine, for instance, that an IRA owner has 1,000 shares of ABC Solutions within her IRA, each worth $100. Furthermore, suppose she has an RMD of $4,000. Here, if the IRA owner did not have enough cash available to take a distribution, she could simply distribute 40 shares of her ABC Solutions stock.

What if, however, the IRA owner had the same $4,000 RMD but had an IRA consisting “only” of a $100,000 rental home and minimal cash? How do you distribute only $4,000 worth of a single property? Do you treat the bathroom as distributed in one year, and the kitchen the next? (No.)

One potential way to resolve this problem would be to create an LLC owned by the IRA, and to transfer the property into the LLC. Then, to satisfy the RMD, it may be possible to distribute a portion of the LLC interests in-kind. This, however, can create its own litany of complications!

For instance, if you distribute 5% of the property in-kind, the ownership of the property on the property’s deed must be updated to reflect the change in ownership of the LLC. Mortgage documents may need to be updated to reflect the same. And now, whenever any expenses arise, you must make sure that your IRA pays its portion and that you separately pay your portion. Good luck keeping that straight and not running afoul of the prohibited transaction rules!

Direct-Owned Real Estate In An IRA Can Be Hard And/Or Expensive To Fairly Value

When an IRA consists of “traditional” investments, such as stocks, bonds, mutual funds, ETFs, and annuities, determining the fair market value of the investments is generally fairly straightforward. In the case of publicly traded investments, the prices of such investments are readily available and are essentially kept track of automatically by an IRA custodian. Valuing non-traditional assets, such as direct-owned real estate, however, can be more complicated, leading to even more potential headaches for IRA owners with direct-owned real estate.

The Fair Market Value Of An IRA Must Be Reported To The IRS Annually

One common misconception is that the value of an IRA owner’s account only matters once they turn 70 ½ when the account balance needs to be determined to calculate the required minimum distribution itself.

The reality, however, is that the IRS requires that the fair market value of an IRA to be reported to the Service each year on IRS Form 5498. Clearly, there’s no way to know what the fair market value of the account, as a whole, unless you know the fair market value of the investments within the IRA!

Plus, since 2015, the IRS has required additional reporting for “hard-to-value” assets, which includes direct-owned real estate. In addition to reporting the fair market value of the account, as a whole, custodians must also separately report the fair market value of hard-to-value assets (Box 15a of IRS Form 5498), and the type(s) of hard-to-value assets found within the account (Box 15b of IRS Form 5498). Thus, an IRA custodian must know the value of such assets each year!

But how does an IRA custodian know the value of a piece of direct-owned real estate? This comes down to knowing a custodian’s procedures and policies.

Admittedly, unless an IRA owner distributes all, or a portion, of their hard-to-value IRA asset(s) (including via a Roth conversion), the value of the asset(s), while required to be reported to the IRS, doesn’t really matter all that much. In other words, there are no income tax repercussions from having a “wrong” valuation.

Thus, many self-directed IRA custodians will allow IRA owners to self-report such valuations (prior to turning 70 ½), or to provide the custodian with an estimate from an “ online source” such as a Zillow, Realtor.com, or Redfin (seriously!), which the custodian will then use to complete the IRS Form 5498. Some custodians will, however, require more formal valuations, even at this point, which can create an additional, ongoing expense for the IRA that must be planned for and considered.

Formal Valuations Are Often Required Once It “Matters”

As noted earlier, once an IRA owner turns 70 ½ they must begin taking RMDs. Those RMDs are calculated, in part, using the prior-year-end’s fair market value. Thus, once an IRA owner turns 70 ½, the value of the IRA – and as such, the value of the assets within the IRA – really matter. Undervaluing an asset would, for instance, result in an artificially low RMD calculation (because the prior-year-end balance would be understated), “robbing” the government of some of its long-awaited tax revenue… and creating the risk that the IRS audits, adjusts the valuation, determines that the prior RMD was insufficient, and applies the draconian 50% penalty for the failed amount of the RMD that would have been due with a “proper” valuation.

