Executive Summary

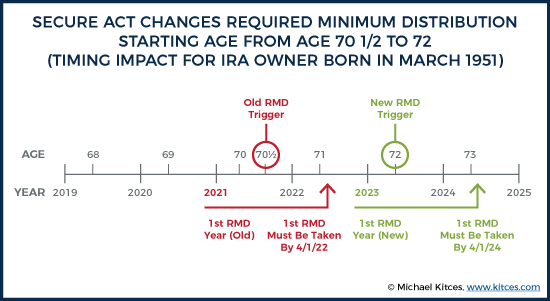

Last month, the Setting Every Community Up For Retirement Enhancement (SECURE) Act was passed into law, creating the most substantial updates to the laws governing retirement accounts since the Pension Protection Act in 2006. One notable change resulting from the SECURE Act will be the increase in age at which Required Minimum Distributions (RMDs) must begin. Prior to the SECURE Act, individuals with IRA accounts or qualified employer-sponsored retirement plans were required to take RMDs beginning in the year in which they turned 70 ½ with a deadline (for the first RMD only) of April 1 of the following year.

Beginning in 2020, however, the new age at which RMDs must start is age 72 (also with a deadline of April 1 of the following year). Notably, RMDs for individuals who turned 70 1/2 in 2019 are not delayed, and instead, such individuals must continue to take their RMDs under the same rules prior to passage of the SECURE Act. Despite the delay in the starting age for RMDs, though, Qualified Charitable Distributions (QCDs) from IRAs will not be affected by the SECURE Act; accordingly, QCDs may still be taken from IRAs as early as age 70 1/2.

While the same life expectancy factors will continue to be used with no change under the SECURE Act, the IRS has recently (and separately) proposed to update the current life expectancy tables to adjust for longer expected lifespans. The IRS proposal has not yet been finalized, but is largely expected to be effective for RMDs calculated for 2021, and beyond.

Interestingly, for those who were born in the first half of the year (i.e., between January 1st and June 30th), the SECURE Act provides a longer delay of the first RMD than for those individuals born on July 1st or later. Those with birthdates in the first six months of the year reach age 70 and 70 1/2 in the same year (and thus their first RMD is not required until two years later, when they reach age 72), whereas those whose birthdates are in the last six months of the year reach age 70 1/2 in the year they reach age 71 (and thus, their first RMD is ‘only’ delayed until the following year, when they turn 72).

The majority of retirees will not be impacted by the delayed RMD starting age (since most people aren’t able to afford to wait until the age when RMDs must begin), but for those that are, strategically timed Roth Conversions can be an effective tool to accelerate income in a tax-efficient manner, leveraging the additional time that IRA owners are afforded before their RMDs start, thus increasing their annual income.

Ultimately, the key point is that, while the change in RMD starting age won’t impact a large swath of the population, financial advisors are likely to have clients who will be affected by the change and who may benefit from the additional time in which Roth Conversions can be executed. Furthermore, advisors should also review their technology systems and planning processes, specifically for clients born after June 30, 1949 and who will be affected by the new RMD rules.

On December 20, 2019, President Donald Trump signed the Setting Every Community Up For Retirement Enhancement (SECURE) Act into law as part of the broader Further Consolidated Appropriations Act of 2020 (Note: the year 2020 is used because it is for the 2020 fiscal year). By most accounts, the SECURE Act will have the largest direct impact on retirement accounts since the passage of the Pension Protection Act in 2006.

While for financial advisors, the SECURE Act’s repeal of the “Stretch” provision for inherited retirement accounts (at least for most non-spouse beneficiaries) is likely the biggest headline, other changes will also have a significant impact on planning for years to come.

One such change is the ‘subtle’ increase in the age at which Required Minimum Distributions (RMDs) must begin during a retirement account owner’s lifetime.

Lifetime Required Minimum Distributions (RMDs) To Begin At Age 72 Under SECURE Act

Section 114 of the SECURE Act increases the age at which an IRA owner, or participant in an employer-sponsored retirement plan, must generally begin taking RMDs, from the year in which they turn 70 ½, to the year in which they reach age 72, instead. Participants in 401(k), 403(b), and similar (non-IRA-based) employer-sponsored retirement plans will continue to be able to delay RMDs to a later age, provided they are still working and meet the requirements of IRC Section 401(a)(9)(c)(ii)(I).