Given the heightened importance of fairly valuing assets inside an IRA once RMDs are required, many self-directed IRA custodians no longer accept an IRA owner’s own estimated value, or less formal valuations such as those from online sources. Instead, formal appraisals are often required… and if RMDs are due on an annual basis, so then so too are formal appraisals. Such appraisals are likely to cost $300 or more for single-family residences, but can easily cost $1,000 or more for larger multi-family buildings and/or commercial properties.

In addition to the requirement to regularly obtain a formal appraisal once RMDs begin, custodians often require similar valuations to be obtained at younger ages if the IRA owner either distributes all or a portion of the direct-owned real estate or if a Roth IRA conversion is made. In either case, the IRA/Roth IRA owner’s reported income (and subsequent tax liability) would be based on the fair market value of the assets distributed/converted, and thus, an accurate valuation is of critical importance.

Notably, any costs associated with obtaining a valuation for IRA purposes are an expense of the IRA itself, as part of the costs associated with the direct-owned real estate investment. Thus, an IRA owner must be sure to pay for such any and all such appraisals with IRA funds, and not with personal assets. The use of personal funds for such an expense, even if by accident, would yet again be a prohibited transaction, resulting in the total distribution of the IRA.

Direct-Owned Real Estate Within An IRA “Misses Out” On Common Real Estate Tax Benefits

IRAs are incredible tools for helping create and preserve wealth, thanks to the tax-deferred “wrapper” that they provide. This helps to remove the “tax drag” associated with investments made with taxable dollars, where interest, dividends and capital gains are taxed each year. But the tax-deferred wrapper both giveth, and taketh.

There Is No Benefit For Depreciation For Direct-Owned Real Estate Held By An IRA

For many real estate investors, one of the most attractive parts of owning real estate is the ability to depreciate the property. The basic idea behind depreciation is that, over time, assets often lose value, and therefore, the owner should be able to deduct that lost value in some way (reducing taxable income). Indeed, this loss-of-value-over-time concept holds true with most assets, from automobiles (other than collectibles) to office furniture.

By contrast, real estate not only typically holds its value over time, but it tends to actually appreciate as well! Nevertheless, real estate purchased with taxable dollars can be depreciated (over 27.5 years for residential real estate, or 39 years for commercial real estate), giving investors a “paper loss” tax benefit for a(n often) fictional “loss in value” while their investment is actually appreciating! And replicating much of the benefit of an IRA’s tax-deferral wrapper anyway (since real estate income is often mostly or fully offset by depreciation deductions, at least in the early years).

Depreciation, however, is not available when direct-owned real estate is held inside an IRA. Because the IRA has no “income” in the first place (as a tax-deferred account), so there is no income against which the depreciation deductions can be applied. (Withdrawals from an IRA result in income, but that is still income to the IRA owner, not income of the IRA, so depreciation deductions still do not apply.) Thus, one of the most valuable tax benefits typically associated with real estate investing is lost.

It’s also worth noting that the tax-deferred nature of the IRA is often underused when the IRA invests in direct-owned real estate. For starters, real estate investments are generally longer-term holds, and as long as the property is held, any appreciation in its price is tax-deferred anyway (as any buy-and-hold investment would be), regardless of the fact that it is held inside an IRA.

The 20% 199A Qualified Business Income Tax Deduction Is Lost

As part of the Tax Cuts and Jobs Act of 2017, Congress created a new tax deduction for small business owners, called the 199A, or qualified business income (QBI), deduction. The deduction is worth up to 20% of profits, and is often applicable to the income generated by real estate investments made with taxable dollars.

Since real estate income is tax-deferred when earned inside an IRA, the QBI deduction offers no additional tax benefit (unless the IRA is subject to the unrelated business income tax [UBIT], further discussed below). Similarly, the QBI deduction available outside of IRAs effectively reduces the relative value of the tax deferral offered by the IRA as well. Simply put, the higher the effective tax rate of an investment, the greater the value of tax deferral. And since, for investments made with taxable dollars, the QBI deduction can lower the effective tax rate of rental income by up to 20%, the value of the tax deferral offered by an IRA is reduced proportionately, too.