Accordingly, the Required Beginning Date for IRA owners and most plan participants is changed from April 1st of the year following the year in which they reach age 70 ½, to April 1st of the year following the year in which they reach age 72.

Mirroring the option available under current rules, individuals will be able to timely distribute their first RMD at any time during the year in which they reach age 72, or in the following year, up until as late as April 1st. However, similar to current rules, if an individual chooses to take their age-72 RMD between January 1st and April 1st of the following year, they will have to take both that RMD (the age-72-RMD), and a second RMD (the age-73-RMD) by the end of the year (potentially pushing them into a higher income bracket and/or increasing other income-related costs, such as the Medicare Income Related Monthly Adjustment Amount (IRMAA).

RMDs For Individuals Who Reached Age 70 ½ In 2019 Won’t Change

Although the SECURE Act delays the age at which RMDs must begin for many individuals approaching the age of 70 ½, it does not offer any relief to those who turned 70 ½ in 2019. Such individuals will continue to have a Required Beginning Date of April 1, 2020, and must continue to take RMDs in the same manner as before the SECURE Act.

More specifically, Section 114(d) of the SECURE Act states:

EFFECTIVE DATE.—The amendments made by this section shall apply to distributions required to be made after December 31, 2019, with respect to individuals who attain age 70 ½ after such date. [Emphasis added]

Thus, anyone who reached the onset of RMDs in 2019 (or a prior year, for those who are already well into their 70s and beyond) will simply have to continue their current RMD schedule. Even someone who is only turning age 71 in 2020 (having turned age 70 ½ in the second half of 2019) cannot wait until age 72 to begin RMDs, because they already triggered the onset of RMDs in 2019 by reaching that age 70 ½ threshold in 2019. Again, only those who were younger than age 70 ½ at the end of 2019 (i.e., those born after June 30th of 1949) are eligible for the new age-72 RMD threshold.

(Nerd Note: As a result of the SECURE Act's changes to RMDs for individuals turning 70 ½ after 2019, together with the requirement that those turning 70 ½ in 2019 continue to take RMDs like 'normal', there will be no IRA owners who have to take their first RMD for the year 2020. Similarly, no IRA owners will have a Required Beginning Date of April 1, 2021!)

SECURE Act Offers Longer RMD Delays For Those With First-Half-Of-The-Year Birthdays

For those who choose to wait to take distributions from their IRAs or other retirement accounts until they reach the age when RMDs must start, the changes made by the SECURE Act to lifetime RMDs actually have twice the impact for those born in the first half of the year, as compared to those born in the second half of the year!

More specifically, those who are born from January 1st through June 30th will reach their 70th birthday in the same year that they reach age 70 ½. Thus, they gain two more years of RMD deferral by virtue of the SECURE Act’s changes.

Example #1: Sulley is a Traditional IRA owner who was born on June 3, 1950. As such, he will turn 70 ½ on December 3, 2020. Prior to the changes made by the SECURE Act, Sulley would have needed to begin taking RMDs in 2020 (or as late as April 1st of 2021).

In light of the SECURE Act’s changes, however, Sulley will not have to begin taking distributions until the year he reaches 72, which is in 2022, with his first RMD due as late as April 1st of 2023. Thus, his RMDs are delayed two calendar years as compared to the current rules.

By contrast, individuals who are born from July 1st through December 31st have their half-birthday the year after they turn 70, which means they actually turn 71 in the year in which they reach age 70 ½. Thus, such individuals will only see one additional year in which they are not obligated to take an RMD.

Example #2: Mike is a Traditional IRA owner who was born on July 10, 1950. As such, Mike will turn 70 ½ on March 10, 2021. Therefore, prior to the changes made by the SECURE Act, Mike would have needed to begin taking RMDs in 2021 (or as late as April 1st of 2022).

Now, however, as a result of the SECURE Act’s change, Mike won’t have to begin taking RMDs until the year he reaches 72, which is 2022 (or as late as April 1st of 2023 for his first RMD). As such, the SECURE Act buys him only one additional year of no RMDs.

RMD Life Expectancy Factors For Each Age Won’t Change (At Least Under SECURE Act)

One of the most common questions regarding the change to the starting age for RMDs has been “Does this change the life expectancy factors used to calculate those RMDs at all?” The answer, under the SECURE Act, is “No.”

Rather, the current life expectancy factors that apply for various ages will continue to apply when retirement account owners reach those ages. The factors are not ‘pushed back’. Instead, retirement account owners just won’t have to use the factors for an age-70 or age-71 individual anymore, and will begin at age 72 instead!

Example 3: Randall is a single IRA owner who is turning 70 ½ on August 21, 2020. Absent the changes made by the SECURE Act, he would have begun taking RMDs for the year 2020, using the Uniform Lifetime Table, which, for a 70-year-old, indicates a factor of 27.4.

As a result of the SECURE Act’s changes, though, Randall will not have to begin taking RMDs until 2022, when he will reach age 72. Therefore, Randall’s first RMD will still be calculated using the Uniform Lifetime Table factor for a 72-year-old (currently 25.6).

Notably, though, a separate IRS proposal from earlier this in 2019 will potentially change the life expectancy tables to be used for all RMDs in the coming years. And while the Proposed Regulations have yet to be made official, they are widely expected to be finalized sometime in the first half of 2020, to be effective for RMDs beginning in 2021. As such, RMDs that occur in 2021 and later may actually have a different life expectancy factor than under current law… but not as a result of the SECURE Act. Consequently, the SECURE Act impact remains the same – that the life expectancy tables simply won’t apply at ages 70 and 71 and instead will begin at age 72 – but by the time the first SECURE Act new-age RMDs do kick in at age 72 in 2022, they will likely do so with new tables.

As a result of these changes, though, there’s a funny coincidence that is likely to play itself out as a result of the combination of the SECURE Act and the newly Proposed Regulations to change the RMD life expectancy tables. Under the current Uniform Lifetime Table, the factor for a 70-year-old (which has, admittedly, only been used by half of retirement account owners – because the other half have turned 71 in the year that they first reach age 70 ½) is 27.4. Meanwhile, the factor for a 72-year-old under the ‘new’ Uniform Lifetime Table contained in the aforementioned Proposed Regulations is a nearly identical 27.3.

As a result, assuming the Proposed Regulations are finalized and effective for 2021, the future age-72-first-RMD for individuals in 2022 under the SECURE Act is going to be almost an identical percentage of their IRA as would have been for those born in the first half of the year when turning age 70 ½ under the old rules!

SECURE Act Change In RMD Starting Date Doesn’t Impact Starting Age For Qualified Charitable Distributions (QCDs)

Although the SECURE Act changes the age at which RMDs must begin (for those turning 70 ½ after 2019), the law made no change to the age at which Qualified Charitable Distributions (QCDs) may begin (which is also age 70 ½). So, even though IRA owners (QCDs can only be made from IRAs) will not have to start taking RMDs from their IRAs until they reach age 72, they will still be able to make QCDs from those accounts once they reach the actual age of 70 ½ (notably, not just the year in which they reach age 70 ½ like RMDs; for QCDs, the individual must actually reach age 70 ½).

Such pre-RMD QCDs are entirely voluntary and will not reduce or otherwise impact future RMD amounts (other than that the IRA balance will be reduced by the amount of the QCD when calculating those future RMDs).

However, for those individuals who are charitably inclined and want to give to charity anyway, the QCD can (still) be an attractive way of doing so, especially if giving cash (or even appreciated securities) won’t be deductible because total itemized contributions do not exceed the taxpayer’s standard deduction.

Planning With The New RMD Starting Age

While any delay in the ‘forced’ distribution of funds from IRAs and other retirement accounts will, no doubt, be welcome news for many individuals - particularly the clients of financial advisors who tend to have sizable retirement account balances – the reality is that the majority of retirement owners will see little to no benefit from this change.

As it’s important to remember that an RMD is a required minimum distribution, it doesn’t prevent people from taking more than the required amount, or from taking distributions from their retirement accounts before they are mandated to do so. Which in practice is what many people do, simply because they need the money (for retirement!).