Using Debt Can Result In An IRA Owing (Unrelated Business Income) Tax

If you stop to think about it, there’s something that’s not quite “fair” about an IRA securing debt. That debt provides leverage and can essentially act as an “extra contribution” to the IRA that could produce extra earnings that could grow tax-deferred… if there wasn’t some rule to prevent that.

But fear not, Congress is on top of this one, and since 1950, it has had a way of “leveling the playing field.” The mechanism by which this is accomplished is called the Unrelated Business Income Tax (UBIT). Under the UBIT rules, the first $1,000 of Unrelated Business Taxable Income (UBTI) generated by a tax-exempt entity – including an IRA - is subject to the Unrelated Business Income Tax. And since an IRA is considered a trust, it must pay tax on any Unrelated Business Taxable Income in excess of a small $1,000 exemption at trust tax rates… the worst rates around!

Of critical importance to investors using (non-recourse) loans to purchase direct-owned real estate within their IRA is the concept of Unrelated Debt-Financed Income (UDFI), a type of Unrelated Business Taxable Income that is subject to the Unrelated Business Income Tax. More specifically, Unrelated Debt-Financed Income is equal to the ratio of the average acquisition indebtedness of a property, over the average adjusted basis of the property, multiplied by the gross income from the debt-financed property. In other words, whatever percentage of the property is debt-financed, so too is that percentage of the rental income deemed UBTI, causing the IRA to pay income taxes on that amount.

Example #5: On January 1, 2019, Sheila purchased a $1 million dollar rental property inside her IRA, using a combination of IRA cash, and a non-recourse loan made to her IRA. As of December 31, 2019, the average outstanding balance of the non-recourse loan for the year is $550,000, and the property has generated $20,000 of gross income.

Under the Unrelated Debt-Financed Income rules, ($550,000 / $1 million) x $20,000 = $11,000 will be considered Unrelated Business Taxable Income, subject to the Unrelated Business Income Tax. Thus, the $11,000 amount will be reduced by the IRA’s $1,000 exemption amount, with the remaining $10,000 of UDFI/UBTI will be taxable at trust tax rates.

Finally, the Unrelated Business Income Tax serves as yet another reminder of the barrier that must be placed (and kept) between an IRA owner and their IRA. In the event an IRA is subject to the Unrelated Business Income Tax, the IRA, itself, must pay the tax, and not the IRA owner. This is done by the IRA filing an IRS 990-T Tax Return, which is often prepared by the IRA custodian (for a fee, which would be yet another cost of the IRA!).

Consequently, it’s especially important for IRA owners utilizing self-directed real estate as an investment in their IRA to be aware of the prohibited transaction rules, and the other complications that may arise. Because the onus is still on the IRA owner to ensure the IRA is properly maintained, and that the prohibited transaction rules are complied with.

In order to hold direct-owned real estate within an IRA, an investor must generally custody their assets with a self-directed IRA custodian that has the systems in place to handle such “non-traditional” retirement account assets. And because of the various complications discussed above that such custodians must contend with, the fees they charge for maintenance and other items are generally far in excess of the fees charged by traditional custodians.

However, it’s crucial to recognize that one thing self-directed IRA custodians do not necessarily do is make sure that their IRA owners do not violate the aforementioned prohibited transaction rules. While custodians will generally provide education about such matters and may let IRA owners know if they spot obvious potential problems, self-directed IRA custodians are not the “IRA Police,” and they rarely, if ever, take responsibility for ensuring an IRA owner complies with the rules.

I have a new client who rolled her 401k into a self-directed IRA about a decade ago. Her husband directed the funds be invested into an LLC where he apparently spent the funds on a variety of different money losing endeavors.