To that end, earlier this year, as part of Proposed Regulations to update the Life Expectancy Tables that individuals use to calculate RMDs, the IRS indicated that according to its own numbers, only about 20% of people take just the required minimum amount. And if someone is already taking more than the minimum, they’ll likely continue to do so regardless of whether the RMD age is age 70 ½ or age 72. It’s unlikely that they’ll suddenly find enough ‘other’ money to be able to delay taking distributions.

Thus, the SECURE Act’s change to the RMD age is really only likely to benefit the roughly one-fifth of retirement account owners who, according to the IRS, can potentially afford not to be taking distributions from their accounts. Which, admittedly, may disproportionately be the clients that financial advisors tend to work with!

For such individuals, pushing back the RMD starting age “from 70 ½, all the way to 72” (note dripping sarcasm) may seem like only a minor change, but whenever Congress cracks open a planning window, it’s best to make the most of it, no matter how small that crack may be.

(Nerd Note: In the event an unwanted (i.e., not-actually-required) distribution occurs prior to an advisor being able to connect with a client to let them know about the new RMD age, particularly for those whose RMDs would have begun in 2021, advisors can check to see if the distribution is eligible for rollover within the 60-day window as an indirect rollover.)

Additional Partial Roth Conversions Can Be Made During The ‘Bonus’ RMD Gap Years

Traditionally, so-called “Gap Years” have been generally understood to represent the years between when an individual retired and when they began receiving Social Security benefits and taking RMDs. For those who could afford to delay IRAs and Social Security until required to do so (or in the case of Social Security benefits, until there was no longer good reason to delay benefits), Gap Years would end when income from both Social Security and RMDs began to flow in – often at around the same time, as Social Security would begin at age 70, and RMDs in the year an individual reached 70 ½.

These Gap Years can be some of the lowest taxable income years of an individual’s adult life, and as such, they often make prime years for accelerating income that would otherwise be taxable in a future, higher-income year (such as after Social Security benefits and RMDs have kicked in). More often than not, this income acceleration is best accomplished via partial Roth IRA conversions, both because it is easy to generate the income (it’s essentially a matter of paperwork, or in some cases, just the clicking of a few buttons), and because it also provides further tax benefits in the form of future tax-free distributions of earnings (provided the qualified distribution rules are met).

The SECURE Act’s changes will potentially give an additional year or two where Social Security benefits may begin but before the onset of RMDs stacked on top that can substantially increase income (for those who did not already need their retirement account distributions), in essence creating one or two “Semi-Gap” Years where it may still be appealing to do a partial Roth conversion on top of Social Security benefits to fill the void of not-yet-required-to-be-taken RMDs.

However, even with this benefit, such individuals will generally find that these years do not allow for the same volume of tax-efficient Roth IRA conversions as earlier years Gap Years, because the receipt of Social Security income will at least partially crowd out the lower tax brackets (and phasing in the taxation of Social Security benefits, also known as the ‘tax torpedo’, can be especially tax-unfavorable). As a result, continued, but slightly lower, partial Roth IRA conversions may still make sense during these new ‘bonus’ years in which RMDs are no longer required (but will need to be evaluated on a case-by-case basis to coordinate with the onset of Social Security benefits).

SECURE Act Provides Opportunities To Review 2020 Retirement Distribution Plans

Chances are that long before the SECURE Act was passed, individuals turning 70 ½ in 2020 had established their 2020 income ‘game plan’ with the idea that some or all of their living expenses would be covered by distributions that they would be required to begin taking from their retirement accounts.

Now, however, such individuals no longer have to take those same distributions from their IRAs and other retirement accounts, as they will be permitted to delay these distributions with a new RMD age of 72 (delaying their first required distributions under 2021 or 2022 depending on when their birthday falls). Thus, a re-evaluation of 2020 cash flow and retirement distribution sources is advisable.

Perhaps, for instance, an individual has ample taxable dollars in a bank or brokerage account that would make sense to spend first. This might allow an individual to keep income low enough to avoid spikes in their marginal tax rate as Social Security income taxability is phased in. Alternatively, switching funding for 2020 spending from pre-tax retirement dollars to taxable dollars may allow even more dollars to be converted to a Roth IRA at favorable tax rates, as discussed above (for those not being adversely impacted by the taxability phase-in of Social Security benefits).

Bear in mind that in many situations, individuals turning 70 ½ in 2020 may have already completed distribution paperwork or other similar requests, that will trigger early-in-2020 distributions from their IRA or other pre-tax retirement account. Such individuals should be prioritized for communication by advisors to avoid now-unwanted (or unnecessary) distributions from occurring.

Update Technology System Settings and Operational Processes

Many advisors use various kinds of technology to help them plan for and communicate with clients. And in many cases, the workflows and other systematized processes advisors employ are self-built, or at the very least, highly customized by the advisors who benefit from them.

It’s likely that many of these systems have some sort of logic built around RMDs beginning at age 70 ½, such as:

- Letters automatically generated to send to clients about their first RMD year;

- 70 ½ ‘birthday’ reminders to send presents, cards, letters, etc.; and

- Inclusion of such individuals on year-end RMD ‘double-check’ lists.

Advisors should carefully review systems and processes to see what items may need to be updated in order to keep them in compliance with the SECURE Act’s changes.

A good starting point would be to segment clients based on their birthday – where those born prior to July 1st of 1949 are subject to the ‘current’/old rules (where RMDs begin or already began by age 70 ½), while those born after June 30th of 1949 wouldn’t have been turning age 70 ½ until 2020 or later and consequently will all be eligible for the new age-72 RMD rules.

Changes To The RMD Starting Age Have Some ‘Side Effects’ For Account Beneficiaries

Clearly, the most significant aspect of the SECURE Act’s change in the age at which RMDs must begin is the direct impact it has on RMDs. But lifetime RMDs are not the only things impacted by this change. Notably, the change impacts Non-Designated Beneficiaries after the death of the retirement account owner, as well as spousal beneficiaries who choose to remain beneficiaries of an inherited retirement account.

Required Minimum Distribution Rules For Non-Designated Beneficiaries

Under IRC Section 401(a)(9)(A), when a retirement account owner dies prior to their RMD Required Beginning Date and has named a Non-Designated Beneficiary (e.g., charities, estates, non-see-through trusts), that Non-Designated Beneficiary is required to distribute all the assets in the inherited retirement account within 5 years. Conversely, IRC Section 401(a)(9)(B) provides that when the owner dies on or after their Required Beginning Date with a Non-Designated Beneficiary, annual minimum distributions are calculated using the decedent’s remaining single life expectancy (had they lived).

The SECURE Act made no direct change(s) to these rules (as the new 10-Year Rule does not apply to Non-Designated Beneficiaries). However, as a result of the change in the age at which RMDs begin, an IRA owner’s Required Beginning Date is now pushed back to April 1, of the year following the year that they turn 72 (the same age applies to plan participants unless an exception, such as the “Still Working Exception” is applicable). Thus, for Non-Designated Beneficiaries, the 5-Year Rule will still apply if death occurs at an even later age, requiring full distribution of the inherited account within 5 years of the retirement account owner’s death if they die prior to April 1st of the year after they reach age 72.

Special RMD And Successor Beneficiary Benefits For Spousal IRA Beneficiaries Last Longer

Another important side effect of the delay in the age at which RMDs must begin is that it potentially enhances two benefits available to surviving spouse beneficiaries who choose to remain a beneficiary of the IRA or employer-sponsored retirement plan account (as opposed to, for instance, rolling the inherited account over into a retirement account in their own name). The two benefits are:

- Under IRC Section 401(a)(9)(B)(iv)(I), spousal beneficiaries do not have to take RMDs from the inherited account until the decedent would have needed to begin taking RMDs of their own; and

- Under IRC Section 401(a)(9)(B)(iv)(II), if the surviving spouse beneficiary dies before the distributions would have been required under IRC Section 401(a)(9)(B)(iv)(I) as outlined above, the surviving spouse would be treated as the original owner of the account (so that the surviving spouse’s beneficiaries will be treated as the first beneficiaries of the account).

To maintain consistency with the direct change to the age at which RMDs begin, the SECURE Act includes language that applies the age change to these important spousal beneficiary benefits. Thus, surviving spouse beneficiaries who establish and maintain an account as an inherited IRA (or, where the plan allows, an inherited plan account) will not have to take RMDs from the inherited account until the decedent would have reached age 72.

Similarly, if the spouse-beneficiary dies, themselves, before that time, they will be treated as the original account owner, and their beneficiaries will be treated as having inherited directly from the original retirement account owner.