My client is now a widow, she wanted to close the self-directed IRA and did so successfully in June of 2019. In January of this year she received a Form 1099-R.

In the taxable box was $180,000, the FMV of the investment which had never been updated to reflect the now defunct LLC. The Trustee says they can’t make any adjustments after 60 days have passed from the time of the distribution. They suggest that her tax professional can handle it.

My question is how would you suggest that I handle this situation? Thanks

Great Article. I think Investing in an IRA is a big risky process with real estate. If you are looking to get a good profit through IRA you can visit us at http://www.preciousmetalsdirect.com/

Excellent article. The section titled “An IRA Owner Cannot Do Any Work On Direct-Owned IRA Real Estate Themselves” is alone worth the price of admission.

There is another aspect of considerations not covered, which include the loss of cost recovery and mortgage interest write off to offset income taxes, since the entire account is tax deferred. Those are benefits of real estate ownership that are key, and lost, owning an investment in an IRA.

Great summary.

I assume these rules apply to indirect real estate such as via crowdfunding or fractional CRE investments. My cursory knowledge indicates that these type of investments run into the UBIT because they pretty much all finance the properties with interest only loans with only ~20% equity among the sponsors and investors.

Good question, but aren’t these crowd funding platforms funds rather than hard assets?

Outstanding summary. I am a longtime tax attorney, and I only see one minor omission. I believe you meant above the first $1,000 in UBTI… “subject to UBIT”.

How would this apply as far as step-up in basis goes? What if a farm client purchased farmland for $7,000 per acre and when they pass away it is worth $12,000 per acre? If it was outside an IRA, the land would get a step up and the kids could sell it with no income tax. If the land was inside an IRA, the kids would not get a step up and the RMDs would be ordinary income each year. Would the client & family be better off in the long run to buy land outside the IRA with a loan, take the tax deductions and use the RMD to make land payments instead, and then kids inherit the land instead.

Jennifer,

This is something that, like most issues, has to be looked at on a case-by-case basis. However, in my opinion, that would often be the better route. And notably, if the family has ANY intention to farm the land themselves, then there is no option. It would have to be purchased with non-IRA money, as otherwise the farming of the land would be a service provided to the IRA, resulting in a prohibited transaction.

Jeff

I share office space with three divorce attorneys, and about two weeks ago one of the three attorneys called me into her office as she had a potential client contemplating a divorce. This potential client, and his wife had used their traditional and roth IRAs to purchase a house and quite a few acres by using a self-directed IRA. The attorney introduced me to the client and then preceded to ask me if it was compliant for her client and his soon-to-be ex-wife to be living in the house on the property that they were running their business on. My first response was “I don’t believe so, but let me do a little research on this.” After speaking with an ERISA attorney with Pension Resources out of California I was able to confirm that it was, indeed, not compliant. Throw in the fact that the couple were now divorcing and the value of the IRAs would most likely be subject to a court order splitting the value of those assets, that the value of their four IRAs would now be taxable, AND that both parties were going to need to find a new place to live…and you can imagine what type of a mess had been created. The couple learned about self directed IRAs online, and procured their SDIRA by using a service in Oregon (We are in Maine, on the other side of the country for those of you not familiar with where Maine is), and they did everything over the phone.

My suite-mate, the divorce attorney, told him he could not afford to get divorced, that he should go home and reconcile with his wife, and THEN drop the bomb on her regarding the plight of their IRAs. We imagine we will see him back in the office any day now 🙂

Gary,

Ouch! That is one heck of story. Thanks for sharing. Unfortunately, I’ve seen this type of thing – though frankly, the divorce element is a bit of a wrinkle here – happen all too often. If the couple comes back, you can give them good and bad news. The bad news is that the clear, 100%-no-doubt-about-it prohibited transaction means that the retirement account(s) are already deemed distributed and are taxable. The “good” news is that since the house is no longer in an IRA, either of them can live there. :-/

Best,

Jeff

This blog is looking good, keep up the great content and great blog!