For financial advisors, changes to the “Stretch” rules (and perhaps the opportunity to offer MEPs and to use lifetime annuities in qualified retirement plans) are likely to be the biggest headlines out of the SECURE Act. But other changes made by the law, such as the ‘pushing back’ of the age at which RMDs must begin, will have a meaningful impact for some retirees.

Although while roughly 80% of retirement account owners need to take more than their RMD amount each year (presumably because they need, or want, that income to meet living expenses) and likely won’t benefit from delayed RMD age, those who are lucky enough to be able to have enough wealth to delay taking RMDs (disproportionately, the clients that financial advisors serve!) can really benefit from this change.

The SECURE Act will provide an extra year or two where income may be kept at lower levels, enabling extra opportunities for partial Roth IRA conversions, or simply for preventing RMDs from pushing individuals into higher tax brackets, paying higher IRMAAs, or increasing other income-related costs.

I will be 72 on June 25, 2022. If I take a distribution from my IRA CD ANY TIME during 2022, will some of the distribution count as the RMD? I expect to take a $15,000 distribution (in the CD grace period) before my 72th birthday in 2022. My RMD will be about $5000 at that time.

I don’t believe this question was answered in the above. If a client is taking RMD’s from a beneficiary IRA (her parent passed a couple of years ago and left her daughter her IRA) and the client (surviving child) makes her spouse the primary beneficiary of her inherited IRA, when she passes, will the surviving spouse be required to take out distributions in 10 year window or will he be able to stretch it over his life expectancy? I am quite sure he is limited to the 10 year window, but would like to confirm. Thank you so much!

How soon after the birth or adoption of the child does the 5k penalty free distribution need to take place in? Or is it anytime after they are born and before age 18? Does it apply for babies born 2020 and beyond or for current parents as well?

Jeff & Michael,

Two questions that are lingering on the RMD front.

1) I believe QCD rules for individuals taking RMDs prior to 2020 were that the maximum QCD amount could be the lesser of their RMD amount or 100k. In a previous post you noted that the QCD amount 2020+, for individuals over 70-1/2 but not yet 72, is less than or equal to 100k. Does this essentially mean for example that an account owner in this age range who has an IRA valued at 100k could make a QCD of their entire IRA? Seems too good to be true if there is no lesser than the RMD rule applies, since there is no RMD amount calculated for these individuals.

2) For minor individuals that inherit an IRA. In a prior post it seemed to indicate that a minor would still have to take life expectancy distributions from and inherited IRA prior to the age of majority? Then once they reach the age of majority the RMD requirement stops and 10-yr clock starts? Is this correct? Also, does the 10-year clock start at age 18, or the age of majority based on what state the inheritor resides?

Thanks for all your great continued work on this!

– Connor Smith

I believe the QCD rules have always said that the maximum QCD in a given year is $100K, regardless of the amount of your RMD. For example, it the RMD for the year is $3,000, the individual could still make a QCD up to $100K. That was always my understanding and I don’t believe this has changed with the SECURE Act.

When ObamaCare was passed,originally the members of Congress were exempt from it and they were able to maintain their doctor(s) at the Mayo Clinic.You lost your doctor.. The US taxpayers paid 73% of their insurance premiums and still do. While most of us saw about 115% premium increase.Has anyone asked if ALL three (3) branches of the US governrnent and their staff are subject to the entire SECURE Act exactly like you, me, and the guy next door are? Will the Heirs to Nancy Pelosi’s $112 Million estate have 10 years to withdraw these funds and report each dime as income? Will they be subjected to any and ALL penalties if they do NOT like your heirs will be?

LOL

Congress was never excluded from Obamacare. The original bill (prior to passage) did not allow employees of large companies or federal workers (including members of Congress) to purchase insurance through the exchanges, but that did not make them “exempt” from the law. Like all Americans, they were required to have insurance or pay a penalty. But before the bill was passed into law, a change was made so that under the law members of Congress are actually REQUIRED to purchase their health insurance through the Obamacare insurance exchanges.

As for Pelosi’s fortune, my guess is that most of her money is in real estate and other non-IRA assets, so the SECURE Act will probably have little impact on her or her heirs. Just like they will have little impact on Kelly Loeffler’s (R-GA) $500M estate, or Greg Gianforte’s (R-MT) $135M estate, or Michael McCaul’s (R-TX) $113M estate…. (all numbers taken from Roll Call’s 2018 list of wealthiest members of Congress, in which Nancy Pelosi ranked #23).

Most did not see a 115% increase. Prior to Obamacare we had decades of double digit annual increases. After Obamacare single digit annual increases. Go to Kaiser foundation for real facts.

Obamacare if not trashed by the Repubs and instead built on we could have a lot more people covered. People did get refunds but it many cases the refunds went to your employer that provides insurance. Insurance companies could only spend a certain expense on overhead and if they spent more were required to get a refund.

The first few years before the Repubs started screwing with Obamacare we went from annual double digit annual increases to single digit increases.

We had Rubio boasting in the Repub primary debate he cause Obamacare rates to increase. Rubio added an unrelated rider to a spending bill in order to cause increases in Obamacare.

Trump has been doing everything to destroy healthcare for all. By eliminating the mandate it makes it hard for insurance companies to provide pre existing coverage.

Trump currently has a lawsuit before the supreme court to completely eliminate Obamacare.

We now have Trump offering to bail out the airline industry and travel industry along with his resorts and golf courses while screwing the health insurance coverage in this country

Jeff,

Can an IRA owner annuitize using a joint life with a child?

thank you thank you thank you for this summary!

For a taxpayer aged 71 who would not otherwise be claiming itemized deductions, does it make sense to use QCD from his IRA balance even before having to take RMDs for planned charitable giving? It seems like the only benefit would be the reduction in value of the IRA for future RMDs. Is there any other advantage over making the contributions with appreciated securities from a taxable account?

the QCD would be better for heirs. Appreciated securities would receive a stepped up basis at death. Heirs will pay tax on IRA distributions. The QCD also gets around the percentage of AGI limitation.

Thanks Jeff. Nice job. Do you do individual consulting? I have a case that this hits on the head.

Great stuff as always, Jeff. Thank you. Can you comment on 2nd tier beneficiaries. Here is the scenario: Mike passes away at age 75 in 2021. His son John who is 55 starts taking RMDs over a 10 year period. If John dies in year 3, will his son Ted (age 30) start a new 10 year period? Or is he stuck with his father’s 10 year period? Thank you.

Thanks Jeff – we just updated our platform last night, so that RMDs now start at 72 for those born on or after 7/1/1949.

https://www.newretirement.com/

For Example #2 wouldn’t Mike turn 70 1/2 on January 10th 2021 and not March 10th 2021? Am I missing something?

I have a question about the 2019 RMD that does not have to be taken now, when do you have to take it?

“Mirroring the option available under current rules, individuals will be able to timely distribute their first RMD at any time during the year in which they reach age 72, or in the following year, up until as late as April 1st. ”

Thank you, thank you, thank you! You are the first website I’ve read, of many dozens, that has clearly stated this. Not even the IRS site does! They all use mushy wording that is confusing, such as, “RMDs start once you reach age 72 …”, but never clearly say they may start anytime IN THE TAX YEAR you reach age 72. This should always be clearly stated, because otherwise one crossing this threshold thinks that the reason for the April 1st date is to give someone with a late year birthday time to make the withdrawal (Someone born on December 31st would have to make that withdrawal on December 31st with no mistakes!). Again, thank you for clearly writing what others fail to.

This is just terrible. I am going to need the RMD before age 72, especially if my husband passes and I lose his social security and his pension. It could happen–he is much older than I am. I won’t even get my own SS because I am victimized by the Windfall Elimination Provision. My “windfall”, btw, would be about $300 a month. Now this fresh hell.

After 59 you can take money from your 401k any time you want. You don’t have to wait until age 72. This is for rich people that don’t need their 401k retirements to like on. At age 72 they are forced to start taking the money so they have to pay taxes on it.

Thanks–but does that mean I’d have to pay 20% in taxes on the withdrawal?

That depends. The IRA withdrawal is likely fully taxable, so the tax you pay would depend on the size of the withdrawal as well as your other income & deductions. The 20% amount is the standard withholding that’s done on these, but your actual tax cost may be more or less. You should check with a CPA or tax specialist to see the impact of a withdrawal in your own situation.